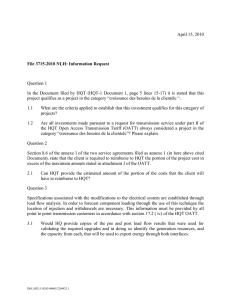

Hydro- Québec ANSWERS OF THE TRANSMISSION PROVIDER TO INTERROGATORY REQUESTS No 1

advertisement

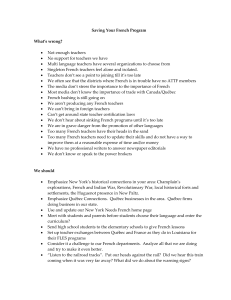

Hydro- Québec TransÉnergie Application R-3605-2006 ANSWERS OF THE TRANSMISSION PROVIDER TO INTERROGATORY REQUESTS No 1 OF OPTION CONSOMMATEURS (OC) Original : 2006-09-21 HQT-13, Document 8 Page 1 of 40 Hydro- Québec TransÉnergie Original : 2006-09-21 Application R-3605-2006 HQT-13, Document 8 Page 2 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Question #1 Reference: HQT-1, Document 1, page 6, lines 9-13 HQT-4, Document 2 Question: a) Please identify specifically (with reference to the relevant sections in HQT4, Document 2) what is HQT proposing to defer to the next rate application as a result of the changes in accounting principles. Is it just the impact on the cost of regulatory long-term debt as discussed on pages 20-21 of HQT4, Document 2? R1a) As indicated in Exhibit 4, Document 2, pages 15 to 22, it is elements of new accounting standards that potentially affect the cost of longterm debt. Such as: - The accounting of derivative instruments and the application of hedge accounting; - Long-term debt; - The hedging of sales: including interest on the hedging of sales. However, as indicated in Exhibit HQT-8, Document 1, page 11 and in Exhibit HQT-4, Document 2, pages 11 to 12, the re-classification of foreign exchange gains or losses related to elements in the sales hedging relationship has been applied since January 1, 2006, in accordance with the standards that are currently in effect. It was therefore reflected in the 2007 projection for the cost of debt, along with the other existing practices and standards. Question #2 Reference: HQT-1, Document 1, page 7, lines 5-8 (Table) Question: a) What was HQT’s actual return on equity (ROE) for the historic year 2005? Original : 2006-09-21 HQT-13, Document 8 Page 3 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 R2a) As shown in Exhibit HQT-5, Document 1, page 4, the Transmission Provider’s return on equity for 2005 is 10.32% b) What is HQT’s projected ROE for the base year 2006? R2b) As shown in Exhibit HQT-5, Document 1, page 4, the Transmission Provider’s projected return on equity for 2006 is 8.58%. Question #3 Reference: HQT-3, Document 1, page 7, lines 17-21 Question: a) Please indicate where in the 2005 Annual Report the results for the Régie’s performance indicators were presented. R3a) As indicated in Exhibit HQT-2, Document 11, the Transmission Provider presented the results for the 2005 performance indicators selected by the Régie in its 2005 annual report. Question #4 Reference: HQT-3, Document 1, page 10, Table 1 Question: a) Please provide the results for the same 23 performance indicators for 2003 and 2004. R4a) See Exhibit HQT-13, Document 1, answer to question 1.1 of the Régie’s interrogatory request. b) Based on current load forecasts and projected investments & financial results for 2006 and 2007, please provide the projected 2006 and 2007 results for: R4b) The three performance indicators related to net O&M costs, R4b) The two performance indicators related to cost of capital assets,and R4b) The two performance indicators related to the cost of service. Original : 2006-09-21 HQT-13, Document 8 Page 4 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 R4b) As shown in Exhibit HQT-3, Document 1, Annex 1, these subjects will be addressed in technical meetings with the Régie and intervenors which will take place at the end of September in the context of the, working group on the Transmission Provider’s performance regulation. Question #5 Reference: HQT-3, Document 1, page 12, Table 3 and page 13, lines 2-15 Question: a) With respect to the Continuity Index for Transmission Service, please provide the comparable results for the years 1990 to 2004 inclusive. R5a) The Transmission Provider reminds the intervenor that the current application covers the 2005 historic year, the 2006 base year and the 2007 projected test year. However, out of courtesy, the Transmission Provider provides the data for 2001 to 2004. CI-Transmission 2001 2002 2003 2004 0.50 0.55 0.44 0.45 b) With respect to the Continuity Index for Transmission Service, please identify the 5 events referred to on line 8. R5b) The Transmission Provider’s major events in 2005 which led to a service interruption to customers are: 1. On April 5, 2005, the air system for the 120 kV breakers at the Beaumont substation (Island of Montreal) was contaminated, which contributed to 0.06 on the CI. 2. On June 2, 2005, there was an automated load shedding (“télédélestage”) due to forest fires in the James Bay region, which contributed to 0.09 on the CI. Original : 2006-09-21 HQT-13, Document 8 Page 5 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 3. On June 17, 2005, there was an automated load shedding caused by an operating incident coupled with the malfunction of a line protection in the James Bay region, which contributed to 0.08 on the CI. 4. On December 21, 2005, a jumper broke down at the Bout-de-l’Ile substation (island of Montreal), which contributed to 0.10 on the CI. 5. On December 26, 2005 there was a galloping of overhead transmission lines caused by ice in the Montérégie region, which contributed to 0.05 on the CI. c) With respect to the Continuity Index for Transmission Service, please also indicate how many events of a similar magnitude occurred in each of the years 1990 to 2004 and what the effect of these events was in each year on the Continuity Index for Transmission Service. R5c) In the past, the Transmission Provider had major events that contributed to the Transmission-CI: • On January 17, 2001, a breaker broke down in the James Bay region, which contributed to 0.10 on the CI. • On March 21, 2002, violent winds in the Montérégie region contributed to 0.05 on the CI. • On July 5, 2002, there was a forest fire in the James Bay region, which contributed to 0.12 on the CI. • On October 11, 2003, there was a short-circuit on the transmission line caused by an airplane in the Laurentians, which contributed to 0.05 on the CI. • On July 5, 2004, an operating incident during the maintenance work for a line protection required an automatic load shedding in the James Bay region, which contributed to 0.09 on the CI. As for 1990 to 2000, the Transmission Provider reiterates the comments made in response to question 5a. d) Does energy receipt imbalance service apply to parties who are importing (i.e., where the point of receipt is one of HQT’s interconnection points)? If not, why not? Original : 2006-09-21 HQT-13, Document 8 Page 6 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 R5d) It is the Transmission Provider’s understanding that the current question does not apply to the reference indicated in question 5, but assumes that it deals with the Energy receipt imbalance ancillary service as described in Exhibit