*Presentation for wholesale investors only

advertisement

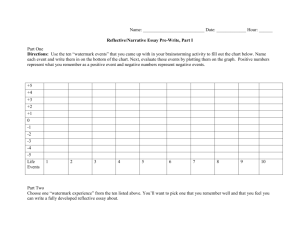

*Presentation for wholesale investors only Disclaimer This presentation has been prepared by Watermark Funds Management Pty Limited (Watermark) and Watermark Neutral Fund Limited (WMN). The information contained in this presentation is for information purposes only and has been prepared for use in conjunction with a verbal presentation and should be read in that context. This presentation is provided to you on the basis that you are a either a Sophisticated Investors or Professional Investor, as those terms are used in sections 708(8) or 708(11), respectively, of the Corporations Act 2001 (Cwlth). The information contained in this presentation is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. Please note that, in providing this presentation, Watermark and WMN (Watermark Entities) have not considered the objectives, financial position or needs of any particular recipients. The Watermark Entities strongly suggest that investors consult a financial advisor prior to making an investment decision. The Watermark Entities have prepared this document based on information available to it at the time of preparation, from sources believed to be reliable and subject to the qualifications in this document. To the maximum extent permitted by law, Watermark, WMN, Morgan Stanley Australia Securities Limited ABN 55 078 652 276 (Morgan Stanley), Macquarie Capital (Australia) Limited ABN 79 123 199 548 (together with Morgan Stanley, the Joint Lead Managers), and Taylor Collison Limited (Taylor) and RBS Morgans Limited (together with Taylor, the Co-Managers, and the Co-Managers and the Joint Lead Managers, the Managers) and each of their respective affiliates, related bodies corporate (as that term is defined in the Corporations Act) and their respective directors, employees, officers, representatives, agents, partners, consultants and advisers (each a Limited Party and together, the Limited Parties) accept no responsibility or liability for the contents of this document and make no recommendation or warranties concerning any offer. No representation or warranty, express or implied, is made as to the fairness, accuracy, adequacy, validity, correctness or completeness of the information, opinions and conclusions contained in this document. To the maximum extent permitted by law, none of the Limited Parties accept any responsibility or liability including, without limitation, any liability arising from fault or negligence on the part of any person, for any loss whatsoever arising from the use of this document or its contents or otherwise arising in connection with it. Neither of the Managers, nor any of their respective affiliates, related bodies corporate and their respective directors, employees, officers, representatives, agents, partners, consultants and advisers have authorised, permitted or caused the issue, lodgement, submission, dispatch or provision of this document, and none of them make or purport to make any statement in this document and there is no statement in this document which is based on any statement by them. The recipient acknowledges and agrees that neither it, Watermark, WMN, or the Managers intend that the Managers or any member of the Managers group or any of their affiliates act or be responsible as a fiduciary to the recipient of this document, its officers, employees, consultants, agents, security holders, creditors or any other person. Each recipient of this document and the Managers (on behalf of each other member of the Managers group and their affiliates), expressly disclaim any fiduciary relationship. The Limited Parties (other than Watermark and WMN) may have interests in the securities referred to in this document, including being directors of, or providing investment banking or corporate advisory services to, WMN. Further, they may act as a market maker or buy or sell those securities or associated derivatives as a principal or agent. The Managers accept no responsibility for the contents of this document or any information contained in it. This presentation is not, and does not constitute, an offer to sell or the solicitation, invitation or recommendation to purchase any securities and neither this presentation nor anything contained in it forms the basis of any contract or commitment. A prospectus (Prospectus) is available in connection with the initial public offering, and quotation on the financial market operated by ASX Limited, of ordinary shares and options to acquire ordinary shares in WMN (Offer). Copies of the Prospectus can be obtained by contacting Justin Braitling, Tom Richardson, Joshua Ross or Nerida Dawson on 02 9252 0225 during the period from and including the date on which the Offer opens until and including the date on which the Offer, or an electronic version of the Prospectus Prospectus) can be downloaded from the following website: www.wfunds.com.au. Offers of shares and options under the Offer will be made in, or accompanied by a copy of, the Prospectus. Prospective investors should consider the Prospectus in deciding whether to acquire shares and options under the Offer. Prospective investors who want to acquire shares under the offer will need to complete an application form that is in or accompanies the Prospectus. Statements in this document are made only as of the date of this document unless otherwise stated and the information in this document remains subject to change without notice. WMN may, in its absolute discretion, but without being under any obligation to do so, update or supplement this document. Any further information