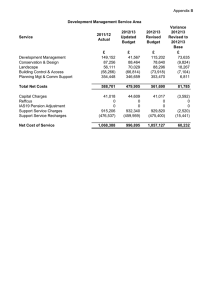

Appendix B £ ENVIRONMENT SERVICE AREA

advertisement

Appendix B 2011/12 Updated Budget 2011/12 Revised Budget Variance £ £ £ 375,334 378,283 (24,434) 230,380 (24,434) 205,610 581,280 559,459 Rural Sewerage Schemes Gross Direct Costs Support Service Charges Net Expenditure 335,441 800 336,241 335,441 0 335,441 Travellers Gross Direct Costs Capital Charges Gross Direct Income Net Expenditure 40,000 97,800 (40,000) 97,800 42,236 97,800 (42,236) 97,800 124,884 (180,183) 154,770 116,609 (175,183) 177,410 Net Expenditure 99,471 118,836 R117B Street Naming Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges 27,140 3,330 0 4,940 27,214 5,691 0 970 74 No major variances 2,361 Depreciation 0 (3,970) Costs now going direct to final services and no longer through the Environmental Health management unit R117B Net Expenditure 35,410 33,875 (1,535) Pest Control Gross Direct Costs Gross Direct Income Support Service Charges 28,532 (4,500) 20,250 28,274 (3,770) 6,990 (258) No major variances 730 No major variances (13,260) Costs now going direct to final services and no longer through the Environmental Health management unit Net Expenditure 44,282 31,494 (12,788) 431,763 434,228 2,465 £9,491 - Salary and on costs - includes additional Standby payments. (£7,000) - Land Drainage Grants 0 (18,930) 222,960 3,600 (18,930) 207,470 635,793 626,368 3,600 Depreciation 0 (15,490) Costs now going direct to final services and no longer through the Environmental Health management unit plus some are now recharged where staff costs are coded (9,425) Explanation for Major Variances ENVIRONMENT SERVICE AREA R111A Commercial Services Gross Direct Costs Gross Direct Income Support Service Charges R111A Net Expenditure R114 R114 R115 R115 R117 R117 R118 R118 Licensing Gross Direct Costs Gross Direct Income Support Service Charges R119A Environmental Protection Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges R119A Net Expenditure 2,949 £6,949 - Salaries and on costs are higher due to incremental increases and maternity cover. (£4,000) Saving on costs associated with Food Hygiene courses now provided in-house 0 (24,770) Costs now going direct to final services and no longer through the Environmental Health management unit (21,821) 0 (800) No major variances (800) 2,236 Inflation on lease rental payments 0 (2,236) Grant income to cover the inflationary increases 0 (8,275) (£10,000) - Taxi testing contract costs 5,000 Refunds due for annual fees erroneously charged 22,640 Costs now going direct to final services and no longer through the Environmental Health management unit in addition to increased recharges from Legal Services 19,365 Appendix B 2011/12 Updated Budget 2011/12 Revised Budget Variance £ £ £ Explanation for Major Variances ENVIRONMENT SERVICE AREA R120 Dog Control Gross Direct Costs Gross Direct Income Support Service Charges 58,054 (500) 39,540 57,973 (500) 33,600 (81) No major variances 0 (5,940) Costs now going direct to final services and no longer through the Environmental Health management unit R120 Net Expenditure 97,094 91,073 (6,021) R151 Env Health - Service Mgmt Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure 258,480 9,347 (850) (266,977) 0 256,486 12,482 (850) (268,118) 0 Parks & Open Spaces Gross Direct Costs 444,745 484,038 Capital Charges Gross Direct Income 28,059 (50,954) 27,668 (66,965) Support Service Charges 120,720 94,420 R300 Net Expenditure 542,570 539,161 R303 Sports Centres Gross Direct Costs 430,404 439,921 34,725 (183,838) 34,725 (150,622) Support Service Charges 112,560 148,700 R303 Net Expenditure 393,851 472,724 R304 Leisure Complexes Gross Direct Costs Capital Charges Support Service Charges 299,129 268,440 29,850 298,629 270,835 19,310 Net Expenditure 597,419 588,774 R151 R300 Capital Charges Gross Direct Income R304 (1,994) No major variances 3,135 Intangible Amortisation on computer software 0 (1,141) More accurately allocated to final services 0 39,293 £4,000 - Repairs to Irrigation equipment. £8,380 Remedial tree works. (£5,000) - Expenditure not required on playground repairs. £10,769 - Payment to Horning Parish Council re Section 106 agreement. £20,239 - Expenses incurred in relation to the Childrens Play Programme, funded by BIG Lottery Grant (391) (16,011) £14,997 - No charge for grass verge cutting - no longer undertaken for Norfolk County Council. (£10,769) Section 106 income re Lower Street, Horning. (£20,239) - BIG Lottery Grant. (26,300) Reduced recharges from Leisure Services reflecting lower Legal and Publicity costs. (3,409) 9,517 (£4,689) - Savings in salaries and on costs as a result of new working practices. £8,890 - Hall hire costs at Cromer are greater than anticipated due to repair of fire damage and floor refurbishment. £5,200 - Purchase of equipment funded from the Sports Hall Equipment reserve. 