Making CRM work

advertisement

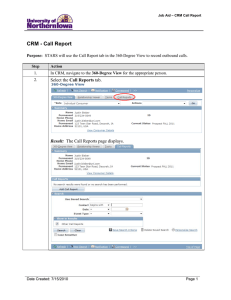

Making CRM work By Darrell Rigby & Fred Reichheld What’s going on when everybody wants something that disappoints most users? Customer Relationship Management, or CRM, which harnesses Internet and other technology to build customer loyalty, has just such a dilemma swirling about its applications. By many measures CRM is the hottest growth tool to hit management techniques. Books on the topic have surged from one in 1989 to 14,000 in 2000. Bain’s global Management Tools 2001 Survey of senior executives found usage expected to double this year—from 35% of respondents to 72%. Who wouldn’t want to adopt a tool that promises—in hard times—to quickly winnow out your most profitable customers and then target them with campaigns to increase their purchases and strengthen their bonds of fidelity to your brands, while lowering the cost of interactions? Indeed, one CRM provider offers “CRM in 90 Days,” and another, in just nine. It’s almost as seductive as weight-loss advertising. Yet few CRM users are skimming off Many successful CRM programs, like the New York Times’, don’t even look like CRM at the outset. the cream. The Gartner Group finds that 55% of CRM programs are failing to pay back on programs that typically cost $60 million to $130 million. And CRM, among 25 tools evaluated by 451 senior executives, placed fourth to last in satisfaction ratings on the Bain survey. Indeed, a fifth of CRM users had abandoned the tool altogether. Darrell Rigby is a director of Bain & Company in Boston and founder of Bain’s Management Tools Survey. Fred Reichheld is a Bain Fellow and author of Loyalty Rules: How Today’s Leaders Build Lasting Relationships, Harvard Business School Press: September 2001. Indeed, many successful CRM programs, like So how do you fix the problem? The New York Times’, don’t even look like CRM The problem starts with CRM’s definition. If you at the outset. The Times spent years last decade log on to CRMguru.com, the most commonly asked question is: “What is CRM?” The truth is CRM is not so new and slippery. It draws on the tried-and-true management technique of customer segmentation, the starting point for figuring out which customers you want to CR—create relationships with—and which you want to CM—cost manage. (See Figure 1: Abandoning CRM) With CRM, targeting research of core customers to find similar pools in cities outside of New York. Then it set about understanding what it would take to appeal to those pools, and, by way of response, upgraded its local distribution system and customized local content like weather and TV listings to meet the market. The upshot? The New York Times is growing in a relatively flat industry, and it has a as with good old-fashioned loyalty leadership, the customer retention rate of 94% in an industry that win-win economics lie in segmenting the attractive, averages about 60%. All this, long before acquiring profitable clients—with whom you can broaden new CRM technology, which it is just now and deepen relationships—from the cherry pickers implementing to automate some processes. who you need to serve at low cost. So CRM starts with customer strategy. Figure 1: Abandoning CRM 2000 Defection Rates: CRM vs. Related Tools 20% 18% 15% 11% Average 11% 10% 7% 7% 6% 5% 0% CRM Customer Retention* Customer Satisfaction One-to-one marketing Customer Segmentation *1999 result: Customer Retention was replaced by CRM in this year's survey. B a i n & C o m p a n y, I n c . Making CRM work 2 The Times example leads to a second fix—realigning business processes with strategy. In a recent CRM Grand Expeditions capitalized on a list of Forum survey of senior executives, 87% pinned customers who hadn’t traveled for more than the failure of CRM on leadership and change management three years. One-to-one marketing to those issues. Only four percent cited software problems. customers yielded three times the average The Times invested in upgrading its printing and conversion of a typical mailing, a key delivery processes and subscriber call-handling contribution to the company’s 30% increase procedures before it invested in Internet-based in bookings in a flat industry. software to speed these processes and reduce costs. Insurance company USAA, another loyalty leader, provides further evidence that process change must precede technology in getting CRM right. The company—the premier insurer of military personnel and veterans—was historically organized into six regional units, each comprising large functional departments (claims, underwriting, policy holder When your customer strategy is at the center, and your processes are aligned, you can make wise decisions about where software technology can help—and where low-tech solutions make more sense. Loyalty leader Enterprise Rent-A-Car, in the wake of