Our greatest resOurce can be

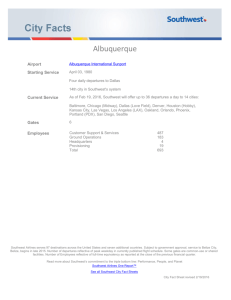

advertisement