WORKING PAPER SERIES Centre for Competitive Advantage in the Global Economy

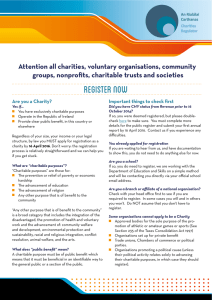

advertisement

Apr 2015

No.226

Does Market Size Matter Also for Charities?

Kimberley Scharf & Janne Tukiainen

WORKING PAPER SERIES

Centre for Competitive Advantage in the Global Economy

Department of Economics

Does Market Size Matter Also for Charities?∗

Kimberley Scharf†

Janne Tukiainen‡

April 2015

A BSTRACT

We analyze implications of market size on market structure in the not-forprofit sector. We show that, while a standard model of oligopolistic competition

between for-profits predicts a positive relationship between market size and firm

size, an analogous model of not-for-profit competition predicts no such correlation. We then interrogate these predictions empirically by focusing on five charitable markets for local public goods. These findings both reject the applicability

of the classic theories of oligopolistic competition between for-profit firms to the

not-for-profit case and fail to reject the simple model proposed here.

KEY WORDS: Competition in the Non-profit Sector, Market Structure

JEL CLASSIFICATION: L11, L13, L15, L31, L33

∗ We

thank Itai Ater, Jana Friedrichsen, Essi Eerola, Oskari Harjunen, Jonathan Haskel, Heikki

Pursiainen, Carol Propper, Tanja Saxell, Michael Waterson and seminar participants at HECER and

VATT, and the 2014 EARIE, the 2015 FEAAM and the 2015 RES conference for their comments. We are

also grateful for the financial support of the UK’s Economic and Social Research Council. Correspondence should be addressed to: Janne Tukiainen, VATT Institute for Economic Research, Arkadiankatu

7, P.O.Box 1279, FI-00101 Helsinki, Finland; janne.tukiainen@vatt.fi.

† Department

of Economics and CAGE, University of Warwick, Coventry, UK and CEPR;

k.scharf@warwick.ac.uk

‡ VATT

Institute for Economic Research, Finland, and HECER, Finland;

janne.tukiainen@vatt.fi

D OES M ARKET S IZE M ATTER A LSO FOR C HARITIES ?

A BSTRACT

We analyze implications of market size on market structure in the not-forprofit sector. We show that, while a standard model of oligopolistic competition

between for-profits predicts a positive relationship between market size and firm

size, an analogous model of not-for-profit competition predicts no such correlation. We then interrogate these predictions empirically by focusing on five charitable markets for local public goods. These findings both reject the applicability

of the classic theories of oligopolistic competition between for-profit firms to the

not-for-profit case and fail to reject the simple model proposed here.

1

Introduction

In many countries the charitable sector is responsible for providing a considerable

share of public services. The sector is also subject to government regulation and

receives a substantial amount of direct or indirect financial support from government.1 While most academic attention has focused on donors’ choices – for example, on how tax incentives can promote charitable giving2 – the question of how

inter-charity competition shapes entry decisions and market structure in the charitable sector has been little studied. Yet, the design of optimal government policies

vis-à-vis the charitable sector is likely to depend on the answer to this question. This

paper seeks to help fill this gap, offering a new model of oligopolistic competition

1 For

example, in the United Kingdom in 2013, the total revenue of the charitable sector was £61

billion and the UK treasury provided £3.25 billion of tax relief to UK charities; in Canada in 2012,

approximately $8.5 donations made by almost 6 billion people, about 7% of GDP, received federal tax

relief of more than $2.9 billion.

2 See

Scharf and Smith (2015) for a recent overview of the literature.

1

between charities as well as the first empirical analysis of competitive conduct in

many different donative non-profit/charitable sectors.3

We first develop a simple analytical model of oligopolistic competition between

for-profit firms providing a homogeneous product through increasing-returns-toscale technologies (operationalized with a combination of fixed and convex variable

costs) under conditions of free entry. This parallels the structure of the standard

framework used in the study of industrial organization with reference to producers

of private goods.4 We then adapt the model for the non-profit case by taking into

account the long-run distribution constraint, that is, charities cannot make profits in

the long-run. Absent a profit motive, we consider both the case where charities’ motivation is purely pro-social, that is, their objective coincides with social surplus, as

well as departures from that behavior that are driven by charities concerns for their

own individual activities.

Our model generates the usual predictions for the for-profit sector – both the

number of firms and their average size will increase in market size (see e.g. Campbell and Hopenhayn, 2005, hereafter referred to as CH for short) – but in the nonprofit case results are strikingly different than those that obtain in the for-profit case.

3 Scharf

(2014) presents a theoretical model of competition between charities and charity selection;

and Perroni et al., (2014) examines the effect of coordination on efficiency. Relatedly, implications

of policy reforms for competition and quality of provision of health services have been analyzed

extensively (e.g., Propper et al., 2008; and Cooper et al., 2011). However, these studies do not focus

on entry effects or the nature of competition. Other studies, including those of Gaynor and Vogt

(2003), and Capps et al., (2010), have asked if the choice of organizational form affects the pricing

decisions of competing hospitals. But these studies also abstract from entry decisions. Other studies

focus on the effect of competition on entry decisions of hospitals, but there are very few contributions

looking at other types of private providers of public goods, which is what we are interested in doing

here. Recent exception is Bowblis (2011), who examines, among other things, the effect of public

insurance on closures of for-profit and non-profit nursing homes respectively. One paper that does

focus on entry in the broader non-profit context is Lakdawalla and Philipson (2006), but their interest

is on the question of selection of organizational form through entry decisions, and not, as is ours,

the implications of market size on market structure in a non-profit context. Gaynor and Town (2011)

contains a very comprehensive and recent overview of the literature.

4 See

e.g., Bresnahan and Reiss (1991).

2

Unlike in the case of for-profit firms, an increase in market size simply raises the

number of providers but has no effect on the size of individual providers (rather

than raising average firm size); this applies whether or not providers are biased towards their own activities. Thus the model provides testable predictions concerning

the relationship between market size and average producer size, and these predictions are distinctively different depending on providers’ competitive conduct.