HQT-10, Document 1, page 18. The Transmission Provider proposes to apply the Energy receipt imbalance service to all receipts of point-to-point customers whose generation source is located within the Transmission Provider’s control area. In the case of receipts for which the source is located outside of the Transmission Provider’s control area, such as receipts coming from New Brunswick, New England, New York or Ontario, the provisions related to inadvertent energy are applied. Transmission service customers are therefore not directly implicated in such cases since they do not control the fluxes between neighbouring systems. Question #6 Reference: HQT-3, Document 1, page 12, Table 3 and page 13, lines 17-19 Question: a) With respect to the Reduction Rate for Point-to-Point Transactions, please explain more fully what this performance measure is based on and how it is calculated. R6a) This indicator measures, as a percentage, confirmed reductions in point-to-point transactions (import-export) with neighbouring networks, for which the reduction is attributable to the Transmission Provider’s responsibilities. The calculation method is the following: The sum of the reductions in MWh, divided by the energy total for the transactions in MWh, multiplied by 100. Question #7 Original : 2006-09-21 HQT-13, Document 8 Page 7 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Reference: HQT-3, Document 1, page 12, Table 3 and page 13, line 21- page 14, line 6 Question: a) With respect to the indicator of Quality of Partnership with the Distributor, does the determination of the performance measure involve soliciting input from HQD staff? If yes, please describe how this input is obtained and specifically address what measures, if any, are taken to ensure the confidentiality of the responses by individual HQD staff. R7a) As indicated in Exhibit HQT-3, Document 1, pages 13 and 14, the annual evaluation of the quality of the services rendered by the Transmission Provider is carried out together with the Distributor. However, since it entails the evaluation of certain criteria in designated spheres of activity, the data that is obtained is not the confidential data of the Distributor’s employees. Question #8 Reference: HQT-3, Document 1, page 12, Table 3 and page 14, lines 15-22 Question: b) With respect to the indicator of Employee Satisfaction, please describe what measures, if any, are taken to ensure the confidentiality of the responses by individual HQT staff. R8b) An external agency administrates the survey to ensure complete confidentiality of the results. Hydro-Quebec submits the list of employees to be surveyed to the surveying agency. A Personal Identification Number (PIN) derived from a random sequence and specific to the survey is attributed to each employee. The survey is placed and hosted on the agency’s server. The majority of employees are reached by e-mail, directly by the surveying agency. Employees that do not have access to a computer receive a paper questionnaire by internal mail, which they return directly to the surveying agency. Original : 2006-09-21 HQT-13, Document 8 Page 8 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 To ensure the confidentiality of employee’s responses, no reports are published for units with less than ten (10) respondents. Question #9 Reference: HQT-3, Document 1, page 12, Table 3 Question: a) With reference to the footnote in the Table, what were the Corporate objectives originally approved by the administration council for 2005? R9a) See the 2005 Corporate Objectives shown hereafter. Original : 2006-09-21 HQT-13, Document 8 Page 9 of 40 Hydro- Québec TransÉnergie Original : 2006-09-21 Application R-3605-2006 HQT-13, Document 8 Page 10 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 b) What was the total payout to employees based on the profit sharing and variable remuneration regimes and the 2005 actual results? R9b) As indicated in Exhibit HQT-6, Document 2, page 13, Table 6, the payout for profit-sharing schemes and for Performance Management Schemes totaled $11.93 million in 2005. Question #10 Reference: HQT-3, Document 1, page 16, Table 4 and page 17, Table 5 Question: a) Why were the threshold and target values for the Continuity Index increased for 2006? R10a) Regarding the Transmission Continuity Index, the Transmission Provider notes that the threshold and the target did not increase in 2006. In fact, the Transmission Provider set more ambitious objectives for 2006, based on the analysis of historical data. This was done in response to a request by the Régie and out of concern for improvement. Therefore, relative to the 2005 values, the 2006 objectives have decreased: the threshold went from 0.85 to 0.80 in 2006 and the target went from 0.65 to 0.60 in 2006. b) Please describe more fully the three priority actions associated with the Quality of Partnership with the Distributor index. R10b) For the year 2006, the three priority actions associated with the Quality of Partnership with the Distributor are the following: i. HQT-HQD Strategic and regulatory harmonization (“arrimage”) ii. Step-down voltage iii. Satellite posts Original : 2006-09-21 HQT-13, Document 8 Page 11 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 In terms of strategic and regulatory harmonization, the objective is the review the Transmission Provider’s ratemaking model, i.e. the main ratemaking mechanisms and regulatory principles applicable to the Transmission provider, in order to ensure that the native load bears the right proportion of transmission costs according to the different elements included in the Rates and Conditions, Investment Plans and in the Transmission Provider’s efficiency strategies. As for Step-down voltage, the objective that was agreed upon with the Distributor consists in implementing an action plan to ensure the contribution of step-down voltage on the system, within acceptable limits for voltage, as a means of managing the system. Finally, in regards to the satellite posts that supply the Distributor’s loads, it consists, on the one hand, of identifying solutions related to satellite posts for which excesses in capacity are expected between 2005 and 2010. It also consists of carrying out at least 85% of projected new developments prior to December 31, 2006. c) Why was the index related to Reduction Rate for Point-to-Point service transactions dropped for 2006? R10c) The objectives contribute to achieving the goals set out in HydroQuebec’s Strategic Plan and in the division’s business plan. The number of annual objectives that were selected is limited. d) Based on the projected financial result for 2006, please provide a schedule that calculates the projected value for the Benefit Index for 2006. Please indicate, with reference to the Application, the source of the various inputs used in the calculation. R10d) The table below shows, within Hydro-Quebec’s financial framework for approval