Gaz Métro inc. Rating Report

advertisement

Société en commandite Gaz Métro

Cause

tarifaire

2009, R-3662-2008

Report Date:

September

19, 2007

Press Release:

April 5, 2007

Previous Report: March 16, 2005

Rating Report

Gaz Métro inc.

Jade Freadrich/Adeola Adebayo

+1 416 597 7351/+ 1 416 597 7421

jfreadrich@dbrs.com / aadebayo@dbrs.com

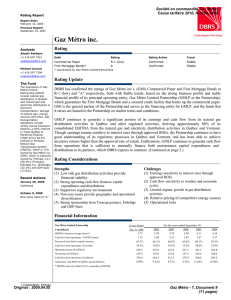

RATING

Debt Rated

Commercial Paper

First Mortgage Bonds*

Rating Action Rating

Trend

Confirmed

R-1 (low) Stable

Confirmed

A

Stable

Current

2006

2005

2004

2003

2002

2001

RATING HISTORY

Commercial Paper

R-1 (low)

R-1 (low) R-1 (low) R-1 (low) R-1 (low) R-1 (low) R-1 (low)

First Mortgage Bonds*

A

A

A

A

A

A

A

* Guaranteed by Gaz Métro Limited Partnership

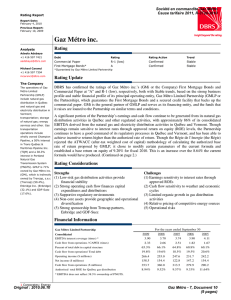

RATING UPDATE

DBRS confirmed the ratings of Gaz Métro inc. (GMi)

GMLP’s regulated gas distribution businesses remain

on April 5, 2007 based on the continued strong

the core component of business operations (86% of

business profile and credit metrics of its principal

2006 EBITDA) and provide stability of earnings and

operating entity Gaz Métro Limited Partnership

cash flow as the company seeks to grow via targeted

(GMLP or the Partnership), which guarantees the First

acquisitions and development projects in its other

Mortgage Bonds and a secured credit facility that

businesses. GMLP continues to generate cash flow

backs up the commercial paper. GMi is the general

from operations that is sufficient to internally finance

partner of the Partnership and serves as the financing

both its capital expenditures and distributions to GMi

entity for GMLP, and the funds that it raises are loaned

and public unitholders. Pending resolution of the tax

to the Partnership on similar terms and conditions.

issue as GMLP continues to operate in accordance

This removed the company from Under Review with

with current business and financial strategies, DBRS

Developing Implications where it was placed

expects this trend to continue over the medium term.

November 1, 2006, as a result of the proposed change

(Continued on page 2)

in tax law scheduled to take effect in 2011.

RATING CONSIDERATIONS

Strengths

• Core gas distribution companies operate in

supportive regulatory environments, exhibit low

business risk and provide financial stability

• Strong operating cash flow that finances capital

expenditures and distributions

• Investments in pipelines and non-domestic

operations diversify earnings base

• Strong sponsorship from Trencap shareholders,

Enbridge and Gaz de France

Challenges

• Earnings sensitivity to interest rates through

approved ROEs

• Cash flow sensitivity to weather and economic

cycles

• Relative pricing of competitive energy sources

• Operating challenges at PNGTS

FINANCIAL INFORMATION

Gaz Métro Limited Partnership

Consolidated

EBITDA interest coverage (times) *

Cash flow / CAPEX (times)

Percent debt in capital structure

Cash flow / Total debt

Operating income ($ millions)

Net income ($ millions)

Cash flow from operations ($ millions)

Approved total ROE for Québec gas distribution

* EBITDA does not reflect 38.3% ownership of PNGTS.

For the year ended September 30

2006

2005

3.90

4.11

1.82

1.67

60.8%

60.1%

19.5%

20.6%

12 mos ended

June 30, '07

3.79

2.26

61.2%

18.6%

240.1

150.9

302.2

9.57%

†

231.7

147.2

279.9

9.33%

242.2

154.4

290.2

11.64%

2004

4.14

2.37

58.3%

23.9%

2003

4.28

2.79

60.1%

22.4%

2002

4.24

3.06

60.7%

22.9%

243.0

160.4

295.2

10.96%

252.8

153.3

295.3

10.34%

244.0

154.6

290.9

9.69%

† Authorized ROE for fiscal 2007.

THE COMPANY

Gaz Métro inc. (GMi or the Company) is the general partner of Gaz Métro Limited Partnership (GMLP or the

Partnership) and currently owns 71% of the partnership units. GMi is indirectly owned by Trencap s.e.c. (50.4%),

Enbridge Inc. (Enbridge) (32.1%) and Gaz de France (17.6%). The operations of GMLP include natural gas

distribution in Québec and Vermont (86% of 2006 EBITDA); transportation (9%); storage (3%); energy services and

other; and electricity distribution (since April 2007). Gas transportation operations include wholly owned Champion

Pipeline, a 50% interest in Trans Québec & Maritimes Pipeline (TQM) and a 38.3% interest in Portland Natural Gas

Transmission System (PNGTS).

