Daily Commodity Report as on Monday, May 16, 2016 1 Date : URL : www.achiieversequitiesltd.com

advertisement

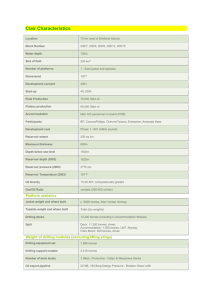

Daily Commodity Report as on Monday, May 16, 2016 Date : Monday, May 16, 2016 URL : www.achiieversequitiesltd.com Page No - 1 Open High Low Close Precious Metals Gold Silver 29943 40799 30068 41018 Alum. Copper Lead Nickel Zinc 103.25 308.75 114.7 577.8 125.75 103.5 311.35 115.7 584.1 126.65 3084 142.5 3110 145.3 29750 40253 % Cng OI 30034 40974 0.44 0.42 7398 10267 102.95 309.85 114.95 580.9 126.5 -0.24 0.45 0.35 0.52 1.32 5363 28879 2680 21875 5448 3097 141.4 0.03 -1.74 19860 6166 Market Round up Gold gained buoyed by weak equity markets and chart-based strength, as it shrugged off a higher dollar. Base Metal 102.3 308 114.35 575.2 124.65 Energy Crude Nat. Gas 3063 139.1 29943 30068 29750 30034 0.44 Turmeric Jeera Dhaniya 835.6 8206 16790 7301 840.9 8206 16840 7390 828.7 8070 16660 7261 Nickel prices bounced back as optimism over a rebound in U.S. economic growth overshadowed a stronger dollar. 833.9 8120 16750 7361 -0.19 -1.00 -0.68 0.40 1215 26195 18666 19190 1641 1649 1639 1649 0.18 12590 Mentha oil ended with gains due to rising demand from consuming industries at the spot market. Oil and Oilseeds & Others Soyabean Ref. Oil CPO RMSeed Menthol Cotton 4011 649.5 544.6 4422 860 17110 4011 656.5 548.5 4433 871.6 17150 3966 647.5 539 4357 854.1 17040 3987 655.5 547.3 4425 866 17080 -1.24 0.01 0.04 0.36 0.39 -0.06 99340 121060 3043 70970 2332 5441 Date : 66.92 76.19 96.66 61.49 67.00 76.19 96.67 61.67 66.86 75.89 96.31 61.44 Monday, May 16, 2016 Soyabean prices dropped owing to lack of consistency in demand for soybean meal and slowing demand for refined soy oil. Chana prices ended with gains amid anticipation of limited supplies amid lower production and expensive imports. Turmeric prices ended with losses due to fall in demand at the spot market. Currency USDINR EURINR GBPINR JPYINR Natural gas prices ended with losses weighed down by a lingering oversupply. Ref soyoil prices ended with losses on higher supply in global market. Cereals Wheat Copper rose after a string of declines as some investors closed out positions that had been betting on lower prices. 7398 Spices Cardamom Crude oil settled flat as a slight uptick in OPEC production in April reinforced long-term concerns related to the excessive supply glut on global energy markets. Zinc prices gained as support seen after data showed inventories in warehouses registered with the LME continued to erode, falling to 390,375 tonnes. Pulses Chana Silver prices recovered tracking firmness in gold and base metals prices after prices seen pressure after release of strong U.S. economic data. 66.94 76.01 96.52 61.47 0.19 1304389 -0.23 59480 -0.21 34810 0.44 22881 Jeera prices dropped on profit booking after prices gained on good demand from stockists on quality arrivals. URL : www.achiieversequitiesltd.com Page No - 2 MCX Gold Jun 2016 TRADING IDEA OPEN 29943 SUP-2 29633 Gold trading range for the day is 29633-30269. HIGH 30068 SUP-1 29834 Gold gained buoyed by weak equity markets and chart-based strength, as it shrugged off a higher dollar. LOW 29750 P.P. 29951 Global demand for gold soared markedly during the first three months of the year, the wgc said, saying that it was the strongest first quarter on record. CLOSE 30034 RES-1 30152 SPDR gold trust holdings gained by 0.70% i.e. 5.94 tonnes to 851.13 tonnes from 845.19 tonnes. % CNG 0.44 RES-2 30269 SELL GOLD JUNE @ 30200 SL 30450 TGT 29990-29800.MCX Gold on MCX settled up 0.44% at 30034 buoyed by weak equity markets and chart-based strength, as it shrugged off a higher dollar and strong U.S. economic data suggesting a brightening outlook for the economy. Bullion has rallied 20 percent this year as concerns about the strength of the global economy prompted traders to pare expectations for U.S. rate increases by the Federal