Receivables 9 Click to edit Master title style 1

advertisement

1

Click to edit Master title style

9

Receivables

1

2

Click

to

edit

Master

title

style

After studying this chapter, you should

be able to:

1. Describe the common classifications

of receivables.

2. Describe the nature of and the

accounting for uncollectible

receivables.

3. Describe the direct write-off method

of accounting for uncollectible

receivables.

2

3

Click

to

edit

Master

title

style

After studying this chapter, you should

be able to:

4. Describe the allowance method of

accounting for uncollectible

receivables.

5. Compare the direct write-off and

allowance methods of accounting for

uncollectible accounts.

3

4

Click

to

edit

Master

title

style

After studying this chapter, you should

be able to:

6. Describe the nature, characteristics,

and accounting for notes receivables.

7. Describe the reporting of receivables

on the balance sheet.

4

5

Click to edit Master title style

Objective 1

9-1

Describe the

common

classifications of

receivables.

5

6

Classification of Receivables

Click to edit Master title style

9-1

The term receivables includes

all money claims against other

entities, including people,

business firms, and other

organizations.

6

7

Accounts Receivable

Click to edit Master title style

9-1

Accounts receivable are

normally expected to be

collected within a

relatively short period,

such as 30 or 60 days.

7

8

Notes Receivable

Click to edit Master title style

9-1

Notes receivable are

amounts that customers

owe for which a formal,

written instrument of

credit has been issued.

8

9

Other Receivables

Click to edit Master title style

9-1

Other receivables expected to be

collected within one year are

classified as current assets. If

collection is expected beyond one

year, these receivables are classified

as noncurrent assets and reported

under the caption Investments.

9

10

Click to edit Master title style

Objective 2

9-2

Describe the nature of

and the accounting for

uncollectible

receivables.

10

11

Click to edit Master title style

9-2

Companies often sell their

receivables to other companies.

This transaction is called factoring

the receivables, and the buyer of the

receivables is called a factor.

11

12

Uncollectible Receivables

Click to edit Master title style

9-2

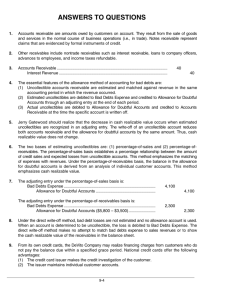

There are two methods of

accounting for receivables that

appear to be uncollectible: the

direct write off method and the

allowance method.

12

13

Click to edit Master title style

9-2

The direct write off method records

bad debt expense only when an

account is judged to be worthless.

The allowance method records bad

debt expense by estimating

uncollectible accounts at the end of

the accounting period.

13

14

Click to edit Master title style

Objective 3

9-3

Describe the direct writeoff method of accounting

for uncollectible

receivables.

14

15

Direct Write-Off Method

Click to edit Master title style

9-3

On May 10, a Rp4,200,000 accounts

receivable from D. L. Rosana has

been determined to be uncollectible.

May 10 Bad Debt Expense

Accounts Receivable—D. L. Ross

4 200 000

4 200 000

15

15

16

Click to edit Master title style

9-3

The amount written off is later

collected on November 21.

Nov. 21 Accounts Receivable—D. L. Rosana

Bad Debt Expense

21 Cash

Accounts Receivable—D. L. Rosana

4 200 000

4 200 000

4 200 000

4 200 000

16

16

17

9-3

Click to edit Master title style

Example Exercise 9-1

Journalize the following transactions using the

direct write-off method of accounting for

uncollectible receivables.

July 9 Received Rp1,200,000 from Jaya Basuki

and wrote off the remainder owed

of Rp3,900,000 as uncollectible.

Oct. 11 Reinstated the account of Jaya Basuki

and received Rp3,900,000 cash in full

payment.

17

17

18

9-3

Click

to

edit

Master

title

style

Follow My Example 9-1

July 9 Cash

1,200,000

Bad Debt Expense

3,900,000

Accounts Receivable—Jaya Basuki

5,100,000

Oct. 11 Accounts Receivable—Jaya Basuki

Bad Debt Expense

3,900,000

3,900,000

11 Cash

3,900,000

Accounts Receivable—Jaya Basuki

3,900,000

For Practice: PE 9-1A, PE 9-1B

18

18

19

Click to edit Master title style

Objective 4

9-4

Describe the allowance

method of accounting for

uncollectible receivables.

