The Saudi Stock Market: Structural Issues, Recent Performance and Outlook Report Series

advertisement

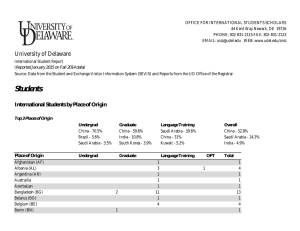

December 2009 Report Series The Saudi Stock Market: Structural Issues, Recent Performance and Outlook Executive Summary The Saudi stock exchange, the Tadawul, is the largest in the Gulf region, with current market capitalisation of around $325 billion or 70 percent of 2008 GDP. For most of 2009 the main index lagged emerging market benchmarks by some margin, reflecting concerns about corporate balance sheets. However, investor sentiment has recently improved. The market has a number of structural rigidities, many of which contributed to a substantial run-up in prices in 2005-06. The subsequent correction was painful and prompted a number of regulatory changes, focusing on corporate governance and transparency. The door to foreign investment has also been opened ajar. The short-term outlook for the market is reasonably good given firming external demand and robust government spending, which should support corporate profit growth. However, we see global growth softening again towards the end of 2010. Office of the Chief Economist Economics Department Samba Financial Group P.O. Box 833, Riyadh 11421 Saudi Arabia In the medium term, the market will be supported by Saudi Arabia’s impressive economic and financial fundamentals, and further improvements to the regulatory structure. Foreign involvement is also ChiefEconomist@samba.com +9661-477-4770; Ext. 1820 (Riyadh) +4420-7659-8200 (London) This and other publications can be Downloaded from www.samba.com expected to increase, and this should enhance transparency and stability. December 2009 Table of Contents Introduction 3 Market Overview 3 Market Structure 4 Governance 6 Recent Performance 9 Market Outlook – Short Term 10 Market Outlook – Long Term 11 2 December 2009 Introduction Stock markets have an important economic role to play In principle, stock markets are a useful tool for economic development. Efficient stock markets pool private funds, and allocate them for corporate investment. This gives firms access to cheaper capital than traditional bank finance and also helps them to mitigate financial risk. Stock markets also encourage efficiency through the prospect of takeover: if management does not maximise shareholder value, then another economic agent could take control of the firm and introduce more efficient practices and personnel. Stock markets can encourage more efficient corporate behavior Academic research indicates that various measures of stock market activity are positively correlated with stronger economic growth and productivity improvement across countries and that the association is particularly strong in emerging markets. There are drawbacks however. For example, very liquid stock markets might negatively influence corporate governance: with share prices rising, investors might be tempted to take a relaxed view of management practices, safe in the knowledge that they can sell their shares at any time and for a profit (this was the case in Saudi Arabia in the middle of this decade). Markets also tend to favour big firms over smaller ones, often with little regard to efficiency. Thus, large inefficient firms are more likely to take over and/or absorb small efficient firms without any improvement in their own management practices. Saudi Arabia: Tadawul All Share Index 20000 15000 10000 5000 Robust supporting institutions are necessary for a market to thrive 0 Dec-00 Mar-03 Source: Bloomberg Jun-05 Sep-07 Dec-09 For a market to thrive, it also needs to have robust supporting architecture, such as good quality institutions and a well-functioning supervisory structure. These are often lacking in emerging markets. Other research points to the importance of foreign investment as a catalyst to the development of emerging market bourses. In this paper we will consider the structure and main characteristics of the Saudi stock market; key regulatory changes following the 2006 correction; and the bourse’s recent performance and outlook. We will start by looking at the market’s essential characteristics. Market Overview The Tadawul is easily the biggest market in the Arab world Saudi bourse dwarfs others in the Arab world The Saudi bourse, known as the Tadawul, is easily the largest in the Arab World. In mid-Decemer its market capitalisation was around $313 billion, dwarfing that of the next largest, Kuwait, which had a market cap of $94 billion. As a percentage of GDP, the Tadawul’s market cap is around 67 3 December 2009 64.4 64 Abu Dhabi Morocco Bahrain Oman 33.4 16.4 16.2 Dubai Egypt Qatar Kuwait 93.9 86.3 86.2 Saudi Arabia percent of 2008 GDP or 82 percent of our forecast for 2009 GDP. The bourse is technologically advanced, and introduced the world’s first