DEBT RESTRUCTURING MECHANISM (DRM) FOR MICRO

DEBT RESTRUCTURING MECHANISM (DRM) FOR MICRO

SMALL AND MEDIUM ENTERPRISES ( DRM FOR MSME )

1. Objective

The objective of this Policy is to ensure timely and transparent Debt

Restructuring Mechanism ( DRM ) for restructuring the debts of viable

MSMEs facing problems, outside the purview of BIFR, DRT, CDR and other legal proceedings. In particular, the framework will aim at preserving viable MSMEs that are affected by certain internal and external factors and minimize the losses to the creditors (the Bank) and other stakeholders through an orderly and coordinated debt restructuring mechanism or rehabilitation package

2. Scope & Applicability

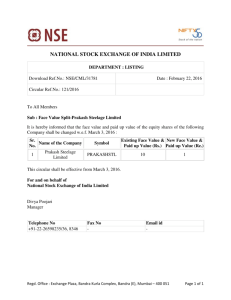

The Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 which has come into effect from 2 levels as under : nd October, 2006 classifies enterprises into three categories viz., Micro, Small and Medium based on investment

Sr.

Description of

Enterprises

Manufacturing

Sector

Investment (*) in

Plant & Machinery

Services Sector

Investment(*)

Equipment in a b

Micro

Enterprises

Small

Enterprises

Upto and including

Rs. 25 lacs

Above Rs. 25 lacs but upto and inclusive of Rs. 5 crores

Upto and including

Rs. 10 lacs

Above Rs. 10 lacs but upto and inclusive of

Rs. 2 crores b Medium

Enterprises

Above Rs. 5 crores but upto and inclusive of Rs.10 crores

Above Rs. 2 crores but upto and inclusive of Rs. 5 crores

(*) excluding cost of pollution control, research and development, industrial safety devices and such other items as may be specified by notification.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

1

These will include Small Road & Water Transport Operators, Small

Business, Retail Trade, Professional & Self employed Persons and other

Service Enterprises as defined under MSMED Act.

This policy intends to cover basically Viable or Potentially Viable MSME units (both manufacturing and non-manufacturing ) that are facing problems which can be overcome with timely remedial /corrective action. These problems may be due to cost/time overrun before commercial production, mismatch in cash flows resulting in temporary liquidity crunch, external factors etc. The guidelines enumerated below may generally be made applicable to accounts which are showing signs of slippage or have slipped to NPA category but have not become

“unviable”. In such accounts, timely decision on restructuring would be helpful. These accounts are more likely to be Standard and Sub

Standard accounts but instances of even doubtful accounts having potential viability cannot be ruled out. Restructuring may or not involve additional funding. In such accounts, we may be required to permit “Holding on operations” in the account till decision is taken on the restructuring proposal.

For eligible MSMEs under Consortium/Multiple Banking Arrangement the Bank with the maximum outstanding may work out the restructuring package along with the Bank having the second largest share.

In case of multiple banking/syndicate/consortium accounts where restructuring can be considered under Corporate Debt Restructuring

Scheme (CDRS), we may make effective use of CDR mechanism. In such cases restructuring may be considered on the basis of rehabilitation scheme worked out and approved by CDR Empowered

Group.

Suit filed cases are eligible if a minimum of 75% of the lenders (by value) in case of multiple banking/ syndicate/consortium accounts consent for such restructuring.

Borrowers who have been identified as willful defaulters in terms of

RBI directives (Annexure I) may generally not be considered for restructuring where the default is due to diversion of funds.

Restructuring may be however considered when the funds diverted have been brought back and/or there is a change in management and/or where the diversion is intra Company. However, restructuring need not be withheld where even inter-Company diversion had taken place. However, in such instances, the restructuring would be subject

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

2

to such diversion being brought back within a reasonable time and the same will be decided on a case to case basis. It shall also be our endeavour to address this issue by stipulation of additional margin/contribution, security etc. and wherever possible & feasible and placing suitable covenants to ensure non-recurrence in future keeping in mind safety of bank‟s funds. Viability and the ability to service after restructuring shall be the important criteria for determining eligible cases.

3. Definition of Sick Micro & Small Enterprises and Medium

Enterprises.

Medium Sector Enterprises :

As per extant RBI guidelines, a Medium Sector Enterprise may be classified as sick if : i) any of the borrower accounts of the unit remains sub-standard for more than 6 months i.e., principal or interest, in respect of any of its borrowal accounts has remained overdue for a period exceeding one year. The requirement of overdue period exceeding one year will remain unchanged even if the present period for classification of an account as sub-standard, is reduced in due course: or ii) there is erosion in the net worth of the borrower due to accumulated cash losses to the extent of 50 per cent of its net worth during the previous accounting year: and

iii) the unit has been in commercial production for at least 2 years

As per RBI circular No. RPCD.CO.MSME & NFS.BC.40/06.02.31/2012-2013 dated 01.11.2012 a Micro and Small Enterprise ( MSE) unit may be classified as sick when: a) any of the borrowal account of the enterprise remains NPA for three

months or more or b) there is erosion in the net worth due to accumulated losses to the extent of 50 per cent of its net worth during the previous accounting year.

The decision on viability of the unit should be taken at the earliest

but not later than 3 months of unit becoming sick under any

circumstances.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

3

4. Eligibility criteria

The following entities would be eligible for Debt Restructuring Mechanism

(DRM): i) ii)

All non-corporate MSMEs irrespective of the level of dues to the

Bank.

All Corporate MSMEs enjoying banking facilities solely from our

Bank irrespective of the level of dues to the Bank. iii) All corporate MSMEs, which have funded and non-funded outstanding up to Rs. 10 Crores under multiple / consortium banking arrangement with our Bank and other Banks. iv) Accounts classified as Sub-Standard or Doubtful would also be eligible but accounts classified as “Loss Assets” will not be eligible v) for DRM.

