WRITTEN EVIDENCE OF MICHAEL J. VILBERT The Brattle Group

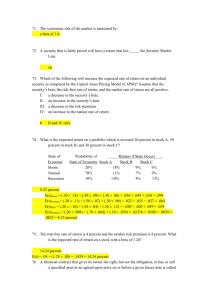

advertisement