Secondly, we test empirically whether these predictions hold in a panel data on

registered Canadian charities. We separately study five different charitable sectors:

food and clothes banks, daycare, housing, senior care and disabled care. In order

to study well-defined markets as the unit of observation in the empirical analysis,

we restrict our attention to local charities, i.e. charities that operate only in a given

geographical area, provide public goods consumed locally and compete for funding from local donors. We focus on these five sectors because they are the ones that

contain the largest proportion of “local” charities in our data (where local charities

are defined as those that operate in only one municipality) and because their products can be regarded as local public goods. This empirical analysis can be seen as a

fairly close replication, in a non-profit context, of the CH study on how market size

is related to firm size in various for-profit industries.

We find that market size is not correlated with average charity size in four out of

the five sectors we analyze. A model of non-profit competition can rationalize these

findings. In one sector, we even find a negative correlation between market size and

average charity size, a result that could be accounted for by heterogeneous capacity

constraints for non-profit providers. The results are in stark contrast to those of CH,

who find that in ten out of twelve analyzed industries, average firm size increases

with market size. The results clearly reject the applicability of the standard for-profit

model of oligopolistic competition to these sectors, while also failing to reject the

model of non-profit competition proposed here. These conclusions are robust to

including a rich set of control variables and market level fixed effects, restricting

the analysis to a sub-sample of comparatively more insulated markets, and using

alternative measures of market size.

Our findings have potentially important implications for the debate on the effect

of government policies on the private provision of public goods, a debate that has

3

largely ignored the effects of public funding on inter-charity competition and market structure in the third sector. Our analytical framework predicts that free entry

may result in charities that are inefficiently small relative to the optimal size; but this

effect should be independent of market size – a prediction that is confirmed by our

findings. Thus, government intervention may be warranted to encourage charities

to exploit economies of scale (e.g. by directing government grants towards charities’

core funding needs) independently of market size and of market concentration; in

other words, if, in a given charity sector, there is a tendency for charities to be inefficiently small, a larger market size and more competition cannot be counted on to

offset the problem.

The departure from profit maximization in the context of non-profits has been

investigated by others; but, as mentioned, that literature has focused mainly on provision of health services through hospitals. In this paper, we focus on more broadly

defined non-profits. There have been a few contributions focusing on competition

between charities and on its implications for government regulation, but these have

focused mainly on the implications of organizational form for within-charity performance along various dimensions,5 and/or differential regulatory and tax regimes.6

The mechanics of entry in the non-profit sector, however, and their implications

for competitive conduct of the charitable sector has received scant attention. This

is rather surprising, as it is hard to find another category of economic activity for

which competition would not be at the center of any economic analysis one way or

another. In striking contrast, the competitive conduct of firms in the profit sector and

its implications for industry structure have been studied extensively by a long and

established literature.

The rest of the paper is structured as follows. The next section introduces a

theoretical model that compares competition outcomes for for-profit firms and for

charities in the presence of fixed costs. Section 3 describes the data, the estimation

procedures and the empirical results. Section 4 concludes.

5 See

for example, Alchian and Demsetz (1972); Hansmann (1980); Easley and O’Hara (1983);

Glaeser and Schleifer (2001).

6 For

example, Lakdawalla and Philipson (2006).

4

2

Impact of Market Size on Market Structure

We present parallel models of oligopolistic competition under conditions of free entry for the for-profit and the not-profit sectors. Our aim is to make both of these

models as simple as possible, and as comparable as possible, both with respect to

each other and with respect to standard theories of competition. As a benchmark,

we follow the model presented in Bresnahan and Reiss (1991) (BR for short) closely.

However, the BR analysis starts with reduced form equations. As we are interested

in comparing competitive behavior in the for-profit and non-profit sector, we first

develop a simple analytical framework of competition in the non-profit sector and

derive the reduced form of the model from first principles. This will allow us to

highlight the differences in behavior and responses across the two sectors.7

In our analysis, we take market size (defined in terms of the aggregate value of

demand for a homogenous good) as exogenous, and model how the equilibrium

size and number of providers varies endogenously with exogenous changes in market size. In this sense, the model is a partial-equilibrium model that abstracts from

endogenous effects on market size arising from changes occurring in other markets

– or equivalently as a general equilibrium model in which the the cross-price elasticity of demand of the good produced in the market under consideration is zero. In

turn exogenous variations in market size in the model can be thought of arising from

variations in income and/or population or variations in the level of demand itself.8

2.1

The For-profit Case

We begin by developing a simple model of competition in the for-profit sector. Consider a market with N identical oligopolistic firms. Firm i = {1, . . . , N } supplies qi

units of a homogeneous product, with market supply being given by ∑iN=1 qi ≡ Q.

The cost function of a representative firm, i, (the same for all firms) is C (qi ) =

7 Our

model generates predictions that are comparable to those obtained in BR.

8 Variation

in demand may be the result of variation in factors that affect demand – e.g. demand

for beverages might be affected by variations in whether conditions, or “demand”, for soup kitchens

for the hungry may be affected by variations in the numbers of the needy.

5

F + c(qi ), with c0 (qi ) > 0, and c00 (qi ) > 0, where F represents fixed costs and c(qi )

are convex variable costs. Assume that all firms hold Cournot conjectures about

their own choices and the choices of other firms. Let φ ∈ R be market size, or equivalently, the value of market demand, p Q( p) = φ where, p denotes the price of the

homogeneous good; and let aggregate market demand be given by Q( p) = φ/p.9

Inverse aggregate market demand can be written as p( Q) = φ/Q, and so each

firm i’s profits are

Πi = p ( Q ) qi − c ( qi ) − F =

φ qi

− c(qi ) − F.

Q

(1)

Each firm, i, chooses qi so as to maximize its own profits while taking output choices

of all other firms, x−i , as given. The first order condition for firm i’s optimal choice

of qi is then given by

φ

Q − qi

− c0 (qi ) = 0.

