ZEF Bonn Private Sector Development and Competitiveness in

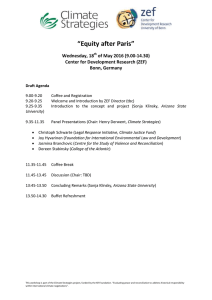

advertisement