Reserve this year. Global demand for gold soared markedly during the first three months of the year, the World Gold Council said, saying that it was the strongest first quarter on record. Gold demand rallied a whopping 21% year-on-year to 1,289 tonnes in the first quarter, the industry-linked organization said, adding that the boom came on the back of especially strong investment demand – particularly for gold-backed ETFs, which saw inflows at 363.7 tonnes, rocketing over 300% and booking the highest point since the start of 2009. India's gold demand in the first quarter slumped 39 percent from a year ago due to a rally in gold prices, jewellers' strike and as consumers had delayed purchases hoping a cut in India's 10 percent import duty on gold in the national budget, the World Gold Council said. Dealers were offering discounts of up to $15 an ounce to the global spot benchmark this week, up from a discount of up to $12 in the previous week. Technically market is under fresh buying as market has witnessed gain in open interest by 4.05% to settled at 7398, now Gold is getting support at 29834 and below same could see a test of 29633 level, And resistance is now likely to be seen at 30152, a move above could see prices testing 30269. MCX Silver Jul 2016 TRADING IDEA OPEN 40799 SUP-2 39983 Silver trading range for the day is 39983-41513. HIGH 41018 SUP-1 40478 Silver prices recovered tracking firmness in gold and base metals prices after prices seen pressure after release of strong U.S. economic data. LOW 40253 P.P. 40748 U.S. retail sales jumped 1.3 percent last month, the largest gain since March 2015 and a bigger rise than the 0.8 percent expected. CLOSE 40974 RES-1 41243 The University of Michigan's Consumer Survey Center said its Consumer Sentiment Index soared nearly seven points in its mid-May flash reading to 95.8. % CNG 0.42 RES-2 41513 SELL SILVER JUL @ 41200 SL 41560 TGT 40900-40600.MCX Silver on MCX settled up 0.42% at 40974 as prices recovered tracking firmness in gold and base metals prices after prices seen pressure after strong U.S. economic data suggested a brightening outlook for the economy. U.S. retail sales jumped 1.3 percent last month, the largest gain since March 2015 and a bigger rise than the 0.8 percent expected. The overall reading received a lift from auto sales, which surged 3.2% on the month. Still, core retail sales, which discounted the effects of auto purchases, increased by 0.8% above forecasts for gains of 0.5%. The University of Michigan's Consumer Survey Center said its Consumer Sentiment Index soared nearly seven points in its mid-May flash reading to 95.8, significantly above consensus expectations of 89.7. It came weeks after consumer sentiment slumped to 89.0 in the final April reading, dropping to its lowest level since last September. In the May reading, though, the expectations component surged nearly 10 points to 87.5, pulling up the general index. Over the last year, the sluggish expectations component has dragged down consumer sentiments overall. Investors also continued to react to a letter from Federal Reserve chair Janet Yellen to a member of the House Financial Services Committee regarding the Fed's remote possibility likelihood of adopting a negative interest rate policy in the near future. Over the Federal Open Market Committee's (FOMC) first three meetings of 2016, the U.S. central bank has held its benchmark interest rate steady while central banks in Japan and the euro area have adopted negative interest rate regimes. Technically now Silver is getting support at 40478 and below same could see a test of 39983 level, And resistance is now likely to be seen at 41243, a move above could see prices testing 41513. Date : Monday, May 16, 2016 URL : www.achiieversequitiesltd.com Page No - 3 MCX Crudeoil May 2016 TRADING IDEA OPEN 3084 SUP-2 3043 Crudeoil trading range for the day is 3043-3137. HIGH 3110 SUP-1 3070 Crude