AUTHORIZED PAPER LIMIT

$400 million

Original : 2008.06.10

Energy

Gaz Métro - 8, Document 10

(12 pages)

DBRS

Gaz Métro inc. – Page 2

RATINGS UPDATED (Continued from page 1)

GMLP will evaluate strategies to mitigate the

impact of any new taxes, within the context of

maintaining the capital structure of its regulated

utility business in accordance with regulatory

approved levels. The confirmation of GMi’s

Commercial Paper rating is based on the credit

strength of GMi, as well as the credit facility

backing the commercial paper program which is

guaranteed by GMLP.

GMLP has experienced some weakness in earnings

in the domestic gas distribution business over the

last two years which remains sensitive to lower

return on equity due to interest rates and volume

throughputs. In addition, short-term profitability

has been challenged by its 38.3% owned Portland

Natural Gas Transmission System (PNGTS). As a

result of earnings pressure, management reduced

cash distributions paid by 9% in July 2006 in order

to preserve the equity base of the gas distribution

activity and the Partnership.

This near-term weakness has been partially offset

by completion of TransCanada Energy’s 550MW

Bécancour cogeneration plant and by interruptible

sales to industrial customers. Representing the

Partnership’s largest customer, the new

cogeneration facility will provide a benefit to both

earnings and cash flow as firm industrial deliveries

have increased 42% year-to-date (YTD).

The Partnership continues to explore ways to grow

and diversify its operations by implementing its

strategy to become an integrated energy provider.

Strategic diversification should improve the

Partnership’s overall business profile, and both

geographic and operational diversification benefits

are expected from the acquisition of electric utility

Green Mountain Power Corp. (Green Mountain)

completed in April 2007. The Green Mountain

acquisition is consistent with the company’s

business strategy to grow through targeted

acquisitions. Although the acquisition has resulted

in a temporary increase in leverage, DBRS notes

that management of the company has stated that it

expects to finance the acquisition with debt and

units in proportions that will leave the financing

structure at levels comparable with the past. At

these levels, DBRS would expect the acquisition,

after giving consideration to the incremental

earnings and cash flow of the acquired entity, to

have little net impact on those same credit metrics

for GMLP. Other projects under consideration that

could also provide growth include the Rabaska

LNG terminal and the Seigneurie de Beaupré wind

farm.

BASIS OF ANALYSIS

GMi as it is structured today came into existence

via a corporate reorganization in 1991 that also

established the funding parameters that are still

used. The Partnership assumed all of the

obligations then outstanding under the First

Mortgage Bonds with the assets of the Partnership

continuing to secure outstanding obligations. The

reorganization agreement also established the

terms of the subordinated debt at GMi that is

invested as equity into GMLP. Importantly, it

established that failure to pay interest or principal

would not cause either acceleration of that debt or

a cross default to senior debt, thus resulting in the

heavy equity treatment that is afforded that debt.

GMi is the financing vehicle for GMLP with funds

raised loaned to GMLP on similar terms and

conditions as those imposed on GMi. Given the

mirror like structure of the financing, the only

substantive difference between the two entities is

the subordinated debt at GMi and the guarantees

that exist. DBRS’s analysis will focus on the

operations and credit of GMLP (see section below

for a more complete description of operations).

Gaz Métro inc. – Page 3

DESCRIPTION OF CORPORATE STRUCTURE

Solidarity

Fund

QFL

Caisse de dépôt et

placement du Québec

(General Partner)

16.7%

51.1%

BC

Investment

Management

Corporation

SNC-Lavalin

Group Inc.

11.1%

11.1%

Enbridge Inc.

Trencap s.e.c

Gaz de France

32.1%

50.4%

17.6%

Régime des

rentes du

Mouvement

Desjardins

Régime de

Retraite de

l'Université

du Québec

8.3%

1.7%

Noverco Inc.

100%

Gaz Métro Inc. "GMi " (Québec, Canada)

Public

Unitholders

y $707.8 million - subordinate intercompany debt (Noverco)

y Commercial paper rated R1 (low)

{

y $400 million secured credit facility

y $1.025 billion First Mortgage Bonds rated 'A'

71% of units

(General Partner)

Guarantee

29% of units

(Limited Partners)

Gaz Métro Limited Partnership "GMLP" (Québec, Canada)

50%

TQM Pipeline & Company, Limited

Partnership (Québec, Canada)

y $137.5 million First Mortgage

Bonds rated A (low)

99.99%

Gaz Métro Plus

Limited

Partnership

(Québec,

Canada)

Northern New England Energy Corporation

(Vermont, USA)

38.29%

Intragas Holding, Limited

Partnership

(Québec, Canada)

y US$100 million

100%

Portland Natural Gas

Transmission System

(Maine, USA)

49.99%

100%

Northern New

England

Investment

Company, Inc.