19

20

Allowance Method

Click to edit Master title style

9-4

On December 31, IndoToner Company estimates that

a total of Rp40,000,000 of the Rp1,000,000,000

balance in her company’s Accounts Receivable will

eventually be uncollectible.

Dec. 31 Bad Debt Expense

Allowance for Doubtful Accounts

40 000 000

40 000 000

Uncollectible accounts

estimate.

20

20

21

Net Realizable Value

Click to edit Master title style

9-4

The net amount that is expected to be

collected, Rp960,000,000

(Rp1,000,000,000 – Rp40,000,000), is

called the net realizable value (NRV).

The adjusting entry reduces receivables to

the NRV and matches uncollectible

expenses with revenues.

21

22

Click to edit Master title style

9-4

On January 21, Johan Pariang’s account totaling

Rp6,000,000 is written off because it is

uncollectible.

Jan. 21 Allowance for Doubtful Accounts

Accounts Receivable— Johan Pariang

6 000 000

6 000 000

To write off the uncollectible

account.

22

22

23

Click to edit Master title style

9-4

23

23

24

Click to edit Master title style

9-4

During 2008, IndoToner Company

writes off Rp36,750,000 of uncollectible

accounts, including the Rp6,000,000

account of Johan Pariang. After posting

all entries to write-off uncollectible

amounts, the Allowance for Doubtful

Accounts will have a credit balance of

Rp3,250,000 (Rp40,000,000 –

Rp36,750,000).

24

25

Click to edit Master title style

9-4

ALLOWANCE FOR DOUBTFUL ACCOUNTS

Jan. 1, 2008 Bal.

40,000,000

Total accounts

Jan. 21 6,000,000

written off

Rp36,750,000 Feb. 2 3,900,000

“

“

“

“

Dec. 31 Unadjusted bal 3,250,000

{

25

25

26

Click to edit Master title style

9-4

If IndoToner Company had

written off Rp44,100,000 in

accounts receivable during

2008, the Allowance for

Doubtful Accounts would have

a debit balance of Rp4,100,000.

26

27

Click to edit Master title style

9-4

ALLOWANCE FOR DOUBTFUL ACCOUNTS

Jan. 1, 2008 Bal.

40,000,000

Total accounts

Jan. 21 6,000,000

written off

Feb. 2 3,900,000

Rp44,100,000

“

“

“

“

Dec. 31 Unadjusted bal 4,100,000

{

27

27

28

Collecting a Written-Off Account

Click to edit Master title style

9-4

Nani Siregar account of Rp5,000,000 which

was written off on April 2 is later collected on

June 10. Two entries are needed: one to

reinstate Nani Siregar account and a second to

record receipt of the cash.

28

29

Click to edit Master title style

9-4

Entry 1: Reinstate the account.

June 10 Accounts Receivable—Nani Siregar

Allowance for Doubtful Accounts

To reinstate the account

written off on Jan. 21.

5 000 000

5 000 000

29

29

30

Click to edit Master title style

9-4

Entry 2: Record collection of cash.

June 10 Cash

Accounts Receivable—Nani Siregar

Collection of written-off

account.

5 000 000

5 000 000

30

30

31

9-4

Click to edit Master title style

Example Exercise 9-2

Journalize the following transactions using the

allowance method of accounting for

uncollectible receivables.

July 9 Received Rp1,200,000 from Jaya Basuki

and wrote off the remainder owed

of Rp3,900,00 as uncollectible.

Oct. 11 Reinstated the account of Jaya Basuki

and received Rp3,900,000 cash in full

payment.

31

31

32

9-4

Click

to

edit

Master

title

style

Follow My Example 9-2

July 9 Cash

1,200,000

Allowance for Doubtful Accounts

3,900,000

Accounts Receivable—Jaya Basuki

5,100,000

Oct. 11 Accounts Receivable—Jaya Basuki

Allowance for Doubtful Accounts

3,900,000

3,900,000

11 Cash

3,900,000

Accounts Receivable—Jaya Basuki

3,900,000

For Practice: PE 9-2A, PE 9-2B

32

32

33

Estimating Uncollectibles

Click to edit Master title style

9-4

The allowance method uses two ways

to estimate the amount debited to Bad

Debt Expense.

1. Estimate based on a percentage

of sales.

2. Estimate based on analysis of

receivables.