Cases where Operating Agency has been appointed, restructuring may be considered on the basis of the Rehabilitation Scheme worked out by the Operating Agency. vi) Accounts where recovery suits have been filed or action under

SARFAESI Act has been initiated will generally not be considered eligible for restructuring under DRM for MSMEs. However, in exceptional cases General Manager of the Zone / Corporate Office may permit restructuring in such cases. vii) In respect of units referred to CDR mechanism, restructuring may be considered on the basis of scheme worked out and approved by

CDR Empowered Group. viii) Accounts involving willful defaults, fraud and malfeasance will not be eligible for restructuring under these guidelines. ( Definition of

“willful default” as stated by the RBI is given in Annexure I ) ix) Where funds diverted earlier have been brought back into the business and/or there is change of management and/or where the diversion is intra company, restructuring may be undertaken on a case to case basis. However, restructuring/rehabilitation need not be withheld where intra company or even inter-company diversions have taken place, provided the amount diverted is brought back within a reasonable time. Such restructuring would be decided on a case to case basis, at the sole discretion of the bank. But additional margin/ contribution, security etc. wherever possible & feasible and suitable covenants may be considered as per Bank‟s discretion to ensure both safety of Bank‟s funds and non-recurrence in future.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

4

5. Viability Criteria for Small and Micro Enterprises

Viability and the ability to service the debt after restructuring shall be the important criteria for determining eligible cases.

Potentially Viable Sick MSME Unit. a.

A unit may be regarded as potentially viable if it would be in a position to continue to service its repayment obligations as agreed upon including those forming part of the package, after implementing a relief package spread over a period not exceeding 10 years if it is engaged in infrastructure activities and

– 7- years in case of other Units from the commencement of the package from Banks/ Financial Institutions/ Government

(Central/State) and other concerned agencies, as may be necessary, without the help of the concessions after the aforesaid period. b.

The repayment period for restructured (past) debts including moratorium period if any should not exceed 15 years in case of infrastructure Advances and 10 years in case of other Advances from the date of implementation of the package. c.

Financial Parameters applicable for DRM are given in Annexure-

IV. d.

Based on the norms specified above, it will be for the banks/financial institutions to decide whether a sick MSME unit is potentially viable or not. i) For Medium Sector Enterprises:

The decision on viability of a unit should be decided quickly but not later than -04- months and made known to the unit and others concerned at the earliest. ii) For Micro & Small Enterprises (MSEs)

The decision on viability of the unit should be taken at the

earliest but not later than 3 months of becoming sick

under any circumstances and made known to the unit and

others concerned at the earliest. e.

Restructuring/Rehabilitation scheme for MSME sector to be implemented within three months from date of receipt of full fledged applications alongwith copies of Audited Balance sheets for the last -3- years and all the necessary relevant papers required to prepare the scheme.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

5

f.

PARTICULARS

Minimum Average DSCR

Maximum period within which the unit should become viable

Maximum repayment period of all term loans / FITL /WCTL

Minimum Promoters‟

Contribution of which at least

50% must come upfront

1.25

7 years

10 years

DRM for SMEs

15% of the long term requirement of funds plus the monetary value of the sacrifices made by the lenders

g. A unit should be declared unviable only if the viability status is evidenced by a viability study. However, it may not be feasible to conduct viability study in very small units and will only increase paper work. As such for micro (manufacturing) enterprises, having investment in plant and machinery upto Rs.

5 lakh and micro (service) enterprises having investment in equipment upto Rs. 2 lakh, the Branch Manager may take a decision on viability and record the same, alongwith the justification.

The declaration of the unit as unviable, as evidenced by the viability study, should have the approval of the next higher authority/ present sanctioning authority for both micro and small units. In case such a unit is declared unviable, an opportunity should be given to the unit to present the case before the next higher authority.

The Authority for presenting the case to the next higher authority is as under:

The Authority empowered to sanction the loans and advances to the units including additional amount proposed under restructuring package shall have the powers for presenting the case to the next Higher Authority However, the Authority who have sanctioned the original proposal or proposal for increase in limits will not sanction the rehabilitation/restructuring proposal.

In such cases, restructuring / rehabilitation proposals will be approved by immediate next Higher Authority and in case of

Zonal Office Level Credit Committee (ZOCC) such restructuring / rehabilitation proposal will be sanctioned by the Corporate Office

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

6

Level Credit Committee headed by the Executive Director or as the case may be at BCC, Mumbai.

The next authority should take such decision only after giving an

opportunity to the promoters of the unit to present their case.

For sick units declared unviable, with credit facilities of Rs. 1 crore and above, a Committee approach as detailed above are to be adopted as the Committee approach will improve the quality of decision as collective wisdom of the members shall be utilized, especially while taking decision on rehabilitation proposals.

Decision of the above higher authority should be informed to the promoters in writing. The above process should be completed in a time bound manner not later than – 03 – months.

The concerned Regional Head may, however, take decision in cases of malfeasance or fraud without following the above procedure.

6. Reference for restructuring

“Restructuring” is the change in the terms of the loan on account of financial difficulties being faced by the borrower which would not have been otherwise permitted by the Bank. The restructuring would follow after receipt of a request to that effect from the borrowing units. The reference shall be treated to have been received, if the request is accompanied with the Audited Balance Sheets for the last three years, unaudited data for the current year, and complete details of the relief and concessions sought by the unit along with their justifications and other necessary relevant papers/data required for the purpose of examining/preparing revival scheme for the unit.

