ANZ SUBORDINATED NOTES OFFER DOCUMENT

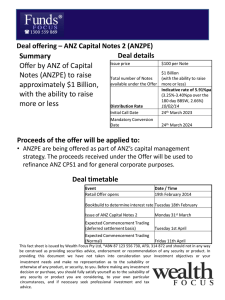

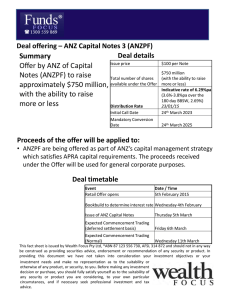

advertisement