33

34

9-4

Estimate Based on a Percentage

of Sales

Click to edit Master title style

If credit sales for the period are

Rp3,000,000,000 and it is estimated that

1½ % will be uncollectible, the Bad Debt

Expense is debited for Rp45,000,000

(Rp3,000,000,000 x .015). This

approach disregards the balance in the

allowance account before the adjustment.

34

35

Click to edit Master title style

9-4

After this adjusting entry is posted,

Allowance for Doubtful Accounts will

have a balance of Rp48,250,000.

Dec. 31 Bad Debt Expense

Allowance for Doubtful Accounts

Uncollectible accounts

(Rp3,000,000,000 x 0.015

= Rp45,000,000).

45 000 000

45 000 000

35

35

36

Click to edit Master title style

Dec. 31 Adj entry

Dec. 31 Adjusted bal.

9-4

BAD DEBT EXPENSE

45,000,000

45,000,000

ALLOWANCE FOR DOUBTFUL ACCOUNTS

Jan. 1, 2008 Bal. 40,000,000

Total accounts

Jan. 21 6,000,000

written off

Feb. 2 3,900,000

Rp36,750,000

“

“

Dec. 31 Unadjusted bal 3,250,000

Dec. 31 Adj. entry

45,000,000

Dec. 31 Adjusted bal.

48,250,000

{

36

36

37

9-4

Click to edit Master title style

Example Exercise 9-3

At the end of the current year, Accounts Receivable has a

balance of Rp800,000,000; Allowance for Doubtful

Accounts has a credit balance of Rp7,500,000; and net

sales for the year total Rp3,500,000,000. Bad debt

expense is estimated at ½ of 1% of net sales.

Determine (a) the amount of the adjusting entry for

uncollectible accounts; (b) the adjusted balances of

Accounts Receivable, Allowance for Doubtful

Accounts, and Bad Debt Expense; and (c) the net

realizable value of accounts receivable.

37

37

38

9-4

Click

to

edit

Master

title

style

Follow My Example 9-3

(a)

Rp17,500,000 (Rp3,500,000,000 x .005)

Adjusted Balance

(b) Accounts Receivable

Rp800,000,000

Allowance for Doubtful Accounts

(Rp7,500,000 + Rp17,500,000)

25,000,000

Bad Debt Expense

17,500,000

(c) Rp775,000,000 (Rp800,000,000 – Rp25,000,000)

For Practice: PE 9-3A, PE 9-3B

38

38

39

Estimating Uncollectibles Based

on Analysis of Receivables

Click to edit Master title style

9-4

The longer an account receivable is

outstanding, the less likely that it will be

collected. Basing the estimate of

uncollectible accounts on how long specific

amounts have been outstanding is called

aging the receivables.

39

40

Aging of Accounts

Receivables

Click to edit Master title style

A

Customer

1 Aslan

2 B.T.Barus

3 Bambang

21

22 Subang Jati

23 Total

B

Balance

Rp 150,000

610,000

470,000

C

Not

Past

Due

D

E

F

G

H

I

181-365

Over

365

9-4

Days Past Due

1-30

31-60

Rp150,000

61-90

91-180

Rp470,000

1

2

3

160,000

Rp86,300,000 Rp75,000,000

21

22

Rp300,000 23

Rp350,000

Rp4,000,000

Rp3,100,000

Rp1,900,000

160,000

Rp1,200,000

Rp260,000

Rp800,00

40

41

Estimate of

Uncollectible Accounts

Click to edit Master title style

A

1

2

3

4

5

6

7

8

Age Interval

Not past due

1-30 days past due

31-60 days past due

61-90 days past due

91-180 days past due

181-365 days past due

Over 365 days past due

Total

B

Balance

Rp75,000,000

4,000,000

3,100,000

1,900,000

1,200,000

800,000

300,000

Rp86,300,000

C

9-4

D

Estimated

Uncollectible Accounts

Percent

Amount

2%

Rp1,500,000

5

200,000

10

310,000

20

380,000

30

360,000

50

400,000

80

240,000

Rp3,390,000

41

42

Collection Rates by Number of

Months Past Due

Click to edit Master title style

9-4

42

42

43

Estimate Based on Analysis of

Receivables

Click to edit Master title style

9-4

If it is estimated that Rp3,390,000 of

the receivables will be uncollectible

and the Allowance for Uncollectible

Accounts currently has a balance of

Rp510,000, the Bad Debt Expense

must be debited for Rp2,880,000

(Rp3,390,000 – Rp510,000).

