How The Left Wing Government Affected the Greek Economy and... Wenhui Gao and Georgios Kotzamanis Introduction

advertisement

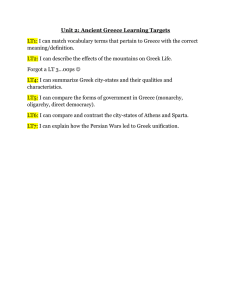

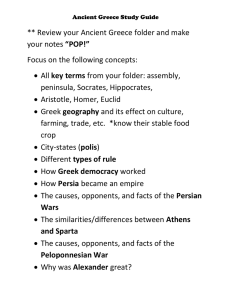

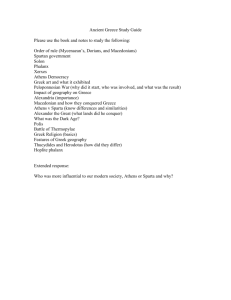

How The Left Wing Government Affected the Greek Economy and Their Future Wenhui Gao and Georgios Kotzamanis Introduction Policies Before and After Syriza: Discretionary fiscal policies including tax raises and cut of wages, pensions and government spending were always the conditions for signing fiscal stimulus agreements with EU and IMF after Greece being excluded for the money markets due to the high spreads resulting from the inability of Greece to pay the outstanding bonds that led to deterioration of the bond ratings even characterizing them junk (in April 2010 from Standard and Poor’s). The situation shifted in 2014 when a primary surplus was announced, ratings increased, Greece participated in the markets with yield below 6% and the first signs of recovery and growth appeared. The announcement of elections at the end of 2014 combined with the lost first half of 2015, during which the new Greek government was negotiating new conditions to receive financial aid, led to a new wave of recession peaking with the capital controls in July. The deterioration of economy and the deficiency of cash forced the Greek government to agree with European institutions to receive a bailout, the Third Economic Adjustment Program for Greece known as Third Memorandum. This bailout required the Greek parliament to approve a new austerity package. We are going to refer to both before and after Syriza policies as well as illustrate this situation through 3 different economic indicators. Theoretical Implications of Policies Theoretically, the set of policies adopted by Syriza would be Deficit Reducing and Economically Contractionary. We would analyse from the Labour Market and GDP. Theoretically, a sizable cut in pension schemes, a large reduction in the Public Sector Jobs and reduction in workers wages would undoubtedly worsen the performance of the Labour Market, raising unemployment rate. As the incentive to work has fallen, due to both the cut in wages and tax on pension schemes. 2010-2014: 9 austerity packages had been signed in order for Greece to secure two bailout packages from EU and IMF. These policies included: • New taxes (New property tax to be collected through the electricity bill) and rise in taxes (VAT from 19% to 21%) • 3 cuts of workers' wages; • Public pension cuts on average between 5% and 15% through the removal of two seasonal bonuses; • an increase of the retirement age from 65 to 67; • Abolishment of 15,000 state jobs by 2014; Syriza won on January 2015, based on the promise of changing these ‘’cruel’’ austerity measures. After 6 months of no results, Greek government was forced to sign bailout program based on following policies as preconditions: • New tax rise (Rise of tax of solidarity for incomes over €50.000, corporation tax rise from 26% to 29% for small companies, VAT from 21% to 23% and many more ) • Abolition of the VAT discount of 30% for the most touristic Greek islands, after 1 October 2015. • Rise of health contributions paid by pensioners (6% from 4% ) • End to early retirement by 2022 and a retirement age increase to 67 • Private education taxed at 23 percent. • Interest on expired debts to the state that are payable in 100 instalments rises from 3 percent to 5 percent on amounts over 5,000 euros. • Greece’s shipping industry will also be subject to new tax rises. -GDP trend is volatile since 2012 GDP Growth -A clear divergence from trend around 2015 -Suspect the divergence to be correlated with the Left Wing Government -Find a control country to compare—Spain in order to rule out the possibility of systematic factors. Also, due to the aggressive measure adopted by the government to tackle sovereign debt, there should be a sizable improvement on the Government Deficit as Greece is now reducing its spending while collecting far more forms of taxes. With a improved budget position of the economy, it should be easier for the Greek Government to access to credit and enabling it to drag the economy out of prolonged recession. Labour Market -Their GDP growth trend has strong correlation with each other, correlation of 0.750(Pearson Correlation Coefficient) -The correlation clearly breaks entering late 2014 when the Prediction of Winner was revealed in late 2014 as they reverse in direction and is not expected to converge soon. When combined with GDP in 2015, the correlation has weakened to 0.4675(37.7% decrease) Unemployment rate maintained a fairly steady trend No significant structural break has been detected Relative effect in comparison to previous policy regime is minimal 26.5 26 25.5 25 24.5 24 23.5 Sep-14 Dec-14 Apr-15 Jul-15 Oct-15 Jan-16 Forecast Line remained smooth Further strengthen our argument that employment was not affected by the change of regime Exports &Imports Forecasting Government Debt Crisis -It historically accounts for 30% of Greece’ GDP