fully electronic market in the 1990s, comprising trading, clearing, settlement and depository. Stock Market Capitalisation (as of December 9, $ billion) 313 The main index, the Tadawul All Share Index (TASI) reached its zenith in February 25 2006, when it closed at 20,635. The TASI is currently trading at around 6000. In 2008 the Tadawul was second only to London for new equity issuance, though Saudi IPOs dwindled rapidly after the intensification of the international financial crisis in October of that year. The Saudi Arabia Monetary Agency (SAMA) was responsible for supervising the market from 1984 until 2003. In July 2003, authority was handed over to the newly-formed Capital Market Authority (CMA). The CMA is now the sole regulator and supervisor of Saudi Arabia’s capital markets, and issues the necessary rules and regulations to protect investors and ensure fairness and efficiency in the market. Source: Zawya Door has been gradually opened to foreign participation Tadawul: IPOs, 2007-09 (number) 10 For many years the Tadawul was open to only Saudi nationals. In December 2007, as part of the moves to establish a GCC common market, the Tadawul was opened to GCC nationals, though their participation remains limited as they have tended to focus on their domestic markets. Until 2008, non-Arab foreigners who were not resident in the Kingdom could only participate through few mutual funds. However, in August 2008 the CMA approved new rules that allowed non-Arab foreigners to participate in share trading through swap arrangements with local CMA-approved and -licensed intermediaries. 8 6 4 2 0 Jan-07 Sep-07 Source: Tadawul May-08 Jan-09 Sep-09 Market Structure Financials and Petrochemicals are the largest sectors The Saudi stock market currently lists 134 companies, divided into nine sectors, according to Bloomberg’s classification, each of which has its own sub-index. In order of size, they are: Financials Tadawul: Market Share by Sector (percent of market cap, December 9 2009) Industrials Utilities, 1.8 Consumer goods, 4.1 Consumer services, 3.7 Oil & gas, 1.7 Basic Materials (Petrochemicals) Healthcare, 0.4 Industrials, 10.8 Telecoms Consumer Goods Consumer Services Oil and Gas Telecoms, 8.1 Utilities Basic materials, 23.5 Source: Tadawul Financials, 46.0 Healthcare Financials and Basic Materials are the dominant sectors, together accounting 4 December 2009 Tadawul: Buy Transactions by Source, November 2009 (percent of value) Non-Arab residents, 0.2 GCC/Arab citizens, 3.0 Mutual funds, 1.5 for just under 70 percent of market capitalisation. The biggest two companies by market share are Al Rajhi Bank and the petrochemicals producer, Sabic, both of which command around 11 percent of the market. However, some of the smaller sectors have larger numbers of companies: for example, the Consumer Goods sector contains 16 companies, despite accounting for just 4 percent of the market’s value. Foreign swap agreements, 1.2 The market is dominated by retail investors… Saudi corporates, 7.0 Saudi individuals, 87.5 Source: Tadawul 100 These small cap firms tend to be heavily traded by retail investors, who dominate the market. Retail investors accounted for 88 percent of buy transactions in November 2009 (essentially unchanged from a year earlier). Saudi corporations accounted for just 7.0 percent of such orders, while mutual funds registered 1.5 percent. In large OECD bourses, such as London’s, institutional investors tend to account for around 90 percent of transactions. GCC and other Arab citizens accounted for 3 percent of buys, while foreigners resident in the Kingdom registered just 0.2 percent. Foreigners resident outside the Kingdom placed 1.2 percent of buy orders with a small number of transactions. This indicates that their average purchase was sizeable, which fits the profile of large foreign institutions looking to buy and hold Saudi shares. Nevertheless, there was a net outflow of this type in November, reflecting unease caused by the Dubai World debt standstill request (see below). Volatility: TASI vs MSCI EM (daily standard deviation, absolute spread) 80 …who have contributed to considerable volatility 60 40 20 0 Jan-05 Jun-07 Source: Bloomberg 21000 Nov-09 TASI MSCI A massive run-up in prices was followed by a painful downturn Tadawul All Share Index (2005-06 ) Unsurprisingly, valuations became increasingly stretched with the average price-to-earnings ratio reaching a high of 47 in late February 2006 (the ratio exceeded 100 for a number of companies). Expected corporate profit growth began to run ahead of actual results; this was compounded by annual reporting showing that many companies had invested heavily in the stock exchange and booked unrealised stock market earnings. 