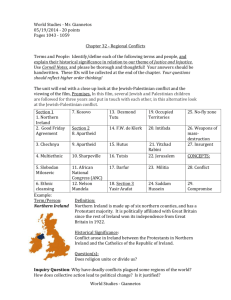

Universal Credit in Northern Ireland: the challenges?

advertisement