7. Need for Restructuring / Rehabilitation

A need for restructuring of an asset could arise due to any one of the following internal / external problems faced by the unit resulting in incipient sickness and borrower‟s inability to meet his financial commitments to the Bank

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

7

Internal /External problems:

Technical problems in production / temporary break down of plant

Commercial compulsions caused by demand and supply position, pricing and market.

Managerial inadequacies such as delay in appointing technical/ professional staff.

Economic factors – external in nature caused by changes in

Government policies.

Financial factors such as cost-over run in project implementation

Temporary cash flow aberration:

Temporary cash flow aberration may also arise due to any of the following aspects: resulting in liquidity crunch, unexpected payments, delay in release of Bank finance etc.

Delay in commencement of commercial production. e.

f.

g.

h.

a.

b.

c.

d.

Non-release of subsidies/grants by Government;

Inadequacy of own funds/long term funds;

Increase in credit on receivables;

Decrease in trade credit;

Spurt in prices of raw materials, other inputs;

Decrease in selling price of finished goods;

Disturbance in production due to strike;

Power cuts, major repairs, etc.; i.

Accumulation of inventories due to bulk purchases, temporary demand constraints, transport bottlenecks; etc.

Due to any of the above problems, the borrowers may not be in a position to service interest or installments or meet their commitments under Letters of

Credit or Guarantees issued.

8. Identification of accounts for Debt Restructuring Mechanism

(DRM)

Sickness should be arrested at the incipient stage itself. Appropriate measures should be taken by the branches to ensure this. A close watch should be kept on the account operations. Borrowers should be advised about their primary responsibility to inform the Bank of any problems faced by them which could result in the unit‟s sickness so as to restore the unit to normal health at the earliest. Early detection of sickness and prompt

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

8

remedial action are very crucial. Effective monitoring of the operations of the unit as well as the borrowal account(s) with the Bank is essential to identify the units showing symptoms of sickness. A note on this system is appended as Annexure-II.

Deteriorating quality of an asset is detectable well in time through a proper system of asset classification. Slippage of a standard account into watch category or substandard asset or any of the early warning signals should immediately be followed up with the borrower/unit. Necessary corrective/remedial action should be initiated immediately. The action needs to be pre-emptive for an early and effective restoration of health to a unit turning sick or showing signs of incipient sickness.

9. Restructuring / Rehabilitation Methods

Restructuring may involve:

Re-phasement of recovery schedule in term loan accounts for both interest and installment(s).

Waiver/concessions in interest charged with or without recompense.

Funding the un-serviced interest/irregular portion in the working capital facilities /term loan facilities (WCTL/FITL).

Reduction in margin for funded and non-funded limits.

Realignment of limits from pre-sale to post-sale and vice versa or from funded to non-funded limits.

Reassessment of the credit facilities including the working capital.

Such a restructuring may be:

For a short or medium term

With or without additional term or working capital funding normally with additional financing in genuine cases for

Balancing Equipment, Modernisation, Critical Capital

Expenditure (CAPEX) essential to make business Unit viable

/operationalise etc. Working Capital may be required over short/medium/long term basis restructuring/rehabilitation frame work.

9.1

Rescheduling: within the

It is changing the Pattern of debt service obligation from equated monthly installment to ballooning schedule or descending schedule

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

9

without considering any enhancement in repayment period and quantum of outstanding: i) ii)

Retaining the existing repayment period.

Not exceeding the existing outstanding exposure. iii) Without changing the nature and quantum of existing credit facilities. iv) Without sanctioning any fresh credit facility or additional limit beyond the existing outstanding exposure.

9.2 Rephasement:

Rephasement is rescheduling with enhancing the repayment period only.

9.3 Restructuring :

In Restructuring following may be considered: a.

b.

c.

d.

Rephasement and / or Rescheduling.

Changing existing outstanding exposure, and / or

Changing the nature and quantum of existing credit facilities

Sanctioning any fresh credit facility or additional limit whether within the existing outstanding exposure or beyond.

9.4

Repeated Re-structuring:

The account is expected to revert to normal health during the stipulated time-frame when the Restructuring is done for the first time.

However, further restructuring may be necessitated in some cases of genuine difficulties beyond the comprehension of the borrower like change in Govt. policies, shift in supply/demand, etc.

However, the special dispensation for asset classification would be available only when the restructuring is done for the first time.

9.5 Holding on Operations

For Medium Sector Enterprises:

While identifying and implementing the restructuring/rehabilitation package, “holding operation” may be considered for a period of 06 months. This will allow small-scale units to draw funds from the cash credit account at least to the extent of their deposit of sale proceeds

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

10

during the period of such “holding operation” less pre-agreed cutbacks to reduce overdues.

Holding on Operations essentially implies:

- Continuous operations in the account, like opening fresh

LCs to the extent of reduction in devolvement, even if

-

- devolvement is not fully cleared.

Roll over of LC opened by the Bank.

Allowing operations in the cash credit account despite interest/forced debits not being cleared.

- Fall in drawing power etc.

Such Holding on Operations may generally be permitted with a cut back of say about 10-15% towards reduction in overdues.

Holding on Operations can also be permitted even without cut back arrangement on case to case basis and merits of the case.

For Micro and Small Units:

Handholding stage: A.

1.

Timely and adequate assistance to MSEs and rehabilitation effort should begin on a proactive basis when early signs of sickness are detected. This stage would be termed as ‘handholding stage’ as defined below. This will ensure intervention by banks immediately after detecting early symptoms of sickness so that sickness can be arrested at an early stage. An account may be treated to have reached the „handholding stage‟; if any of the following events are triggered: a.

There is delay in commencement of commercial production by more than six months for reasons beyond the control of the promoters. b.

The Company incurs losses for two years or cash loss for one year, beyond the accepted timeframe; c.

