Société en commandite Gaz Métro

Cause tarifaire 2008, R-3630-2007

Date of Release: April 5, 2007

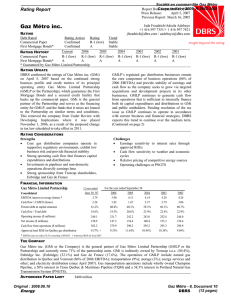

DBRS Confirms Gaz Métro inc. at A and R-1 (low), Gaz Métro Limited

Partnership at STA-2 (middle)

Industry: Energy

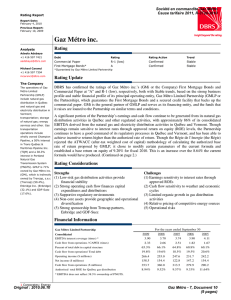

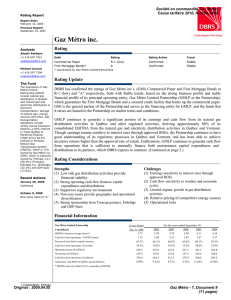

DBRS has today confirmed the ratings of Gaz Métro inc.’s (GMi) Commercial Paper at R-1 (low)

and its First Mortgage Bonds at “A,” both with Stable trends, and confirmed the stability rating of

Gaz Métro Limited Partnership (GMLP) at STA-2 (middle). This removes the First Mortgage Bond

and stability ratings from Under Review with Developing Implications where they were placed

November 1, 2006, following the announcement of proposed changes to the tax rules for income

trusts scheduled to take effect in 2011.

The confirmation of the stability rating reflects DBRS’s belief that GMLP will evaluate strategies to

mitigate the impact of any new taxes, within the context of maintaining the capital structure of its

regulated utility business in accordance with regulatory approved levels. However, as DBRS stated in

its November 2006 press release, any reduction in future distributions due to the imposition of new

taxes would be viewed as a one-time event, with subsequent analytical focus on the stability and

sustainability of the revised distributions.

The confirmation of GMi’s First Mortgage Bonds is based on the continued strong business profile

and credit metrics of the guarantor, GMLP, whose regulated gas distribution business remains the

core component of its business operations (84% of net income). GMLP also continues to generate

cash flows from operations that are sufficient to internally finance both its capital expenditures and

distributions to GMi and public unitholders. DBRS expects this trend to continue over the medium

term pending resolution of the tax issue and as GMLP continues to operate in accordance with current

business and financial strategies. The confirmation of GMi’s Commercial Paper rating is based on the

credit strength of GMi, as well as the credit facility backing the commercial paper program, as this

credit facility is also guaranteed by GMLP.

GMLP has experienced some weakness of earnings in its domestic gas distribution business over the

last two years, which remains sensitive to lower return on equity due to interest rates and volume

throughputs. In addition, short-term profitability remains a challenge at its 38.3% owned Portland

Natural Gas Transmission System (PNGTS). As a result of earnings pressure from these factors,

management reduced distributions by 9% in May 2006 in order to preserve the equity base of GMLP.

This near-term weakness is expected to be partially offset with the completion of the 550 MW

Bécancour cogeneration plant. Representing GMLP’s largest customer, this facility will contribute to

both earnings and cash flow as deliveries are expected to increase by 15%.

Copyright © 2007, DBRS Limited, DBRS, Inc., and DBRS (Europe) Limited (collectively, "DBRS"). All rights reserved. The information upon which DBRS ratings and reports

are based is obtained by DBRS from sources believed by DBRS to be accurate and reliable. DBRS does not perform any audit and does not independently verify the accuracy

of the information provided to it. DBRS ratings, reports and any other information provided by DBRS is provided "as is" and without warranty of any kind. DBRS hereby

disclaims any representation or warranty, express or implied, as to the accuracy, timeliness, completeness, merchantability, fitness for any particular purpose or

non-infringement of any of such information. In no event shall DBRS or its directors, officers, employees, independent contractors, agents, and representatives (collectively,

