Low-wage Import Competition, Product Switching and Performance of

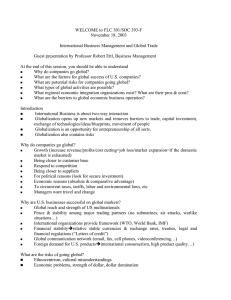

advertisement