of the business plan, the contribution of Hydro-Québec’s TransÉnergie division to the Benefit before financial charges, taxes and corporate charges (BAII) are applied. Original : 2006-09-21 HQT-13, Document 8 Page 12 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Benefit Prior to Financial Charges, Taxes and Corporate Charges Target 443.5 Net profit (excluding CRT) 1.9 Minus: Interest on loan – CRT Plus: Financial charges 767.4 Plus: Taxes 158.9 Plus: Corporate charges 35.3 BAII 1 403.2 e) When will the Corporate Performance Objectives for 2007 be established? R10e) The 2007 Corporate Performance Objectives of Hydro-Quebec’s TransÉnergie division will be established during the fall 2006 and they will be presented and approved by Hydro-Quebec’s administration council in December 2006. f) If the Corporate Performance Objectives for 2007 are established in time will they be filed as part of the current proceeding? R10f) Considering the time-frame indicated in response to question 10e regarding the establishment of 2007 Corporate Performance Objectives, the Transmission Provider does not believe that these Objectives will be available for filing within the schedule set by the Régie, by decisions D-2006-119 and D-2006-126, for the current application. g) The 2005 and 2006 Corporate Objectives both had unique Category A – Customer objectives. What “customer objectives” are being considered for 2007? R10g) See answer to question 10e. Original : 2006-09-21 HQT-13, Document 8 Page 13 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Question #11 Reference: HQT-4, Document 2, page 12, lines 3-26 and page 21, line 26 – page 22, line3 Hydro Québec’s 2005 Annual Report (http://www.hydroquebec.com/publications/en/annual_report/2005/ index.html) Question: a) Please confirm that the removing the hedging effect (per lines 17-20) does not impact on Hydro Québec’s overall corporate financial results in terms of reported net income. If it does, please explain why. R11a) The change in presentation stems from the accounting principle that seeks to present the effects of hedging instruments (gains and losses on the exchange rate for elements of the hedging of sales) through the hedged elements (products). The impacts of this presentation stem from the fact that the regulated units (Transmission and Distribution), bear approximately 50% of HydroQuebec’s financial charges while these same units do not bear risks related to the exchange rate for the company’s income in American dollars. These risks, related to the exchange rate, are borne by the Generator. Prior to re-classification, through the cost of debt, the regulated units assumed approximately 50% of the gains or losses in the exchange rate related to the Generator’s hedging of sales strategy, set by Hydro-Quebec, without having to bear the effects of compensation on their income. As for Hydro-Quebec, it was deprived of half of the compensation effects related to its hedging strategy, to which it was entitled, all the while continuing to bear 100% of the risks related to the exchange rate on the Generator’s sales. The exchange rate is a very volatile economic variable and, depending on its level, the regulated units and the shareholder can Original : 2006-09-21 HQT-13, Document 8 Page 14 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 either be advantaged or disadvantaged when the cost of debt is influenced by the effects of the exchange rate on certain elements of the hedging of sales. The Transmission Provider and the Distributor have already raised the issue of applying a cost of debt that includes a significant exposure to the risks in the exchange rate, while they are not exposed to the effects of compensation on their income. Therefore, on an isolated basis, these two units would not have maintained significant exposure to the risks of the exchange rate on their debt. As indicated in Exhibit HQT-13, Document 1, answer to question 17.2 of interrogatory requests no.1 of the Régie, after re-classification, the projected cost of debt for 2007 is practically no longer sensitive to the exchange rate. b) The Application states that the hedging effect is reclassified to the Products line-item in the Financial Statements. Hydro Québec’s 2005 Financial Statements do not appear to include a specific line item entitled “Products”. Please indicate, with reference to the 2005 Financial Statements, which specific line items in the Financial Statements will be impacted by the reclassification of the effect of hedging sales in American dollars with debts and swaps. R11b) In the consolidated statement for the results of Hydro-Quebec’s 2005 Annual Report, on page 69, the line-item “Products” in French is labelled “Revenue” in English. c) Does removing the hedging effect from the financial costs impact on the cost of debt for HQT in 2006 and 2007, as presented in the Application? If no, please explain why not. If yes, please indicate what the anticipated impact is for 2006 and 2007. R11c) The re-classification of the gains and losses in the exchange rate have an impact on the projected costs of debt for 2006 and 2007. Without this re-classification, and in accordance with the exchange Original : 2006-09-21 HQT-13, Document 8 Page 15 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 rates selected for the projection, the cost of debt would have continued to decrease following the gains associated with the sales hedging strategy; gains that should normally have been entirely assigned to compensating the unfavourable effects of the foreign currency on the Generator’s sales. The impact on the cost of debt of not reclassifying the gains and losses of the exchange rate, is presented in Exhibit HQT-8, Document 1, annex 10. d) Is the offsetting impact of reclassifying the impact of the hedging effect also captured in the HQT costs presented in the Application? If so, please explain how and where the offset occurs. R11d) As indicated in response to question 11 a) above, the cost of debt is the only element of the Transmission Provider’s financial framework that is affected by the re-classification. Indeed, the Transmission Provider does not have income in American dollars. e) Does this change in cost classification impact at all on the overall revenue requirement requested by HQT for 2007. If no, please explain why. If yes, please indicate the magnitude of the impact and explain how the impact was calculated. R11e) See answers to questions 11 c and 11 d. Without re-classification, the Transmission Provider’s revenue requirement in 2007 would have dropped by $63 million to the detriment of Hydro-Quebec as a whole, since the risk of the exchange rate on income is entirely assumed by the Generator. Hydro-Quebec would therefore have been deprived of a $63 million part of profits resulting from its sales hedging strategy in American dollars. Finally, the Transmission Provider notes that the amount in question is