(Vermont,

USA)

100%

Green Mountain

Power Corp.

(Vermont, USA)

y US$112.4 million

100%

Vermont Gas

Systems, Inc.

(Vermont, USA)

79.99%

Intragas Limited Partnership

(Québec, Canada)

y US$20.0

million notes

Notes:

Consolidated long-term debt amounts outstanding for GMLP and GMi were $1.6 billion and $2.3 billion respectively as of June 30, 2007.

GMLP’s subsidiaries and joint ventures can borrow up to $88.2 million under term loan agreements.

20%

Gaz Métro inc. – Page 4

RATING CONSIDERATIONS

Strengths

(1) Regulated gas distribution and transportation

operations account for almost all earnings and

provide GMLP with significant long-term stability.

Excluding Vermont Gas Systems (VGS) from

reported segregated earnings, DBRS estimates that

approximately 78% of EBITDA is derived solely

from gas distribution operations in Québec. These

domestic gas distribution operations are permitted

to utilize deferral accounts that smooth the

earnings impact of: a) weather-induced revenue

fluctuations, and (b) interest rate fluctuations on

floating rate debt, both of which are amortized and

recovered in future rates over a five-year period.

Note that while these deferral accounts smooth

income, they do not smooth cash flow from

operations.

(2) GMLP continues to generate cash flow from

operations that is sufficient to internally finance

both its capital expenditures and distributions to its

partners. DBRS expects this to continue over the

medium- to long–term, with credit metrics to

remain generally consistent with historical levels

with temporary variation due to acquisitions or

major project developments.

(3) GMLP continues to explore ways to diversify

its operations in connection with its strategy to

become an integrated energy provider. The

acquisition of Green Mountain will provide

geographic and operational diversification

benefits. Also, the 50% interest in Intragas

(acquired in December 2004) added underground

natural gas storage capability to the Partnership’s

activities.

(4) Construction of the 550MW Bécancour

cogeneration plant was completed September

2006. This represents GMLP’s biggest customer

and should increase deliveries by 15% on an

annual basis.

Challenges

(1) GMLP’s earnings and cash flow are sensitive to

interest rates through approved ROEs. A 25 basis

point change in approved ROE equates to

approximately a $2 million impact on earnings.

(2) GMLP’s cash flow is sensitive to changes in

economic cycles on a medium-term basis and

weather impacts cash flow on a short-term basis.

The rate stabilization account mitigates weatherinduced fluctuations on income. Approximately

55% of gas volumes are delivered to industrial

customers that are most sensitive to economic

conditions.

(3) Relative pricing of competitive energy sources

impacts volume throughputs over the medium to

longer term. Market penetration of natural gas in

Québec is well below the national Canadian

average resulting from the low cost of electricity in

Québec. Gas distribution throughputs are

somewhat volatile in conjunction with the tight

competitive situation between natural gas, fuel oil,

and electricity in Québec. The company continues

to look for ways to distribute greater volumes of

gas and has had recent success with interruptible

volumes to industrial customers and has increased

market penetration in new home construction.

(4) PNGTS’s earnings have been challenged by

loss of two major customers and subsequent excess

transportation capacity. A source of growth

however is expected from the Rabaska project

which is scheduled for completion in 2010 if the

decision is made to proceed.

Gaz Métro inc. – Page 5

EARNINGS AND OUTLOOK

Gaz Métro Limited Partnership

Consolidated

(CAD millions)

12 mos ended

June 30, 2007

For the year ended September 30

2006

2005

2004

2003

2002

Gross margin *

601.9

576.3

563.2

555.0

568.8

555.9

EBITDA

388.0

369.5

375.3

371.6

384.7

379.2

102.4

94.7

91.3

89.7

90.0

89.4

9.5

11.9

8.8

7.6

9.5

150.9

147.2

154.4

160.4

153.3

†

Interest expense

Income taxes

Net Income

154.6

Segmented EBITDA

For the year ended September 30

(CAD millions)

2006 (%)

2006

2005

2004

2003

2002

86%

317.1

317.4

329.0

331.3

325.6

Transportation

9%

34.6

43.9

Storage †

3%

11.8

7.0

4%

15.6

15.7

8.5

5.6

5.5

-3%

(9.6)

(8.7)

(5.3)

(3.7)

(0.8)

Distribution ‡

Energy services & other

Non-allocated expenses & eliminations

Total EBITDA

100%

369.5

375.3

39.4

51.5

48.9

-

-

-

371.6

384.7

379.2

* Net of direct co s ts as s o ciated with the purchas e of gas .

† EBITDA do es not reflect 38.3% owners hip o f P NGTS.

‡ Reflects reported s egmented res ults , which aggregates Québec and Vermont dis tribution. Excluding Vermont Gas Sys tems , DBRS es timates that

approximately 78% of EBITDA is derived s olely fro m Québec dis tribution operations .