14000 7000 Jan-05 Source: Bloomberg The long-standing dominance of retail investors has led to considerable volatility in the Saudi bourse. The middle part of this decade saw a vertiginous run-up in the TASI. This reflected a number of factors, but key among them was a huge influx of small first-time traders attracted by a number of underpriced IPOs. (Under-priced IPOs encourage investors to sell part of their existing holdings in order to raise capital to invest in the new issues, thereby fuelling volatility.) Between 2003 and its peak in February 2006 the index gained a staggering 700 percent, with market capitalisation soaring to $800 billion—around two-and-a-half times nominal GDP. At its peak, the Tadawul was the world’s tenth largest stock market by value, despite having only 78 listed stocks, many with a limited free float. Dec-05 Nov-06 The correction, when it came, was severe, with the TASI losing half its value in less than three months, ending the year more than 53 percent below where it began. Between the peak and end-2006 nearly $480 billion was removed 5 December 2009 from the value of the exchange, equivalent to about 140 percent of 2006 GDP. Tadawul: Market Capitalisation (2005-06 ; $ bn) 800 700 This pattern was repeated, to varying degrees, across most of the other GCC states. Abu Dhabi, Qatar and especially Dubai all witnessed tremendous surges in stock prices in 2005, before experiencing equally abrupt (and in some cases even steeper) falls. 600 500 400 300 200 Jan-05 Dec-05 Source: Bloomberg Nov-06 Governance Millions of Saudis lost considerable sums in the stock market crash. Mindful of their distress, and to prevent any repeat, the CMA was quick to articulate a three pronged strategy: increase the size and, most importantly, the depth of the market; improve transparency and disclosure; and clamp down on insider trading. Authorities are keen to boost foreign participation The authorities have taken a number of steps to boost foreign participation Foreigners can now participate through swap arrangements The key to deepening the market lies with institutional participation, particularly from foreign entities. Foreign institutions have the potential to reduce volatility in the market by buying when stocks are undervalued and withdrawing when valuations become stretched. Their focus on research also tends to discourage bubbles from developing and, by promoting more rigorous scrutiny of the market, helps to improve corporate governance. Granted, sudden inflows or outflows of foreign ―hot money‖ can destablilise markets, such as during the 1998 Asian crisis—but by and large foreign institutions, particularly pension and mutual funds, are seen as a positive force. Since 2005, the authorities have awarded investment banking licenses to a number of foreign banks, who have also been allowed to provide brokerage services. Consequently, the quantity and quality of corporate research has improved markedly, and many investors are now better informed than previously. Regular analysis of individual shares of major companies is now available, providing valuations based on internationally recognised models such as Discounted Equity Cash Flow, Dividend Discount and peer-based valuations, as well as buy, hold or sell recommendations. Better quality research should complement the execution and clearing, settlement and custody systems, which are already highly-regarded. Foreign participation through swap arrangements has been initiated Developments such as this paved the way for the most significant regulatory move to date. In August 2008, the CMA granted non-resident and non-Arab foreign investors the opportunity to buy Saudi shares for the first time. Prior to this action, foreign investors’ access was restricted to mutual funds. Foreign asset managers are still not allowed to trade shares directly but must enter into a swap arrangement in which their CMA-approved and –licensed brokerage conducts the trade on their behalf and then retain the shares, 6 December 2009 passing on any profits or dividends. Until recently, interest was muted given the widespread aversion to emerging market securities, but activity has increased sharply in recent months. The value of foreign swap purchases in October was $472 million—small perhaps, but up sharply from the $250 million recorded in September and the $45 million recorded a year earlier (a relatively large outflow was recorded in November, however, as the Dubai World debt standstill request reverberated around regional bourses—see below). Interest has come mainly from emerging market fund managers and hedge funds. Tadawul: Foreign Swap Activity (SR m) 2000 1500 1000 500 0 Aug-08 Source: Tadawul Jan-09 Jun-09 Buys Nov-09 Sells However, swap arrangements imply enhanced counterparty risk One drawback with the swap arrangements is that they do not confer ownership rights, meaning that foreign buyers