the product of three terms: Original : 2006-09-21 HQT-13, Document 8 Page 16 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 • The 0.59% variance between the cost of debt with and without re-classification; • The presumed proportion of the debt of 70%; and • The Transmission Provider’s rate base of $15 302 million. Question #12 Reference: HQT-4, Document 2, page 13 Question: a) Please confirm that the change in what falls under the Scope of Chapter 3065 of the CICA Manual has no effect on HQT’s overall revenue requirement for 2007. R12a) The Transmission Provider confirms that, pursuant to the agreements that are currently in effect, following the entry into force of CPN-150 on January 1, 2005, changes made to the application area of Chapter 3065 do not affect the revenue requirements for 2005, 2006 and 2007. b) If this is not the case, please explain why and provide a schedule that sets out the calculation of the impact. R12 b) Non applicable Original : 2006-09-21 HQT-13, Document 8 Page 17 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Question #13 Reference: HQT-4, Document 2, pages 15-21 Question: a) Do the changes in accounting norms for financial instruments (as discussed in section (a), pages 15-21) have any impact on HQT’s overall revenue requirement requested for 2007? If yes, please explain why and provide a schedule that sets out the calculation of the impact. R13a) The impact of the new accounting norms presented in Exhibit HQT4, Document 2, pages 15 to 22 is not taken into account in the evaluation of the projected cost of debt for 2007. Question #14 Reference: HQT-6, Document 2, page 6, lines 9-15 Question: a) The identified causes account for $16.3 M of the $19.8 M increase in base salaries. Please explain what the reasons were for the remaining $2.5 M increase. R14a) The residual increase of $2.5 million for the base salaries of the Transmission Provider’s employees stem from elements of minor importance such as legal obligations. Question #15 Reference: HQT-6, Document 2, page 6, Table 2 and page 7, lines 5-8 HQT-3, Document 1, page 12, Table 3 Question: a) Are the two variable remuneration schemes referred to HQT-6, Document 2 (i.e., régime de gestion de la performance and regime d’intéressement) the same schemes as those referred to in Table 3 of HQT-3, Document 1 (i.e., regime d’intéressement et de remuneration variable)? If not, please explain the differences and provide the 2005 and 2006 costs for the schemes referenced in Table 3. Original : 2006-09-21 HQT-13, Document 8 Page 18 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 R 15a) They are the same remuneration schemes. b) Please provide an explanation as to what is included in the “Other” category under Bonuses and Other Revenues in Table 2, HQT-6, Document 2 (i.e., the $12.1 M in 2007). R15b) The “Other” category in Table 2 includes all of the compensation given to employees for specific, difficult or constraining work conditions. For example, it includes bonuses for shift work (“quart de travail”), isolated post allowances (“primes d’éloignement”), bonuses for work management or for the replacement of higher-level employees, as well bonuses for work in emergency conditions. Question #16 Reference: HQT-6, Document 2, page 7, lines 21-26 Question: a) Please provide further details regarding the requirement for HQT to temporarily pay part of the group insurance costs (e.g., why is HQT required to pay, how much is the payment for 2007, how long will HQT be required to pay)? R16a) As shown in Table 14, page 21 of the document cited in the reference, the temporary requirement to pay part of the group insurance costs covered the years 2004, 2005 and 2006. Therefore, there are no costs related to this measure for 2007. The Table also shows that improvements to the Benefit Schemes are the result of negotiations that led to the renewal of collective bargaining agreements in 2003 (for 2004 and beyond) for all unionized personnel. Original : 2006-09-21 HQT-13, Document 8 Page 19 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Question #17 Reference: HQT-6, Document 2, page 8, Table 3 HQT-2, Document 1, First Chart Question: a) Please provide a schedule that, for the years 2005 and 2007, breaks down HQT’s workforce (i.e., FTEs) by organizational unit. For purposes of the response please provide the breakdown according to the 15 organizational units shown for HQT in the first chart of HQT-2, Document 1. R17a) The following Table provides the requested information. Original : 2006-09-21 HQT-13, Document 8 Page 20 of 40 Hydro- Québec TransÉnergie Administrative unit Application R-3605-2006 Annual full-time equivalents (FTE) Historic year Base year Test year (actual data) (projected data) 2005 Total 2006 2007 3 373 3 437 Hydro-Quebec TransÉnergie Presidency 2 5 Vice-presidency, Operation of installations 1 3 Regional Management- Saguenay Lac-Saint-Jean and TransmissionNorth 427 429 Management - Transmission–South 622 618 Management - Transmission–East 572 577 Management – Transmission–West 584 618 Management - Remote Management 452 438 24 33 Management - Control of Energy Movements 164 174 Management - Planning of Assets 126 126 Management – Transmission Service Technical Support Expertise 227 233 15 22 117 120 39 41 Management – Business Plans and Strategies Management – Marketing and Regulatory Affairs Management – Human Resources Control Bureau 3 462 b) For each of the 15 organizational units please indicate the reasons for the change in workforce levels between 2005 and 2007. In doing so, please distinguish between changes that were due to transfer of responsibilities and staff from one business unit to another versus increases in total staff levels. Original : 2006-09-21 HQT-13, Document 8 Page 21 of 40 Hydro- Québec TransÉnergie R17b) Application R-3605-2006 The details of the deployment of the level of full-time equivalents (FTE), by administrative unit, that are planned for 2007, will be known at the end of the annual business planning cycle. The Transmission Provider notes, however, that the projected increase, between 2006 and 2007, of 25 temporary FTE, comprised of 12 temporary “Trades” FTE and 13 temporary “Technicians” FTE, will be divided between the four managers of the vice-presidency - Operation of Installations, in accordance with the requirements needed to carry out several investment projects. For the 2005-2006 period, variations in the level of FTE basically stem from an increase in the workload due to the undertaking of investments projects and preparation and employee training needs: • Hydro-Quebec TransÉnergie Presidency (+3): temporary creation of the management –Special Projects unit; • Management – Transmission West (+34): increase in personnel to catch up on maintenance and investment projects; • Management – Transmission East (+5): increase in personnel due to investment projects; • Management – Business Plans and Strategies (+10): the Management of Business Plans and Strategies organization was completed in 2006 with the implementation of 10 FTE; • Management – Control of energy movements (+10): Increase in maintenance needs and improving the security of control systems in order to ensure HQT’s compliance with NERC standards; Original : 2006-09-21 HQT-13, Document 8 Page 22 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 • Management – Planning of assets (0) transfer of 7 FTE towards Management – Marketing and Regulatory Affairs. The increase in 7 FTE was due to investment projects and the preparation of employees; • Management – Transmission Service Technical Support Expertise (+6): Increase of employees due to the preparation of employees (transfer of expertise); • Management – Marketing and Regulatory Affairs (+7): Transfer of 7 FTE coming from the Management – Planning of Assets; • Management – Human Resources (+3): Increase in personnel due to investment projects (increase of security training for entrepreneurs.) Question #18 Reference: HQT-6, Document 2, page 9, line 13 to page 10, line 17 Question: a) With respect to the Performance Management scheme, for each of the years 2005 to 2007 how much of the total payment shown in Table 6 is contingent upon achievement of the “financial trigger”? R18a) Having achieved the financial trigger in 2005 and assuming that it will be in 2006 and 2007, as shown in Table 6 of the document cited in the reference, the amounts paid out by virtue of the Performance Management Scheme for the Business Results component were $1.07 million in 2005, and should be $0.93 million in 2006 and $0.95 million in 2007. Original : 2006-09-21 HQT-13, Document 8 Page 23 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 b) With respect to the Performance Management scheme, for each of the years 2005 to 2007, how much of the payment which was contingent on achieving the financial trigger (per response to part (a)) is directly related to attaining the objectives of the shareholder? R18b) By approving Hydro-Quebec’s Strategic Plan, the shareholder expects Hydro-Quebec to achieve a certain profit level. The financial trigger approved by the Administration Council is directly based on this profit level. Question #19 Reference: HQT-6, Document 2, page 10, line 19 to page 11, line 12 Question: a) The Application states that as of January 1, 2007, the amount that can be paid to specialists is dependent upon the business results of the employee’s division. Please indicate whether the reference to business results is just the financial results of the employee’s division or whether the business results would include other performance measures as well. R19a) As explained in Exhibit HQT-6, Document 2, page 24, section 2.4.1, lines 7 to 14, the business results of each division or unit are comprised of three types of objectives to be met: those related to customers, those related to employees, and those related to shareholders. b) With respect to the Profit Sharing scheme, for each of the years 2005 to 2007 please indicate how much of the total payment was due to the payment of an additional bonus of 1.5% related to the attainment of the net profit targeted by Hydro-Québec. R19b) As shown in Table 6 of the document cited in the reference, the payout related to the financial trigger in virtue of the profit-sharing scheme amounted to $2.32 million in 2005 and should be set at $2.37million in 2006 and 2.42 million in 2007. Original : 2006-09-21 HQT-13, Document 8 Page 24 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 c) With respect to the additional 1.5% bonus, please confirm that the financial trigger is based on the profit of Hydro-Québec overall and not linked to HQT’s profit levels. R19c) Indeed, the financial trigger is based on the net profit of HydroQuebec as a whole. Question #20 Reference: HQT-6, Document 2, page 19, lines 5-7 Question: a) Does HQT use any external information sources or consultants to assess the competitiveness/reasonableness of its employees’ salaries on an annual basis? If not why not? If yes, please provide the most recent results of any such comparisons or analyses. R20a) The labour market evaluation carried out in 2003 remains the primary source of information on the salary positions of Hydro-Quebec employees. Two main sources of information are used by Hydro-Quebec to verify the competitive position of employee compensation for different posts. On the one hand, specialized consulting firms offering services in Human Resources have databanks from which salary information for different posts can be extracted. On the other hand, certain businesses carry out their own labour market evaluations or outsource them to consultants in Human Resources. When a business is invited to participate and it agrees to participate, it is good business practice to provide it with the results of the study. Hydro-Quebec also consults other studies, such as the study on direct employee compensation for engineers, carried out by the Ordre des ingénieurs du Québec, or inquiries carried out by the Canadian Institute for Chartered Accountants among its members. The results of these inquiries can be obtained from each of these Original : 2006-09-21 HQT-13, Document 8 Page 25 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 organizations. In addition, the Institut de la statistique du Québec, releases, on an annual basis, the Comparison of the State and Evolution of Compensation for Salaried Employees (“Rémunération des salaries - État et évolution comparés”), which can be obtained from Les Publications du Québec. Question #21 Reference: HQT-6, Document 3, page 7, lines 15-16 Question: a) Please provide more details regarding the $7 M expenditures planned for 2007 for applications to the transmission networks automation equipment (e.g., what is the work involved, why is it required, etc.). R21a) The budgeted amount of $7 million in 2007 is attributable to additions and modifications to the system automation equipment known as Rejection of Generation and Automated Load Shedding (RPTC) (“Rejet de Production et Télédélestage de Charge”). This sum will allow for activities to be carried out for twenty posts on the Transmission Provider’s main system as well as the Churchill Falls installations. There will be two types of activities: logistic and material. RPTC automation equipment is important to the reliability of the transmission system. One major component to which this sum can be attributed seeks to make the maintenance of the RPTC automation equipment more secure, by reducing the probability of human error. The other component is to add functionalities that will allow this automation equipment to respond better to multiple transit conditions on the system with the aim of reducing the number of unnecessary operations of the automation equipment. Question #22 Original : 2006-09-21 HQT-13, Document 8 Page 26 