The capacity utilization is less than 50% of the projected level in terms of quantity or the sales are less than 50% of the projected level in terms of value during a year.

2.

The bank branches should take timely remedial action which includes an enquiry into the operations of the unit and proper scrutiny of accounts, providing guidance / counseling services, timely financial assistance as per established need and also helping the unit in sorting out difficulties which are non – financial in nature or requiring assistance from other agencies .

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

11

In order to ensure timeliness for banks for taking remedial action / measures in „handholding stage‟, the handholding support to such units should be undertaken within a maximum period of two months of identification of such units .

For Medium Sector Units:

Holding on Operations

While identifying and implementing the restructuring/rehabilitation package, “holding operation” may be considered for a period of 06 months. This will allow small-scale units to draw funds from the cash credit account at least to the extent of their deposit of sale proceeds during the period of such “holding operation” less pre-agreed cutbacks to reduce overdues.

Holding on Operations essentially implies:

- Continuous operations in the account, like opening fresh

LCs to the extent of reduction in devolvement, even if

-

- devolvement is not fully cleared.

Roll over of LC opened by the Bank.

Allowing operations in the cash credit account despite interest/forced debits not being cleared.

- Fall in drawing power etc.

Such Holding on Operations may generally be permitted with a cut back of say about 10-15% towards reduction in overdues.

Holding on Operations can also be permitted even without cut back arrangement on case to case basis and merits of the case.

10.

Techno Economic Viability Study

(i)

(ii)

To ascertain the viability of a sick unit, detailed technical, economical, financial and managerial appraisal should be carried out to find out whether sufficient profit will be generated within the period of rehabilitation and whether the unit will be able to achieve positive „Networth‟.

In Accounts where aggregate exposure (existing/proposed) exceeds Rs. One Crore, TEV study to be carried out by outside empanelled Agency with our Bank/Member Banks or our Bank‟s Project Finance Department, BCC, Mumbai. In respect of Accounts where such exposure exceeds Rs. Five

Crores such TEV report to be vetted by our Bank‟s / Member

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

12

(iii)

Bank‟s Project Finance Division. In respect of Accounts with exposure upto Rs. One Crore, In House report submitted by the Borrower can be accepted subject to our usual scrutiny and if necessary the same may be vetted by our Project

Finance Division.

The study so conducted should cover various aspects relating to technical, financial, commercial and managerial appraisal.

11. Eligibility criteria for restructuring of advances

11.1.1 Bank may restructure the accounts classified under 'standard',

'sub-standard' and 'doubtful' categories.

11.1.2 Bank can not reschedule / restructure / renegotiate borrowal accounts with retrospective effect. While a restructuring proposal is under consideration, the usual asset classification norms would continue to apply.

The process of re-classification of an asset should not stop merely because restructuring proposal is under consideration. In case there is undue delay in sanctioning a restructuring package and in the meantime the asset classification status of the account undergoes deterioration, it would be a matter of regulatory concern.

11.1.3 Restructuring of debt can take place only with the formal consent/ application of the debtor. However, the process of restructuring can be initiated by the bank in deserving cases subject to customer agreeing to the terms and conditions.

11.1.4 No account will be taken up for restructuring by the bank unless the financial viability is established and there is a reasonable certainty of repayment from the borrower, as per the terms of restructuring package.

The viability should be determined by the bank based on the acceptable viability benchmarks as mentioned at Para No . 5 of this policy document.

The accounts not considered viable should not be restructured and bank should accelerate the recovery measures in respect of such accounts. Any restructuring done without looking into cash flows of the borrower and assessing the viability of the projects / activity financed by banks would be treated as an attempt at ever greening a weak credit facility and would invite regulatory concerns/action.

11. 2 Asset classification norms

Restructuring of advances could take place in the following stages :

(a) before commencement of commercial production/operation;

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

13

(b) after commencement of commercial production/operation but before the asset has been classified as „sub-standard‟;

(c) after commencement of commercial production/operation and the asset has been classified as „sub-standard‟ or „doubtful‟.

11.2.1 The accounts classified as „standard assets‟ should be immediately reclassified as „sub-standard assets‟ upon restructuring

(subject to provisions contained at Para No 11.3 of this policy document .

11.2.2 The non-performing assets, upon restructuring, would continue to have the same asset classification as prior to restructuring and slip into further lower asset classification categories as per extant asset classification norms with reference to the pre-restructuring repayment schedule.

11.2.3

All restructured accounts which have been classified as nonperforming assets upon restructuring, would be eligible for up-gradation to the „standard‟ category after observation of „satisfactory performance‟ during one year period from the date of first payment of interest or installments in terms of the restructuring package („specified period‟).

Satisfactory performance during the specified period means that i) in case of cash credit accounts, the account should not be out of order for more than 90 days during the specified period and there should not be any over dues at the end of the specified period. ii) in case of term loans no payments should remain overdue for more than 90 days during the specified period and there should be no over dues at the end of the specified period.

11.2.4

In case, however, satisfactory performance after the specified period is not evidenced, the asset classification of the restructured account would be governed as per the applicable prudential norms with reference to the pre-restructuring payment schedule.

11.2.5 Any additional finance may be treated as „standard asset‟, during the specified period. However, in the case of accounts where the pre restructuring facilities were classified as „sub-standard‟ and „doubtful‟, interest income on the additional finance should be recognized only on cash basis. If the restructured asset does not qualify for upgradation at the end of the above specified period, the additional finance shall be placed in the same asset classification category as the restructured debt.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

14

11.2.6 In case a restructured asset, which is a standard asset on restructuring, is subjected to restructuring on a subsequent occasion, it should be classified as substandard. If the restructured asset is a substandard or a doubtful asset and is subjected to restructuring, on a subsequent occasion, its asset classification will be reckoned from the date when it became NPA on the first occasion. However, such advances restructured on second or more occasion may be allowed to be upgraded to standard category after one year from the date of first payment of interest or repayment of principal whichever falls due earlier in terms of the current restructuring package subject to satisfactory performance.