Q2

(2)

In a symmetric noncooperative equilibrium with N symmetric firms each supplying an amount q (Q = N q), the equilibrium markup choice is obtained by substituting Q = N q into the above expressions

N−1 φ

− N c0 (q) = 0;

N q

(3)

and the zero-profit condition that identifies the equilibrium number of firms in a

free-entry equilibrium, in conjunction with (3), is

φ

− c(q) − F = 0.

N

(4)

Note that the equilibrium conditions (3)-(4) differ from the condition that defines

the socially optimal number and size of firms, obtained from maximizing social sur

plus, φ ln N q̂( N ) − N c q̂( N ) + F , by choice of q and N. Of the resulting two

9 This

specification, in which φ acts as a proxy for market size, is consistent with Cobb-Douglas

consumer preferences whereby the value, φ, of demand in the market of interest amounts to a constant

share, θ, of disposable income M, with M exogenous (i.e. φ = pQ = θM).

6

conditions, one is formally identical to (4), but the second one – the condition idenφ

tifying q in place of condition (3) – becomes − N c0 (q) = 0; which for the same N,

q

implies a larger q. Thus, under for-profit competition, firm size is inefficiently small.

The following result fully parallels that of BR:

Proposition 1 As market size increases, the number and the size of firms increases.

P ROOF: Totally differentiating the optimal markup and the zero profit condition with respect

to φ, N and Q yields the following comparative static results:

dN

1 ( N − 1) φ − N q c0 (q) + N q2 c00 (q)

;

=

dφ

D

N 2 q2

(5)

dq

1 φ − N q c0 (q)

=

;

dφ

D

N2 q

(6)

( N − 1)φ2 + N x c0 (q) φ − N 2 q c0 (q) + N 2 q2 φ c00 (q)

D≡φ

.

N 3 q2

(7)

By the first order condition,

φ − N q c0 ( x ) > φ − N 2 q c0 ( x ) > ( N − 1)φ − N 2 q c0 (q) = 0,

(8)

so that the numerators of the above three expressions are all positive, and thus

dN

>0

dφ

and

dq

> 0.

dφ

(9)

The size of a representative firm, measured in revenue terms, is s ≡ p( Nq)q = φ/N, and

market size, S ≡ N p( Nq)q equals φ. Rewriting (4) as N = φ/(c(q) + F ), the effect of an

increase in q on N is ∂N/∂q = −c0 (q)φ/(c(q) + F )2 . Using this, the effect of an increase in

market size (φ) on s can be expressed as

1

φ ∂N dq

1

φ2 c 0 ( q )

dq

ds

=

− 2

=

+ 2

> 0.

2

dφ

N

N ∂q dφ

N

N (c(q) + F ) dφ

(10)

This implies that, as market size increases, both the number and the size of firms increase. Thus, an increase in market size causes firms to become larger, and closer in size

to the socially optimal size (for N approaching infinity, condition (3) coincides with

7

the condition identifying the socially optimal firm size); i.e. a larger market brings

about rationalization of production choices.

Example: Specialize c(q) to be c(q) =

tions:

φ + φ (φ + 8F )

N=

4F

4φF

s=

φ + φ (φ + 8F )

1 2

q . We can then obtain closed-form solu2

1/2

;

(11)

1/2 .

(12)

Both of the above are increasing and concave in φ. That is, there are steeper marginal

effects of market size on market structure when market size is small.10

2.2

The Non-profit Case

Charities – be they donative charities (non-commercial, i.e. receiving donations) or

commercial charities (charging a price for its output) – differ from for-profit organizations because they face a long-run binding non-distribution constraint, that is,

they might incur surpluses and losses in the short run, but, on average (i.e., in a ‘long

run’ sense), their revenues must equal their expenditures.11

10 Although

entry thresholds are not the focus of this study, we also note that all of our results are

in harmony with those found in the BR estimations: this result consistent with declining thresholds

effects for sequential entry in the discrete case; and as market size increases, the number of firms

increases at a decreasing rate (the threshold for entry of the first firm is positive and the per firm

threshold for entry of subsequent firms remain positive and are larger than those for the previous

firm. Moreover, as market size increases, there is fast convergence to competition consistently with

the empirical results of BR.

11 The

discussion in this section focuses on the donative charity case, which directly implies

marginal cost pricing. Nevertheless, it can be shown that the same analysis and results also apply

to the case of commercial charities that engage in average cost pricing – provided that they operate

under the same non-distribution constraint.

8

In deriving results for the non-profit case, we abstract from the public good nature of output – if present. Consistently with the for-profit case, the marginal valuation of output by buyers/donors (the “shadow price” of output) is v( Q) = φ/Q.

In a symmetric noncooperative equilibrium, the binding non-distribution constraint means that, in order for providers not to incur a loss, donations must cover

full costs, c(q) + F. At the margin, however, donors face a marginal cost of provision

equal to c0 (q).12 The optimal giving choice is therefore characterized by setting the

marginal valuation of output by the donors to the marginal cost of provision, that is

φ

= c 0 ( q ).

Nq

(13)

Hence, in the non-profit case, market size, as measured by the revenues of charities,

N c(q) + F , does not coincide with φ as it does in the for-profit case.

Condition (13) identifies the equilibrium level of q for a given N, denoted by

q̂( N ). Totally differentiating (13) with respect to q and N shows that the equilibrium

level of q is decreasing in N,

φ

q

∂q̂

=−

< 0.

∂N

N φ + N q2 c00 (q)

(14)

A fully pro-social not-for-profit provider who chooses to operate in the market

in a symmetric equilibrium with N identical providers aims at maximizing social

surplus, which equals

Γ E ( N ) = φ ln N q̂( N ) − N c q̂( N ) + F .