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Reference: HQT-6, Document 3, page 9, Table 2 Question: a) The actual costs of the shared services provided by the Technology Group increased by 5.5% from 2005 to 2007. However, the “return” component of the total charges increased by 68%. Please explain the significant increase in the “return” component of the charges from the Technology Group. R22a) At the time of setting the adjustment on the return, the financial charges from the rate grids were reduced and replaced with regulated financial charges in accordance with the rate of the Transmission Provider’s average weighted cost of capital. The financial charges included in the 2007 rate grid for the provider of this service ($37.9 million) are inferior by $9.7 million compared to regulated financial charges ($47.6 million). This variance has an impact on the upward adjustment of the return. It is relevant to note that there was practically no variance between both in previous years. Question #23 Reference: HQT-6, Document 3, page 11, Table 3 Question: a) The actual costs of the services provided by the Shared Services Centre increased by 7.5% from 2005 to 2007. However, the “return” component of the total charges increased by 52%. Please explain the significant increase in the “return” component of the charges from the Shared Services Centre. R23a) This increase is primarily explained by an increase in the share of assets attributable to the Transmission Provider. Question #24 Reference: HQT-6, Document 6, page 4, Table 1 and page 4, lines 7-12 and 1317 Question: Original : 2006-09-21 HQT-13, Document 8 Page 27 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 a) How much was the 2006 insurance premium refund referred to in lines 11 to 13 of HQT-6, Document 6? R24a) The non-recurrent insurance premium refund received by the Finance Group in the course of 2006 was of $2 million. b) Is this insurance refund reflected in the 2006 costs reported in Table 1 for 2006? R24b) This insurance refund was reflected in the 2006 corporate charges shown in table 1 of the reference. c) The Application suggests that most of the increase for 2006 was due to higher payroll costs as a result of pension cost increases. Year 2006 total salary increases for HQT attributable to pension costs were roughly 6.4% of 2005 total salary costs (per HQT-6, Document 2, Table 2). Similarly, the increase in total Corporate costs in 2006 due to pension costs is 6.1% (i.e., 6.6/108.9). Please explain more fully the 140% increase in total corporate Human Resource costs between 2005 and 2006 (i.e., $2 M to 4.8 M). R24c) The differential is mainly due to the fact that actual corporate charges for Human Resources in 2005 led to a favourable variance compared with the level of the original 2005 budget. In 2006, the projection took into account the level of the original 2005 budget. Question #25 Reference: HQT-7, Document 1, page 23, lines 4-5 and page 25, lines 6-11 Question: a) Please explain more fully the reason for the increase between the approved and the actual inventory levels for 2005 (e.g., how were the returned materials from suspended projects and from surpluses at the end of projects treated prior to 2004?). R25a) See Exhibit HQT-13, Document 1, answer to question 14.1 of the interrogatory request no.1 of the Régie. Question #26 Original : 2006-09-21 HQT-13, Document 8 Page 28 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Reference: HQT-9, Document 1, page 9, lines 4-17 Question: a) When are the standards being developed by the new ERO likely to come into play? R26a) On July 20, 2006, the NERC officially achieved ERO status. The application of the new structure is set for January 1, 2007. In the midst of the restructuring of the electricity industry, the NERC’s reliability standards, either existing or those currently being evaluated, continue to be applicable. The important upcoming change deals mainly with choosing the standards that must necessarily be respected and for which financial sanctions will be applied in case of non-conformity. For many of these standards, it is likely that this change will take place in 2007. b) Is there any indication as to whether the standards that the ERO will develop will be stricter than those currently established by NERC and the NPCC? If yes, please discuss what the impact will be on HQT. R26b) The primary objective of the ERO is to apply compulsory, but not necessarily superior, reliability standards and to associate these standards to financial sanctions in the case of non-conformity. Essentially, the ERO standards are the same as NERC and NPCC standards. c) Could new (stricter) standards by the ERO impact at all on HQT’s revenue requirement? R26c) The new compulsory standards enacted by the ERO will have to be applied by all systems in North America. Only when these compulsory standards are known will the Transmission Provider be able to evaluate Original : 2006-09-21 whether investments are required on the HQT-13, Document 8 Page 29 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 transmission system to ensure conformity and obtain the required approval by the Régie. d) If the response to (c) is yes, has any allowance for such impacts been included in HQT’s proposed 2007 revenue requirement? If yes, please indicate the dollar value, where it has been included and the assumptions on which the value was based. R26d) See answer to question 26c. Question #27 Reference: HQT-9, Document 1, page 14, Tables 2 & 3 HQT-9, Document 1, page 15, Table 5 Question: a) Please explain the basis for the significant increase in long term point-topoint service requirements starting in 2008 (per Table 5). R27a) See Exhibit HQT-13, Document 12, answer to question 14.4 of UC. b) Does the significant increase in long-term point-to-point service requirements in 2008 trigger the need for any of the investments reported in Table 2? If yes, please identify the projects and the associated expenditures by year. R27b) Indeed. These are primarily investments required for the interconnection with Ontario. Exhibit HQT-9, Document 1, Table 1 shows the investments by year for this project. c) If the response to (b) is yes, are any of these expenditures being paid for by the “new” long-term point-to-point customers? If so, how much is being contributed by these customers? If not, why not? R27c) The Transmission Provider notes that 100% of these expenditures will be covered by revenues from point-to-point transmission services. d) Are any of the new assets reported in in-service in 2006 or 2007 (per Table 5) the result of expenditures to accommodate the increase in long-term Original : 2006-09-21 HQT-13, Document 8 Page 30 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 point-to-point sales in 2008? If so, please estimate the values and the impact on the 2007 Rate Base. R27d) The Transmission Provider does not expect projects to be put in service in 2006 