0 33,216 £28,216 - It has not been possible to meet the 5% participation increases which have impacted on projected income due to the continuing difficult financial climate. £2,500 - The installation of the new Multi Use Games Area at Stalham was delayed. £2,500 Outreach work with schools and the income generated from this has also reduced due to the pressure on school budgets. 36,140 This consists of various recharges, eg Insurances, Personnel and Computers that are recharged based on where staff costs are allocated. 78,873 (500) No Major Variances 2,395 (10,540) Reduced recharges from Leisure Services reflecting lower Legal and Publicity costs. (8,645) Appendix B 2011/12 Updated Budget 2011/12 Revised Budget Variance £ £ £ Explanation for Major Variances ENVIRONMENT SERVICE AREA R305 Other Sports Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges 84,976 123,819 38,843 £17,293 - Salaries and on costs - extension of fixed term contracts as a result of securing one-off funding. £5,000 - Expenditure incurred in relation to the Walking Project. £8,565 - Community Sports Network projects. £7,271 - Free Swimming Projects 0 (29,055) 20,860 0 (67,184) 35,490 0 (38,129) (£38,129) - Grant funding for projects listed above. 14,630 This consists of various recharges, eg Insurances, Personnel and Computers that are recharged based on where staff costs are allocated. 15,344 R305 Net Expenditure 76,781 92,125 R306 Recreation Grounds Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure 11,349 0 (1,000) 4,060 14,409 9,149 520 (1,000) 3,170 11,839 Arts & Entertainments Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges 129,260 0 (1,460) 22,670 129,502 480 (1,460) 44,930 242 No Major Variances 480 0 No Major Variances 22,260 £11,150 - Recharge from Media and Communications. The balance consists of various recharges, eg Insurances, Personnel and Computers that are recharged based on where staff costs are allocated. R307 Net Expenditure 150,470 173,452 22,982 R308 Museums Gross Direct Costs Support Service Charges Net Expenditure 46,513 4,530 51,043 46,509 4,000 50,509 Pier Pavilion Gross Direct Costs Support Service Charges 96,377 23,800 96,377 14,510 R306 R307 R308 R309 R309 Net Expenditure 120,177 110,887 R310 Foreshore (Water Safety, Lifeguards etc) Gross Direct Costs 427,034 390,534 Gross Direct Income Support Service Charges (14,750) 41,690 (14,750) 32,630 R310 Net Expenditure 453,974 408,414 R312 Woodlands Management Gross Direct Costs 95,369 96,898 1,497 (18,600) 1,386 (42,949) 76,920 88,110 155,186 143,445 Capital Charges Gross Direct Income Support Service Charges R312 Net Expenditure (2,200) No Major Variances 520 0 No Major Variances (890) No Major Variances (2,570) (4) No Major Variances (530) No Major Variances (534) 0 No Major Variances (9,290) (£4,980) - Reduced charge from Property Services. (£4,280) - Reduced recharges from Leisure Services reflecting lower Legal and Publicity costs. (9,290) (36,500) (£34,000) - Maintenance budget transferred to the Foreshore service in the Resources Service Area. (£2,500) - Lower maintenance and repair costs for memorial seats. 0 No Major Variances (9,060) (£9,840) - Reduced recharges from Leisure Services reflecting lower Legal and Publicity costs. (45,560) 1,529 (£17,909) - Salaries and on costs are lower as a result of a vacant post. £16,848 - Expenditure relating to the Access to Nature Project. (111) (24,349) (£16,848) - Grant from Natural England for the Access to Nature Project. (£5,500) - Grant from the Forestry Commission 11,190 This consists of various recharges, e.g. Insurances, Personnel and Computers that are recharged based on where staff costs are allocated. (11,741) Appendix B 2011/12 Updated Budget 2011/12 Revised Budget Variance £ £ £ Explanation for Major Variances ENVIRONMENT SERVICE AREA R314 R314 R315 Cromer Pier Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure 37,733 5,232 (14,904) 17,550 45,611 38,417 5,232 (15,588) 26,350 54,411 Public Conveniences Gross Direct Costs 409,649 428,820 Capital Charges 65,460 70,217 Gross Direct Income Support Service Charges (2,183) 61,230 (2,405) 54,350 R315 Net Expenditure 534,156 550,982 R316 Waste Collection