have no obvious recourse should their brokerage enter into administration. Sensitivity to counterparty risk has grown in the wake of the turmoil that followed the collapse of Lehman Brothers in 2008. The lack of direct ownership also prevents international investors that build significant stakes in companies from pushing for representation on the board or from voting in the event of a takeover bid. Other efforts to boost the Tadawul’s foreign appeal are in train There are concerns about the degree of counterparty risk inherent in swap arrangements Other lower-profile developments have also piqued foreign interest. Earlier this year the CMA indicated it was considering the possibility of allowing exchange traded funds (ETFs). ETFs can be bought and sold like shares, have lower costs than mutual funds and give exposure to a wider constituent than individual shares. The CMA certainly sees the value of ETFs, though no timetable for their rollout has yet been announced. The CMA has also indicated that it is considering introducing derivatives, such as options and futures, as an obvious way of allowing institutions (and individuals) to hedge. However, it is unlikely to allow the full panoply of products that contributed to the global financial crisis. More definite progress has been recorded with regard to indexing, which provides the platform for many ETFs. In July 2009, the US’ Dow Jones Indexes became the first international index provider to offer indices on the Tadawul. Dow is now providing four Saudi indices based on real time data and prices from the Kingdom. Standard & Poor’s and Bloomberg have also reached similar agreements to provide indices. A number of foreign firms are now providing Tadawul indices Since the start of the year the CMA has also granted four institutions licences to launch indices tracking the performance of sharia-compliant companies listed on the exchange. The strong position of Islamic finance in the kingdom means that investor demand for sharia-compliant products is healthy. Moreover, there is also strong demand worldwide for such products. According to Singapore-based data provider Eurekahedge, which tracks the global funds industry, there are now more than 608 Islamic investment funds globally, valued at $60bn in total. 7 December 2009 Authorities hope foreign institutions will enhance transparency The participation of foreign institutions should in turn help to drive greater transparency. There has been measurable progress on this: in November 2006 the CMA launched a new Corporate Governance Code, which includes measures to boost shareholder rights, establish and enhance the role of nonexecutive directors, improve the level and frequency of corporate reporting, and publish details of directors’ remuneration. Although large parts of the code are still voluntary, the CMA now insists that the names of individual shareholders with more than 5 percent of listed companies be disclosed. In November 2008, the CMA made earning disclosures, which had previously been voluntary, mandatory in the case of listed companies. Corporate governance regulations have been beefed up Yet there is still much to do to convince listed firms (particularly the smaller ones) to heed international best practice. Many listed firms with a limited free float retain family-ownership structures that tend to blur the dividing line between ownership and management. It is hoped that as foreign investors become more active in the market, their preference for greater accountability will encourage wider adoption of the CMA’s code. There has been a crackdown on insider trading TASI vs Private Sector Credit Growth, 2005-06 40 18000 20 13000 8000 A lack of transparency tends to go hand-in-hand with insider trading. The CMA has stepped up its surveillance and prosecution of this practice. In 2007, the regulator introduced a new trading system that has enabled it to track trades and individual traders far more rigorously than previously. Nearly 400 cases of suspected market manipulation have been investigated by the regulator, approximately 30 of which are currently going through the court process. Several high-profile market participants have been publicly convicted and fined, and one has even been imprisoned. 