11 Small Business Taxation Claire Crawford and Judith Freedman

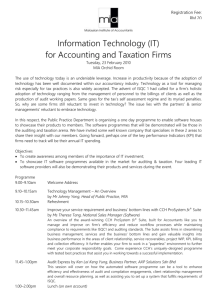

advertisement