11.3 Special Regulatory Treatment for Asset Classification

The special regulatory treatment for asset classification, in modification to the provisions in this regard stipulated in Para 11.2 of this policy document, will be available to the borrowers engaged in important business activities, subject to compliance with certain conditions as enumerated in Para 11.3.1 below. Such treatment is not extended to the following categories of advances: i) Consumer and personal advances;

ii) Advances classified as Capital market exposures;

iii) Advances classified as commercial real estate exposures

The asset classification of these three categories accounts as well as that of other accounts which do not comply with the conditions enumerated in para 11.3.1 will be governed by the prudential norms in this regard described in Para 12 of this policy document.

11.3.1 Elements of Special regulatory framework

The special regulatory treatment has the following two components: i)

ii)

Incentive for quick implementation of restructuring package.

Retention of the asset classification of the restructured account in the pre-restructuring asset classification category.

11.3.1.1 Incentive for quick implementation of the restructuring package

As stated in para 11.1.2, during the pendency of the application for restructuring of the advance with the bank, the usual asset classification norms would continue to apply. The process of reclassification of an asset should not stop merely because the application is under consideration.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

15

However, as an incentive for quick implementation of the package, if the approved package is implemented by the bank as per the following time schedule, the asset classification status may be restored to the position which existed when the reference was made to the CDR Cell in respect of cases covered under the CDR Mechanism or when the restructuring application was received by the bank in non-CDR cases. i) ii)

Within 120 days from the date of approval under the CDR mechanism.

Within 90 days from the date of receipt of application by the bank in cases other than those restructured under the CDR

Mechanism.

11.3.1.2 Asset classification benefits

Subject to the compliance with the undernoted conditions in addition to the adherence to the prudential framework laid down in para 11.2

i)

ii)

In modification to para 11.2.1, an existing „standard asset‟ will not be downgraded to the sub-standard category upon restructuring. in modification to para 11.2.2, during the specified period, the asset classification of the sub-standard / doubtful accounts will not deteriorate upon restructuring, if satisfactory performance is demonstrated during the specified period.

However, these benefits will be available subject to compliance with the following conditions:

i) The dues to the bank are „fully secured‟ by tangible security.

The condition of being fully secured by tangible security will not be applicable in the following cases:

a)

b)

c)

MSE borrowers, where the outstanding is upto Rs. 25 lac.

Infrastructure projects, provided the cash flows generated from these projects are adequate for repayment of the advance, the financing bank(s) have in place an appropriate mechanism to escrow the cash flows, and also have a clear and legal first claim on these cash flows.

Dues of Micro Finance Institutions (MFIs) restructured up to

March 31, 2011.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

16

ii) The unit becomes viable in 10 years, if it is engaged in infrastructure activities, and in 7 years in the case of other

iii) units.

Promoters‟ sacrifice and additional funds brought by them should be a minimum of 15% of banks‟ sacrifice.

iv) However, based on the representations received from Banks and Indian Banks‟ Association that corporate under stress find it difficult to bring in the promoters share of sacrifice and additional funds upfront on some occasions, it was decided by

RBI that :

a)

b)

c)

The promoter‟s sacrifice and additional funds required to be brought in by the promoters should generally be brought in upfront. However, if banks are convinced that the promoters face genuine difficulty in bringing their share of the sacrifice immediately and need some extension of time to fulfill their commitments, the promoters could be allowed to bring in

50% of their sacrifice, i.e., 50% of 15%, upfront and the balance within a period of one year.

However, in case the promoters fail to bring in their balance share of sacrifice within the extended time limit of one year, the asset classification benefits derived by banks will cease to accrue and the banks will have to revert to classifying such accounts as per the asset classification norms specified under

Para No. 11.2 of this policy document.

Promoter‟s contribution need not necessarily be brought in cash and can be brought in the form of de-rating of equity,

d)

e) conversion of unsecured loan brought by the promoter into equity and interest free loans.

Personal guarantee is offered by the promoter except when the unit is affected by external factors pertaining to the economy and industry.

The restructuring under consideration is not a „repeated restructuring‟ as defined in Para 9.4 of this policy document.

11.4 Income recognition norms

Interest income in respect of restructured accounts classified as 'standard assets' will be recognized on accrual basis and that in respect of the accounts classified as 'non-performing assets' will be recognized on cash basis.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

17

11.5 Provisioning norms

11.5.1

Normal provisions

Bank will hold provision against the restructured advances as per the existing IRAC norms.

11.5.2

Provision for diminution in the fair value of restructured advances

(i) Reduction in the rate of interest and /or reschedulement or rephasement of the repayment of principal amount, as part of the restructuring, will result in diminution in the fair value of the advance.

Such diminution in value is an economic loss for the bank and will have impact on the bank‟s market value of equity. It is, therefore, necessary for the bank to measure such diminution in the fair value of the advance and make provisions for it by debit to Profit & Loss Account. Such provision should be held in addition to the provisions as per existing provisioning norms as indicated in para 8.4.1 above, and in an account distinct from that for normal provisions.

