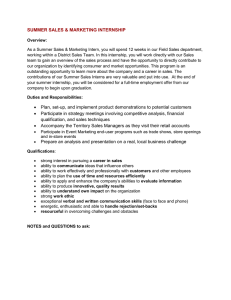

Summer Internship Opportunity HCA Internship runs from mid-May through end of July

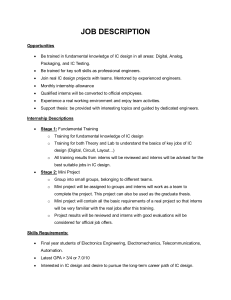

advertisement

Summer Internship Opportunity HCA Internship runs from mid-May through end of July Interns receive same training as full-time tax staff Interns are responsible for portions of our actual federal/state tax compliance work Interns experience working for multiple reviewers, providing a rich learning experience Specific work would include federal and state return preparation, including exposure to depreciation/amortization concepts and tax deferrals Candidate requirements – Generally looking for students in upper-class years in an accredited program, with a GPA of 3.5 or higher preferred. CPA eligibility is not required, but is a plus. Interested candidates should submit resumes for consideration to: Jill.Scobey@HCAHealthcare.com