Summary

• Recent weakness in distribution net income

was primarily the result of the reduced

authorized ROE as a result of a lower interest

rate environment, as well as reduced

normalized throughput.

− Fiscal 2007 authorized ROE has been

increased to 9.57% from 9.33% in 2006.

− Lower distribution throughputs resulted

from higher natural gas prices which

prompted customers (especially highvolume industrial and small commercial)

to reduce consumption. The Partnership

has worked to replace this volume with

short-term interruptible volumes and has

already begun to benefit from the start-up

of the Bécancour cogeneration unit.

− Loss of two significant customers at

PNGTS

has

negatively

impacted

transportation earnings but this volume

has recently been partially replaced on a

short-term basis.

Outlook

• Over the medium term, the outlook for

GMLP’s earnings remains stable. Modest

growth expected from the gas distribution

business may be partially offset by short-term

weakness in PNGTS.

− The penetration of natural gas in Québec

compared to other provinces is low. The

•

•

•

•

gas distribution segment will benefit from

continuing penetration of the new

residential construction sector and efforts

to increase industrial gas sales on an

interruptible basis.

Domestic gas distribution may benefit from

recently approved changes to the incentive

return, as well as proposed changes in the

2008 rate case to the rate of return allowed on

deemed equity to provide a better reflection of

GMLP’s

business

risk

and

market

expectations.

Bécancour represents GMLP’s biggest

customer and should increase deliveries by

15% on an annual basis.

The acquisition of Green Mountain will

provide

geographic

and

operational

diversification benefits to GMLP’s gasdistribution operations in Québec, which is

consistent with the strategy to become an

integrated energy provider.

TQM benefits from stable revenues as almost

all revenues are under long-term contracts with

TransCanada PipeLines Limited until 2018.

Gaz Métro inc. – Page 6

•

−

Over the longer term, DBRS expects

continued earnings stability, with potential

growth from various projects currently being

pursued, including the following:

− The Rabaska project, a liquefied natural

gas terminal in the eastern part of Québec.

GMLP intends to submit a joint bid with

Boralex Inc. into Hydro-Québec’s 2007

call for tender for the Seigneurie de

Beaupré wind project.

FINANCIAL PROFILE

Gaz Métro Limited Partnership

Consolidated Statement of Cash Flows

($ millions)

12 mos ended

June 30, '07

For the year ended September 30

2006

2005

2004

2003

2002

Net income before extras

150.9

147.2

154.4

160.4

153.3

154.6

Depreciation & amortization of def. charges

152.2

140.7

133.8

130.9

134.8

136.3

1.9

4.0

7.1

Other (future income taxes, adj. of equity income)

Cash flow from operations

Capital expenditures

Free cash flow before working capital changes

(0.9)

302.2

279.9

290.2

295.2

295.3

(133.9)

(153.9)

(174.2)

(124.4)

(105.7)

(95.0)

168.3

126.1

116.0

170.9

189.6

196.0

57.3

54.5

57.1

53.1

49.3

45.8

(23.0)

(37.1)

(1.7)

2.3

11.7

(50.5)

Reduction in def. charges related to gas costs

Rate stabilization

Working capital changes

Free cash flow before distributions

Distributions to Partners

Free cash flow after distributions

(8.0)

56.3

12.1

(26.1)

(57.3)

12.6

258.9

155.5

145.3

216.5

193.3

203.9

(147.5)

(156.3)

(157.7)

(154.3)

(148.0)

(141.4)

(0.7)

(12.5)

62.2

45.2

62.5

111.4

(9.8)

290.9

Acquisitions & Divestitures

(224.1)

14.6

(96.7)

(31.9)

(25.6)

(4.4)

Deferred charges

(102.9)

(37.0)

(64.8)

(215.6)

(23.2)

(174.0)

(65.9)

(35.6)

(129.7)

(110.1)

(12.0)

46.1

196.7

32.9

123.3

22.0

42.5

(39.2)

50.2

0.1

66.1

10.6

66.7

-

31.3

9.8

15.4

(3.0)

(0.9)

6.9

Cash flow to total debt

18.6%

19.5%

20.6%

23.9%

22.4%

22.9%

Percent debt in capital structure

61.2%

60.8%

60.1%

58.3%

60.1%

60.7%

Cash flow / CAPEX (times)

2.26

1.82

1.67

2.37

2.79

3.06

EBIT interest coverage (times) *

2.35

2.45

2.65

2.71

2.81

2.73

EBITDA interest coverage (times) *

3.79

3.90

4.11

4.14

4.28

4.24

Cash flows before financing

Net debt financing

Net equity financing

Net change in cash

Key Ratios:

* EBIT and EBITDA do not reflect GMLP 's 38.3% owners hip of P NGTS.