For this purpose, “The erosion in the fair value of the advance should be computed as the difference between the fair value of the loan before and after restructuring. Fair value of the loan before restructuring will be computed as the present value of cash flows representing the interest at the existing rate charged on the advance before restructuring and the principal, discounted at a rate equal to the bank‟s BPLR or base rate

(whichever is applicable to the borrower) as on the date of restructuring plus the appropriate term premium and credit risk premium for the borrower category on the date of restructuring". Fair value of the loan after restructuring will be computed as the present value of cash flows representing the interest at the rate charged on the advance on restructuring and the principal, discounted at a rate equal to the bank‟s

BPLR or base rate (whichever is applicable to the borrower) as on the date of restructuring plus the appropriate term premium and credit risk premium for the borrower category on the date of restructuring".

(ii) In the case of working capital facilities, the diminution in the fair value of the cash credit /overdraft component may be computed as indicated in para (i) above, reckoning the higher of the outstanding amount or the limit sanctioned as the principal amount and taking the tenor of the advance as one year. The term premium in the discount factor would be as applicable for one year. The fair value of the term loan components( Working Capital Term Loan and Funded Interest Term Loan)

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

18

would be computed as per actual cash flows and taking the term premium in the discount factor as applicable for the maturity of the respective term loan components.

(iii) In the event any security instrument is taken in lieu of the diminution in the fair value of the advance, it should be valued at Re.1/- till maturity of the security. This will ensure that the effect of charging the economic sacrifice to the Profit & Loss account is not negated.

(iv) The diminution in the fair value may be re-computed on each balance sheet date till satisfactory completion of all repayment obligations and full repayment of the outstanding in the account, so as to capture the changes in the fair value on account of changes in BPLR or base rate (whichever is applicable to the borrower), term premium and the credit category of the borrower. Consequently, bank will have to provide for the shortfall in provision or reverse the amount of excess provision held in the distinct account.

(v ) Due to lack of expertise it would be difficult to ensure computation of diminution in the fair value of advances by the branches. The bank has the option of notionally computing the amount of diminution in the fair value and providing there for, at five percent of the total exposure, in respect of all restructured accounts where the total dues to bank are less than rupees one crore till the financial year ending March 2013. The bank has decided to opt for the simplified system for making provision in small accounts (less than Rs.1 crore i.e. making provision of 5% of total exposure in restructured accounts. The position would be reviewed thereafter).

12. Prudential Norms for Restructured Non-Manufacturing Units.

Units other than manufacturing can also be restructured/rescheduled subject to their satisfying the basic test of viability.

Important Note

Reference may be made to RBI Master circular No. DBOD No.

CID.BC.10/20.16.003/2012-13 dated 02.07.2012 available on

RBI website which can be visited at www.rbi.org.in

For Income Recognition/Asset classification /Provisioning

Norms for MSME units under DRM covered under this policy,

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

19

Reserve Bank of India directives / guidelines issued from time to time will be applicable and operative and will have overriding status over any other instructions .

13. Reliefs / Concessions to be extended and Sacrifice

Norms for grant of Reliefs/Concessions are furnished in annexure III and are common for MSMEs under Restructuring as well as Rehabilitation. For the sake of clarity we state here that the term Restructuring refers to the borrowal facilities (Fund Based as well as Non-Fund Based) of the unit with us/other Financial Institutions whereas the term Rehabilitation refers to the progress of the unit on its way to recovery through restructuring of its liabilities/repayment obligations. Rehabilitation should result in the unit becoming viable again so as to meet such liabilities/repayment obligations.

The viability and the rehabilitation of a unit would depend primarily on the unit‟s ability to continue to service its repayment obligations including the past restructured debts. It is, therefore, essential to ensure that ordinarily there is no write-off or scaling down of debt such as by reduction in rate of interest with retrospective effect except to the extent indicated in the guidelines. Interest concessions granted, if any, may be subject to annual review depending on the performance of the units.

The reliefs and concessions specified are not to be given in a routine manner and have to be decided based on the commercial judgement and merits of each case. Reliefs and concessions may be extended beyond the parameters in deserving cases. Only in exceptional cases, concessions/reliefs beyond the parameters would be considered. In fact, the viability study itself should contain a sensitivity analysis in respect of the risks involved that in turn will enable firming up of the correction action matrix.

14. Delegation of Powers for sanctioning proposals under DRM for

MSMEs and approving concessions

The Authority empowered to sanction the loans and advances to the units including additional amount proposed under restructuring package shall have the powers to sanction the restructuring / rehabilitation package. However, the Authority who have sanctioned the original proposal or proposal for increase in limits will not sanction the rehabilitation/restructuring proposal.

In such cases, restructuring / rehabilitation proposals will be approved by immediate next Higher Authority and in case of Zonal Office Level Credit

Committee (ZOCC) such restructuring / rehabilitation proposal will be

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

20

sanctioned by the Corporate Office Level Credit Committee headed by the

Executive Director or as the case may be at BCC, Mumbai.

Reliefs and concessions proposed under the DRM for MSMEs will be approved by immediate next Higher Authority in whose power proposal falls. In case of proposal within the powers of Zonal Office Level Credit Committee (ZOCC) such reliefs and concessions will be approved by the Executive Director. i) In case of default – 2% penal interest would be charged over and above prevailing normal rate, which would be applied on the amount of default for the period of default in the event of the unit achieving the projections but defaulting in payment of principal / interest. ii) According to RBI guidelines small and medium enterprises engaged in service sector are also eligible for relief and concessions for rehabilitation / restructuring. iii) Relief and concessions in services charges permissible under extant guidelines may also be permitted to accounts under restructuring / rehabilitation package. iv) The bank shall have the right to recompense i.e., recovery of the sacrifice made by it after the unit becomes profitable and all the term loans outstanding at the time of restructuring and sanctioned as a part of restructuring package have been repaid. v) It should be ensured that relief and concessions are not granted to the maximum permissible extent in all the cases as a matter of routine.