oil settled flat as a slight uptick in OPEC production in April reinforced long-term concerns related to the excessive supply glut on global energy markets. LOW 3063 P.P. 3090 OPEC said in its Monthly Report that crude oil production last month rose by 188,000 barrels per day to average 32.44 million bpd. CLOSE 3097 RES-1 3117 "Record bullish bets on higher futures prices by speculators also helped once more this month," OPEC said in the report. % CNG 0.03 RES-2 3137 BUY CRUDE OIL MAY ABV 3112 SL 3065 TGT 3145-3190.MCX Crude oil settled flat as a slight uptick in OPEC production in April reinforced long-term concerns related to the excessive supply glut on global energy markets. OPEC said in its Monthly Oil Report for May that crude oil production last month rose by 188,000 barrels per day to average 32.44 million bpd, according to secondary sources. It came amid considerable increases in Iran, Iraq and Angola, partially offset by declines in Nigeria and Kuwait. Saudi Arabia, the largest producer in the 13-member cartel, saw its production fall slightly by 8,000 bpd to 10.125 million bpd. Output in the Saudi kingdom still remains near all-time record highs. Overall, OPEC production reached its highest level since the peak of the Financial Crisis. Still, the value of OPEC's Reference Basket moved higher for the third consecutive month, gaining $3.21 per barrel to $37.86. OPEC credited an accelerated decline of US crude production, a weaker dollar, a wave of supply disruptions worldwide and forecasts for a sharp fall in non-OPEC production for the latest price gains. "Record bullish bets on higher futures prices by speculators also helped once more this month," OPEC said in the report. "Nevertheless, fundamentally, oversupply still persists, and oil output remains high." Elsewhere, oil services firm Baker Hughes said in its weekly rig count report that oil rigs last week fell by 10 to 318, dropping to the lowest level since October, 2009. Moreover, the IEA issued a bullish forecast for the commodity by saying that global oil markets are heading towards a long-awaited balance as crude supplies will shrink "dramatically" later this year. Technically now Crudeoil is getting support at 3070 and below same could see a test of 3043 level, And resistance is now likely to be seen at 3117, a move above could see prices testing 3137. MCX Copper Jun 2016 TRADING IDEA OPEN 308.8 SUP-2 306.4 Copper trading range for the day is 306.4-313. HIGH 311.4 SUP-1 308.1 Copper rose after a string of declines as some investors closed out positions that had been betting on lower prices. LOW 308.0 P.P. 309.7 Codelco, sees prices rising toward the end of next year as investment cuts hasten a rebalancing of global supply and demand. CLOSE 309.9 RES-1 311.4 SHFE stocks have fallen more than 26,000 tonnes; there is growing speculation location that metal will continue to out to LME warehouses in the coming weeks. % CNG 0.45 RES-2 313.0 BUY COPPER JUN @ 308 SL 304 TGT 312.50-316.MCX Copper on MCX settled up 0.45% at 309.85 after a string of declines as some investors closed out positions that had been betting on lower prices though others remained cautious ahead Chinese economic data. U.S. producer prices rose in April as energy prices increased, but a marginal gain in the cost of services pointed to a moderate increase in inflation in the coming months. The Labor Department said its producer price index climbed 0.2 percent last month after slipping 0.1 percent in March. The Commerce Department said retail sales jumped 1.3 percent last month, the largest gain since March 2015. Codelco, the world’s biggest copper producer, sees prices rising toward the end of next year as investment cuts hasten a re-balancing of global supply and demand. Poor Chinese data has done little to improve sentiment. The country’s M2 money supply at 556 billion yuan undershot the expected 820 billion yuan while new loans at -3.6 