Summary

• The predominance of regulated operations

provides generally stable earnings and cash flow

resulting in a stable financial profile and credit

metrics.

• GMLP’s cash flow from operations is typically

strong enough to internally fund both capital

expenditures and distributions. This was not the

case in 2005 as a result of negative working

capital adjustments and high capital expenditures.

− 2005 capital expenditures were notably high

as a result of pipeline expansions in Eastern

Montreal and for the Bécancour cogeneration

plant.

• Free cash flow is sensitive to fluctuations in

weather and natural gas costs, however the

•

•

regulatory mechanism provides for normalization

in rates over future years.

− The recent impact of warmer than normal

temperature is seen in the change in the rate

stabilization account which will be recovered

in future rates over five years.

The acquisition of Green Mountain is relatively

modest in comparison with GMLP’s existing

operations.

A $50 million private placement of GMLP units

was completed in October 2006 with SNCLavalin. The proceeds were used to pay down a

portion of outstanding commercial paper and to

maintain the equity of the gas distribution activity

within regulatory parameters.

Gaz Métro inc. – Page 7

Outlook

• Over the medium term, cash flow from

operations will continue to remain relatively

stable and exhibit moderate growth. In the near

term, improvement is expected from:

− The Green Mountain acquisition is

expected to provide accretive cash flow.

− Completion of the 550MW Bécancour

cogeneration plant in September 2006

should increase gas deliveries 15% on an

annual basis.

•

•

Cash flow from operations is expected to

remain sufficient to fund capital expenditures

and distributions to partners.

− Capital expenditures over the medium

term will increase as a result of various

projects under development including the

Rabaska LNG terminal and Seigneurie de

Beaupré wind farm.

Over the longer term, DBRS expects key

financial ratios to remain in line with current

levels.

LONG-TERM DEBT MATURITIES AND BANK LINES

Annual Capital Repayments *

(CAD millions)

First mortgage bonds

Subordinated debt at GMi

Subsidiaries’ debt †

Total

F2007

75.0 ‡

6.0

81.0

F2008

0.7

0.7

F2009

100.0

58.4

158.4

F2010

100.0

151.2

251.2

F2011

47.1

47.1

*Capital required to meet maturities and sinking fund requirements, excluding redemptions before maturity at the Partnership’s option.

†Represents TQM (GMLP 50% ownership) and Canadian dollar equivalencies of Green Mountain Power, NNEEC and VGS notes.

‡$75 million of First Mortgage Bonds matured December 15, 2006.

Summary

• GMi’s debt maturities are reasonably spread

out over the next five years with refinancing

being straightforward, given the market and

the company’s strong rating.

• The acquisition of Green Mountain resulted in

a temporary increase in leverage. DBRS notes

that management of the company has stated

that it expects to finance the acquisition with

debt and units in proportions that will leave

the financing structure at levels comparable

with the past. At these levels, DBRS would

expect the acquisition, after giving

consideration to the incremental earnings and

cash flow of the acquired entity, to have little

net impact on credit metrics over the medium

term.

− USD 100 million of debt was issued by

Northern New England Energy Corp.

(NNEEC) in June 2007 to reimburse part

of the bridge loan put in place to fund the

acquisition.

− USD 113 million of additional debt was

assumed with the Green Mountain

acquisition completed in April 2007.

Green Mountain’s debt maturities are

spread out from F2018 to F2036.

• GMi has term credit facilities totalling $622.9

million and various operating credit facilities

totalling $164.9 million. Borrowings under

•

•

these facilities were $213.1 as of June 30,

2007, leaving the company with ample

liquidity to fund its business. Debt proceeds at

GMi are lent to GMLP on similar terms and

conditions as those incurred at the parent.

Notable credit facilities include:

− A $400 million five-year fully committed

credit facility that is guaranteed by

GMLP and backs GMi’s commercial

paper program. Maturity is currently

December 2011 and is extendible each

year.

− $100 million, unsecured 364-day

renewable lines of credit.

The Partnership’s subsidiaries can borrow up

to $88.2 million under term loan agreements.

These loans are secured by the assets of the

respective subsidiaries; however no recourse

exists to the Partnership.

The company was in compliance with its bond

covenants as of June 30, 2007 and DBRS

believes that GMi and GMLP will be able to

operate their business without being restricted

by the covenants. It is significant to note that

GMLP is restricted from incurring funded

debt greater than 65% of capitalization and

GMi is restricted from paying distributions if

the ratio of debt to capital were to increase to

greater than 75%.

Gaz Métro inc. – Page 8

REGULATION

Québec Gas Distribution: operations are

regulated by the Régie de l’énergie (Régie) by a

hybrid of cost of service/rate of return

methodology and performance-based regulation

(revenue cap).

• Deemed capital structure by the regulator is

38.5% common equity, 7.5% preferred shares

and 54% debt.

• Authorized ROE is derived from a base ROE

plus an incentive component.