15. Right of Recompense

Normally, every Rehabilitation/Restructuring package involves some waivers and concessions extended by the lenders to deserving borrowers during their difficult times in order to keep them afloat. When the borrower stops incurring losses and starts earning profit, the lenders have right to recoup the sacrifice. Technically, 100% of such waivers/ concessions result in sacrifice of past dues or future dues can be recovered by the lenders at the time of enforcing the right of recompense. But, in practice the entire amount is not demanded from the borrower for the reason that the amounts involved would be high which, if paid in full, would again cause stress on the asset which has just come out of past difficulties. Therefore only certain elements of sacrifice are considered for exercising Right of Recompense. Detailed guidelines on Right of Recompense have been appended as Annexure VI .

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

21

It may be noted that the Bank will not entertain proposals with a request to waive the stipulation of right of Recompense. However in exceptional cases, reference may be made to BCC with views/recommendations of the

Branch/Regional/Zonal Heads. The authority to waive this condition rests only with the Executive Director/Chairman and Managing Director.

16. Methodology to be followed for

SCENARIO A

WHERE WE ARE THE SOLE LENDER

1. The borrower will make request for restructuring under DRM for MSMEs to the branch along with Proforma Package (PP, the application form for making request for restructuring under DRM for MSMEs – format of which is placed at annexure I) and its enclosures/ documents. Three sets of documents shall be provided by the borrower. The request should be entered in the Proposal Receipt Register and acknowledgement given to the borrower.

2 The branch shall examine the eligibility of the reference for restructuring under DRM for MSMEs. The branch shall send one set each to its controlling office & the sanctioning authority, where necessary, along with its views/ recommendations.

3. Techno-economic Viability needs to be established before proceeding with the restructuring. All cases shall be forwarded to the controlling office for assessment of viability and further action.

4. If the unit is found viable, the branch should prepare the Final

Restructuring Package based on the TEV study report and submit the same to the appropriate authority of the Bank.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

22

SCENARIO B

(i) WE ARE THE LARGEST LENDER

1. The borrower will make request for restructuring under DRM for MSMEs to the branch along with Proposal Papers (PP) and its enclosures/ documents. The request should be entered in the Proposal Receipt

Register and acknowledgement given to the borrower.

2. The branch shall examine the eligibility of the reference for restructuring under DRM for MSMEs.

3. The branch shall send a copy each of the PP to other lenders, informing the date of joint meeting of the lenders which shall not be later than 15 days from the date of the receipt of the request.

4. Our stand on the restructuring proposal should be finalized before the

Joint meeting. The views of other lenders may be obtained in the Joint meeting.

5. The lenders shall discuss the admissibility of the reference, the reasonableness of the relief and concessions sought, the system to be adopted for establishing viability and major issues to be addressed in the same, the terms and conditions to be stipulated [in case the account is restructured

6. Techno-Economic Viability needs to be established before proceeding with the restructuring. Whether the TEV study is to be done by the largest lender along with the second largest lender in-house or through an outside agency may be decided in the joint meeting itself.

7. The branch along with the second largest lender should prepare the

Final Restructuring Package based on the TEV study report and circulate the same to other lenders. Before circulating the Final

Package, the branch should obtain the approval of the stand from the sanctioning authority. The other lenders should obtain the approval of their competent authority and implement the restructuring package.

8. Package would be implemented simultaneously by all the lenders after it is sanctioned by their respective competent authorities.

9. 75% Lenders by value should agree for restructuring scheme approved.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

23

(ii) WE ARE THE SECOND LARGEST LENDER

1. The branch shall examine the eligibility of the reference for restructuring under DRM for MSMEs.

2. Our stand on the restructuring proposal should be crystallized before the Joint meeting. Our views may be conveyed in the Joint Meeting.

3. Techno-Economic Viability needs to be established before proceeding with the restructuring.

4. The Final Package circulated by the largest lender should be put up to the competent authority, after the joint meeting, for sanction of the restructuring package.

(iii) WE ARE NEITHER THE LARGEST NOR THE SECOND LARGEST

LENDER

1. The branch shall examine the eligibility of the reference for restructuring under DRM for MSMEs. The branch shall, immediately thereafter, send one copy each to its Regional Office & the sanctioning authority, where necessary.

2. Our stand on the restructuring proposal should be crystallized before the Joint meeting. Our views may be conveyed in the Joint meeting.

17. Date of Commencement of Commercial Operations (DCCO)

Guidelines on DCCO as per Master Circular No. DBOD No.

BP:BC:9/21.04.048/2012-13 dated 02.07.2012 are as under :

Project Loans for Infrastructure Sector

(i)

3. The Final Package circulated by the largest lender should be put up to the competent authority for sanction of the restructuring package and implemented within the prescribed time frame.

A loan for an infrastructure project will be classified as NPA during any time before commencement of commercial operations as per record of recovery (90 days overdue), unless it is restructured and becomes eligible for classification as „standard asset‟ in terms of paras (iii) to (v) below.

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

24

(ii)

(iii)

A loan for an infrastructure project will be classified as NPA if it fails to commence commercial operations within two years from the original DCCO, even if it is regular as per record of recovery, unless it is restructured and becomes eligible for classification as „standard asset‟ in terms of paras (iii) to (v) below.

If a project loan classified as „standard asset‟ is restructured any time during the period upto two years from the original date of commencement of commercial operations (DCCO), in accordance with the provisions of Part B of the above referred RBI Master

Circular, it can be retained as a standard asset if the fresh DCCO is fixed within the following limits, and further provided the account continues to be serviced as per the restructured terms.

(a) Infrastructure Projects involving court cases

Upto another 2 years (beyond the existing extended period of 2 years i.e. total extension of 4 years), in case the reason for extension of date of commencement of production is arbitration proceedings or a court case.