12 This is the non-profit analogue to marginal cost pricing in the for-profit sector.

(15)

If charity providers

are commercial, they may or may not be able to rely on non-linear pricing schemes and/or price

discrimination. If they can do so, and also aim at maximizing social surplus, then they will price

the marginal unit at marginal cost. If they cannot rely on non-linear pricing schemes and/or price

discrimination, then they will price at average cost, AC (q) = c(q) + F /q; but even in this case,

given that marginal costs are increasing, they will be able to choose a scale of operation q such that

AC (q) = c0 (q), and it will be optimal for them to do so (as social surplus is maximized at this scale

of operation). Thus, in our framework, implications of market size for entry for donative and for

commercial charities are the same.

9

Then, if the marginal provider exits the market, the provider’s payoff is

Γ X ( N ) = φ ln ( N − 1) q̂( N − 1) − ( N − 1) c q̂( N − 1) + F .

(16)

The optimal entry decision, identifying an equilibrium level of N in a symmetric

outcome, is then identified by the level of N for which Γ E ( N ) ≥ Γ X ( N − 1) and

Γ E ( N + 1) < Γ X ( N ), or, in differential terms (i.e. allowing N to vary continuously),

φ φ

∂q̂ ∂q̂

=

− c(q) − F = 0.

q+N

− c(q) − F − N c0 (q)

Nq

∂N

∂N

N

(17)

The assumption of full pro-social motivation by charities can be viewed as extreme; and indeed a large literature has highlighted how charities may pursue objectives other than profit maximization or social surplus maximization, such as, for

example, the maximization of own revenues (see the previously mentioned survey

by Gaynor and Town, 2011). A simple way of modeling such departure from surplus

maximization objectives is to amend (15) as follows:

Γ E ( N ) = µ c q̂( N ) + F + φ ln N q̂( N ) − N c q̂( N ) + F ,

(18)

where the last two terms coincide with social surplus, and where the first term, with

µ ≥ 0 is a premium that the provider attaches to own activities, as measured by

terms their cost or associated revenues, above and beyond the provider’s concern

for social surplus (pro-social motivation) as represented by the last two terms.13 In

this case, the no-entry condition must be amended as follows:

φ

µ c(q) + F + − c(q) − F = 0.

N

(19)

The presence of a premium on own activities involves a divergence from optimality with respect to the number and size of providers operating in the charitable

13 This

specification is consistent with the literature incorporating additional elements over and

above social surplus, that literature however, has not focused on entry decisions, but rather on the

effect that additional component may have on ex-post competitive conduct. Instead, we focus on the

implications of the additional motives on entry decisions, that is, our additional term in the payoff

would accrue to charity contingent on entry; whereas, the social surplus component would accrue to

charity independently of whether or not it enters.

10

market: for µ = 0, condition (19) coincides with the condition for social surplus

maximization, i.e. it identifies the socially optimal number of providers for a given

market size, φ; an increase in µ from zero starting from the socially optimal N makes

the left-hand side of the above positive, and so N must rise relative to the the case

µ = 0 (the total derivative dN/dµ evaluated at µ = 0 is positive). This implies that

own-output biased non-profits make positively biased entry decisions, resulting in

excessive entry and a suboptimal scale of production.14

Such positive entry bias, however, is independent of market size – and so has no

implications for how market size affects charity size:

Proposition 2 Unlike in the case of for-profit firms, an increase in market size raises the

number of providers but has no effect on the size of individual providers – independently of

whether or not charity providers are fully pro-socially motivated.

P ROOF: Totally differentiating condition (13), we obtain

∂q̂

φq

=−

,

∂N

Nφ + N 2 q2 c00 (q)

(20)

∂q̂

q

=

.

∂φ

φ + Nq2 c00 (q)

(21)

and

The marginal benefit to a firm entering is

φ

µ c(q) + F +

− c(q) − F ≡ Ω.

N

(22)

The equilibrium number of charities, N, is identified by

Ω = 0;

(23)

totally differentiating this with respect to N and φ, using the fact that φ = Nqc0 (q) – from

(13) – and simplify, we obtain

N

dN

= .

dφ

φ

14 Some

(24)

of the literature on non-profits – e.g. Philipson and Posner (2009) – effectively assumes

µ = ∞, i.e. that non-profit providers only care about their own output.

11

The effect of an increase in φ on the size of a charity (measured in terms of revenues), c(q) +

F ≡ s, is

ds

∂q

∂q dN

0

= c (q)

+

.

dφ

∂φ ∂N dφ

(25)

Substituting the expression for dN/dφ from (24) into the above, substituting the expressions

for ∂q/∂φ and ∂q/∂N from (20) and (21), relying again on the identity φ = Nqc0 (q), we obtain

ds

= 0.

dφ

(26)

The total effect of an increase in φ on market size, as measured by total revenues, Ns ≡ S, is

dS

dN

=s

> 0.

dφ

dφ

(27)

Thus an increase in market size, brought about by an increase in φ, has no effect on charity

size or on their cost structure.

Example: As before, specialize c(q) to be c(q) =

N=φ

s=

1 2

q . For µ > 0, we obtain:

2

1+µ

;

2(1 − µ ) F

(28)

2F

.

1+µ

(29)

Thus, if charity providers attach a constant marginal premium to own activities

(as measured by revenues), the number of charities will be too high, but an increase

in market size will have no effect on charity size – just as in the case of fully prosocially motivated providers (µ = 0). If there is a departure from pure pro-social

objectives, this will result in sub-optimally small providers just as in the for-profit

case; but unlike in the for-profit case, increased competition in a larger market will

not act to promote rationalization in production choices.15

15 As

noted earlier, these conclusions extend to commercial charities. If a charity is a pro-socially

12

3

Empirical Evidence

3.1

Data

Charitable contributions in Canada are eligible for tax relief and tax receipts to donors

are offered by the organizations to whom the donation is made. The Canada Customs and Revenue Authority (CCRA) keeps track of these tax receipts by requiring

all issuing organizations to file an annual information return, the T3010 within a

specified period after the end of the charity’s financial year. Among other things,

information contained on the forms includes charities’ fiscal period end, their registration number, detailed information about their revenues and expenditures, their

geographical areas of activities (municipal; provincial; national; international); their

full postal address; and a summary of their main activities. Our raw data consists of

the universe of T3010 forms submitted to CCRA over the period 1997-2005.