43

43

44

Estimate Based on Analysis of

Receivables

Click to edit Master title style

Aug. 31 Bad Debt Expense

Allowance for Doubtful Accounts

Uncollectible accounts

(Rp3,390,000 – Rp510,00).

9-4

2 880 000

2 880 000

44

44

45

Click to edit Master title style

Aug. 31 Adj. entry

Aug. 31 Adj. bal.

9-4

BAD DEBT EXPENSE

2,880,000

2,880,000

ALLOWANCE FOR DOUBTFUL ACCOUNTS

Aug. 31 Unadj. bal. 510,000

Aug. 31 Adj. entry 2,880,000

Aug. 31 Adj. bal. 3,390,000

45

45

46

Click to edit Master title style

9-4

If the unadjusted balance of Allowance for

Uncollectible Accounts had been a debit

balance of Rp300,000, the amount of the

adjustment would have been Rp3,690,000

(Rp3,390,000 + Rp300,000).

46

47

Click to edit Master title style

Aug. 31 Adj. entry

Aug. 31 Adj. bal.

9-4

BAD DEBT EXPENSE

3,690,000

3,690,000

ALLOWANCE FOR DOUBTFUL ACCOUNTS

Aug. 31 Unadj. bal. 300,000 Aug. 31 Adj. entry 3,690,000

Aug. 31 Adj. bal.

3,390,000

47

47

48

9-4

Click to edit Master title style

Example Exercise 9-4

At the end of the current year, Accounts Receivable has a

balance of Rp800,000,000; Allowance for Doubtful

Accounts has a credit balance of Rp7,500,000; and net

sales for the year total Rp3,500,000,000. Using the aging

method, the balance of Allowance for Doubtful Accounts

is estimated as Rp30,000,000.

Determine (a) the amount of the adjusting entry for

uncollectible accounts; (b) the adjusted balances of

Accounts Receivable, Allowance for Doubtful Accounts,

and Bad Debt Expense, and (c) the net realizable value of

accounts receivable.

48

48

49

9-4

Click

to

edit

Master

title

style

Follow My Example 9-4

Rp22,500,000 (Rp30,000,000 – Rp7,500,000)

Adjusted Balance

(b) Accounts Receivable

Rp800,000,000

Allowance for Doubtful Accounts

30,000,000

Bad Debt Expense

22,500,000

(a)

(c) Rp770,000,000 (Rp800,000,000 – Rp30,000,000)

For Practice: PE 9-4A, PE 9-4B

49

49

50

Click to edit Master title style

Objective 5

9-5

Compare the direct writeoff and allowance methods

of accounting for

uncollectible accounts

50

51

Click to edit Master title style

Comparing Direct-Write-Off

and Allowance Methods

Allowance Method

Direct Write-Off Method

Mar.1 Bad Debt Expense

Accounts Receivable - C.Yanuar

Apr.12 Cash

Bad Debt Expense

Accounts Receivable - Karina Budiman

June.22 Accounts Receivable - C.Yanuar

Bad Debt Expense

22 Cash

Accounts Receivable - C.Yanuar

Sept.22 Bad Debt Expense

Accounts Receivable - Jason Bimasakti

Accounts Receivable - Santoso Budiman

Accounts Receivable - Sari Nuriah

Accounts Receivable - Sandy Nurmila

Accounts Receivable - Amir Wicaksana

Dec.31 No Entry

9-5

3,650,000

3,650,000

2,250,000

3,250,000

Allowance for Doubtfull Accounts

Accounts Receivable - C.Yanuar

Cash

Allowance for Doubtfull Accounts

5,500,000 Accounts Receivable - Karina Budiman

3,650,000

3,650,000

3,650,000

2,250,000

3,250,000

5,500,000

Accounts Receivable - C.Yanuar

Allowance for Doubtfull Accounts

3,650,000

3,650,000

Cash

Accounts Receivable - C.Yanuar

3,650,000

3,650,000

Allowance for Doubtfull Accounts

Accounts Receivable - Jason Bimasakti

Accounts Receivable - Santoso Budiman

Accounts Receivable - Sari Nuriah

Accounts Receivable - Sandy Nurmila

Accounts Receivable - Amir Wicaksana

6,445,000

1,100,000

2,220,000

775,000

1,360,000

990,000

3,650,000

6,445,000

3,650,000

3,650,000

1,100,000

2,220,000

775,000

1,360,000

990,000

Bad Debt Expense

42,500,000

Allowance for Doubtful Accounts

42,500,000

Uncollectible accounts estimate.

