Decentralization and Electoral Accountability: Incentives, Separation, and Voter Welfare

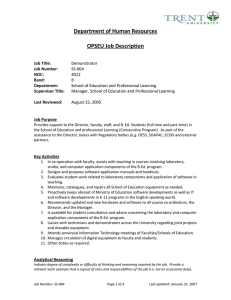

advertisement