percent missed the projected -2.8 percent. The European flash GDP reading at 0.5 percent also missed the forecast 0.6 percent. Copper inventories fell a net 3,800 tonnes to 156,675 tonnes and cancelled warrants dropped 3,700 tonnes to 36,525 tonnes. Meanwhile, SHFE stocks have fallen more than 26,000 tonnes; there is growing speculation location that metal will continue to out to LME warehouses in the coming weeks. The shortfall in refined copper will reach 56,000 metric tons in 2016, the International Copper Study Group said in March. In October, the group predicted a surplus of 175,000 tons. Technically now Copper is getting support at 308.1 and below same could see a test of 306.4 level, And resistance is now likely to be seen at 311.4, a move above could see prices testing 313. Date : Monday, May 16, 2016 URL : www.achiieversequitiesltd.com Page No - 4 MCX Zinc May 2016 TRADING IDEA OPEN 125.8 SUP-2 123.9 Zinc trading range for the day is 123.9-127.9. HIGH 126.7 SUP-1 125.2 Zinc prices gained as support seen after data showed inventories in warehouses registered with the LME continued to erode, falling to 390,375 tonnes. LOW 124.7 P.P. 125.9 Refined zinc production will trail consumption by 352,000 metric tons this year, the ILZSG said in April, widening its deficit forecast from 152,000 tons in October. CLOSE 126.5 RES-1 127.2 Combined zinc inventories in Shanghai, Tianjin and Guangdong fell 10,600 to 350,700 tonnes past week. % CNG 1.32 RES-2 127.9 BUY ZINC MAY @ 125.50 SL 124 TGT 126.50-127.80.MCX Zinc on MCX settled up 1.32% at 126.5 as support seen after data showed inventories in warehouses registered with the LME continued to erode, falling to 390,375 tonnes. The figure is the lowest since July 2009, about twothirds below the record peak in 2013, although some stock is thought to have been shifted to cheaper storage outside LME warehouses. Refined zinc production will trail consumption by 352,000 metric tons this year, the ILZSG said in April, widening its deficit forecast from 152,000 tons in October. Combined zinc inventories in Shanghai, Tianjin and Guangdong fell 10,600 to 350,700 tonnes past week. Some goods were shipped from Shanghai to Tianjin as the price spread between Shanghai and Tianjin was bigger than freight charges. Zinc smelters preferred to deliver goods to Tianjin, reducing arriving shipments in Shanghai. But arriving shipments in Tianjin were also limited, with inventories down. Outward shipments in Guangdong increased due to bargain hunters, so local inventories also slid. Zinc stocks and cancelled warrants both down 1,125 tonnes at 390,375 tonnes and 25,375 tonnes respectively. Lead at $1,713 was up $2 after a marginal stock increase of 25 tonnes to 176,075 tonnes. TCs of domestic zinc concentrate (50%) held stable at 5,100-5,300 yuan per tonne (zinc content) this past week, and those for imported zinc concentrate (50%) were $110-130 per dry metric tonne. Supply tightness in North China is expected to ease, though, as an increasing number of mines restart due to warmer weather. Technically market is under fresh buying as market has witnessed gain in open interest by 24.53% to settled at 5448, now Zinc is getting support at 125.2 and below same could see a test of 123.9 level, And resistance is now likely to be seen at 127.2, a move above could see prices testing 127.9. MCX Nickel May 2016 TRADING IDEA OPEN 577.8 SUP-2 571.2 Nickel trading range for the day is 571.2-589. HIGH 584.1 SUP-1 576.1 Nickel prices bounced back as optimism over a rebound in U.S. economic growth overshadowed a stronger dollar. LOW 575.2 P.P. 580.1 U.S. retail sales jumped 1.3 percent last month, the largest gain since March 2015 and a bigger rise than the 0.8 percent expected. CLOSE 580.9 RES-1 585.0 Nickel weekly stocks at Shanghai exchange came up by 5972 tonnes. % CNG 0.52 RES-2 589.0 BUY NICKEL MAY ABV 582 SL BELOW 568 TGT 592-608. MCX (BTST) Nickel on MCX settled