"DBRS Representatives") be liable for: (i) any inaccuracy, delay, interruption in service, error, or omission, or for any resulting damages, or (ii) any direct, indirect, incidental,

special, compensatory, or consequential damages with respect to any error (negligent or otherwise) or other circumstance or contingency within or outside the control of DBRS

or any DBRS Representatives in connection with, or related to, obtaining, collecting, compiling, analyzing, interpreting, communicating, publishing, or delivering any

information. Ratings and other opinions issued by DBRS are, and must be construed solely as, statements of opinion and not statements of fact as to credit worthiness or

recommendations to purchase, sell, or hold any securities. DBRS receives compensation, ranging from US$1,000 to US$750,000 (or the applicable currency equivalent), from

issuers, insurers, guarantors and/or underwriters of debt securities for assigning ratings. This publication may not be reproduced, retransmitted, or distributed in any form

without the prior written consent of DBRS.

Original : 2007.06.29

Gaz Métro - 7, Document 12

(2 pages en liasse)

GMLP continues to explore ways to diversify its operations by implementing its strategy in becoming

an integrated energy provider. Strategic diversification should improve GMLP’s overall business

profile, as both geographical and operational diversification benefits are expected from the proposed

acquisition of Green Mountain Power Corporation (Green Mountain), expected to close shortly. Other

projects under consideration include the Rabaska LNG terminal and Seigneurie de Beaupré wind

farm. DBRS notes that while an increase in leverage is anticipated as the Green Mountain acquisition

is expected to be financed with debt at closing, we expect this increase to be temporary as GMLP has

already indicated that it will finance the acquisition with a mix of debt and equity.

DBRS will publish separate GMi and GMLP reports shortly that will provide additional analytical

detail on these rating actions. If you are interested in receiving this report, contact us at

info@dbrs.com.

Issuer

Gaz Metro Limited

Partnership

Gaz Metro inc.

Gaz Metro inc.

Debt Rated

Income Fund

Rating Action

Confirmed

Commercial Paper

Confirmed

First Mortgage Bonds Confirmed

Rating

Trend

STA-2 (middle) --

Latest Event

Apr 5, 2007

R-1 (low)

A

Apr 5, 2007

Apr 5, 2007

Stb

Stb

Jade Freadrich

Senior Financial Analyst

+1 416 597 7351

jreadrich@dbrs.com

Adeola Adebayo

Assistant Vice President - Canadian Utilities

+1 416 597 7421

aadebayo@dbrs.com

Copyright © 2007, DBRS Limited, DBRS, Inc., and DBRS (Europe) Limited (collectively, "DBRS"). All rights reserved. The information upon which DBRS ratings and reports

are based is obtained by DBRS from sources believed by DBRS to be accurate and reliable. DBRS does not perform any audit and does not independently verify the accuracy

of the information provided to it. DBRS ratings, reports and any other information provided by DBRS is provided "as is" and without warranty of any kind. DBRS hereby

disclaims any representation or warranty, express or implied, as to the accuracy, timeliness, completeness, merchantability, fitness for any particular purpose or

non-infringement of any of such information. In no event shall DBRS or its directors, officers, employees, independent contractors, agents, and representatives (collectively,

"DBRS Representatives") be liable for: (i) any inaccuracy, delay, interruption in service, error, or omission, or for any resulting damages, or (ii) any direct, indirect, incidental,

special, compensatory, or consequential damages with respect to any error (negligent or otherwise) or other circumstance or contingency within or outside the control of DBRS

or any DBRS Representatives in connection with, or related to, obtaining, collecting, compiling, analyzing, interpreting, communicating, publishing, or delivering any

information. Ratings and other opinions issued by DBRS are, and must be construed solely as, statements of opinion and not statements of fact as to credit worthiness or

recommendations to purchase, sell, or hold any securities. DBRS receives compensation, ranging from US$1,000 to US$750,000 (or the applicable currency equivalent), from

issuers, insurers, guarantors and/or underwriters of debt securities for assigning ratings. This publication may not be reproduced, retransmitted, or distributed in any form

without the prior written consent of DBRS.