(b) Infrastructure Projects delayed for other reasons beyond the control of promoters:

Upto another 1 year (beyond the existing extended period of 2 years i.e., total extension of 3 years), in other than court cases.

(iv) It is re-iterated that the dispensation in para (iii) above is subject to adherence to the provisions regarding restructuring of accounts as contained in the RBI Master Circular DBOD No.

BP:BC:9/21.04.048/2012-13 dated 02.07.2012 which would inter alia require that the application for restructuring should be received before the expiry of period of two years from the original DCCO and when the account is still standard as per record of recovery. The other conditions applicable would be:

(a) In cases where there is moratorium for payment of interest, banks should not book income on accrual basis beyond two years from the original DCCO, considering the high risk involved in such restructured accounts.

(b) Banks should maintain provisions on such accounts as long as these are classified as standard assets as under:

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

25

Until two years from the original DCCO 0.40%

During the third and the fourth years after the original

DCCO

2.00%

(v) For the purpose of these guidelines, mere extension of DCCO will also be treated as restructuring even if all other terms and conditions remain the same.

Project Loans for Non – Infrastructure Sector:

(i)

(ii)

(iii)

A loan for a non-infrastructure project will be classified as NPA during any time before commencement of commercial operations as per record of recovery (90 days overdue), unless it is restructured and becomes eligible for classification as „standard asset‟ in terms of paras (iii) to (v) below.

A loan for a non-infrastructure project will be classified as NPA if it fails to commence commercial operations within six months from the original DCCO, even if it is regular as per record of recovery, unless it is restructured and becomes eligible for classification as

„standard asset‟ in terms of paras (iii) to (v) below.

In case of non-infrastructure projects, if the delay in commencement of commercial operations extends beyond the period of six months from the date of completion as determined at the time of financial closure, banks can prescribe a fresh DCCO, and retain the “standard” classification by undertaking restructuring of accounts in accordance with the provisions contained in the RBI

Master Circular DBOD No. BP:BC:9/21.04.048/2012-13 dated

02.07.2012 provided the fresh DCCO does not extend beyond a period of twelve months from the original DCCO. This would among others also imply that the restructuring application is received before the expiry of six months from the original DCCO, and when the account is still “standard” as per the record of recovery.

The other conditions applicable would be: a.

b.

In cases where there is moratorium for payment of interest, banks should not book income on accrual basis beyond six months from the original DCCO, considering the high risk involved in such restructured accounts.

Banks should maintain provisions on such accounts as long as these are classified as standard assets as under:

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

26

Until the first six months from the original DCCO

During the next six months

0.40%

2.00%

(iv) For this purpose, mere extension of DCCO will also be treated as restructuring even if all other terms and conditions remain the same.

Other issues:

(i)

(ii)

All other aspects of restructuring of project loans before commencement of commercial operations would be governed by the provisions of Part B of Master Circular No. DBOD No.

BP:BC:9/21.04.048/2012-13 dated 02.07.2012 on Prudential Norms on Income Recognition, Asset Classification and Provisioning

Pertaining to Advances. Restructuring of project loans after commencement of commercial operations will also be governed by these instructions.

Any change in the repayment schedule of a project loan caused due to an increase in the project outlay on account of increase in scope and size of the project, would not be treated as restructuring if:

(a) The increase in scope and size of the project takes place before commencement of commercial operations of the existing project.

(b) The rise in cost excluding any cost-overrun in respect of the original project is 25% or more of the original outlay.

(c) The bank re-assesses the viability of the project before approving the enhancement of scope and fixing a fresh DCCO.

(d) On re-rating, (if already rated) the new rating is not below the previous rating by more than one notch.

(iii) These quidelines would apply to those cases where the modification to terms of existing loans, as indicated above, are approved by banks from the date of this circular.

18. Standard terms and conditions

The need for restructuring would arise in stressed assets. The reasons for stress may be internal to the Company like diversion of funds, non-induction of promoters contribution, poor vision and mismanagement or external to the

Company/ management like sudden downturn in the market, technology changes, policy changes etc. An indicative list of standard terms and conditions that may be imposed by the lenders is given at Annexure V . The branches may be guided by the reasons for the stress in the account while

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

27

stipulating the conditions. The list given at the annexure is only indicative and the branch may impose conditions as may be necessary to safeguard bank‟s interest.

19. Disclosure

Bank is required to disclose in its published Annual Balance Sheet, under "Notes on Accounts", information relating to number and amount of advances restructured under DRM for MSMEs and the amount of diminution in the fair value of the restructured advances.

Bank is required to disclose the total amount outstanding in all the accounts/facilities of borrowers whose accounts have been restructured along with the restructured part or facility. This means even if only one of the facilities/accounts of a borrower has been restructured, the bank should also disclose the entire outstanding amount pertaining to all the facilities/ accounts of that particular borrower.

Credit Monitoring and Rehabilitation of Sick units under CDR & BIFR Accounts

List of Annexures:

Annexure I

Annexure-II

Annexure-III

:

:

:

Willful Defaulters

Early Warning Signals

Reliefs & Concession which can be extended by the Bank to potentially viable Sick

MMSME units

Annexure-IV

Annexure-V

Annexure-VI

:

:

:

Financial Parameters applicable for DRM

Standard Terms & Conditions

Guidelines on Right of Recompense

Baroda Corporate Centre, Credit Monitoring Department, 2 nd floor, C-26, G Block,

Bandra Kurla Complex, Bandra( East), Mumbai-400051

Tele. 66985646/66985735 Fax.(022) 26525760 .

MODIFIED AS PER RBI MASTER CIRCULAR DTD 02.7.12 & RBI CIRCULAR DATED 01.11.2012 ON REHABILITATION OF MICRO & SMALL ENTERPRISES

28