0 Jan-05 Aug-05 Mar-06 Oct-06 Private sector credit (12 month percent change, rhs) TASI (lhs) Source: Bloomberg; SAMA Caps on personal credit have helped stabilise the market to some extent One further measure instituted by the authorities involves limiting the credit available for speculative activity. An extremely liquid monetary environment certainly contributed to the 2005 bubble: private sector credit growth, having averaged around 10 percent a year in 2002-04, soared to 37 percent in 2004 and to 39 percent in 2005 as the frenzy to invest was translated into soaring demand for new bank credit. Bank lending was largely unrestrained, with loans that were ostensibly meant for other purposes often finding their way into the stock market. In November 2005, SAMA implemented a policy limiting repayments on personal loans and credit cards to one third of an individual's salary, later tightened to one third of salary across the banking system (mortgages are not covered under these guidelines). It also capped the tenor on personal loans to 60 months. Reduced leverage has aided the stability of the market, although the Tadawul continues to be buffeted by global currents. 8 December 2009 300 Recent Performance TASI vs. MSCI-EM, 2005-07 (Jan. 2005 = 100) The TASI is broadly tracking global benchmarks… 250 200 150 100 50 0 Jan-05 Dec-05 Nov-06 TASI Source: Bloomberg 160 Oct-07 MSCI - EM TASI vs. MSCI-EM, 2007-09 (Jan. 2007 = 100) 140 This realignment did not prevent another serious period of turbulence in 2008. Surging global equity markets and oil prices in the first part of the year prompted a spike in activity on the Tadawul. However, this was followed by an abrupt collapse in the second half as the global financial system seized up. Although not as severe as the correction in 2006, the TASI still shed 49 percent between June and December, ending the year at 4800. Market capitalisation fell to $244 billion. The biggest loser by sector was petrochemicals, which lost 63 percent of its value during the course of the year, with investors concerned about a global supply glut and an apparent shortage of gas feedstock in Saudi Arabia. The TASI continued to track emerging equity markets—as measured by the MSCI EM—very closely in the first quarter of 2009. Performance was subdued as the global economic recession hardened and oil prices also tracked lower. In the second quarter, global economic conditions began to improve, with the first signs that financial markets had stabilised and the real economy was nearing, or at, its trough. Oil prices also began to move upwards again. This saw the MSCI-EM gain 62 percent during the quarter. 120 100 80 60 40 Jan-07 The run-up in the stock market during the middle part of the decade saw the TASI soar well above global equity benchmarks as speculators ignored fundamentals and gambled that prices would keep on rising. The subsequent crash saw the TASI lag global benchmarks for over a year. Since the beginning of 2008, the index has basically realigned itself with the direction of global equity markets. Sep-07 Source: Bloomberg Jun-08 Mar-09 Dec-09 TASI MSCI - EM Tadawul: Performance by Sector (Jan. 2008: 100) …though there has been some divergence Although the TASI initially tracked the benchmark higher, its recovery stalled in May as concerns about debt problems in the Saudi corporate sector began to emerge. The scale of these problems is almost impossible to quantify given a lack of publicly available data. Nevertheless, this opacity itself unsettled investors, and while the MSCI EM gained upward momentum, the TASI remained subdued, adding just 19 percent during the second quarter. The lull in activity during the summer, followed immediately by the onset of the Muslim holy month of Ramadan further dampened activity in the third quarter. Investors have been unsettled by recent events, though the Tadawul has performed better than most 105 85 65 45 25 Jan-08 Source: Bloomberg Aug-08 TASI Telecoms Apr-09 Dec-09 Petrochemicals Financials Notwithstanding a pickup in September, when the TASI edged above the 6,500 mark, the stock market’s performance has been uneven, and has once again diverged from the broadly upward trajectory of global markets. Third quarter corporate results were subdued, with 12-month earnings per share growth down more than 30 percent, even though many firms beat analysts’ expectations. Profit-taking also contributed to the generally lacklustre performance. More fundamentally, the limits on foreign participation meant 9 December 2009 Price/Earnings Ratios (Current Year Estimate, December 7) 20.4 17.4 that the Tadawul did not benefit from the level of inflows seen elsewhere in the emerging world. 