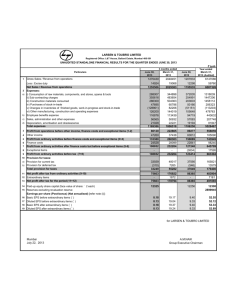

Nineteenth Annual Report 2011-2012

advertisement