Document 12756729

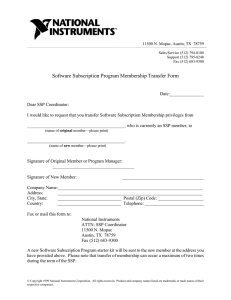

advertisement