up 0.52% at 580.9 as prices bounced back as optimism over a rebound in U.S. economic growth overshadowed a stronger dollar, but high inventories are keeping market participants cautious about the future direction of prices. April retail sales recorded their biggest increase in a year, suggesting the economy is regaining momentum, and U.S. consumer sentiment rose to the highest levels since June last year. Nickel stocks fell 1,674 tonnes to 412,344 tonnes. In a move centred on Vlissingen, cancelled warrants dropped 4,116 tonnes to 120,720 tonnes. The cash/May date is looking tight at a small contango of just $1. Investors have been worried about reports that many Chinese smelters were reversing production cutbacks after prices rebounded, which would add to a global surplus. U.S. retail sales jumped 1.3 percent last month, the largest gain since March 2015 and a bigger rise than the 0.8 percent expected. The U.S. Census Bureau said retail sales last month jumped by 1.3%, above consensus expectations of 0.9%, rebounding from a 0.3% decline in March. The University of Michigan's Consumer Survey Center said its Consumer Sentiment Index soared nearly seven points in its mid-May flash reading to 95.8, significantly above consensus expectations of 89.7. It came weeks after consumer sentiment slumped to 89.0 in the final April reading, dropping to its lowest level since last September. In the May reading, though, the expectations component surged nearly 10 points to 87.5, pulling up the general index. Technically market is under short covering as market has witnessed drop in open interest by -3.07% to settled at 21875, now Nickel is getting support at 576.1 and below same could see a test of 571.2 level, And resistance is now likely to be seen at 585, a move above could see prices testing 589. Date : Monday, May 16, 2016 URL : www.achiieversequitiesltd.com Page No - 5 NCDEX Chana Jun 2016 TRADING IDEA OPEN 5725 SUP-2 5615 Chana trading range for the day is 5615-5907. HIGH 5818 SUP-1 5704 Chana prices ended with gains amid anticipation of limited supplies amid lower production and expensive imports. LOW 5672 P.P. 5761 In the third advance estimates, chana production is revised downwards to 7.5 mt from 8 mt forecasted in 2nd estimate. CLOSE 5792 RES-1 5850 The Maharashtra government demanded the Centre to release 10,000 tonnes of tur dal immediately from the buffer stock. % CNG 1.49 RES-2 5907 BUY CHANA JUNE @ 5710 SL 5680 TGT 5760-5820.NCDEX Chana on NCDEX settled up 1.49% at 5792 amid anticipation of limited supplies amid lower production and expensive imports. In the third advance estimates (May 2016), chana production is revised downwards to 7.5 mt from 8 mt forecasted in 2nd estimate (Feb 2016). Country imported over 79,000 lt of chana in Feb 2016 higher than 38,000 tones imports last year in Feb. India has imported 9.93 lt of Chana until February in the current financial year (Apr 2015-Feb 2016). To control the prices, centre has asked states to impose stock holding limits for traders on all varieties of pulses in order to curb hoarding. The Maharashtra government demanded the Centre to release 10,000 tonnes of tur dal immediately from the buffer stock to meet the requirement of pulses in the state. Keeping in view the state's monthly tur demand of 7,000 tonnes, the state government had sought for 28,000 tonnes of the dal from the buffer stock created by the Centre, but it has been offered only 7,000 tonnes. The pulses issue was raised by Maharashtra's Food and Civil Supplies Minister Girish Bapat in a meeting with Union Food Minister Ram Vilas Paswan. Import of pulses rose 26 per cent to 5.79 million tonnes (mt) last financial year to meet rising domestic demand, Parliament was informed. India had imported 4.58 mt during 2014-15. Technically market is under fresh buying as market has witnessed gain in open interest by 2.29% to settled at 18340 while prices up 85 rupee, now