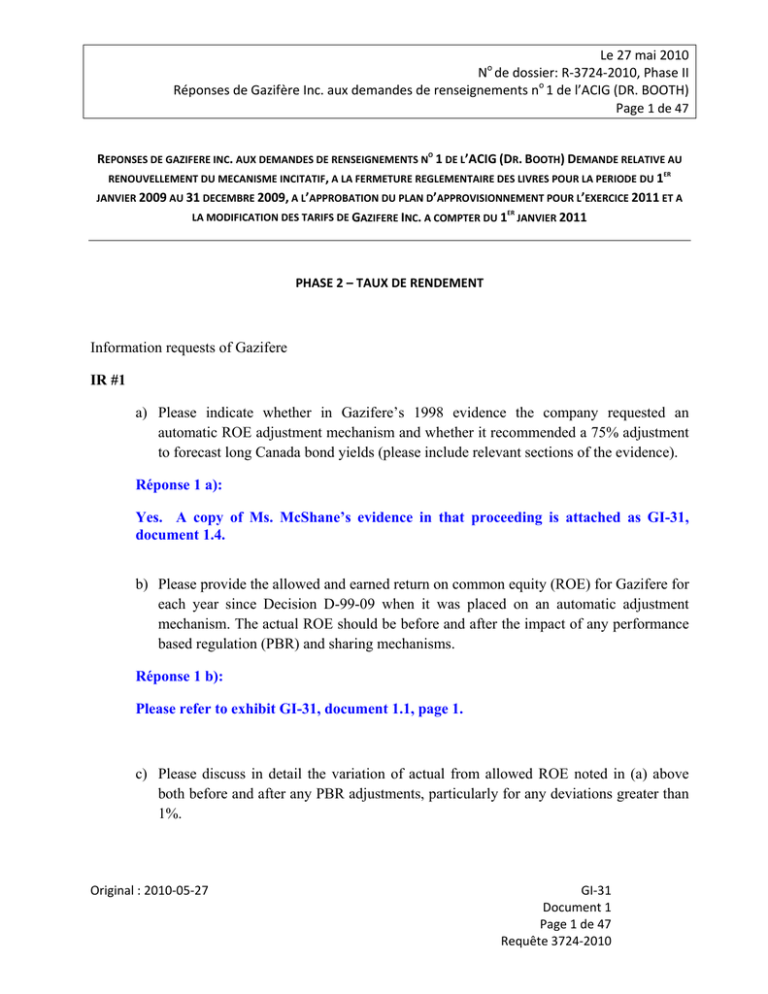

Le 27 mai 2010 N de dossier: R‐3724‐2010, Phase II Réponses de Gazifère Inc. aux demandes de renseignements n

advertisement