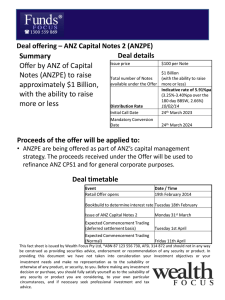

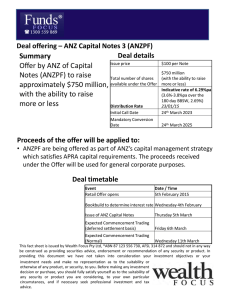

ANZ SUBORDINATED NOTES OFFER DOCUMENT

advertisement