Chana is getting support at 5703 and below same could see a test of 5615 level, And resistance is now likely to be seen at 5849, a move above could see prices testing 5907. NCDEX Turmeric Jun 2016 TRADING IDEA OPEN 8206 SUP-2 7996 Turmeric trading range for the day is 7996-8268. HIGH 8206 SUP-1 8058 Turmeric prices ended with losses due to fall in demand at the spot market. LOW 8070 P.P. 8132 Though, some losses were capped on poor arrivals of turmeric from the producing regions. CLOSE 8120 RES-1 8194 NCDEX accredited warehouses turmeric stocks gained by 289 tonnes to 4550 tonnes. % CNG -1.00 RES-2 8268 BUY TURMERIC JUNE ABV 8180 SL 8000 TGT 8320-8480.NCDEX Turmeric on NCDEX settled down -1% at 8120 due to fall in demand at the spot market. Though, some losses were capped on poor arrivals of turmeric from the producing regions. At Sangli market sources reported arrivals at 9500 quintals, higher by 4500 quintals as against previous day. At Warangal market total arrivals are at 1500 bags, lower by 2000 bags as compared to previous day. New season crop has hit the markets and continue to peak in current month but majority of arrivals are of medium quality. As per dept of commerce data, turmeric exports for the period April 2015- Feb 2016 is pegged at 77,081 tonnes while the export for the 2014-15 was 83,713 tonnes for the same period. Due to poor demand for turmeric, prices were down Rs. 9,000 a quintal. Turmeric growers are bringing very limited stock for sale due to poor upcountry demand. Farmers brought only 4,400 bags on Monday and 70 per cent of the stock was sold. Buyers also quoted decreased price. Further, due to the Tamil Nadu Assembly Election and implementation of model code of Conduct Rules by the Election authorities, buyers were reluctant to take huge money for buying the commodity. Of the total arrival of 902 bags, 544 were sold. At the Regulated Market Committee finger turmeric sold at Rs. 7,899 to Rs. 9,029 a quintal, root variety at Rs. 7,769 to Rs. 8,695 a quintal. Technically market is under long liquidation as market has witnessed drop in open interest by -0.89% to settled at 26195 while prices down -82 rupee, now Turmeric is getting support at 8058 and below same could see a test of 7996 level, And resistance is now likely to be seen at 8194, a move above could see prices testing 8268. Date : Monday, May 16, 2016 URL : www.achiieversequitiesltd.com Page No - 6 TRADING IDEA MCX Menthaoil May 2016 OPEN 860.0 SUP-2 846.4 Menthaoil trading range for the day is 846.4-881.4. HIGH 871.6 SUP-1 856.2 Mentha oil spot at Sambhal closed at 999.20 per 1kg. Spot prices is down by Rs.-3.10/-. LOW 854.1 P.P. 863.9 Mentha oil ended with gains due to rising demand from consuming industries at the spot market. CLOSE 866.0 RES-1 873.7 However, sentiments still remain weak which will cap the gains as this season the farmers are seen getting more interested in sowing. % CNG 0.39 RES-2 881.4 SELL MENTHA OIL MAY @ 870 SL 885 TGT 858-845.MCX Menthaoil on MCX settled up 0.39% at 866 due to rising demand from consuming industries at the spot market. However, sentiments still remain weak which will cap the gains as this season the farmers are seen getting more interested in sowing mentha in the major growing area of Barabanki. Markets had remained weak for quite sometime from lack of demand amidst reports of higher sowing activities. The preliminary mandi source suggests that production of menthol is likely to be around 34-35000 tonnes during 2016-17 as compared to 32000 tonnes in 2015-16. While some sources estimate that total area under Mentha planting has dropped by 25% to 1.70 lakh ha this season resulting into a proportionate fall in Mentha oil production this year. However a pick up in sowing over last few weeks have ensured prices falling for the commodity, as low demand further pressurized market sentiments. As per latest reports Mentha Oil export in 2014-15 has surpassed