T B P :

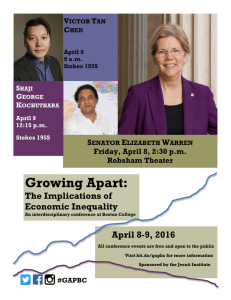

advertisement