Testimony of Dr. Ren Orans Theme 4 Imbalance Pricing

advertisement

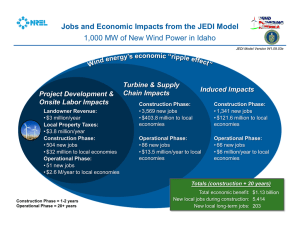

Energy Environmental Economics Testimony of Dr. Ren Orans Theme 4 Imbalance Pricing + Founder and Managing Partner of Energy and Environmental Economics, Inc. (E3) + Worked in Transmission Pricing, Cost of Service Ratemaking and Wholesale Market Design for more than 25 years • 20 peer reviewed published papers in these areas + Have testified many times as an expert on US and Canadian transmission pricing issues + Have worked on developing balancing energy services in the Canadian jurisdictions of Québec, Ontario and BC + Ph.D. and MS in Civil Engineering, BA in Economics • Dissertation: Area and Time-Specific Costing for Electric Utilities: A Case Study of Transmission and Distribution Costs Energy+Environmental Economics 2 * Key Questions and Issues Introduce by Mr. Marshall's Revised Testimony ,,, + Two key questions: 1. Is HQT's proposal compliant with the Régie's decision? 2. Is HQT's proposal compliant with FERC's guidelines? + To answer these questions, we need to consider three technical issues: 1. What market-based formula provides an implementable, opportunity-cost-based imbalance energy price? 2. Does the FERC default tiered pricing structure provide sufficiently strong incentives to prevent "leaning" on the system in Québec? 3. Is HQT's proposal consistent with other most comparable jurisdictions? Energy+Environmental Economics 3 Defining Opportunity Costs in ••ÿ Québec + HQ's "opportunity costs" are defined by the financial consequences of providing imbalance energy service + Opportunity costs are a function of: • Differences in market prices in neighboring jurisdictions • Applicable transmission and ancillary service costs • Time value of storage + Marshall's revised testimony introduces the following four scenarios that we must consider*: HQ Importing OverInjection Scenario #1 UnderInjection Scenario #3 HQ Exporting Scenario #4 Scenario #2 * Marshall's revised testimony, pp. 7-8 Energy+Environmental Economics 4 Scenario #1: HQ is importing and Generator A has a +10 MWh imbala^. Generator A injects 10 MWh more than scheduled [Over-Injection] $30/MWh HQ is importing from IESO at $30/MWh ISO-NE $80/MWh Instead of buying from Generator A, HQ could have bought energy from IESO at $30/MWh, which is HQ's contemporaneous opportunity cost to buy energy. Energy+Environmental Economics 5 Scenario #2: HQ is exporting and Generator A has a -10 MWh imbalance Generator A injects 10 MWh less than scheduled [Under-Injection] $30/MWh HQ is exporting to ISO-NE at $80/MWh ISO-NE $80/MWh Instead of selling to Generator A, HQ could have sold energy to ISONE at $80/MWh, which is HQ's contemporaneous opportunity cost to sell energy. Energy+Environmental Economics 6 Scenario #3: HQ is importing and Generator A has a -10 MWh imbalance Generator A injects 10 MWh less than scheduled [Under-Injection] $30/MWh HQ is importing from IESO at $30/MWh ISO-NE N. $80/MWh Instead of selling to Generator A, HQ could have sold energy to ISONE at $80/MWh, which is HQ's contemporaneous opportunity cost to sell energy. Energy+Environmental Economics 7 Scenario #4: HQ is exporting and Generator A has a +10 MWh imbala: Generator A injects 10 MWh more than scheduled [Over-Injection] $30/MWh HQ is exporting to ISO-NE at $80/MWh ISO-NE $80/MWh Instead of buying from Generator A, HQ could have bought energy from IESO at $30/MWh, which is HQ's contemporaneous opportunity cost to buy energy. Energy+Environmental Economics 8 Summary of Scenarios Introduced by Marshall's Proposal Scenario Scenario #1: HQ importing, over-injection Scenario #2: HQ exporting, underinjection Scenario #3: HQ importing, underinjection Scenario #4: HQ exporting, over-injection Opportunity Cost Minimum market price Minimum market price Maximum market price Maximum market price Maximum market price Maximum market price Minimum market price Minimum market price HQT Proposal • HQT's proposal relies on market prices and is based on HQ's contemporaneous opportunity cost • HQ's opportunity cost of buying and selling energy does not depend on whether it is a net importer or net exporter Energy+Environmental Economics 9 Using Empirical Data to Test Strength Penalties in Marshall's Proposal + Empirical results from Response to IR 7.1 from Régie • Assume HQ is a net exporter during high market price hours and a net importer during low load hours. • Under Marshall's proposal, a generator can profit by under-delivering in lowpriced hours and over-delivering in high-priced hours • Empirical analysis considered 12 possible "trades" per day: • • Marshall's proposal with no penalty allows 3,252 profitable trades during 2008 (75% of the 4,380 possible trades) • • Generator under-injects during 12 hours with lowest prices in any neighboring market (IESO, NYISO