22.9 17.0 16.8 12.4 11.0 14.3 FTSE100 S&P 500 Russia China India Brazil Qatar Abu Dhabi Saudi Arabia Dubai 6.6 8.1 Source: Bloomberg 110.0 Saudi Arabia: Relative Stock Market Performance (5 November 2009 = 100) This worked in the Kingdom’s favour when Dubai World made its shock request for a standstill on some of its $60 billion in debt in late November. The request was poorly received by creditors and sparked a major sell-off in global equity markets, as well as in the region. By December 9 the main index of the Dubai Financial Market (DFM) was down 26 percent from the date of the announcement (and that decline was capped by daily limits), while other Gulf markets had also taken heavy hits. Saudi Arabia, by contrast, had shed a comparatively mild 5.5 percent. In response to the Dubai announcement foreigners unwound many of their swap positions on the Tadawul in November, but at a net outflow just SR385 million, this had little impact on the overall index. Saudi investors’ relative calm is illustrated by comparative valuations. Bloomberg’s full-year estimate for the average Saudi p/e was around 17.4 in early December, some way ahead of its Gulf peers, but in line with valuations in the BRIC countries 105.0 100.0 95.0 90.0 85.0 80.0 5-Nov-09 21-Nov-09 7-Dec-09 Tadawul All Share Dubai (DFM) Source: Bloomberg Market Outlook – Short Term Oil prices and the global recovery are supporting sentiment… Is the equanimity of Saudi investors justified? To answer this, it is worth sketching out what is currently supporting sentiment and how we see the market performing over the next year or so. Ethylene Prices (Japan spot, fob, $/metric ton) 1600 The market’s current stability is being supported by four main factors: 1200 800 400 0 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 First, the strengthening of external demand has raised hopes that corporate profitability will begin to firm, and thereby ease concerns about debt financing. For example, petrochemicals prices have increased sharply in 2009— following last year’s collapse—with the benchmark price of ethylene rising by 67 percent so far in 2009 (year to date). Source: Bloomberg Saudi Arabia: Points of Sale Transactions (value; 12 month percent change) 40.0 30.0 20.0 10.0 0.0 -10.0 Oct-08 -20.0 Source: SAMA Jan-09 Apr-09 Jul-09 Oct-09 Second, domestic consumer demand appears to be firming. Following almost a year of weakening growth, points of sale transactions (a proxy for retail sales), bounced back in the past three months, signalling that Saudi consumers may have recovered their confidence. This has improved the outlook for domestic sectors such as wholesale, retail and transport services. Third, global markets are continuing to track upwards, albeit with the usual day-to-day volatility. Equity markets are being supported by reasonably brisk level of economic activity in many emerging markets, particularly in East Asia and some Latin American countries, which are benefitting from renewed strength in global demand for commodities and recovering risk appetite among Western institutions. As noted above, the structural limitations on foreign participation mean that this is unlikely to have much direct impact on 10 December 2009 150 Oil Prices: WTI ($/bbl) the Saudi bourse, but it should help to bolster sentiment. Fourth, oil prices remain high by historical standards. Oil prices will not have a critical short-term bearing on the country’s economic health given the government’s strong financial position, but they will still have a an important bearing on consumer confidence and investor sentiment. 110 70 …but we remain cautious about the second half of 2010 30 Jun-08 Oct-08 Jan-09 Source: Bloomberg Apr-09 Aug-09 Nov-09 Domestically-focused firms are likely to fare better than export oriented ones Our six-month outlook broadly matches investors’ expectations. We are perhaps more guarded about the prospects for Saudi corporate growth since we believe that banks will remain cautious about extending fresh credit for some time; nevertheless, export demand is increasing, and with domestic demand also firming, corporate profitability is set to improve. Oil prices should maintain an upward trajectory, assuming supply restraint does not unravel. We also note that oil prices continue to exhibit a close inverse relationship to U.S. dollar movements. Currency movements are notoriously difficult to predict, but the massive build-up in U.S. government debt points to some U.S. dollar weakness in the short term. However, we are less sanguine about the horizon beyond six months. There is no doubt that financial market confidence and risk appetite have strengthened, contributing to and reinforcing a further rally in asset prices. However, the primary triggers have been proactive fiscal and monetary policies in both advanced and emerging market economies (along with restocking). The impact of these stimuli should not be underplayed: for example, the OECD estimates that the fiscal stimuli undertaken by OECD states were equivalent to 3.5 percent of members’ GDP. Once the impact of this fades (and many of the measures are of the ―one-off‖ variety) then global output could well begin to slow again. Fundamentals are still poor: credit remains tight for many borrowers, unemployment is still rising, and business investment will be dampened by widespread spare capacity. Thus, it may well be that external demand begins to soften again in 6-12 months time. This could put some downward pressure on oil prices, and cloud the