AN ABSTRACT OF THE THESIS OF Timing A

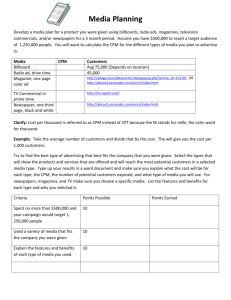

advertisement