or ISO-NE) and over-injects during 12 hours with highest prices in any neighboring market Remaining hours unprofitable due to transmission & losses component of proposed imbalance energy rate 25% penalty in Band 3 of Marshall's proposal still allows 2,200 profitable trades during 2008 (50% of the 4,380 possible trades) Marshall's proposal encourages deviations during 50% of hours Energy-"Environmental Economics 10 Does Marshall's Proposal Consider Ti Value of Storage? Number of Intra-day Trades by Value Avg. Value of Intra-day Trades by Month 2,000 - 1,500 MEE Avg Diff 2,249 - Avg Buy - Avg Sel I 1,000 500 713 $0-$50 $50-$100 >$100 Fig. 1: Number of intra-day trades in three ranges of net profits (Chart presented in response to IR 7.1 from the Régie). Fig 2: This chart shows the same trades as Fig. 1, expressed as the average value for all intra-day trades in each month. • Marshall's proposal does not consider the intra-day arbitrage possibilities • Further measures are needed to provide fair compensation to the Service Provider and to discourage arbitrage Energy+Environmental Economics 11 Does HQT's Proposal Consider Time Value of Storage? Contemporaneous Intraday with Storage $140 -_ Avg Diff $SC - Avg Buy $60 - Avg $40 Sel Avg Diff - Avg Buy - Avg Sel I $20 • $0 _1 ^ 1 Month Fig. 1: Average value for all intra-day trades in each month (same chart as Slide 11). T 2 3 ;-^ T-^ 5 6 7 8 9 _ t-^ 10 11 12 Month Fig 2: Average value for same-hour trades in each month (HQT proposal without fixed maximum buy and minimum sell prices) HQT proposal includes the following necessary characteristics of opportunity cost: a) Market prices to represent contemporaneous value of energy b) Fixed minimum and maximum prices to represent time value of storage EnergyEnvironmental Economics 12 Other Similar Jurisdictions with Separate Buy and Sell Prices + BC Hydro - separate buy and sell price for Band 2 • Band 2: Imbalances beyond Band 1 threshold are settled at BC Hydro's separate hourly buy or sell prices + BPA - separate buy and sell price and storage value for Band 3 • Band 3: Imbalances beyond ±10 MW or 7.5% of the scheduled amount are settled at separate buy and sell prices: • For over-injections, 75% of BPA's lowest incremental cost that occurs that da Y • For under-injections, 125% of BPA's highest incremental cost that occurs that day • For persistent or intentional deviations: • For over-injections, no credit • For under-injections, maximum of 100 mills or 125% of highest daily incremental cost Energy+Environmental Economics 13 + Opportunity Costs • "The Régie considers that using a market price meets the objective of offering fair compensation to the service provider without opening the way to arbitrage by Transmission Provider customers." (Translation D-2009015, R-3669-2008, March 5, 2009, pg. 111) • "The Régie is of the opinion that the reference price must reflect hourly prices on neighbouring markets, adjusted for transmission costs." (Ibid.) Energy+Environmental Economics 14 FERC Guidelines + Opportunity costs: • "The determination and calculation of opportunity costs associated with providing imbalance service will vary based on the circumstances of the transmission provider... We will therefore continue to consider proposals to include recovery of legitimate and verifiable opportunity costs on a case-by-case basis consistent with Commission precedent." (FERC Order 890-A, pp.156-157) + Tiered structure: • "The Commission affirms the decision in Order No. 890 to adopt a tiered bandwidth approach for both energy and generation imbalances....Market structures in place within RTOs and ISOs are fundamentally different from those in non-RTO/ISO regions. In organized markets, system operators generally use a five minute dispatch with multiple suppliers of imbalance energy responding to system operator instructions...This is not the case outside of the organized markets and, therefore, other incentives must be provided to discourage deviations." (FERC Order 890-A, p. 136) Energy+Environmental Economics 15 + Three technical issues 1. Opportunity Costs: HQT proposal for balancing energy relies on a plausible definition of opportunity costs, whereas Marshall's proposal does not 2. Tiered Structure: The standard tiered structure used by FERC might need to be strengthened in Québec to prevent "leaning" on system if Marshall's proposal is adopted 3. Other Jurisdictions: Separate buy/sell prices and tiered penalties in HQT's proposal are consistent with other similar bilateral trading jurisdictions with large hydro systems + Two key questions 1. Régie Compliance: HQT's proposal is compliant with the Régie's requirements 2. FERC Compliance: Given 1 and 2 above, HQT's balancing energy proposal is consistent with FERC principles and falls into FERC "caseby-case" category Energy+Environmental Economics 16