Math 1030-7 Midterm 2

advertisement

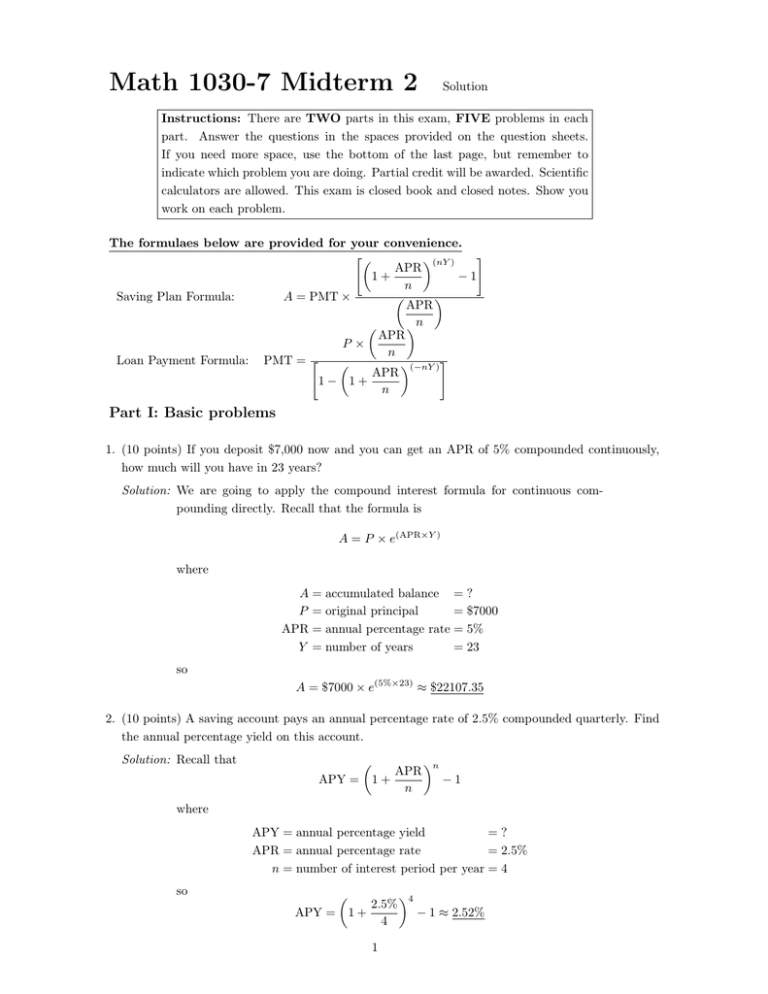

Math 1030-7 Midterm 2 Solution Instructions: There are TWO parts in this exam, FIVE problems in each part. Answer the questions in the spaces provided on the question sheets. If you need more space, use the bottom of the last page, but remember to indicate which problem you are doing. Partial credit will be awarded. Scientific calculators are allowed. This exam is closed book and closed notes. Show you work on each problem. The formulaes below are provided for your convenience. " # (nY ) APR −1 1+ n Saving Plan Formula: A = PMT × APR n APR P× n Loan Payment Formula: PMT = " (−nY ) # APR 1− 1+ n Part I: Basic problems 1. (10 points) If you deposit $7,000 now and you can get an APR of 5% compounded continuously, how much will you have in 23 years? Solution: We are going to apply the compound interest formula for continuous compounding directly. Recall that the formula is A = P × e(APR×Y ) where A = accumulated balance = ? P = original principal = $7000 APR = annual percentage rate = 5% Y = number of years = 23 so A = $7000 × e(5%×23) ≈ $22107.35 2. (10 points) A saving account pays an annual percentage rate of 2.5% compounded quarterly. Find the annual percentage yield on this account. Solution: Recall that APY = APR 1+ n n −1 where APY = annual percentage yield =? APR = annual percentage rate = 2.5% n = number of interest period per year = 4 so APY = 1+ 2.5% 4 1 4 − 1 ≈ 2.52% 3. (10 points) Life expectancy in 1910 was 35 years and life expectancy in 2008 is 66.12 years. Suppose it grows linearly, find the rate of change of life expectancy. Solution: First, we have to figure out which is the independent variable and which is the dependent variable in this linear growth. We have two variables: number of year (e.g. 1910 and 2008) and the life expectancy (e.g. 35 and 66.12). Number of year won’t depend on life expectancy, but life expectancy depends on number of year. So we conclude that number of year is the independent variable while life expectancy is the dependent variable. By the definition of rate of change in a linear growth, rate of change = change in dependent variable 66.12 − 35 31.12 = = ≈ 0.318 change in independent variable 2008 − 1910 98 The unit is year/year. 4. (10 points) If the US population grows 3.5% per 5 years, estimate the doubling time of it. (Logarithm is NOT allowed) Solution: Since 3.5% 6 15%, we may apply the approximate doubling time formula. Tdouble = 70 70 = = 20 P 3.5 The unit of Tdouble should be the same as the time needed for a 3.5% growth which is 5 years. So Tdouble = 20 × 5 years = 100 years 5. (10 points) A community of mice has doubling time of 5 months. If there are initially 500 mice, find the population after 2 years. Solution: From the problem, we already know that Tdouble = 5 months. What we are going to do is to apply the general formula of exponential growth with respect to the doubling time: new value = original value × 2t/Tdouble where original value = 500 t = 2 years = 24 months Tdouble = 5 months so new value = 500 × 224 months/5 months ≈ 13929 2 Part II: Advanced problems 6. (10 points) A saving account pays an annual percentage rate of 2.5% compounded quarterly. You decide that you would like to make a regular quarterly deposits to this account since you would like to have $750,000 when you retire in 40 years. How much should your quarterly deposits be in order to accomplish your goal? Solution: Since I am making a regular payment, this is a saving plan and I am going to use the saving plan formula " # (nY ) APR 1+ −1 n A = PMT × APR n where A = accumulated balance = $750000 PMT = quarterly regular payment =? APR = annual percentage rate = 2.5% n = number of interest period per year = 4 Y = number of years = 40 We will have (4×40) 2.5% −1 4 $750000 = PMT × 2.5% 4 $750000 ≈ PMT × 273.5737 PMT ≈ $750000/273.5737 ≈ $2741.49 1+ 3 7. You have found that you are eligible for a 30-year house loan with annual interest rate (APR) of 6.25%, compounded monthly. (a) (3 points) If you take out this loan for $200,000, what will your monthly payment be? (b) (3 points) How much will you pay in interest (in $ terms) over the life of the loan if you take out this loan for $200,000? (c) (4 points) If you decide instead to get a 20-year loan at the same rate for the same amount, what would your monthly payment be and