prospects for firms in sectors such as petrochemicals, oil refining and steel production (the shortage of gas feedstock will serve as a separate constraint on petrochemicals output). Domestic demand should hold up better, thanks to robust public sector investment, which should remain brisk well into 2011. Private consumption should also tick upwards. Therefore, firms that are more focused on domestic markets, such as retail, real estate and telecoms, among others, should fare better than those relying on exports. Market Outlook – Long Term Solid fundamentals support the long-term outlook An excellent long-term play, but foreign investment will dictate pace of change The Tadawul is rightly seen as having enormous long-term potential given the 11 December 2009 Kingdom’s abundant economic and financial assets and its favourable demographic outlook. With 20 percent of the world’s oil reserves, foreign assets of around 90 percent of GDP, and a young and fast-growing population, the stock market—and the economy more generally—represents an excellent long-term play. However, as discussed above, the pace of development will be determined largely by foreign involvement in the market. Price/Earning Ratios (end-month current ) 50 40 30 20 10 0 Jan-09 TASI Jun-09 Brazil Nov-09 China Russia Source: Bloomberg The Tadawul has an important role to play as an agent of corporate and economic change Foreign investors have been impressed with the CMA’s reform agenda and its willingness to enforce such reforms. Yet many remain hesitant in the face of unanswered questions, such as the degree of counterparty risk that swap arrangements entail, and whether foreigners will be allowed full access to the market in the near term. Looking at the broader market, many foreign institutions would like to see an end to the deliberate under-pricing of IPOs given the instability that these sales tend to impart to the market. If the CMA continues to push through its reform agenda, and full foreign investment is allowed into the exchange, then the market should become more stable, predictable and transparent. This, in turn, should help to convince more local firms to list on the exchange, particularly if bank credit remains at a premium. Currently, many of the family-owned firms that have resisted listing have done so precisely because of the greater scrutiny that this might entail. Over time, it might be possible to create a virtuous circle whereby listing, and the transparency that this entails, allows firms to raise capital cheaply on the Tadawul, thereby encouraging additional firms to list. Generational pressures may also encourage more firms to list. Those of the younger generation who may be reluctant to become involved in managing the family business tend to view listing as an efficient and profitable way to liquidate their holdings. This trend has become a new feature of other emerging markets, particularly those in Latin America. The Tadawul’s evolution into Saudi Arabia’s primary centre for raising corporate capital will clearly be a long-term process. But assuming that full foreign investment is allowed, and surveillance and enforcement continue to be tightened, the Tadawul has the potential to become both the main market for Saudi corporate finance and an important agent of corporate and economic change. 12 December 2009 Keith Savard Director of Economic Research Keith.Savard@samba.com James Reeve Senior Economist James.Reeve@samba.com Andrew B. Gilmour Senior Economist Andrew.Gilmour@samba.com Raza A. Agha Research Economist Raza.Agha@samba.com Touheed Ahmed Management Associate Touheed.Ahmed@samba.com Disclaimer This publication is based on information generally available to the public from sources believed to be reliable and up to date at the time of publication. However, SAMBA is unable to accept any liability whatsoever for the accuracy or completeness of its contents or for the consequences of any reliance which may be place upon the information it contains. Additionally, the information and opinions contained herein: 1. Are not intended to be a complete or comprehensive study or to provide advice and should not be treated as a substitute for specific advice and due diligence concerning individual situations; 2. Are not intended to constitute any solicitation to buy or sell any instrument or engage in any trading strategy; and/or 3. Are not intended to constitute a guarantee of future performance. Accordingly, no representation or warranty is made or implied, in fact or in law, including but not limited to the implied warranties of merchantability and fitness for a particular purpose notwithstanding the form (e.g., contract, negligence or otherwise), in which any legal or equitable action may be brought against SAMBA. Samba Financial Group P.O. Box 833, Riyadh 11421 Saudi Arabia 13