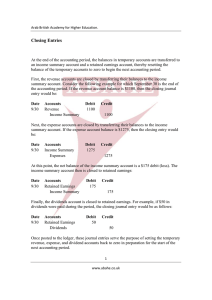

FINANCIAL STATEMENTS The goal of journalizing, posting to the ledgers, and preparing the trial balance is to gather the information necessary to produce the financial statements. Thetime period concept requires companies produce the financial statements on a regular basis over the same time interval, such as a month or year. Most of the amounts on these statements are copied directly from the trial balance, and then appropriate calculations and summary amounts are also displayed. The first of the four financial statements will be discussed here. Income Statement The net income from a business’s operations for a period of time is so important to business people and investors that one financial statement—the income statement—is dedicated to showing what that amount is and how it was determined. The income statement is a report that lists and summarizes revenue, expense, and net income information for a period of time, usually a month or a year. It is based on the following equation: Revenue - Expenses = Net income (or Net loss). Revenue is shown first; a list of expenses follows, and their total is subtracted from revenue. If the difference is positive, there is a profit, or net income. If the difference is negative, there is a net loss that is typically presented in parentheses as a negative number. The income statement answers a business’s most important question: How much profit is it making? It is limited to a specific period of time (month or year) from beginning to end. The income statement relies on the matching principle in that it only reports revenue and expenses in a specified window of time. It does not include any revenue or expenses from before or after that block of time. SAMPLE INCOME STATEMENT FORMATTING TIPS Complete heading: Company Name, Name of Financial Statement, Date Two Columns of numbers—left one for listing items to be sub-totaled; right one for results Dollar signs go at the top number of a list of numbers to be calculated Category headings for revenue and expenses only if there is more than one item listed in the category Expenses listed in order of highest to lowest dollar amounts, except for Miscellaneous Expense, which is always last The word “Expense” on expense account names Single underline just above the result of a calculation (two of these) Dollar sign on final net income number Double underline below the final net income result You have just learned about the income statement—the accounts it displays and its format. We will hold off for now on the other three financial statements— the retained earnings statement, the balance sheet, and the statement of cash flows —and learn about those later. The Accounting Cycle Accounting is practiced under a guideline called the time period assumption, which allows the ongoing activities of a business to be divided up into periods of a year, quarter, month, or other increment of time. The precise time period covered is included in the headings of the income statement, the retained earnings statement, and the statement of cash flows. Therefore, the accounting process is cyclical. A cycle is a period of time in which a series of accounting activities are performed. As was just stated, the typical accounting cycle is a year, a month, or perhaps a quarter. Once the current cycle is completed, the same recording and reporting activities are then repeated in the next period of time of equal length. 4 1 A cycle can be thought of as a repetitive sequence of procedures. Think about the cycle of attending college. Each semester, you register for classes; receive syllabi on the first day of classes; take tests, write papers, and prepare projects; complete final exams; and receive course grades. The following semester, you repeat the same steps toward the completion of your degree. Although your instructors, course content, and grades may be different each semester, the steps in the cycle are very similar. 2 з In accounting, journalizing and posting transactions to the ledgers are done every day in the cycle. Financial statements are typically prepared only on the last day of the cycle. Once the financial statements are complete, the process continues on into the next accounting period, where again the financial statements are the goal of the recordkeeping process. Temporary Accounts The accounts on the income statement are called temporary accounts. They are used to record operational transactions for a specific period of time. Once the income statement is prepared to report the temporary account balances at the end of the period, these account balances are set back to zero by transferring them to another account. When the next accounting period begins, the beginning balances of the temporary accounts are zero, for a fresh start. Closing Entries The financial statements are the goal of all that is done in the accounting cycle. However, there are some steps that need to be taken once those reports are completed to set up the ledgers for the next cycle. These steps involve closing