− Base ROE is derived from: (1) the August

Consensus Forecast yield for ten-year

bonds plus the market spread between

Government of Canada ten- and thirtyyear bond yields; (2) 75% of the variance

in the August forecast rate of return on

30-year Government of Canada bonds.

− Fiscal 2007 authorized ROE is 9.57%,

derived from a base ROE of 8.73% plus

the incentive return of 0.84%.

• The gas costs are flowed through to customers

with monthly price adjustments.

• Favourable regulatory support is evidenced by

changes approved in April 2007 to the

incentive return that will likely benefit GMLP.

Additional changes to the rate of return

allowed on deemed equity to provide a better

reflection of GMLP’s business risk and market

expectations are proposed in the 2008 rate

case.

Vermont Gas and Electricity Distribution: VGS

and Green Mountain are regulated by the Vermont

Public Service Board (VPSB) on a compliant basis

based on a cost of service/rate of return

methodology.

• Temperature normalization reserve accounts

are disallowed.

• New regulatory framework came into effect

for VGS (October 2006) and Green Mountain

(February 2007) which includes a price

adjustment mechanism to reflect the cost of

purchasing gas or electricity sold to customers.

Canadian Gas Transportation: TQM is regulated

by the National Energy Board (NEB) on a rate of

return/cost of service basis.

• The allowed return on equity of 8.46% in 2007

(8.88% in 2006; 9.46% in 2005) is based on

forecasted long-term Government of Canada

bond yields.

• TQM is pursuing an increase in its deemed

equity to 36%, which is in line with other

Canadian pipelines regulated by the NEB.

U.S. Gas Transportation: PNGTS gas

transportation activities are regulated by the

Federal Regulatory Energy Commission (FERC).

• The last rate adjustment has been effective

since April 2002 and a new rate is expected in

April 2008.

• The implicit ROE is currently 12.33%.

Gaz Métro inc. – Page 9

DESCRIPTION OF OPERATIONS

Gas Distribution: represents the core business and

accounted for 86% of EBITDA in 2006. Excluding

Vermont Gas Systems (VGS) from reported

segregated earnings, DBRS estimates that

approximately 78% of EBITDA is derived solely

from gas distribution in Québec.

• The Partnership delivers approximately 97%

of the natural gas consumed in Québec,

serving approximately 167,000 customers and

is one of the largest natural gas distributors in

Canada.

• Vermont Gas Systems (VGS) is the sole gas

distributor in Vermont with approximately

40,000 customers.

•

•

•

•

Electric Distribution: represents a new line of

business for GMLP.

• Green Mountain is a utility operating company

that primarily transmits and distributes

electricity in the state of Vermont, serving

approximately 92,000 customers. Ancillary

businesses include sales of: (1) electric power

at wholesale in New England, and (2)

operations services to other utilities in

Vermont. Approximately 89% of the

electricity Green Mountain distributes is

purchased from others and the remaining 11%

is obtained through ownership interests in

generation facilities.

• The Partnership intends to submit a joint bid

with Boralex Inc. into Hydro Quebéc’s 2007

call for tender for the Seigneurie de Beaupré

wind project.

Gas Transportation: includes a 50% interest in

the TQM pipeline, 100% of the Champion pipeline

and a 38.3% interest in PNGTS. This segment

reflected about 14% of assets at the end of

September 2006 and contributed 15% of net

income in fiscal year 2006.

TQM operates a gas pipeline in Québec that

connects upstream with TransCanada and

downstream with PNGTS and Gaz Métro (see

separate DBRS report dated February 27,

2007).

The newly completed Lachenaie expansion

project improves compression on TQM’s

existing system. This expansion provides

natural gas to TransCanada’s recently

constructed Bécancour gas-fired power plant,

with the power sold to Hydro Québec under a

long-term contract.

PNGTS’s pipeline originates at the Québec

border and extends to the suburbs of Boston.

Over the medium- to long-term, throughput

volumes on the PNGTS pipeline may increase

as a result of increased demand for natural gas

in the U.S. Northeast to support required

capacity expansion in that region.

Gas Storage: The Partnership acquired an

ownership interest in Intragas in December 2004,

adding underground natural gas storage capability

to the Partnership’s activities (4% of GMLP’s

assets).

Energy Services and Other: includes nonregulated activities.

• Energy-related activities are focused on the

maintenance and repair of residential,

commercial and industrial equipment; the

heating and cooling of large buildings; and the

leasing of residential water heaters.

• Water-related activities are focused on

municipal water and wastewater services.

• Fibre optic activities exist mainly in Montreal,

Toronto and Ottawa through GMLP’s 48.8%

interest in MTO Telecom Inc.

