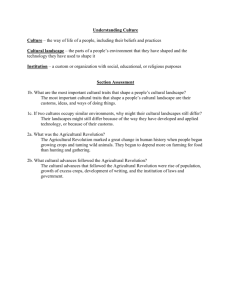

The Nigerian economy: Response of agriculture to adjustment policies By

advertisement