will be provided subject to these terms and conditions. This presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States. The securities of WMN have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (Securities Act) or the securities laws of any state or other jurisdiction of the United States, and may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and any other applicable securities laws or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and any other applicable securities laws. NOT FOR DISTRIBUTION IN THE UNITED STATES About Watermark We are active, high conviction investors in Australian listed companies. As an Absolute Return manager, Watermark is offering investors an alternative to traditional institutional ‘long only’ funds that are more dependent on a rising share market. Our aim is to profit from the mispricing of Australian shares while seeking to protect our investors from loss through the use of hedging strategies based on short selling which aim to enhance returns and reduce market risk. Watermark’s flagship fund is a listed investment company – the Australian Leaders Fund Limited - which has delivered a compound annual return of 15.4% p.a. net of all fees to April 2013, since listing on the Australian Securities Exchange in 2004. Investment Team: Chief Investment Officer Senior Analyst Analyst Operations Manager Justin Braitling Tom Richardson Joshua Ross Nerida Dawson Managed Funds: Australian Leaders Fund - A listed Long/Short Fund Watermark Market Neutral Fund What sets Watermark apart from other managers? An absolute return focus. At Watermark we consider each investment opportunity in the context of an absolute gain or loss of capital whereas many managed funds target relative outperformance where risk is seen in the context of underperforming the share market. Superior returns. As a long/short manager, Watermark has the option of either being ‘long’ or ‘short’ individual shares. Consequently it has a much broader and deeper pool of mispriced shares to consider. In constructing both long and short portfolios, we are able to target higher returns than other funds. An ability to hedge. As ‘shorts’ can be a natural hedge for the fund’s assets we can separately manage market risk (β) through the investment cycle while still taking advantage of mispricing in the share market. Investment Process To deliver superior returns with reduced market risk. To return a consistent stream of fully franked dividends to shareholders. The best investment opportunities are found in strong, well managed companies that can be purchased on attractive terms. The best shorting opportunities are found in weaker companies that are poorly managed and overvalued. A fundamentally driven process based on sound investment ideas; monitoring economic and industry trends; extensive company and industry contact. Qualitative Scorecard: Business Quality + Management + Valuation + Risk. We construct both a long and a short portfolio. The portfolios are constructed around the best investment ideas (qualitative scorecard) with the highest conviction. The relative size of the long and short portfolios will determine the net market exposure Qualitative Scorecard Score Business Quality (1-10) Management (1-5) Valuation (1-5) Financial Risk (1-5) Long Portfolio Short Portfolio Superior economic returns High barriers to entry Sustainable growth Leadership position Weak returns Low barriers to entry Mature Highly competitive Clear consistent strategy Best in class performance Accretive capital management Convoluted strategy Poor operational performance Destructive capital management Undervalued based on range of measures DCF, P/E, EBITDA/EV, Buyout analysis Overvalued based on range of measures DCF, P/E, EBITDA/EV, Buyout analysis Low Gearing Earnings certainty Leveraged Earnings risk We construct two portfolios Investment Universe Target Alpha Ranked by Qualitative/Quant Factors Most preferred securities: 1. ABC 2. BCD 3. CDF 4. ... Least Preferred 1. ZYX 2. YXW 3. XWV 4. ... LONG PORTFOLIO +5% & SHORT PORTFOLIO -5% Sample ALF/Watermark Portfolio Dashboard Business Quality Management 7.0 3.5 6.0 3.0 5.0 2.5 4.0 2.0 LONG 3.0 SHORT 2.0 1.0 1.0 0.5 0.0 LONG 1.5 SHORT 0.0 May-11 Nov-11 May-12 Nov-12 May-11 Nov-11 May-12 Nov-12 Risk Level Valuation 3.0 5.0 4.5 2.5 4.0 3.5 2.0 3.0 2.5 1.5 2.0 LONG 1.5 SHORT LONG SHORT 1.0 1.0 0.5 0.5 0.0 May-11 Nov-11 May-12 Nov-12 0.0 May-11 Nov-11 May-12 Nov-12 *Each entity in Watermark’s database has a qualitative score. The dashboard presents the weighted average score for entities in each of ALF’s portfolios as assigned by Watermark. Investment Strategies Assets Investment Universe Most preferred 1. ABC 2. BCD 3. CDF Capital Variable Long/Short Long Short Market Neutral Long portfolio Funding Cash Capital Long Short Short portfolio Least Preferred 1. ZYX 2. YXW 3. XWY Short Fund Capital Cash Short Performance drives returns 25.0 5 Year Share Performance % 5 Year NTA Vs Share Price Performance 30 April 2013 ALF 20.0 CDM 15.0 WAX CAM WAA MIR 10.0 WAM CIN AMH BKI MLT 5.0 AFI WHF DJW FSI DUI AUI ARG CYA 0.0 0.0 2.0 Source: Bell Potter Research 4.0 6.0 8.0 10.0 5 Year NTA Performance % 12.0 14.0 16.0 18.0 Watermark Market Neutral Fund Limited Offer: Up to 120 million fully paid ordinary shares of $1.00 per share + 1 free option exercisable at $1.00 on or before 31 December 2014. Includes a priority offer of 20 million shares for ASX:ALF members Investment Manager/Trustee: Watermark Funds Management Limited Investment Strategy Market Neutral. ASX listed securities (up to 10% international shares) Benchmark: RBA cash rate Fees: Management fee: 1% p.a. of the NAV + Performance fee 20% outperformance over benchmark Investment Targets Pre-tax return 12% p.a Dividend yield 5% p.a. Fully franked subject to available franking credits Board Matthew Kidman - Chairman Justin Braitling Stephen Van Eyk Rob Ferguson John Abernethy Portfolio Structure Placed on deposit INVEST $100 Target Return: Interest on cash Long Portfolio $100 +5% Short Portfolio $100 -5% Value added by Manager Longs>Shorts (Profit or Loss) + + 10% *This sample portfolio structure reflects a gross exposure of 200% (sum of long and short portfolios) as a % of the company’s capital. Gross exposure is capped at 400% Returns: Market neutral Vs Institutional fund In removing market risk, investors also forfeit the market return be it + or -. Instead returns comprise interest on your capital held at bank plus the alpha or value added by the manager. Valued added by Manager Capital invested (asset class) Institutional Fund Market Neutral Fund RINDEX+ = RMARKET + R MNF = Interest + Alpha (2-4)*Alpha 13 Targeting higher returns We look to profit from the mispricing of shares on an absolute basis across the value spectrum while also benefiting from the hedge in the structure... Target Alpha Step 2: Invest Short Proceeds Step 1: Short Sell Expensive -5% Fair value Cheap +5% Why a Market Neutral Fund? This fund aims to allow investors to profit from the mispricing of Australian securities without increasing their net exposure to the share market. Given a softer outlook for growth in advanced economies, shares are likely to deliver lower returns in the medium term. Financial risks will also remain elevated in the aftermath of the financial crisis ensuring heightened levels of share market volatility. Given this balance of risk and return, there is a strong case for investing in a market neutral fund where investors can profit from the mispricing of individual shares without taking on further market risk. We appear to be in a classic reflation cycle. As asset values move beyond fundamental value and market risks build, investors should consider hedging strategies that reduce market risk With low growth and elevated risks- manage market risk Growth expected to remain weak..... Risks to remain elevated..... OECD - GDP Growth 4.0% 3.0% 2.0% 1.0% 0.0% -1.0% -2.0% -3.0% -4.0% Source: OECD Growth in Fundamental value also weak fat tail risks Managing Market Risk through the cycle Investors should consider ways of reducing market risk as reflation cycle continues *This graph represents Watermark’s view of increasing asset prices above fundamental value If the ‘longs’ outperform the ‘shorts’ we make money If a company’s sales are greater than its expenses it makes a profit. In this company if the ‘long’ portfolio outperforms the ‘short’ portfolio, the company will report a positive return before expenses. What happens to the share market is less relevant... Financial Year Gross Returns for ALF portfolios 40% 30% 20% 10% 0% 2008 2009 2010 2011 -10% 2012 2013YTD Positive spread every year since 2008 -20% -30% -40% ALF Long Portfolio ALF Short Portfolio *Past performance information given on this page relates to the portfolios of ALF and is given for illustration purposes only. It should not be relied upon as (and is not) an indication of future performance of WMN's portfolios. The actual results of WMN's portfolio could differ materially from those referred to on this page, including because of the different strategy to be adopted by Watermark in connection with the WMN portfolios. If the ‘longs’ outperform the ‘shorts’ we make money In every year since ALF commenced reporting its long and short portfolio performance this spread has been positive, indicating a gross profit before net funding costs and expenses. Furthermore the returns are uncorrelated with both the market and other funds which tend to track the share market. Financial Year Returns 40% 30% 20% 10% 0% 2008 2009 2010 2011 2012 2013YTD Positive spread every year since 2008 and uncorrelated -10% -20% -30% All Ords Accum Index ALF Long-Short Spread *Past performance information given on this page relates to the portfolios of ALF and is given for illustration purposes only. It should not be relied upon as (and is not) an indication of future performance of WMN's portfolios. The actual results of WMN's portfolio could differ materially from those referred to on this page, including because of the different strategy to be adopted by Watermark in connection with the WMN portfolios. Australian Leaders Fund Returns Reported Performance to 30 April 2013 ALF 1 YEAR 3 YEARS (P.A.) 5 YEARS (P.A.) SI (P.A.) Long 21.2% 12.2% 13.8% - Short -2.4% -0.4% -1.4% - Net 28.2% 12.4% 16.0% 15.4% All Ords Accum Index 21.0% 6.8% 2.6% 9.5% Net Outperformance 7.2% 5.7% 13.4% 5.9% *As per ASX release on 14th May 2013 *Past performance information given on this page relates to the portfolios of ALF and is given for illustration purposes only. It should not be relied upon as (and is not) an indication of future performance of WMN's portfolios. The actual results of WMN's portfolio could differ materially from those referred to on this page, including because of the different strategy to be adopted by Watermark in connection with the WMN portfolios. PROSPECTUS TIMETABLE Lodgement of Prospectus with ASIC 7th June 2013 Expected expiry of exposure period 14th June 2013 Offer opens 14th June 2013 Broker firm offer closes Offer closes 5.00pm 25th June 2013 5.00pm 5th July 2013 Expected final allotment of Shares and Options 15th July 2013 Expected final despatch of holding statements 16th July 2013 *The above dates are subject to change at the discretion of the company QUESTIONS