so it is a fairly strong indicator --Good measurement of the openness of the economy --Import and export is highly seasonal and cyclical so we decided to use the difference in difference method to analyse the net effect. Assuming constant cyclical changes in import and export from 2013-2015, the decline of export and import was assumed to be the same if all conditions from2013 to 2015 were the same. we used the DiD Model to calculate the net differences between the Year of Syriza(2015) and the year prior to that (2014). The Trade Balance improved from 2014 to 2015. However, it is not a result of improvement in productivity or export growth as productivity was stagnant throughout the period. Therefore, the more dramatic improvement in Trade Balance will be the direct result of a closer economy as income maintained a fairly consistent trend in that year Another outstanding problem associated with this would be its high level of unsustainable debt. In terms of government debt, it has accounted for 180% of GDP in 2015, far exceeding the acceptable 60-90% sustainability range. To make situation worse, Tax has not been an efficient way of cutting debt due to its high level of unauthorised trading. Also, the austerity action taken has yielded much of a result as Greece still mounts high debt compared to other EU countries. The already heavily existent problem of black markets and tax evasion was far worsened during austerity measures including higher taxes. Syriza government promised decreased taxes and expectations of such change were created. However after the detrimental capital controls more taxes were implemented and already increased taxes were furthered increased. As a result, its government debt is not likely to slow down in the near future as indicated by the forecast from TradingEconomics. This constraint would limit the government’s ability to react to shocks and reduce the flexibility of the economy which is made worsen due to the expected cost of 600million dollars to manage the migrant crisis. Tourism Forecast Greece’s tourism receipt has been quiet encouraging especially after the strengthening relationship with Russia and Turkey. Again, we wanted to observe the change of Tourism Receipts from 2015 to 2014. As we can see, tourism receipts has increased in almost every month in comparison to 2014. After the smoothing of the refugee crisis, this number is expected to continue which is beneficial to the Greek Economy. Trade Forecast Its main trading partners ‘economic growth has been fairly strong and steady. We would only look at its top 2 export destinations, Turkey at 10.8% and Italy at 7.5%,(In terms of percentage of trade volume) for simplicity reasons. Turkey’s Economic Growth has a definite upward trend which is projected to continue into the future. A higher Economic Growth in its main trading partner is likely to draw more export opportunities for Greece which can be extremely beneficial to the economy. Moreover, we calculated the MPM of Italy from 2010-2013 which is the period of fairly stable economy, enabling us to omit outliers from previous historical data, the numerical value of MPM is a relatively significant 9.18%, such responsive import will definitely benefit Greek Economy. In 2016 alone, Turkish Imports from Greece is likely to promote a 0.175% GDP growth to Greece (Assuming all quarterly projections are correct, growth is being compounded, trading composition of Turkey remains unchanged and all tradable goods are viewed as homogenous) Also, with oil price expected to reverse its slump trend and regain momentum in late 2016. As Greece’ top export is refined petroleum, a stronger oil price would certainly improve its current account position and further boost AD. Blue Line indicates Greece Dotted Line indicates Spain Moreover, the current credit state does not fare well for Greece, being downgraded to CCC+ earlier this year, it would definitely face more costs financing its operation which would further hamper its growth. And this has been the case and is well documented by the Government Bond issued by the Greek Government Business and Consumer Confidence and access to credit. Consumer Confidence has clearly dwindled after the set of policies, most notably the Capital Control. With Capital control and shrinking consumer confidence, consumption growth would remain weak in Greece.( below 0.5 percent in 2014 and 2015) Also, with more restricted access to capital and credit, business is unwilling to take loans and update their technology, which makes Greece’s future productivity stagnant, prolonging the period of slow economic growth. Conclusion Based on our research, Syriza’s impact on the Greek Economy has not been as severe as general Greek Citizens felt. GDP did suffer strongly from his political regime. While unemployment did continue to deteriorate, it does so on nearly the same pace as it was before. Government debt embarked on a more steady pace of growth. With oil price would eventually pick up, strong growth in its partner and more relaxed access to credit, we are optimistic about its future .