targeted 21000 tons by 23% at 25750 tons. On the other hand, ban on gutka and increased supply of synthetic mentha oil in the global market has increased due to which mentha prices are decreasing in the market. Meanwhile support also seen from the latest reports showing Mentha Oil export in 2014-15 has surpassed targeted 21000 tons by 23% at 25750 tons. Technically market is under short covering as market has witnessed drop in open interest by -2.51% to settled at 2332 while prices up 3.4 rupee, now Menthaoil is getting support at 856.2 and below same could see a test of 846.4 level, And resistance is now likely to be seen at 873.7, a move above could see prices testing 881.4. DAILY MARKET LEVEL FOR METAL AND ENERGY COMMODITIES GOLD SILVER CRUDE NAT.GAS COPPER ZINC NICKEL ALUMINUM CLOSE OI TREND 30034 30470 30269 30152 29951 29834 29633 29516 7398 Positive 40974 42008 41513 41243 40748 40478 39983 39713 10267 Positive 3097 3164 3137 3117 3090 3070 3043 3023 19860 Positive 141.4 150.9 148.1 144.7 141.9 138.5 135.7 132.3 6166 Positive 309.85 314.7 313.0 311.4 309.7 308.1 306.4 304.8 28879 Positive 126.5 129.2 127.9 127.2 125.9 125.2 123.9 123.2 5448 Positive 580.9 593.9 589.0 585.0 580.1 576.1 571.2 567.2 21875 Positive 102.95 104.7 104.1 103.5 102.9 102.3 101.7 101.1 5363 Positive 115.0 117.1 116.4 115.7 115.0 114.3 113.6 112.9 2680 Positive SPREAD 244 658 61.00 10.60 4.65 0.65 6.40 1.00 0.75 RESISTANCE P. POINT SUPPORT Date : Monday, May 16, 2016 URL : www.achiieversequitiesltd.com LEAD Page No - 7 NEWS YOU CAN USE DAY India's gold demand could rise as much as 10 percent in 2016, even after falling 39 percent in the first quarter, as good monsoon rainfall and a sustained rally in gold prices boost buying, the World Gold Council (WGC) said. Stronger demand from the world's second-biggest gold consumer could further support the global bullion price, which has risen nearly a fifth so far in 2016. A jewellers strike, a sharp rise in prices and expectations of a cut in duty hit demand in the first quarter, but demand drivers were turning positive, Somasundaram PR, managing director of the WGC's Indian operations, told. "The monsoon is forecast to be extraordinarily good. If it is well distributed, then demand will come at top end of the range. If the monsoon is not spread out as it should be, then demand will be somewhere near the lower end of the range," said Somasundaram. He forecast demand in 2016 at 850 tonnes to 950 tonnes, compared with 864.3 tonnes last year. Two-thirds of India's gold demand comes from villages, where jewellery is traditionally used for investment. Rural demand has fallen in the past few months after the first back-to-back drought in nearly three decades squeezed farmers' earnings. In 2016, however, India is likely to benefit from surplus rainfall during June-September monsoon season. Unplanned disruptions to oil output could help run down a global overhang of unused crude this year, while demand will profit from growing gasoline consumption particularly in India and China, the International Energy Agency said. The IEA said output from non-OPEC producers is expected to fall by 800,000 barrels per day (bpd) in 2016, an acceleration from the agency's previous forecast for a fall by 710,000 bpd. On the demand front, the Paris-based IEA left its forecast for global growth broadly unchanged at 1.2 million bpd for this year, but said the risks to future forecasts lay to the upside. "Any changes to our current 2016 global demand outlook are now more likely to be upwards than downwards, as gasoline demand grows strongly in nearly every key market, more than offsetting weakness in middle distillates," the IEA said in its monthly Oil Market Report. "Slower demand growth in OECD (Organisation for Economic Co-operation and Development) countries is not unexpected; it represents a return to the norm," it added. This marks a far cry from the IEA's warning at the