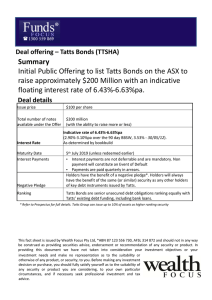

Tatts Bonds

advertisement

Tatts Bonds Tatts Group has just announced the launch of a new income offer: Tatts Bonds. The first round of access is through a broker firm allocation, prior to shareholder and general offers and listing at the end of this month. The Bonds will pay a quarterly coupon of 2.90%‐3.10% over the 90 day bank bill swap rate (BBSW), 3.53% as of 29th May, with an initial indicative rate of 6.43%‐6.63%pa. (The first quarter’s pricing is due to be set on date of issue) and are due to mature on the 5th July 2019*. The Bonds will be traded on the ASX. Tatts Bonds Offer Details Issuer Security Name Maturity Date Margin Size Minimum Parcel Tatts Group Tatts Bonds 5th July 2019 (7 years) 90 day BBSW + 2.90%‐3.10% $200m+ $5,000 (Wealth Focus minimum is $10,000) Source: Tatts Bonds prospectus This issue will be used to refinance existing debt. We’re now seeing a trend Lower risk towards vanilla products and Tatts Bonds offer investors a clean 7 year floating rate bond that ranks in line with its existing debt and offers the added security of a negative pledge. This issue Higher risk Background to Tatts Previously known as Tattersalls, Tatts Group is the largest lottery operator in Australia by revenue, operating in New South Wales, Victoria, Queensland, Tasmania, Australian Capital Territory and Northern Territory and through online channels. Following the cessation of the Tatts Pokies gaming machine operations, the lotteries business of Tatts Group makes up 65% and Wagering 24% of revenue. Tatts lottery business is a long dated Government regulated monopoly and both the Wagering and Lottery businesses have the luxury of not having to hold inventory or ongoing debtors. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 02/06/12 Comparative Securities It would be tempting to consider Tabcorp as a comparable, however, the two businesses are quite different and the terms of the individual issues are very different. We view Tatts as a defensive play on the gaming industry and less likely to be impacted by the economic cycle. Furthermore Tatts Bonds have the security of sitting equal to other debt and the benefit of a negative pledge ensuring that Tatts can only issue up to 10% of its asset base as debt ranking higher in the debt structure. In short there are no direct comparables available in the market place. What we like It’s a small offering of $200 Million. We suspect this will be increased to around $300 Million, but don’t envisage the issue being much more than this. There is currently no debt sitting higher in the debt structure. The security of a negative pledge means Tatts are limited in issuing debt higher in the debt structure and undermining the rights of Tatts Bond holders on company assets. Lottery & Wagering businesses benefit from their clients having to pay up front, ie no debtor and no inventory risk. A very attractive business proposition. Investors looking to diversify away from the financials are likely to want to allocate to Tatts Bonds. Our View We must admit that we have some ethical issues with investing in Tatts. We just don’t like the idea of benefiting from gaming at the lower end of the socio economic scale. That aside, this is Senior Debt and an issue which we feel is likely to be very tightly held, sit around face value throughout the term and hold no nasty surprises for investors. We think this would suit investors looking for a vanilla fixed income product. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 02/06/12 Our view on where the value lies is really based on gut feel with this one, there is little precedent in the retail market. We would like to see this coming in at least 3% over the BBSW. As a result, we are allowing investors to choose whether to bid at margin (2.90%‐3.10%) or elect to only bid at 3.0% or 3.10% over the 90 Day BBSW. Note: Tatts Bonds will be listed on the ASX and as such the price of the Bond’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 02/06/12