Chapter 4 Completing the Accounting Cycle Financial Statements

advertisement

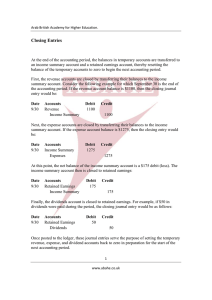

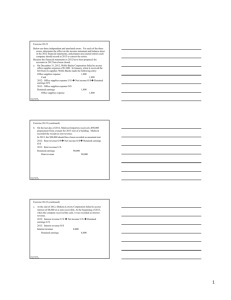

Chapter 4 Completing the Accounting Cycle Financial Statements After the adjusted trial balance is prepared, the financial statements are compiled. There are four financial statements prepared in the following order: 1. Income Statement – shows results of operations for a period of time Brady Corporation Income Statement December 31, 2001 Revenue Fees earned $50,000 Expenses Salaries expense Rent expense Supplies expense Total expense $ $ $ Net Income 12,000 15,800 7,200 $ 35,000 $ 15,000 2. Statement of Retained earnings – shows the changes in the earnings of the corporation. Reflects distributions to owners and profit or losses. Brady Corporation Statement of Retained earnings December 31, 2001 Beginning Retained Earnings, January 1, 2001 Add: net income Deduct: dividends Ending Retained earnings, December 31, 2001 Fall, 2007 Prepared by Maria Mari 1 $ 9,875.00 $15,000.00 $24,875.00 $10,000.00 $14,875.00 Chapter 4 Completing the Accounting Cycle 3. Balance Sheet a. Assets – divided into i. Current assets - cash and other assets expected to be converted to cash or sold or used up usually within one year or less. ii. Property, Plant & Equipment – fixed assets and related accumulated depreciation b. Liabilities – divided into i. Current liabilities – due in less than one year ii. Long term liabilities – due in more than one year c. Stockholder’s Equity i. Retained earnings from the Statement of Retained Earnings ii. Capital stock Brady Corporation Balance Sheet December 31, 2001 Assets Cash Accounts receivable Supplies Fixed Assets Total assets $12,705.00 $ 5,400.00 $ 1,250.00 $15,100.00 $34,455.00 Liabilities Accounts payable Loans payable Total liabilities $ 7,280.00 $ 9,800.00 $17,080.00 Stockholder's Equity Capital stock Retained earnings Total stockholder's equity $ 2,500.00 $14,875.00 $17,375.00 Total liabilities and Stockholder's Equity Fall, 2007 Prepared by Maria Mari 2 $34,455.00 Chapter 4 Completing the Accounting Cycle 4. Statement of Cash Flows a. Discusses sources and uses of cash b. Divided into operating, investing, and financing. Closing Entries Real accounts – the balances of accounts reported on the balance sheet are carried forward from year to year. Temporary accounts or nominal accounts – the balance of accounts reported on the income statement are not carried forward from year to year. Have zero balances at the beginning of the year Also dividends Closing Entries: there are four entries in the closing process Income Summary – a clearance account used to process the closing entries. Disappears after the closing entries are posted. 1. Closing revenues: each revenue account is closed by DEBITING the account for its balance and CREDITING income summary. 2. Closing expenses: each expenses account is closed by CREDITING the account for its balance and DEBITING income summary. 3. Closing the balance of income summary: Income summary is DEBITED and retained earnings are CREDITED for the balance of income summary (net income) for the period. 4. Closing dividends: dividend account is closed by CREDITING the account for its balance and DEBITING retained earnings. Example: the following accounts are found in the general ledger Fees earned Rent expense Wages expense Dividends Retained earnings Fall, 2007 Prepared by Maria Mari $10,000 2,000 6,000 4,000 $12,000 3 Chapter 4 Completing the Accounting Cycle Close Revenues: Date Dec 31 Account Fees earned Income Summary PR Debit $10,000 Credit $10,000 Close Expenses: Date Dec 31 Account Income Summary Rent expense Wages expenses PR Debit $8,000 Credit $2,000 6,000 Close Income Summary: Income Summary _________________________________ Expenses $8,000 $10,000Revenues $2,000 balance in account Date Dec 31 Account Income Summary Retained Earnings PR Debit $2,000 Credit $2,000 Close Dividends: Date Dec 31 Account Retained earnings Dividends PR Debit $4000 Credit $4000 After closing entries are completed only RETAINED EARNINGS are left open with a balance. Dividends Fall, 2007 Prepared by Maria Mari Retained Earnings ___________________________ $12,000 Beginning balance $4,000 2,000 Net income 10,000 Ending balance 4 Chapter 4 Completing the Accounting Cycle Example 1: Fees earned Rent expense Wages expense Miscellaneous expense Retained earnings Dividends Date $20,000 6,000 8,000 $10,000 $8,000 3,000 Account PR Debit Credit After closing entries are recorded in the journal and posted in the general ledger then POST CLOSING TRIAL BALANCE is prepared. Accounting year: Calendar year – ends on December 31st Fiscal year – ends other than December 31st Fall, 2007 Prepared by Maria Mari 5 Chapter 4 Completing the Accounting Cycle Example 1: Retained earnings Dividends Professional fees Rent expense Supplies expense Cash $35,000 $6,000 $15,000 $5,000 $3,000 $45,000 Example 2: Retained earnings Dividends Professional fees Rent expense Supplies expense $15,000 $2,000 $31,500 $15,000 $13,000 Example 3: Retained earnings Dividends Professional fees Rent expense Supplies expense Fall, 2007 Prepared by Maria Mari $23,500 $8,000 $76,000 $45,000 $33,000 6