start of the year that the oil market could "drown in supply" in 2016, given the pace of stock-building and the net rise in global production at the time. The IEA noted the warning last month from the International Monetary Fund, which cut its global economic growth forecast in 2016 to 3.2 percent from 3.4 percent. The Maharashtra government demanded the Centre to release 10,000 tonnes of tur dal immediately from the buffer stock to meet the requirement of pulses in the state. Keeping in view the state's monthly tur demand of 7,000 tonnes, the state government had sought for 28,000 tonnes of the dal from the buffer stock created by the Centre, but it has been offered only 7,000 tonnes. The pulses issue was raised by Maharashtra's Food and Civil Supplies Minister Girish Bapat in a meeting with Union Food Minister Ram Vilas Paswan held in New Delhi. "We requested that 10,000 tonnes should be allocated now and another 10,000 tonnes after 2-3 months," Bapat said after the meeting. The Union food minister has assured that the Centre would consider the state demand, he added. The Centre has procured about 62,178 tonnes of pulses to create buffer stock in order to intervene in the market in case of price rise. Highlighting the measures taken by the Maharashtra government to boost pulses supply and check prices, Bapat said the state cabinet has taken a decision to cap maximum retail prices of pulses and proposal in this regard has been send to President for the approval. Date : Monday, May 16, 2016 Mon ECONOMICAL DATA TIME ZONE EXP PREV All Day EUR All Day EUR French Bank Holiday 0 0 German Bank Holiday 0 6:00pm USD Empire State Manufacturing Index 0 7.2 9.6 7:30pm USD NAHB Housing Market Index 0 0 0 59 58 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Following last Friday's disappointing monthly jobs report, the Labor Department may add to concerns about the labor market on Thursday with the release of a report showing an unexpected increase in initial jobless claims in the week ended May 7th. The report said initial jobless claims climbed to 294,000, an increase of 20,000 from the previous week's unrevised level of 274,000. Jobless claims moved higher for the third straight week. The continued increase came as a surprise to economists, who had expected jobless claims to edge down to 270,000. With the unexpected increase, jobless claims rose to their highest level since reaching 310,000 in the week ended February 28, 2015. The less volatile four-week moving average also jumped to 268,250, an increase of 10,250 from the previous week's unrevised average of 258,000. Continuing claims, a reading on the number of people receiving ongoing unemployment assistance, also surged up by 37,000 to 2.161 million in the week ended April 30th. Meanwhile, the four-week moving average of continuing claims fell by 3,750 to 2,137,250, its lowest level since November of 2000. The United States department of agriculture (USDA) trimmed 2016-17 United States soybean production forecast by 3.27% on on lower harvested area and trend yields, the department said in its World Agriculture Supply and Demand Estimates report. The USDA cut US, the world's biggest bean grower, production estimates to 103.4 million tons in May compared to 106.9 million tons in the same period a year ago. Morever, USDA also trimmed its forecast for 2016-17 US soybean ending stockpiles to 305 million bushels in May compared to 400 million bushels a year ago. Forecast for Brazil, the world's second biggest soybean producer, 2016-17 output hiked at 103 million tons compared to 99 million tons in the same period a year ago, the USDA said. Estimation for Argentina, world's third biggest soybean producer, 2016-17 crop output hiked to 57 million tons compared to 56.5 million tons in the same period a year ago. URL : www.achiieversequitiesltd.com Page No - 8 Date : Monday, May 16, 2016 URL : www.achiieversequitiesltd.com Page No - 9