Gaz Métro inc. – Page 10

Gaz Métro Limited Partnership

Consolidated Balance Sheet

(CAD millions)

As at

As at September 30

As at

2006

2005

Liabilities & Equity

60.1

32.0

22.2

Bank debt

Accounts receivable

140.7

102.4

86.7

Payables & Accruals

Inventories

153.7

250.4

287.4

10.3

5.9

5.6

June 30 '07

Assets

Cash

Prepaid expenses

Current Assets

364.8

390.6

401.9

Net fixed assets

2,161.2

64.5

1,923.6

49.9

1,881.3

26.4

211.8

221.9

168.5

154.6

124.2

116.8

26.4

18.7

228.3

131.8

3,115.1

54.2

2,783.2

56.9

2,880.1

Rate stabilization acct

Deferred charges

Investments and other

Financial instruments

Intangible assets

Total

Balance Sheet Ratios

Current ratio (times)

Accumulated depreciation / Gross fixed assets

Percent debt in capital structure

Payout Ratios

Declared distributions / Cash avail. for distribution † ‡

Distributions / Net income †

Cash Flow Ratios

Cash flow / CAPEX (times)

(Cash flow - Distributions) / CAPEX (times)

Cash flow / Total debt

Coverage Ratios

EBIT interest coverage (times) *

EBITDA interest coverage (times) *

Profitability Ratios

Operating margin

Net margin

Return on partners' equity

Québec Gas Distribution Regulatory Statistics

Approved base ROE

Approved total ROE

Deemed common equity

Rate base ($ millions)

Gas Distribution Normalized Volumes (bcf)

Firm industrial

Interruptible industrial

Commercial

Residential

12 mos ended

June 30 '07

1.32

n.a.

61.2%

58.3%

97.8%

June 30 '07

L.t.d. due in one year

Current Liabilities

29.8

263.6

243.1

251.0

2.6

81.0

28.0

276.0

361.2

308.9

Deferred credits

64.8

73.8

235.4

Future income taxes

87.1

51.8

43.6

Long-term debt

48.8

1,610.5

56.9

1,314.9

1,353.7

Partners' equity

1,027.8

924.6

938.4

Total

3,115.1

2,783.2

2,880.1

2004

1.10

37.0%

58.3%

2003

1.18

34.3%

60.1%

2002

0.85

33.3%

60.7%

59.3%

96.2%

56.9%

96.5%

54.2%

91.5%

Financial instruments

For the year ended September 30

2006

2005

1.08

1.30

36.6%

35.8%

60.8%

60.1%

68.9%

106.2%

62.6%

102.1%

2.26

1.82

1.67

2.37

2.79

3.06

1.16

18.6%

0.80

19.5%

0.76

20.6%

1.13

23.9%

1.39

22.4%

1.57

22.9%

2.35

3.79

2.45

3.90

2.65

4.11

2.71

4.14

2.81

4.28

2.73

4.24

39.9%

25.1%

15.5%

40.2%

25.5%

15.8%

43.0%

27.4%

16.9%

43.8%

28.9%

18.2%

44.4%

27.0%

18.1%

43.9%

27.8%

18.9%

8.73%

9.57%

38.5%

1,814.5 f

8.95%

9.33%

38.5%

1,733.9

9.69%

11.64%

38.5%

1,673.2

9.45%

10.96%

38.5%

1,666.3

9.89%

10.34%

38.5%

1,566.7

9.67%

9.69%

38.5%

1,545.6

104.2

28.3

66.4

25.8

79.4

30.6

66.1

25.7

81.3

24.1

67.0

25.9

82.4

27.7

67.7

26.6

‡ DBRS defines 'Cash available for distribution' as Cash flow from operations less maintenance CAPEX, but before growth CAPEX and working capital changes.

n.a. = not available

2005

37.1

* EBIT and EBITDA do not reflect 38.3% ownership of PNGTS.

= Fiscal 2007 forecast

2006

9.8

† Level of distributions paid were reduced 9% in July 2006.

f

As at September 30

82.5

25.9

67.2

26.2

77.5

37.8

67.6

26.1

Gaz Métro inc. – Page 11

Gaz Métro Inc.

Consolidated Balance Sheet

(CAD millions)

Assets

Cash

Accounts receivable

Inventories

Prepaid expenses

Current Assets

As at

June 30 '07

61.0

138.7

153.7

10.3

363.7

Net fixed assets

Deferred charges

Investments & other

Financial instruments

Intangible assets

Total

2,161.2

276.3

274.6

26.4

251.8

3,354.0

As at September 30

2006

2005

36.9

25.4

100.1

88.0

250.4

287.4

5.9

5.6

393.3

406.4

1,923.6

271.8

164.2

18.7

176.7

2,948.4

1,881.3

194.9

149.4

228.3

179.4

3,039.7

Liabilities & Equity

Bank debt

Payables & Accruals

L.t.d. due in one year

Current Liabilities

Future income taxes

Deferred credits

Financial instruments

Senior debt *

Subordinate debt ‡

Minority interest

Partners' equity

Total

12 mos ended

Key Ratios:

