– Financing for climate change meeting the challenge Mirey Atallah

advertisement

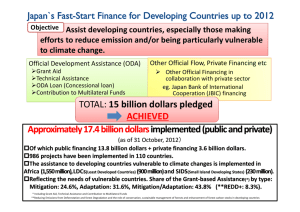

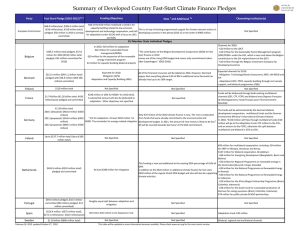

Financing for climate change – meeting the challenge Mirey Atallah Cairo, November 2010 The Global Climate Change Financial Architecture Government Cooperation Budgets National Implementin g entities Bilateral Cooperatio n Multilatera l Cooperatio n Private Cooperation Finance Official Development Assistance Industrialise d countries ODA commitmen t Bilateral Finance Institution s National Financial Institution s ‘New and additional’ climate finance Industrialised countries commitments to ‘new and additional’ finance for climate change Capital Markets Multilater al Finance Institution s Innovative Climate Finance (sources and governance under negotiation Domestic Budget UNFCCC Private Sector CSOs/NGO s Carbon Markets Industrialised countries emission reduction obligations Foreign Direct Investment CDM Levy funding the Adaptation Fund Total finance available for climate change mitigation and adaptation initiatives Source: Adapted from SEI 2009 2 New Financial Investment by Region, 2002-2008,$ billions Global Trends in Sustainable Energy Investment 2009 New investment volume adjusts for re-invested equity. Total values include estimates for undisclosed deals Source: New Energy Finance, UNEP SEFI 3 Mitigation and Adaptation: Complementary Risk Management Strategies or Two Sides of the Same Coins? Cost of abatement (marginal cost) rises Benefit of abatement (marginal benefit) falls Optimal abatement path necessary Economically optimal timing 4 Estimated costs of adapting to climate change Assessment by Annual cost $ bn In 86 2015 UNFCCC (2007) 28-67 2030 World Bank (2006) 9-41 2008 Oxfam (2007) >50 2008 Stern Review (2006) 4-37 2008 UNDP (2007) • 20-40% of ODA and concessional finance are subject to CC risks; • Cost of addressing this risk would be $1-8billion/year Source: World Resources Institute, 2007 5 Catalyzing Environmental Finance Global Environment Trust Funds • GEF Trust Fund •Montreal Protocol Multilateral Fund •SCCF, LDCF, Adaptation Fund Multi/bi lateral funds •WB: CIF, FCPF, CPF •Japan CEP, Norway CFI, Germany ICI, Australia IFCI $ Amounts available in developing countries (2010-2014) $6 - 8 billion $15 billion UN/UNDP E&E Trust Funds (TF) •MDG Spanish Fund, E&E TF $200500 million Foundations/Private Coorperation • UNF, Packard, Gates, Rockefeller $4 billion New UNFCC Related Funds •REDD fund (s) •Fast Start Funds (s) •COP green climate fund (M/A , REDD, TT, CD) •Technology mechanisms $80 billion Market based & Innovative Sources of Financing •Carbon Finance (CDM/JI, VC, sectoral credit + financing) •Insurance + other risk financing •Innovative mechanisms (e.g. IFIs, air levies etc…) Institutional & Corporate Finance • Private equity funds •Green bonds $75-150 billion $400 billion 6 Potential Sources of Climate Change Financing Public finance from climate sources • Phase out of regressive fossil fuel subsidies • AAU auction proceeds • Emission Trading Schemes (ETS) auction proceeds • Carbon taxes • Marine and aviation/bunker fuel levies • Offset levies Public finance from non-climate sources • ‘Tobin’ tax, taxing revenues from financial transactions • Leveraging of IMF Special Drawing Rights Carbon markets Other international financing proposals • Debt for clean energy swap • International Lottery 7 GEF CLIMATE CHANGE MITIGATION - more transformational impact, programmatic approaches and sectoral issues GOAL: support developing countries and economies in transition toward a lowcarbon development path OBJECTIVES Promote demonstration, deployment, and transfer of advanced lowcarbon technologies Promote market transformation for energy efficiency in industry and buildings Promote investment in renewable energy technologies Promote energy efficient, low-carbon transport and urban systems Enabling Activities and Capacity Building Direct access Conserve and enhance carbon stocks through sustainable management of land use, landuse change, and forestry (LULUCF) 8 Under the convention Nationally Appropriate Mitigation Action National Adaptation Plans Sectoral approaches: REDD and REDD+ Energy Transport Insurances 9 THANK YOU 10