entries. Closing entries are special journal entries made at the end of the accounting period (month or year) after the financial statements are prepared but before the first transaction in the next month is recorded in the journal. The purpose of closing entries is to set the balances of income statement accounts back to zero so you can start fresh and begin accumulating new balances for the next month. This process ensures that the balances on the second month’s income statement do not include amounts from transactions in the first month. Profit at the end of the accounting period is transferred into a new account called Retained Earnings when the revenue and expense accounts are closed out. The Retained Earnings account is only used for closing entries. Closing entries transfer the balances from the revenue and expense accounts into Retained Earnings in preparation for the new month. Retained Earnings is an account where profit is “stored.” Think of the retained earnings balance as “accumulated profit,” or all the net income that the business has ever generated since it began operations. Assume a business’s accounting period is a month. For the first month in which the business operates, the beginning retained earnings balance is zero since there were no previous periods and therefore no previous profits. At the end of the first month, the retained earnings balance equals the net income for the month. After the first month, when closing entries for the current month are journalized and posted, the additional net income for the next month is added to any net income already in Retained Earnings from previous months. Since Revenue - Expenses = Net Income, moving revenue and expense balances into Retained Earnings is the same as moving the net income. RUNNING IN CIRCLES A track star is practicing running a lap at a time around the track. He has a timekeeper with a stopwatch timing each lap. The timekeeper clicks “Start” and the runner takes off. He crosses the finish line in 50 seconds, the time elapsed as shown on the stopwatch when “Stop” was clicked. The runner rests, drinks, and decides to try again to see if he can do better. The timekeeper clicks “Start” and the runner takes off, running even faster. He crosses the finish line in 95 seconds, the time elapsed as shown on the stopwatch when “Stop” was clicked. What is wrong with this picture? Was he so much slower? He did not have a poor sprint; he had a poor timekeeper! This person did not reset the stopwatch to zero for the second run, so the 50 seconds from the first run was included with the 45 seconds from the second run. The runner can subtract the 50 from the 95, but who wants to do math on the track? That is what the reset button is for, and it enables the results of both runs to be easily compared. Similarly, income statements include revenue and expense amounts for a period of time—a month or a year. After one month is reported, the ledger balances of these accounts must be reset to zero so that the next month’s income statement does not include amounts from the previous month. This is done by closing out the revenue and expense ledger balances and resetting their balances to zero. The Retained Earnings account is not closed out; instead, revenue and expense accounts are closed out into it. The effects are that the credit balance in Retained Earnings increases each month by the month’s net income amount, and thebalances of Fees Earned and all the expense accounts become zero. Closing entries are entered in the same journal that was used for the general entries during the month. The first closing entry is journalized right after the last general entry. Closing entries must be posted to the ledgers to impact the revenue, expense, and Retained Earnings account balances. As an example, assume that on 6/30 Fees Earned has a credit ledger balance of $2,100 and Rent Expense (the only expense account) has a debit ledger balance of $500. Net income is therefore $1,600. The closing entry process would be as follows: 1. Zero out the Fees Earned account (and any other revenue accounts, if there are others.) Debit Fees Earned for its credit balance of $2,100 to close it out and bring its balance to zero. Credit Retained Earnings for the same amount. Date Account Debit 6/30 Fees Earned 2,100 Retained Earnings Credit ▼ Fees Earned is a revenue account that is decreasing. 2,100 ▲ Retained Earnings is an equity account that is increasing. 2. Zero out the Rent Expense account (and any other expense accounts, if there are others.) Credit Rent Expense for its debit balance of $500 to close it out and bring the balance to zero. Debit Retained Earnings for the same amount. Date Account Debit 6/30 Retained Earnings 500 Rent Expense Credit 500 ▼ Retained Earnings is an equity account that is decreasing. ▼ Rent Expense is an expense account that is decreasing. Once posted, these two closing entries above increase the Retained Earnings balance by $1,600, which is $2,100 - $500. The balances in Fees Earned and Rent Expense are now both zero.