Institutions as the Fundamental Cause of Long-Run Growth

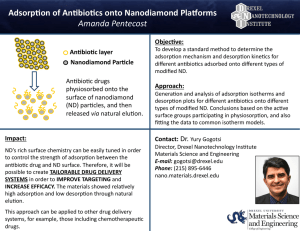

advertisement