And Disposal Gross Direct Costs 3,753,874 Capital Charges 152,771 Gross Direct Income (2,717,738) Support Service Charges 300,860 3,728,227 484,613 (2,839,877) 253,480 R316 Net Expenditure 1,489,767 1,626,443 684 No Major Variances 0 (684) No Major Variances 8,800 Recharge from Coastal Management 8,800 19,171 £18,000 - additional repairs and maintenance costs, £2,000 - one off contribution to National Trust following transfer of Morston Quay public convenience, (£829) reduced NNDR costs 4,757 £4,757 - additional depreciation following property revaluations as a result of refurbishment works. (222) No major variances (6,880) (£6,890) - reduced recharges from Environmental Health and Property Services based on revised recharge allocations 16,826 (25,647) See Note A Below: 331,842 Depreciation (122,139) See Note B Below: (47,380) Costs now going direct to final services and no longer through the Environmental Health management unit. In addition, costs have reduced from Customer Services with the administration being dealt with by Kier staff 136,676 Note A: (£11,391) - Salary and oncosts in connection with restructuring of service; £5,168 - Costs associated with maintenance for the bottle banks; (£12,439) - Rent and Business Rates for land at Northrepps for storage of brown bins; £37,500 - Additional contractor costs to Kier for Tipping Away, Monthly adjustments & Clinical Waste collections; £2,960 - Additional costs for glass and paper processing costs; (£2,063) - Saving on Kier costs for administration; (£10,000) - Contribution to the Norfolk Waste Partnership not being made this year; (£11,500) - Recycling initiatives not being spent; £2,000 - Procurement costs associated with the Materials Recycling Facility; (£13,214) - NEWS processing costs reduced due to lower tonnages of materials going through the facility; (£15,356) - Reduction in recycling credits paid to third parties; £4,000 - Payment to Norfolk Pension Fund for assessment of the pension implications of the new Kier contract Note B: (£192,000) Additional Profit Share; £42,446 Reduction in Recycling Credits received from Norfolk County Council, mainly due to lower tonnages of materials recycled; £49,083 - Loss of fee income from cancelled prescribed waste customers; (£16,500) Additional recharges for Tipping Away and Clinical Waste from Norfolk County Council; (£5,168) - Recharge to Kier Street Services for works at the bottle banks R317 R317 R397 R397 Cleansing Gross Direct Costs 759,927 776,913 Gross Direct Income Support Service Charges Net Expenditure (34,000) 19,380 745,307 (34,000) 21,580 764,493 Leisure Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure 145,670 (700) (144,970) 0 145,814 (700) (145,114) 0 16,986 £11,986 - Salary and on costs - includes restructure of service; £15,000 - Payment for cleansing survey National Indicator 195 (Cleanliness Performance Indicator); (£5,000) - Saving on Initial contract for nappy bins; (£5,000) - Costs associated with litter bin maintenance 0 2,200 No major variances 19,186 144 No Major Variances 0 No Major Variances (144) No Major Variances 0 Appendix B 2011/12 Updated Budget 2011/12 Revised Budget Variance £ £ £ Environmental Strategy Gross Direct Costs 104,234 125,036 Capital Charges Gross Direct Income Support Service Charges 0 (2,500) 23,690 7,717 (5,000) 39,440 125,424 167,193 20,802 £2,500 - Bike Loan scheme. (£1,683) - Staff costs. £20,000 - Transfer from Reserves for Carbon Reduction Plan projects 7,717 Depreciation (2,500) Contributions to the Bike Loan Scheme 15,750 Costs now going direct to final services and no longer through the Environmental Health management unit plus some are now recharged where staff costs are coded 41,769 Explanation for Major Variances ENVIRONMENT SERVICE AREA R412 R412 Net Expenditure R420 Civil Contingencies Gross Direct Costs 94,032 73,842 Gross Direct Income Support Service Charges 0 49,230 0 100,820 143,262 174,662 9,049,903 666,661 (3,341,079) 1,191,293 7,566,778 9,109,189 1,022,966 (3,508,403) 1,200,108 7,823,860 R420 Net Expenditure Gross Direct Costs Capital Charges Gross Direct Income Support Service Charges Net Expenditure (20,190) Salary and on costs associated with the vacant post new post holder appointed with a commencement date of 26/09/11 0 51,590 £26,670 - Reflects the increase in Environmental Health Management time. £4,840 - Corporate Leadership Team, £5,260 Corporate Customer Services and miscellaneous costs being allocated to the final service 31,400 59,286 356,305 (167,324) 8,815 257,082