Adverse Selection Economics 302 - Microeconomic Theory II: Strategic Behavior

advertisement

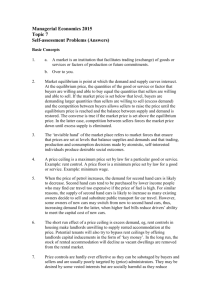

Adverse Selection Economics 302 - Microeconomic Theory II: Strategic Behavior Shih En Lu Simon Fraser University (with thanks to Anke Kessler) ECON 302 (SFU) Adverse Selection 1 / 10 Most Important Things to Learn Today 1 Know what adverse selection is 2 Know how adverse selection can make a market unravel ECON 302 (SFU) Adverse Selection 2 / 10 Hidden Characteristics We have introduced hidden characteristics (one side of the market lacks payo¤ information) in the context of price discrimination. We will now study another example of hidden characteristics: adverse selection. Note: Many situations with hidden characteristics can be modeled as games of incomplete information. But we won’t formally study that area of game theory (save it for grad school). ECON 302 (SFU) Adverse Selection 3 / 10 Adverse Selection Adverse selection refers to a situation where the market attracts exactly the agents on the informed side that are bad for the uninformed side. Example: buyer doesn’t know the quality of a car, and therefore doesn’t know his utility from buying the car. At any given price, owners of bad cars are happier to sell than owners of good cars. We will show that adverse selection can make some markets fail completely and disappear! Sometimes, part of the informed side (e.g. owners of good cars) wants to disclose information. This is called signaling, which we will study after adverse selection. ECON 302 (SFU) Adverse Selection 4 / 10 Used Car Market For simplicity, suppose for both buyers and sellers, the expected utility from a lottery over money is equal to the expected value of the lottery: E [u (L)] = E [L]. (This means they’re risk-neutral.) Good cars are worth $10,000 to buyers and $7,000 to sellers. Bad cars are worth $3,000 to buyers and $1,000 to sellers. Half the cars are good and half are bad. What is the e¢ cient allocation of cars? ECON 302 (SFU) Adverse Selection 5 / 10 Used Car Market: Complete Information Good cars are worth $10,000 to buyers and $7,000 to sellers. Bad cars are worth $3,000 to buyers and $1,000 to sellers. Half the cars are good and half are bad. Suppose both sides observe car quality. What happens? At what prices? ECON 302 (SFU) Adverse Selection 6 / 10 Used Car Market: Incomplete, but Symmetric Information Good cars are worth $10,000 to buyers and $7,000 to sellers. Bad cars are worth $3,000 to buyers and $1,000 to sellers. Half the cars are good and half are bad. Suppose neither side observes car quality. What happens? At what price? ECON 302 (SFU) Adverse Selection 7 / 10 Used Car Market: Asymmetric Information (I) Good cars are worth $10,000 to buyers and $7,000 to sellers. Bad cars are worth $3,000 to buyers and $1,000 to sellers. Half the cars are good and half are bad. Suppose only sellers observe car quality. If both good and bad cars are on the market, how much are buyers willing to pay? What would sellers do at that price? ECON 302 (SFU) Adverse Selection 8 / 10 Used Car Market: Asymmetric Information (II) Buyers are unwilling to pay a lot because some cars are of low quality. But then sellers with good cars are unwilling to sell. So only sellers with bad cars are left. This is adverse selection: the market attracts exactly the sellers that are bad for the buyers. As a result, the market for good cars unravels and disappears. Loss of e¢ ciency: the surplus from trading good cars vanishes. ECON 302 (SFU) Adverse Selection 9 / 10 Conclusion When buyers don’t know the quality of a product, they might not be willing to pay enough to cover high-quality sellers’costs. High-quality sellers will then exit the market, reducing the average product quality and further decreasing buyers’willingness to pay. Vicious cycle leads to low quality. If buyers’value for low quality goods is too low, market could even disappear completely. Ways around problem: signaling (warrantees), reputation, regulation, liability laws, etc. ECON 302 (SFU) Adverse Selection 10 / 10