The data consists of 50,141 charities (in the year 2001) whose activities are aimed

only at the local (municipal) level.16 We focus on five charity service sectors that

are likely to be consumed only locally, and which are well represented in the data.

For example, with reference to the year 2001, we use information on 1,304 food and

clothing banks, 1,103 daycare centers, 1,254 housing charities, 1,319 senior care and

1,368 disabled care organizations.

We defined our market at the level of a statistical unit called the Forward Sortation Area (FSA). In Canada, a postal code is an alphanumeric six-character string

motivated commercial provider pricing at average cost, then the equilibrium entry level N coincides

with the level that maximizes (15) subject to a constraint φ/( Nq) = c(q) + F /q ≡ AC (q). This

gives an optimum level of output per charity, q, that is identified by equality between marginal and

average cost, i.e. by the condition c0 (q) = AC (q). As this is independent of N, the size of individual

providers, s = AC (q) q, will also be independent of N and thus of total market size, Ns; the same

conclusion applies if the charity is own-output biased.

16 These

charities were asked to declare the area for which their programs are carried out. Of the

69,473 charities in total: there is no information on 1,146; of the charities in the sample, 50,141 reported

that their activities are carried out in a single rural, city or metropolitan area; 10,533 reported that they

have activities carried on in a province or territory; and 7,653 have activities that are carried out in

more than one province or territory.

13

that takes the form ‘A1A 1A1’. The FSA is a geographical area in which all postal

codes start with the same three characters (the ‘A1A’ part of the code). The first letter

‘A’ of the code stands for a postal district (most provinces/territories are assigned a

unique postal district – with the exception of Ontario and Quebec, which, due to

their respective sizes, have more (three for Ontario and five for Quebec); the cities of

Toronto and Montreal each have their own postal district (‘H’ for Montreal and ’M’

for Toronto). The digit is a variable that takes on a value of zero for a wide-area rural

region, and nonzero for urban areas. The second letter represents a specific rural region, an entire medium-sized city, or a section of a major metropolitan area. We link

the charities to FSAs using charities’ postal address. We assume that they operate

only within that FSA although there is not a perfect overlap between the FSAs and

the municipalities.

To construct a panel with information on market characteristics, we link our charity data to Canadian census data from years 1996, 2001 and 2006 at the FSA level.

We have to link 1996 Census data to 1997 charity information and 2006 Census data

to 2005 charity information. A panel with five years between each cross-section is

useful for our purposes, since it should contain over time variation in the main explanatory variable, the market size.

One potential issue with this way of of defining of a market is that the FSA may

not be a self-contained market. This is especially so in the larger cities, where FSAs

are typically small in terms of land area, and where the neighboring FSAs are often densely populated, which not only means that it is easy to use the goods in

neighboring markets but also that some donors may donate money to charities in

neighboring FSAs. In such cases, we would not be capturing independent markets.

To address this potential problem, we construct a neighborhood matrix for all FSAs

using GIS. We then study the robustness of the results to using only a sub-sample of

FSAs that are more densely populated than any of their neighbors. This means that

we never include neighboring markets, thus making the independence assumption

more plausible.

To facilitate comparison between the existing empirical evidence concerning market size and size of firms in the for-profit sector, we simply replicate the analysis

conducted in CH. CH estimations are done in a reduced form, and thus we sim-

14

ply correlate market size with average charity size, and compare the results to the

comparative statics implied by our models. Average charity size is measured as the

average of charities’ total revenues in the market, and market size is the total population in the FSA. To begin with we present, in Table 1, descriptive statistics for these

main variables of interest as well as for our control variables. For ease of interpretation we report these descriptive statistics only for the cross-section of charities in

the year 2001. We have a total of 1,573 markets. In all sectors analyzed, charities

are active in slightly less than half of the markets. All variables exhibit substantial

variation across markets.

[Table 1 about here]

3.2

Estimation

CH are interested in the effects of market size on producer size. As discussed in

Section 2, a standard and robust prediction from oligopoly theory is that since larger

markets are more competitive and have lower price-cost mark-ups producers need

to sell more in large markets than in small markets to recover their fixed costs. CH

test these predictions empirically and find that ten out of twelve industries exhibit a

positive relationship between the size of a market and average establishment size of

producers in that market.

To facilitate comparison with the main results in CH, who do not have access

to panel data, we start by analyzing a 2001 cross-section of markets. We conduct

the estimation separately for each of the five sectors. Results from a simple OLS

estimation are reported in Table 2. We begin with a specification without any controls

in the leftmost column. The columns to the right report specification with increasing

amount of control variables, that are added in the order they are reported in Table

1. We find that in four out of five sectors there is no association between market size

and charity size. Only in the senior care sector do we find a positive and statistically

significant correlation that is robust to adding control variables.

[Table 2 about here]

15

In Table 3, we use data from all the three years in our panel. To investigate the

robustness of the results to adding new data compared to Table 2, we report results

from a pooled OLS regression. The qualitative results are identical to those in Table

2, and also very similar in magnitude.

[Table 3 about here]

In Table 4, we exploit the panel structure of the data further and introduce FSA

fixed effects to all specifications in order to control for time-invariant unobservables;

otherwise the results are reported as in Tables 2 and 3. There are two notable differences when focusing on within-market variation as opposed to between-market

variation. The positive and significant correlation in the senior care sector is no

longer present. Moreover, we now have a negative and significant coefficient for

the daycare sector in the richer specifications. Given that the daycare result is significant, there seems to be enough within-market variation in the population to identify

possible effects of market size on charity size. Table 4 can therefore be taken as representing the most reliable set of results, and accordingly we focus the rest of our

discussion on those.

[Table 4 about here]

In Table 5, we restrict attention on the subset of markets that are more densely

populated than any of their neighboring markets. This reduces the size of the sample

and thus increases the standard errors. Of main interest is that the point estimates

are very similar to those in Table 4, in particular for the daycare sector, which was the

only significant result in Table 4. The results indicate robustness to market definition.