(Rp3,400,000,000 x 0.0125 = Rp42,500,000)

51

52

Comparing the Direct Write-Off and

Allowance Methods

Click to edit Master title style

9-5

Direct Write-Off Method

Amount of bad debt

expense recorded

When the actual accounts

receivable are determined

to be uncollectible

Allowance account

No allowance account is

used

Primary users

Small companies and

companies with relatively

few receivables

52

52

53

Comparing the Direct Write-Off and

Allowance Methods

Click to edit Master title style

9-5

Allowance Method

Amount of bad debt

expense recorded

Allowance account

Primary users

Using estimate based on

either (1) a percentage of

sales or (2) analysis of

receivables.

The allowance account is

used

Large companies and those

with a large amount of

receivables

53

53

54

Click to edit Master title style

Objective 6

9-6

Describe the nature,

characteristics, and

accounting for notes

receivable.

54

55

Characteristics of Notes Receivable

Click to edit Master title style

9-6

A note receivable, or promissory note, is

a written document containing a promise

to pay:

• a specific amount of money (face

amount)

• on demand or at a definite time

• to an individual or a business (payee),

or to the bearer or holder of the note.

55

56

Characteristics of Notes Receivable

Click to edit Master title style

9-6

The one making the promise is

called the maker. The date a

note is to be paid is called the

due date or maturity date.

56

57

9-6

Click to edit Master title style

2,500.00

$_____________

Payee

Fresno, California______________20___

March 16

08

Ninety days

________________

_AFTER DATE _______

We PROMISE TO PAY TO

THE ORDER OF ____________________________________________

Judson Company

Two

thousand five hundred 00/100--------------------------_________________________________________________DOLLARS

City National Bank

PAYABLE AT ______________________________________________

Maker

VALUE RECEIVED WITH INTEREST AT ____

10%

NO. _______

DUE___________________

14

June 14, 2008

H. B. Lane

TREASURER, WILLIARD COMPANY

57

57

58

9-6

Click to edit Master title style

What is the due date of a 90-day note dated March 16?

Total days in note

Number of days in March

Issue date of note

Remaining days in March

Number of days in April

Number of days in May

Residual days in June

90 days

31

March 16

–15 days

75 days

–30 days

45 days

–31 days

14 days

Answer: June 14

58

58

59

9-6

Accounting for Notes Receivable

Click to edit Master title style

Received a Rp6,000,000, 12%, 30-day note

dated November 21, 2008 in settlement of

the account of W. A Barito Co.

Nov. 21 Notes Rec.—W. A. Barito Co.

Accts. Rec.—W. A Barito Co.

Received 30-day, 12%

note dated November 21,

2008.

6 000 000

6 000 000

59

59

60

9-6

Click to edit Master title style

On December 21, when the note matures, the firm

receives Rp6,060,000 from W. A. Barito Company

(Rp6,000,000 plus Rp60,000 interest).

Dec. 21 Cash

6 060 000

Notes Rec.—W. A. Barito Co.

Interest Revenue*

Received principal and

6 000 000

60 000

interest on matured note.

*Rp6,000,000 x 12% x 30/360 = Rp60,000

60

60

61

9-6

Click to edit Master title style

If W. A. Bunn Company fails to pay the note on

the due date, it is considered a dishonored note

receivable. The note and interest are

transferred to the customer’s account.

Dec. 21 Accts Rec.—W. A. Barito Co.

Notes Rec.—W. A. Barito Co.

Interest Revenue

Recorded dishonored

6 060 000

6 000 000

60 000

note, plus interest.

61

61

62

9-6

Click to edit Master title style

A 90-day, 12% note dated December 1, 2008, is

received from PT Cemara to settle its account, which

has a balance of Rp4,000,000.

2008

Dec. 1 Notes Rec.—PT Cemara

Accts. Rec.— PT Cemara

Accepted note in

settlement of account.

4 000 000

4 000 000

62

62

63

9-6

Click

to

edit

Master

title

style

Assuming that the accounting period ends

on December 31, an adjusting entry is

required to record the accrued interest of

Rp40,000 (Rp4,000,000 x 0.12 x 30/360).

2008

Dec. 31 Interest Receivable

Interest Revenue

40 000

40 000

Accrued interest

(Rp4,000,000 x 12% x

30/360).

63

63

64

9-6

Click to edit Master title style

On March 1, 2009, Rp4,120,000 is received for the

note (Rp4,000,000) and interest (Rp120,000).