EBIT senior interest coverage (times) †

EBIT total interest coverage (times)

Cash flow / CAPEX (times)

Cash flow to senior debt *

Cash flow to total debt

Percent senior debt in capital structure *

Percent total debt in capital structure

June 30, '07

2.95

1.42

1.69

21.3%

9.7%

37.9%

83.1%

As at

June 30 '07

10.7

302.8

2.6

316.1

131.2

64.8

48.8

1,063.7

1,254.6

298.0

176.8

3,354.0

As at September 30

2006

2005

37.1

29.8

269.6

281.4

81.0

28.0

387.7

339.2

75.1

65.1

73.8

235.4

56.9

1,138.7

1,123.0

883.9

931.2

251.7

255.5

80.4

90.3

2,948.4

3,039.7

For the year ended September 30

2006

2005

2004

3.09

3.44

3.32

1.45

1.48

1.51

1.33

1.18

1.69

17.9%

18.3%

21.0%

9.5%

9.8%

10.8%

46.0%

45.7%

44.4%

86.6%

85.9%

86.3%

* Senior debt includes First Mortgage Bonds and drawdown on the $400 million secured credit facility.

June 30, 2007 secured credit facility drawdown is assumed to be the 2006 year-end amount of $38.7 million as this is not disclosed on an interim basis.

† Senior debt interest reflects DBRS' estimate as this is not publically disclosed by Gaz Métro.

‡ Reflects 100% debt treatment of subordinated debt issued by GMi and GMLP's subsidiaries.

Gaz Metro Inc.

Consolidated Statement of Cash Flows

($ millions)

Net income before extras *

Depreciation & amortization of def. charges

Share of non-controlling Partners

Other (future income taxes; adj. of equity income)

Cash flow from operations

Capital expenditures

Free cash flow before working capital changes

Reduction in def. charges related to gas costs

Rate stabilization

Working capital changes

Free cash flow before distributions

Distributions

Free cash flow after distributions

Acquisitions/Divestitures

Other (incl. deferred charges)

Cash flows before financing

Net debt financing

Net equity financing

Net change in cash

12 mos ended

June 30, '07

30.2

152.2

43.9

0.2

226.5

(133.9)

92.7

57.3

(23.0)

55.7

182.6

(76.2)

106.4

(224.1)

(102.9)

(220.6)

198.9

50.2

28.6

For the year ended September 30

2006

2005

2004

29.7

55.0

40.9

140.7

133.8

130.9

40.1

39.8

40.6

(6.2)

(22.6)

(2.8)

204.2

206.0

209.6

(153.9)

(174.2)

(124.4)

50.3

31.8

85.2

54.5

57.1

53.1

(37.1)

(1.7)

2.3

11.9

79.5

(78.6)

1.0

14.6

(37.0)

(21.4)

32.9

0.1

11.5

(23.8)

63.4

(79.5)

(16.1)

(96.7)

(64.8)

(177.6)

123.3

66.1

11.8

(11.8)

128.8

(58.0)

70.8

(32.7)

(65.0)

(26.9)

22.0

10.6

5.7

* Dilution gain of $16.7 million from the units issued to SNC-Lavalin realized during first quarter of 2007 has been treated as an extraordinary item.

Gaz Métro inc. – Page 12

Note:

All figures are in Canadian dollars unless otherwise noted.

Copyright © 2007, DBRS Limited, DBRS, Inc. and DBRS (Europe) Limited (collectively, DBRS). All rights reserved. The

information upon which DBRS ratings and reports are based is obtained by DBRS from sources believed by DBRS to be accurate

and reliable. DBRS does not perform any audit and does not independently verify the accuracy of the information provided to it.

DBRS ratings, reports and any other information provided by DBRS are provided “as is” and without warranty of any kind. DBRS

hereby disclaims any representation or warranty, express or implied, as to the accuracy, timeliness, completeness, merchantability,

fitness for any particular purpose or non-infringement of any of such information. In no event shall DBRS or its directors, officers,

employees, independent contractors, agents and representatives (collectively, DBRS Representatives) be liable (1) for any

inaccuracy, delay, interruption in service, error or omission or for any resulting damages or (2) for any direct, indirect, incidental,

special, compensatory or consequential damages with respect to any error (negligent or otherwise) or other circumstance or

contingency within or outside the control of DBRS or any DBRS Representatives in connection with or related to obtaining,

collecting, compiling, analyzing, interpreting, communicating, publishing or delivering any information. Ratings and other opinions

issued by DBRS are, and must be construed solely as, statements of opinion and not statements of fact as to credit worthiness or

recommendations to purchase, sell or hold any securities. DBRS receives compensation, ranging from US$1,000 to US$750,000 (or

the applicable currency equivalent) from issuers, insurers, guarantors and/or underwriters of debt securities for assigning ratings.

This publication may not be reproduced, retransmitted or distributed in any form without the prior written consent of DBRS.