Groceries Code Adjudicator Investigation into Tesco plc 26 January 2016

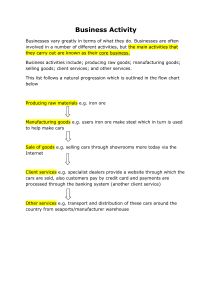

advertisement