how much would you save (in dollars) in interest (if you decided to take a 20-year loan instead of 30-year loan). Solution: We have only one formula for the loan, the loan payment formula, so we are going to apply it. (a) By the loan payment formula, APR P× n PMT = " (−nY ) # APR 1− 1+ n where PMT = regular loan payment =? P = loan principal = $200000 APR = annual percentage rate = 6.25% n = number of payment per year = 12 Y = number of years = 30 We have 6.25% 12 PMT = " (−12×30) # ≈ $1231.43 6.25% 1− 1+ 12 $200000 × (b) Recall that total payment = loan pricipal + total interest We know that total payment = PMT × n × Y ≈ $1231.43 × 12 × 30 = $443314.80 loan principal = $200000 So, total interest ≈ $443314.80 − $200000 = $243314.80 (c) The idea is the same as the above. 6.25% 12 " (−12×20) # ≈ $1461.86 6.25% 1− 1+ 12 $200000 × PMT = total payment ≈ $1461.86 × 12 × 20 = $350846.40 total interest ≈ $350846.40 − $200000 = $150846.40 interest saved ≈ $243314.80 − $150846.40 = $92468.40 4 8. One morning, there were 3 inches of snow on the ground. Then the winter storm started and snow started accumulating at a constant rate of 5 inches every 2 hours. (a) (2 points) Identify the independent and dependent variables. (b) (5 points) Write a linear equation that describes this situation. Explain the meaning of each variable in your equation. Draw a graph for this equation. (c) (3 points) How long did it take for the height of the snow to reach 21 inches? Solution: (a) The independent variable is time (or how many hours passed since there were 3 inches of snow) and the dependent variable is height of snow. (b) Recall that the general formula for a linear growth is dependent variable = initial value+(rate of change)×(independent variable) where initial value = 3 in rate of change = 5 in/2 hr = 2.5 in/hr So we can write down a equation H = 3 + 2.5t where t means how many hours have passed since there were 3 inches of snow in the unit of hour and H means the height of the snow at time t in the unit of inch. Here is the graph. H (in.) 13 11 9 7 5 3 b b b b b b b b b b b b b b b b 0 1 2 3 4 t (hr) (c) Substitute H by 21 in the general formula, we have 21 = 3 + 2.5t 18 = 2.5t t = 7.2 So it took 7.2 hours for the height of the snow to reach 21 inches. 5 9. I deposit $1,000 into my saving account and expect that the compound interest would lead me to a millionaire automatically. Suppose my account has an APR of 5.4% and the interest is compounded annually. (a) (5 points) Find the exact doubling time of the accumulated balance. (b) (5 points) Suppose I’m 20 years old now. How old will I be when I become a millionaire (of course, I mean only from this account)? Solution: (a) An APR of 5.4% and compounding annually lead a exponential growth of the accumulated balance at the rate, which is the same as the APR, every year. So P = 5.4 in the exact doubling time formula. Apply the formula and we have Tdouble = log10 2 log10 2 = ≈ 13.18 log10 (1 + P %) log10 (1 + 5.4%) The unit is year, so the doubling time is 13.18 years. (b) We are going to apply the general formula of exponential growth with respect to the doubling time, new value = initial value × 2t/Tdouble where new value = $1000000 initial value = $1000 t=? Tdouble = 13.18 We have $1000000 = $1000 × 2t/13.18 1000 = 2t/13.18 log10 1000 t/13.18 = log2 1000 = ≈ 9.966 log10 2 t ≈ 131.35 The unit of t is the same as that of Tdouble which is year. And t means how many years have passed since I made the $1000 deposit when I was 20. So I will be 20 + 131.35 ≈ 151 years old when I become a millionaire. 6 10. You take 300mg of a certain medication at 2pm. A lab test done at 6pm shows that you still have 120mg of that medication left in your bloodstream. (a) (5 points) Assuming the medication decays exponentially, what is the rate of decrease of the medication in your bloodstream? (b) (5 points) What is the exact half-life of that medication in your bloodstream? Solution: (a) During the 4 hours between 2pm and 6pm, the relative change of the 120 mg − 300 mg medication is = −0.6 = −60%. So the tricky answer is, 300 mg it decreases at a rate of 60% every 4 hours. (b) According to the exact half-life formula, Thalf = − log10 2 − log10 2 = ≈ 0.756 log10 (1 − P %) log10 (1 − 60%) The unit of Thalf is the same as the time needed for a decrease of 60% which is 4 hours. So, Thalf ≈ 0.756 × 4 hour = 3.024 hour 7