and 2007 for which long-term point-to-point sales of the transmission service would have been concluded in 2008. Question #28 Reference: HQT-10, Document 1, pages 12-16 HQT-12, Document 1, page 15, lines 23-26 Question: a) Please confirm that with the exception of System Control Service, the revenues collected by HQT for Ancillary Services are all remitted to 3rd party suppliers of the services (e.g. Hydro Quebec Production) and that HQT neither gains revenue nor is out of pocket due to offering these services. If this is not the case, please explain. R28a) The intervenor’s interpretation is accurate. Question #29 Reference: HQT-10, Document 1, page 15, Table 1 Question: a) Please provide a table similar to Table 1, but setting out HQT’s proposed application of Ancillary Services per its 2005 Rate Application (R-35492004, Phase 2). R29a) Table 1 of Exhibit HQT-10, Document 1, page 15 of 22 describes the application areas of ancillary services that are applicable to point-topoint transmission services, as approved by the Régie in decision D2006-66, which results from the Transmission Provider’s rate application R-3549-2004 Phase 2. Moreover, in its decision D-2006126, rendered on August 18, 2006, the Régie found that the applicability of voltage control and maintenance of spinning and nonOriginal : 2006-09-21 HQT-13, Document 8 Page 31 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 spinning reserve ancillary services were not included among the subjects to be discussed in the current application. As for the energy receipt imbalance ancillary service, in Exhibit HQT-10, Document 1, page 18 of 22, the Transmission Provider proposes to apply this service to all receipts for which the source is located in the Transmission Provider’s control area. Question #30 Reference: HQT-10, Document 2, page 5, Table 1; page 6, lines 19-20; and page 7, lines 5-12 Question: a) Please replicate Table 1 and include a column setting out the 2005 projected requirements for each service as presented in HQT’s 2005 Rate Application. R30a) See Exhibit HQT-13, Document 1, answer to question 23.1 of Interrogatory Requests no.1 of the Régie. b) Please replicate Table 1 expressing all of the requirements in GWh so as to reconcile with the values reported on page 7. R30b) See Exhibit HQT-13, Document 12, answer to question 19.2 of Interrogatory Request no.1 of UC. c) Please explain what is unique about the 2006 use of Monthly Point to Point service that HQT does not expect the service to be used at all in 2007. R30c) See Exhibit HQT-13, Document 1, answer to question 23.2 of Interrogatory Requests no.1 of the Régie. d) For the years 2005, 2006 and 2007 and for each of the Short Term Point to Point services, please breakdown the values in Table 1 into the following components: a. Service where the point of generation is in HQT’s control area but the load destination is not, b. Service where the load destination is in HQT’s control area but the generation is not, Original : 2006-09-21 HQT-13, Document 8 Page 32 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 c. Service where neither the generation nor the load destination are in HQT’s control area, and d. Service where both the generation and the load destination are in HQT’s control area. In preparing the response please clarify whether generators such as Brascan that are located in Quebec are considered to be within HQT’s system when they are either a point of delivery or a point of receipt. R30d) a. The following Table shows the requested data for the year 2005. However, the Transmission Provider does not have data to this effect for 2006 and 2007. Power in MW 2005 Actual Monthly Point-to-Point (MW) 0 Weekly Point-to-Point (MW) 164 Daily Point-to-Point (MW) 13 679 Hourly Point-to-Point (TWh) b. No reservations for point-to-point 9.8 transmission services corresponded to this scenario for 2005. Moreover, the Transmission Provider does not have data to this effect for 2006 and 2007. c. The following Table shows the requested data for the year 2005. However, the Transmission Provider does not have data to this effect for 2006 and 2007. Power in MW d. No 2005 Actual Monthly Point-to-Point (MW) 72 Weekly Point-to-Point (MW) 219 Daily Point-to-Point (MW) 495 Hourly Point-to-Point (TWh) 0.1 reservations for point-to-point transmission services corresponded to this scenario for 2005. Moreover, the Transmission Provider does not have data to this effect for 2006 and 2007. Original : 2006-09-21 HQT-13, Document 8 Page 33 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Question #31 Reference: HQT-11, Document 1, page 6, Table 1 and page 7, lines 20-23 Question: a) Please provide a schedule similar to Table 1, but instead of calculating the cost of service allocation based on the 13 monthly balances use the average of opening (i.e., December 31st, 2006) and closing (i.e., December 31st, 2007) balances for the rate year. R31a) The following Table shows the 2007 cost allocation according to the average balance on December 31, 2006 and the average balance on December 31, 2007 as well as according to the actual balance on December 31, 2007. It can be noted that according to these approaches, the amounts of the allocation by transmission service, between native load and point-to-point, are fundamentally the same. Original : 2006-09-21 HQT-13, Document 8 Page 34 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 Functions 2007 According to the average balance on Dec. 31, 2006 and the average on Dec. 31, 2007 Native load PointtoPoint Total 2007 According to the Balance on December 31 Native load PointtoPoint Total Connection of generating stations (Generation step-up): Step-up substations Connection lines 230.6 51.4 3.3 0.7 233.9 52.2 233.1 50.6 3.4 0.7 236.5 51.3 Network: Extra high voltage-Mtl-Qc and Mtl surrounding area Extra high voltage-others 450 kV High voltage 346.2 850.9 112.1 492.8 4.6 12.3 1.6 6.6 350.8 863.2 113.7 499.3 350.9 841.0 110.1 501.6 4.7 12.2 1.6 6.7 355.6 853.2 111.7 508.3 407.2 57.3 0.0 0.0 407.2 57.3 406.2 56.9 0.0 0.0 406.2 56.9 23.0 126.8 0.3 1,8 23.4 128.7 22.8 125.1 0.3 1,8 23.1 129.6 2 698.3 31.4 2 729.7 2 698.3 31.4 2 729.7 Customer connections (Subtransmission plant): Step-down stations Connection of high-voltage customers Interconnections: Churchill Falls Others Total b) Please comment on the relative complexity and resources involved in performing the calculation based on the average of the opening and closing annual balances as opposed to the year end balance. R31b) The Transmission Provider comments as follows on the three approaches according to which it determined the cost-of-service allocation for 2007, for which the comparative application required a significant amount of effort. • As detailed in Exhibit HQT-11, Document 1, page 9, using the average of 13 monthly balances to follow-up on Régie decision D-2006-66 involved a significant amount of time and effort, namely as a result