2009

Mar. 1 Cash

4 120 000

Notes Rec.— PT Cemara

Interest Receivable

Interest Revenue

Collected note and

accrued interest.

(Rp4,000,000 x 12% x

30/360).

4 000 000

40 000

80 000

64

64

65

9-6

Click to edit Master title style

Example Exercise 9-5

RS Palmerah Indah received a 120-day, 6% note for

Rp40,000,000, dated March 14 from a patient on

account.

a. Determine the due date of the note.

b. Determine the maturity value of the note.

c. Journalize the entry to record the receipt

of the payment of the note at maturity.

65

65

66

9-6

Click to edit Master title style

Follow My Example 9-5

a.

July 12 determined as follows:

March

April

May

June

July

Total

b.

17 days (31 – 14)

30 days

31 days

30 days

12 days

120 days

Rp40,800,000 [Rp40,000,000 + (Rp40,000,000 x 6% x 120/360)]

c. Cash

40,800,000

Notes Receivable

Interest Revenue

For Practice: PE 9-5A, PE 9-5B

40,000,000

800,000

66

66

67

Click to edit Master title style

Objective 7

9-7

Describe the reporting

of receivables on the

balance sheet.

67

68

Receivables on Balance Sheet

Click to edit Master title style

9-7

Indotronics Co.

Balance Sheet

December 31, 2008

Assets

Current assets:

Cash

Notes receivable

Accounts receivable

Less allowance for

doubtful accounts

Interest receivable

Merchandise inventory

Rp119,500,000

250,000,000

Rp445,000,000

15,000,000

430,000,000

14,500,000

714,000,000

68

68

Receivables (including the allowance account) are highlighted

69

Accounts Receivable Turnover

Click to edit Master title style

9-7

The accounts receivable turnover measures

how frequently during the year the accounts

receivable are being converted to cash.

Net sales

Accounts Receivable =

Average accounts receivable

Turnover

69

69

70

9-7

Federal Express Corporation

Click to edit Master

title

style

2005

2004

2003

Net sales

Accounts receivable

Average accounts

receivable

*

Rp19,364,000 Rp17,383,000

--2,703,000

2,475,000 Rp2,199,000

2,589,000

2,337,000

*

[(Rp2,475,000 +

Rp2,199,00)/2]

Rp17,383,000

Accounts Receivable

= Rp2,337,000

Turnover (2004)

Accounts Receivable = 7.4

Turnover (2004)

70

70

71

Federal Express Corporation

Click to edit Master title style

2005

2004

Net sales

Rp19,364,000 Rp17,383,000

Accounts receivable

2,703,000

2,475,000

Average accounts receivable 2,589,000

2,337,000

9-7

2003

--Rp2,199,000

*

*

[(Rp2,703,000 +

Rp2,475,000)/2]

Rp19,364,000

Accounts Receivable

= Rp2,589,000

Turnover (2005)

Accounts Receivable = 7.5

Turnover (2005)

71

71

72

Number of Days’ Sales in Receivables

Click to edit Master title style

9-7

Use: To assess the efficiency in

collecting receivables and in

the management of credit.

Average Accounts receivable

Number of Days’

=

Average daily sales

Sales in Receivables

72

72

73

9-7

Federal Express Corporation

Click to edit Master title style

2005

2004

Net sales

Rp19,364,000

Accounts receivable

2,703,000

Average accounts receivable 2,589,000

Average daily sales

53.1

Rp17,383,000

2,475,000

2,337,000

47.6 *

2003

--Rp2,199,000

**

*

[(Rp2,475,000 +

Rp2,119,000)/2]

Number of Days’ Sales in

Receivables (2004)

** (Rp17,383,000/365)

Rp2,337,000

=

47.6

Number of Days’ Sales = 49.1

in Receivables (2004)

73

73

74

Federal Express Corporation

Click to edit Master title style

2005

2004

9-7

2003

Net sales

Rp19,364,000 Rp17,383,000

--- ----Accounts receivable

2,703,000

2,475,000 Rp2,199,000

Average accounts receivable

2,589,000

2,337,000

Average daily sales

53.1

47.6

*

**

* [(Rp2,703,000+

Rp2,475,000)/2]

Number of Days’ Sales in

Receivables (2005)

** (Rp19,364,000/365)

Rp2,589,000

=

53.1

Number of Days’ Sales = 48.8

in Receivables (2005)

74

74