[Table 5 about here]

We also examined alternative definitions of market size to make sure that a possible measurement error in the relevant market size variable was not responsible for

16

statistical insignificance. For the senior care we defined the market size as the number of old-age inhabitants and for the daycare as the number of young. The results

are almost identical to those using the total population, and are thus not reported.

According to CH, the main potential endogeneity issues in such analysis are that

if large markets have larger fixed costs or consumers with more elastic demand

curves, they will contain larger producers even if adding competition does not lower

markups. This would result in a spurious positive correlation between market size

and establishment size. We do not find a robust and positive correlation between

charity size in terms of total expenditures and market size in any of the five sectors.

Since the main potential endogeneity issues should not cause bias towards zero or

negative values, and since the endogeneity issues we face are likely to be similar

to those in CH, we can conclude that a typical charitable sector seems to compete

differently than the for profit industries. Moreover, the results for four out of five

sectors are in line with the predictions from our model of non-profit competition.

We find a deviation from the neutrality prediction of Proposition 2 only one out of

five sectors, in a downwards direction, which cannot be explained by a model of

for-profit competition.

The single instance of negative correlation may be confounded by the aforementioned potential endogeneity issue; but it could also be accounted for by the presence

of heterogenous provider sizes stemming from heterogeneous capacity constraints

under non-profit competition.17

Another potential source of bias for our results is that we are missing information on the number of active government or private producers in these markets.

However, this is unlikely to lead to wrong conclusions for two reasons. First, our

model predictions apply to each individual producer. We use the average over the

17 When providers are heterogeneous,

comparatively more efficient, lower-cost providers will enter

the market first and then be followed by less efficient providers, implying that marginal entrants will

be smaller than the average provider; it can then be shown that, under certain conditions, an increase

in market size can result in a fall in the average size of non-profit providers, even when, for the same

technologies, an increase in market size could bring about an increase in the average size of for-profit

firms.

17

charity as the outcome only because we need a market level variable. But since the

prediction applies to each individual producers, the average size should respond

accordingly in any subset of producers in a each market. Second, the presence of

private or public producers is very likely to vary across sectors, and is nonexistent

in the food and clothing banks sectors. If this omitted information were driving the

results, we should see more heterogeneity in results across the sectors in terms of

qualitative conclusions. Similarly, we have also restricted the analysis to only local

charities. Some bigger charities that are active in our markets are omitted variables.

Again the same two arguments why this should not cause substantial bias hold.

These results are striking and interesting. We can reject the standard model of

for-profit oligopolistic competition in all the sectors considered. The results are consistent with our model for charities in four out of five sectors, and we can reject a

model of for-profit competition in all five. The key implication from such finding is

that in non-profit markets increased competition does not have the same effect on

the structure of production as it does in the for profit case: it may be the case that

production choices in the non-profit sector are perfectly efficient; but if inefficiencies

exist in the non-profit sector with respect to the scale of their operation, a change in

the degree of concentration of providers brought about by a larger market size will

leave those inefficiencies unchanged.

4

Conclusions

We provide a simple oligopoly model of charities that compete for donors. The

model has testable predictions that allow us to differentiate between competitive

conduct in charitable markets and the same in for-profit markets. Moreover, we

can test for whether charities are biased towards their own production. We test the

model predictions by correlating market size to average charity size in the market.

We find that for four out of five charitable sectors, market size has no effect on average charity size in the market and in one sector the correlation is negative, whereas

as any reasonable model of for-profit oligopoly competition predicts a positive correlation. According to these results, we can reject the standard model of for-profit

competition. The results are typically consistent with our model of for-profit compe18

tition between either biased or unbiased charities.

Besides providing and testing a model of competition for the third sector, a novel

undertaking as such, the results have also policy implications. First, it seems that

the same policies will not be suitable for all charitable sectors, because the nature

of competition, and thus, the optimal size of charities varies across sectors. Second,

our theoretical analysis suggests that increased competition in non-profit markets

should have no effect on market structure: while in the for-profit sector a larger market size can promote rationalization of production choices, this is not the case with

non-profit competition even when non-profit competitors have private motives, a

conclusion that seems to be borne out by the empirical evidence; accordingly, government policies may have just an equally important role to play in “more competitive” non-profit markets as in smaller ones.

19

References

Alchian, A., and H. Demsetz, 1972. “Production, Information Costs, and Economic

Organization.” American Economic Review 62, 777-95.

Bowblis, J., 2011. “Ownership conversion and closure in the nursing home industry.”

Health Economics 20, 631-644.

Bresnahan T., and P. Reiss, 1991. “Entry and Competition in Concentrated Markets.”

Journal of Political Economy 99, 977-1009.

Campbell J., and H. Hopenhayn, 2005. “Market Size Matters.” Journal of Industrial

Economics 53, 1-25.

Capps, C., D. Dranove, and R. Lindrooth, 2010. “Hospital Closure and Economic

Efficiency.” Journal of Health Economics 29, 87-109.

Cooper, Z., S. Gibbons, S. Jones, and A. McGuire, 2011. “Does Hospital Competition Save Lives? Evidence From The English NHS Patient Choice Reforms.”

Economic Journal 121, F228-F260.

Easley, D., and M. O’Hara, 1983. “The Economic Role of the Nonprofit Firm.” Bell

Journal of Economics 14, 531-38.

Gaynor, M., and W. Vogt, 2003. “Competition Among Hospitals.” RAND Journal of

Economics 34, 764-785.

Gaynor, M., and R. Town, 2011. “Competition in Health Care Markets.” Chapter 9 of

by M. Pauly, T. McGuire and P. Pita Barros (eds.), Handbook of Health Economics,

Vol. 2, 499-637, Elsevier.

Glaeser, E., and A. Schleifer, 2001. “Not-for-profit Entrepreneurs.” Journal of Public

Economics 81, 99-115.

Hansmann, H., 1980. “The Role of the Non-profit Enterprise.” Yale Law Journal 89,

835-901.

20

Lakdawalla, D., and T. Philipson, 2006. “The Nonprofit Sector and Industry Performance.” Journal of Public Economics 90, 1681-98.