of the activities required outside the accounting system for a very large quantity of data. In this sense, here the level of complexity reaches its peak. Original : 2006-09-21 HQT-13, Document 8 Page 35 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 • An allocation by function on the basis of the average of assets on December 31, 2006 and December 31, 2007, allows the Transmission Provider to complete the cost-of-service allocation in a lesser amount of time than required to calculate the average of 13 monthly balances. Basically, it consists of dealing with information on the basis of 2 balances rather than 13 balances. However, even if this approach reduces the amount of work required outside of the accounting system, the level of complexity remains high since the average is determined by comparing the information for each of the two balances. • As for an allocation based on the balance on December 31, 2007, the Transmission Provider maintains the opinion that this approach is the most efficient, all the while ensuring a high level of precision, and that it would be justified to select it for the cost-of service allocation. Finally, it can be noted that the amounts of the allocation by transmission service for the three aforementioned approaches are comparable. Question #32 Reference: HQT-11, Document 1, page 11, lines 6-10 HQT-11, Document 2, page 21, Table 7 Question: a) Please provide a schedule that sets out the data used and the calculation of HQT’s 60% load factor. R32a) In compliance with decision D-2006-66, page 16, the load factor for 2007 is determined from the total energy and coincident peak, including Churchill Falls. Load factor Original : 2006-09-21 = Annual energy / coincident peak / 8760 hours HQT-13, Document 8 Page 36 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 = 190 624 GWh 36, 341 GW / 8760 hours = 60% b) Please also provide a schedule that sets out for native load and point-topoint service the demand and energy values used to determine the allocation of demand and energy costs in Table 7. R32b) The energy and power components used to determine the 2007 costof-service allocation are shown in the table below. TABLE KEY: Column 1: FUNCTIONS; Connection of Generating Stations (Generation step-up); Step-Up Substations; Connection Lines; System; Extra High Voltage-Mtl-Qc and Mtl Surrounding Area; Extra High Voltage-Other; 450 kV; High Voltage; Customer Connections; Step-Down Stations; Connection of High-Voltage Customers; Interconnections; Churchill Falls; Others; Total. Column 2: COST OF SERVICE BY FUNCTION; Column 3: ENERGY; Column 4: POWER Column 5: ALLOCATION FACTOR (A) Allocation factor ordered by the Régie and which is based on the system’s load factor (B) Allocation factor ordered by the Régie which allocates 100% in power (C) Energy Portion including Churchill Falls: Native load 187758 GWh, LT Point-to-Point service = 2865 GWH. Power Portion including Churchill Falls: Native load 35862 MW, LT Point-to-Point service = 479 MW. (D) Direct allocation to the native load Question #33 Reference: HQT-12, Document 1, pages 18 (Table 8), 22 (Table 12) and 23 (Table 13) Régie Decision D-2006-66, page 30 Question: Original : 2006-09-21 HQT-13, Document 8 Page 37 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 a) Please confirm that in its D-2006-66 the Régie did not approve a methodology for setting the rates for voltage control service, maintenance of spinning reserves and the maintenance of non-spinning reserves but, rather, simply maintained the existing rates. R33a) In its Decision D-2006-66, page 30, the Régie indicates the following regarding the Voltage Control, Maintenance of Spinning Reserves and Maintenance of Non-Spinning Reserves ancillary services: “ When additional ancillary services will be required, beyond those acquired by the Distributor pursuant to the order, then the factual and juridical situation presented to the Régie will justify a review of the methodology.” (HQT’s emphasis) The Transmission Provider understands that the existing rate-setting method, which is in effect since 2001, is upheld. Consequently, the Transmission Provider set the rates for ancillary services according to this method for the aforementioned ancillary services for 2007. The Transmission Provider believes that its proposal fully reflects the terms of decision D-2006-66, and notes that the rates it proposes are slightly inferior to existing rates. b) Please confirm that in the calculation of the proposed rates for voltage control, maintenance of spinning reserves and maintenance of nonspinning reserves: 1. The costs used in the numerator of each calculation are the 2001 costs presented in HQT’s first application (R-3401-1998) 2. The loads used in the denominator are the forecast 2007 requirements. R33b) The rate-setting method for Voltage Control, Operating Reserve Maintenance of Spinning Reserves and Maintenance of Non-Spinning Reserves ancillary services, as well as the corresponding transmission services, are presented in detail in Exhibit HQT-12, Document 1, Tables 8, 12 and 13. See also HQT-13, Document 1, answer to question 25.1 of interrogatory requests no.1 of the Régie. Original : 2006-09-21 HQT-13, Document 8 Page 38 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 c) Please explain why the approach used by HQT for establishing the rates for these three ancillary services is considered appropriate and consistent with D-2006-66. R33c) See answer to question 33a. d) Please explain why simply maintaining the rates for these services at their current levels would not be more consistent with D-2006-66. R33d) See answer to question 33a. Question #34 Reference: HQT-12, Document 1, pages 18-19 Question: a) Please confirm that in the calculation of the proposed rates for frequency controls and maintenance of non-spinning reserves: 1. The costs used in the numerator are the 2005 costs presented in HQT’s second application (R-3549-2004, Phase 2) 2. The loads used in the denominator are forecast 2007 requirements. R34a) The rate-setting method for Voltage Control, Operating Reserve Maintenance of Spinning Reserves and Maintenance of Non-Spinning Reserves ancillary services, as well as the corresponding transmission services, are presented in detail in Exhibit HQT-12, Document 1, Tables 9 and 13 respectively. See also HQT-13, Document 1, answer to question 25.1 of interrogatory requests no.1 of the Régie. b) Please explain why the costs used in the calculation were not updated to 2007 values in order to be consistent with the basis for the load data. R34b) See answer to question 34a. Original : 2006-09-21 HQT-13, Document 8 Page 39 of 40 Hydro- Québec TransÉnergie Application R-3605-2006 c) Please provide a schedule that recalculates the proposed frequency control rate based on updated 2007 costs as well as loads. R34c) See answer to question 34a. Original : 2006-09-21 HQT-13, Document 8 Page 40 of 40