the World Trade Center disaster, gave its branch managers latitude to except the firm’s services, etc.). “no one-way rental” rule, which allows it to keep Today, in response to a greater understanding of what customers value, those six units have been broken into 110 teams, each of which focuses on the specific needs of smaller and more uniform segments of customers. Within these teams, the thousands of phone reps are divvied up even further into groups of 10 to 12. The members costs down. Enterprise waived all drop-off fees across the US until September 21st, to ensure that all of its customers could make it home. That no-tech move bought Enterprise a lifetime of loyalty from travelers stranded at airports and train stations, even as other rental car companies were charging oneway penalties of $1000 and more. of each group work out their own schedules and vacations, solve problems together, and are A low-tech tool related to CRM comes to bear, too—customer satisfaction measurements. evaluated together. Consider the technology decisions loyalty leader Team members know the regional idiosyncrasies of the insurance business. They also know their customers—and each other—better than they did in the old system. Customers value the “small company touch.” And USAA’s former CEO, Bob Herres, believes the small-team structure is a key reason USAA has been able to grow and maintain one of the highest retention rates in the industry, while simultaneously shrinking its bureaucracy. (For more on the links between employee loyalty Harley-Davidson made after quizzing its customers. Harley-Davidson’s CEO, Jeff Bleustein, turned down a proposal for a centralized Web site that would have offered Harley’s full line to anyone with access to a computer. Why? Customers wanted to shop Harley on the Internet, but Bleustein knew that such a site would undercut dealers and, understanding the importance of dealer relationships to the company’s strategy, sent the Web experts back to the drawing board. and customer loyalty, see www.loyaltyrules.com, and participate in Bain’s Loyalty Acid Test Survey.) B a i n & C o m p a n y, I n c . Making CRM work 3 Today, Harley’s central Web page asks customers marketing. Travcoa, a luxury tour provider purchased to choose from a list of Harley’s participating by Grand Expeditions, had built its reputation on e-commerce dealers, or to enter their zip code to pleasing customers across destinations around the find the nearest one. A click on the dealer name world in an industry where customer acquisition routes them to the local dealer’s own Web page. costs are very expensive, and clients are risk averse: If they can afford to spend $40,000 on a vacation, Customers win because they now have Web access they want to ensure it’s the trip of a lifetime. After to a wide range of Harley merchandise. Dealers Grand Expeditions acquired several tour operators, are happy because they earn the retailing profits it set out to benchmark CRM techniques and from all Web sales; Harley isn’t encroaching on opportunities at all its acquisitions. At luxury tour their territory. And, they establish connections company Travcoa it found opportunity in an old with new local customers who found them via list of customers who had not traveled with the the Web. Harley wins because it has successfully tour operator for more than three years. Tailoring established a Web presence that provides customers its CRM effort with one-to-one marketing to that convenience at low cost, and its dealer relationships list of customers, Grand Expeditions yielded three have emerged stronger in the process. Too many times the average conversion of a typical mailing, companies venturing onto the Web have alienated a key contribution to the company’s 30% increase such partners. (Levi Strauss had to pull its award- in bookings in a flat industry. winning Web site that let consumers buy jeans online because the Web site bypassed and angered So how do you achieve the promise of CRM Levi’s retailers.) By starting with customers, profits? Start with customer strategy, realign your Bleustein knew when to “Say When.” business processes to fit the strategy, and tailor your technology selection to enhance your processes. For the segment of customers that want a deeper, It’s not simple, and it takes a lot more than a broader relationship, there’s another tested tool that 90-day technology deployment. But it works. CRM software can speed and refine—one-to-one BAIN & COMPANY, INC. Corporate Headquarters Two Copley Place Boston, Massachusetts 02116 1 (617) 572 2000 Amsterdam Milan • • Atlanta Munich • • Beijing New York • • Boston Paris • • Brussels Rome • • Chicago San Francisco • • Dallas • São Paulo Hong Kong • Seoul • • Johannesburg Singapore • • London Stockholm • • Los Angeles Sydney • Tokyo • • Madrid Toronto Mexico City • • Zurich