Perroni, C., G. Pogrebna, S. Sandford, and K. Scharf, 2014. “Are Donors Afraid of

Charities’ Core Costs? Scale Economies in Nonprofit Provision, Technology

Adoption and Entry.” CEPR Discussion Paper Number 10179.

Philipson, T., and R. Posner, 2009. “Antitrust in the Not-for-profit Sector.” Journal of

Law and Economics 52, 1-18.

Propper, C., S. Burgess, and D. Gossage, 2008. “Competition and Quality: Evidence

from the NHS Internal Market 1991-9.” Economic Journal 118, 138-170.

Scharf, K., 2014. “Impure Pro-Social Motivation in Charity Provision: Warm-Glow

Charities and Implications for Public Funding.” Journal of Public Economics 114,

50-57.

Scharf, K., and S. Smith, 2015. “The Price Elasticity of Charitable Giving: Does the

Form of Tax Relief Matter?” International Tax and Public Finance 22, 330-352.

21

Table 1: Descriptive statistics for the year 2001

Variable

No. Obs.

Mean

Std. Dev.

Min

Max

Population (1,000)

1,573

19,117

14,989

40

132,435

Household mean income (1,000)

1,573

59,857

23,385

0

279,759

Share of low income families (%)

1,573

12.0

7.6

0

60

Share over 65 (%)

1,573

5.5

2.2

0

27.5

Share under 5’s (%)

1,573

2.9

0.9

0

12.5

Share of university education (%)

1,573

10.3

7.0

0

43.3

Share of max grade 9 education (%)

1,573

16.9

11.6

0

69.5

Share of immigrants (%)

1,573

15.6

15.4

0

72.4

Unemployment share (%)

1,573

8.1

5.5

0

50

Rental prices (1,000)

1,573

624

225

0

1,968

Mean size, Food & Cloth

721

162,978

411,351

303

5,654,617

Mean size, Daycare

619

762,432

3,646,695

257

8.90E+07

Mean size, Housing

641

988,129

1,732,783

25

1.66E+07

Mean size, Seniors

666

332,777

1,107,736

99

1.38E+07

Mean size, Disabled

687

1,209,306

2,735,799

1

3.38E+07

22

Table 2: Regression results: average charity size on market size –

Table&2&(&NCCQT101.wmf&

&

2001 cross-section

&

&

Log(population)

-0.05

-0.044

s .e.

0.088

0.077

N

R-sq

709

0

704

0.1

Food/cloth?bank

-0.026

0.002

0.077

0.077

0.002

-0.039

-0.063

0.079

0.078

0.079

704

704

704

704

704

0.11

0.12

0.12

0.13

0.14

Daycare

Log(population) 0.054

0.052

0.075

0.093

0.093

0.079

0.06

s .e.

0.069

0.077

0.077

0.077

0.079

0.078

0.08

N

610

602

602

602

602

602

601

R-sq

0

0.02

0.05

0.07

0.07

0.08

0.09

Housing

Log(population) 0.175*

0.210*

0.19

0.191

0.171

0.131

0.129

s .e.

0.106

0.116

0.118

0.119

0.121

0.122

0.122

N

636

631

631

631

631

631

631

R-sq

0

0.04

0.04

0.05

0.05

0.06

0.06

Seniors

Log(population) 0.294*** 0.304*** 0.375*** 0.394*** 0.337*** 0.303*** 0.282**?

s .e.

0.1

0.105

0.109

0.106

0.107

0.11

0.113

N

661

656

656

656

656

656

655

R-sq

0.01

0.07

0.09

0.09

0.11

0.11

0.12

Disabled

Log(population) 0.152

0.212*

0.168

0.167

0.163

0.165

0.138

s .e.

0.112

0.123

0.122

0.12

0.124

0.127

0.13

N

677

672

672

672

672

672

671

R-sq

0

0.01

0.02

0.06

0.06

0.06

0.06

Nro?of?controls

0

2

4

6

7

8

9

&

&

&

&

Notes: The unit of observation is a market defined as an FSA. The outcome is the average expenditures of all charities of given sector in the market. The set of control variables include, and are

added in this order: log(population), log(average household income), share of low income families,

share of population over 65 years of age, share of population under 5 years of age, share of population with no higher than grade 9 education, share of population with university education, share of

immigrant population, share of unemployed and average rental price. Standard errors are robust to

heteroskedasticity but not clustered at any level; * denotes statistical significance at the 10% level, **

at the 5% level and *** at the 1% level.

23

Table 3: Regression results: average charity size on market size –

1997, 2001 and 2005, pooled OLS

Table&3&(&NCCQT101.wmf&

&

Log(population)

-0.058

Food/cloth7bank

-0.022

0.035

-0.035

s .e.

(0.074)

(0.077)

N

R-sq

2063

0.00

2054

0.01

-0.037

-0.060

-0.069777

(0.072)

(0.072)

(0.073)

(0.073)

1312

0.13

1312

0.13

1311

0.14

0.057

0.058

0.036777

(0.062)

(0.062)

(0.061)

(0.062)

1151

0.07

1151

0.08

1150

0.09

0.166*

1772

1151

0.06

0.07

Housing

0.171

0.130

0.097

0.080

0.073777

(0.105)

(0.109)

(0.107)

(0.106)

(0.075)

Log(population)

0.041

0.033

2054

1312

0.04

0.13

Daycare

0.071

0.062

s .e.

(0.050)

(0.059)

(0.058)

N

R-sq

1788

0.00

1772

0.02

Log(population) 0.145*

s .e.

(0.088)

(0.099)

N

R-sq

1840

0.00

1832

0.01

s .e.

(0.093)

(0.098)

N

R-sq

1958

0.01

1952

0.02

Log(population)

0.105

s .e.

N

R-sq

Nro7of7controls

(0.108)

1832

1192

1192

1192

1192

0.01

0.04

0.04

0.05

0.05

Seniors

Log(population) 0.269*** 0.300*** 0.394*** 0.389*** 0.341*** 0.334*** 0.310***

&

&

&

(0.100)

(0.115)

(0.114)

(0.115)

(0.112)

1281

0.10

1281

0.10

1278

0.10

0.146

1952

1281

0.06

0.09

Disabled

0.134

0.094

0.087

0.086

0.065777

(0.094)

(0.100)

(0.102)

(0.107)

(0.108)

(0.107)

(0.108)

2060

0.00

0

2051

0.00

2

2051

0.01

4

1355

0.07

6

1355

0.07

7

1355

0.07

8

1353

0.07

9

&

&

Notes: The unit of observation is a market defined as an FSA. The outcome is the average expenditures of all charities of given sector in the market. The set of control variables include, and are added

in this order: log(population), log(average household income), share of low income families, share of

population over 65 years of age, share of population under 5 years of age, share of population with

no higher than grade 9 education, share of population with university education, share of immigrant

population, share of unemployed and average rental price. Standard errors are clustered at the FSA

level; * denotes statistical significance at the 10% level, ** at the 5% level and *** at the 1% level.

24

Table 4: Regression results: average charity size on market size –

1997-2005 fixed-effects panel estimations

Table&4&(&NCCQT103.wmf&

&

Log(population)

0.365

20.194

s .e.

(0.246)

(0.165)

N

R2sq

2063

0.00

2054

0.11

Log(population) 0.219*

20.220

s .e.

(0.116)

(0.141)

N

R2sq

1788

0.00

1772

0.21

Log(population) 0.779***

Food/cloth8bank

20.071

20.264

(0.185)

(0.299)

20.270

20.239

20.267888

(0.294)

(0.298)

(0.290)

2054

1312

1312

1312

1311

0.12

0.07

0.07

0.07

0.08

Daycare

20.242* 20.443** 20.433** 20.420** 20.423**8

(0.184)

(0.182)

(0.184)

(0.182)8

1151

0.20

1151

0.20

1150

0.20

0.322

1772

1151

0.23

0.19

Housing

0.286

0.269

0.250

0.300

0.288888

(0.250)

s .e.

(0.283)

(0.265)

N

R2sq

1840

0.01

1832

0.06

Log(population)

0.137

s .e.

N

R2sq

(0.140)

(0.394)

(0.393)

(0.387)

(0.390)8

1192

0.03

1192

0.03

1192

0.03

20.130

1832

1192

0.06

0.02

Seniors

20.025

20.334

20.317

20.306

20.283888

(0.096)

(0.181)

(0.193)

1958

0.00

1952

0.07

Log(population)

0.034

s .e.

(0.351)

N

R2sq

Nro8of8controls

2060

0.00

0

&

&

&

(0.363)

(0.351)

(0.358)

(0.337)

1281

0.05

1281

0.05

1278

0.04

20.320

1952

1281

0.08

0.05

Disabled

20.264

0.035

0.028

0.021

20.028888

(0.356)

(0.353)

(0.375)

(0.383)

(0.374)

(0.371)

2051

0.02

2

2051

0.02

4

1355

0.02

6

1355

0.02

7

1355

0.02

8

1353

0.02

9

&

&

Notes: The unit of observation is a market as defined by an FSA. The outcome is the average expenditures of all charities of a given sector in the market. The set of control variables include, and are added

in this order: log(population), log(average household income), share of low income families, share of

population over 65 years of age, share of population under 5 years of age, share of population with

no higher than grade 9 education, share of population with university education, share of immigrant

population, share of unemployed and average rental price. Standard errors are clustered at the FSA

level; * denotes statistical significance at the 10% level, ** at the 5% level and *** at the 1% level.

25

Table 5: Regression results: average charity size on market size –

1997-2005,

fixed-effects panel estimations, FSAs with lower-density neighbors

Table&5&(&NCCQT103.wmf&

&

Log(population)

0.053

Food/cloth9bank

10.278

10.190

10.335

s .e.

(0.215)

(0.170)

N

R1sq

481

0.00

481

0.10

Log(population) 0.205**

(0.185)

(0.475)

10.299

10.351

10.476999

(0.426)

(0.440)

(0.447)

305

0.08

305

0.08

305

0.10

10.060

481

305

0.10

0.07

Daycare

10.178

10.343

10.437

10.400

10.441999

(0.151)

(0.393)

(0.384)

(0.415)

249

0.25

249

0.26

249

0.27

s .e.

(0.104)

(0.125)

N

R1sq

391

0.00

391

0.19

(0.367)

Log(population)

0.484

0.185

391

249

0.21

0.25

Housing

0.205

10.069

s .e.

(0.504)

(0.492)

(0.473)

N

R1sq

412

0.00

412

0.03

Log(population)

0.126

s .e.

N

R1sq

(0.595)

0.078

0.185

0.073

(0.614)

(0.701)

(0.725)

264

0.06

264

0.06

264

0.08

10.124

412

264

0.03

0.06

Seniors

10.008

0.265

0.352

0.337

0.081

(0.143)

(0.182)

(0.179)

(0.911)

467

0.00

467

0.04

Log(population)

0.053

s .e.

(0.416)

N

R1sq

Nro9of9controls

548

0.00

0

(0.962)

(0.929)

305

0.08

305

0.08

303

0.06

10.442

467

305

0.05

0.08

Disabled

10.415

10.409

(0.842)

10.362

10.450

10.435

(0.419)

(0.401)

(0.527)

(0.560)

(0.583)

(0.587)

548

0.05

2

548

0.05

4

364

0.06

6

364

0.06

7

364

0.06

8

364

0.06

9

&

Notes: The unit of observation is a market defined as an FSA. The outcome is the average expenditures of all charities of given sector in the market. The set of control variables include, and are added

in this order: log(population), log(average household income), share of low income families, share of

population over 65 years of age, share of population under 5 years of age, share of population with

no higher than grade 9 education, share of population with university education, share of immigrant

population, share of unemployed and average rental price. Standard errors are clustered at the FSA

level; * denotes statistical significance at the 10% level, ** at the 5% level and *** at the 1% level.

26