%, ijd 1 otrtod

advertisement

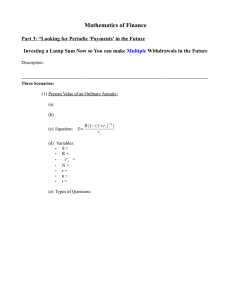

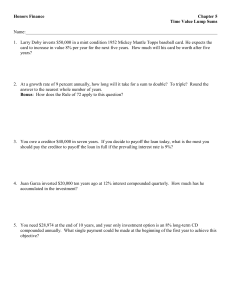

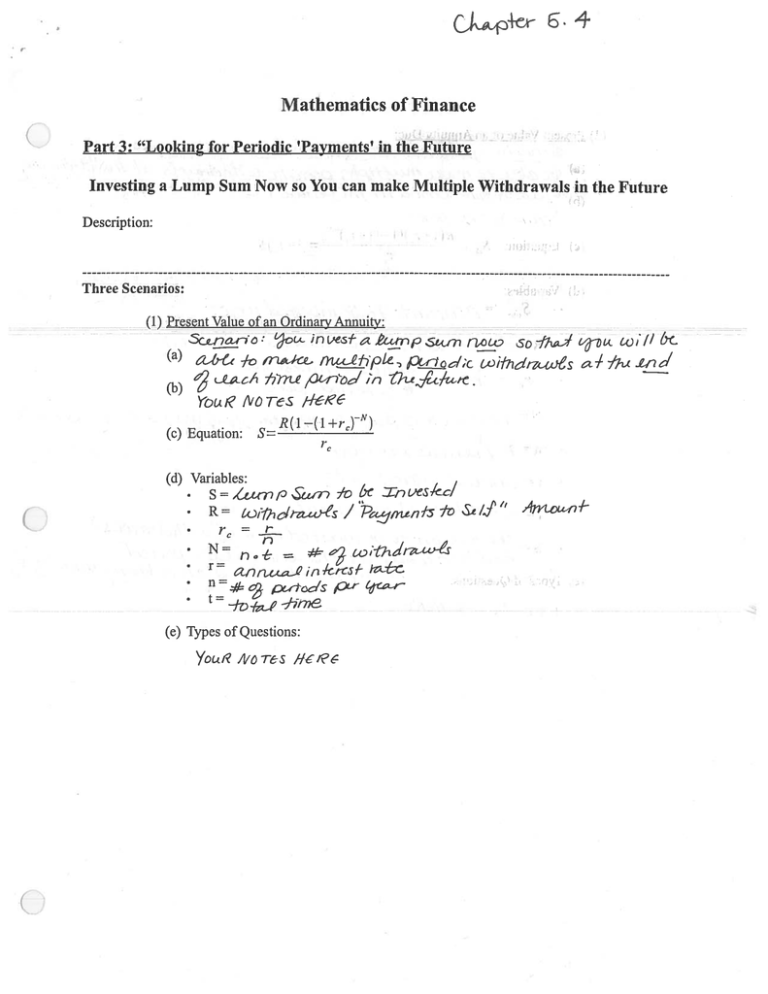

64 p+r Mathematics of Finance Part 3: “Looking for Periodic ‘Payments’ in the Future Investing a Lump Sum Now so You can make Multiple Withdrawals in the Future Description: Three Scenarios: (1) Present Value of an Ordinary Annuity: in (,esf a Pain p Stni aetc2 (a) pk LLZCA (b) otrtod In 7’771U 1 tOil” & So ijd -id o1dI7Atcs çc/wn. Yot.tI? /VOTeS /,iE’é (c) Equation: S= R(l—(l+r) -N C (d) Variables: • • S = /ttm , &tm ‘o 6C .Tn t)eskc/ R j 1z Se if” ,4 / %, = • r=ii. • r ki-cs/- kz& flccdsputar - • • (e) Types of Questions: Yocu JL/OT-S I/eRe fr a) Cd a) k ci +1 -j - • ci o _, _, II ll II I -••-•.-- II z I•_ c: ii II cJ) a) U (3) Present Value of a Deferred Annuity: &riaciO-’ ;nc -)tt t Jttmp aniz-ôY, at-tt Th eiz1 /flaki7 (a) Lv[& ( (b) j- R(1_(l+rc)_N) (c) Equation: P r (1 + r) (d) Variab1: • (ajiotuf R = a/?70(-u7 t cJ zcA to,tAdicot’ à icd • • = - N= • m =÷d • r= • n / 2L-r 1:t -. t • td • tp 1t() (e) Types of Questions: Yoc jtitzs ,4411: i fI7-( iejkditâ-) Example 1: Frank is calculating when he can retire. He estimates that he’ll need to withdraw $10,000 at the end of every quarter from his retirement account for living expenses for 25 years. The account earns 6.5% interest compounded quarterly. What amount of money needs to be in the investment account upon his retirement to achieve his financial goal? c Hi li&c -a), Jttm p wi 1i tth1 O6 j-ijpS: J-17d f s(f) - / ‘ j-t ôtdiy 4tui/-j’ (j)-M7 I—c /07 S = ID, Do 0 — (1 - )_ Lflt1uwn /O,OOO -. S 0 .0(. —4 Example 2: Find the present value of a college fund that pays $2,000 at the end of each month from an account that earns 9% interest compounded monthly for 6 years. V f2U *ip w7 }/6AfrLt17I) Ar (ok Jampsari-i uitL j) g:rLd .‘,(,-,r r__ *) 7 i_ r (/_)27 Vr&’ S UflItrwt ‘-a 11o, Example 3: Tracy received an inheritance of $200,000 from his grandmother. How much can he withdraw from his account at the end of each quarter for the next 30 years, if his money compounds quarterly with 6% interest? 0 ,.. Example 4: Karen receives a lottery prize of $1,200,000 with payments of $5,000 at the beginning of every month for 20 years. If the money is in an account earning 5% interest compounded monthly, what is the real value of the lottery prize today? npum no&r LhpL p iitfl13 iLi-CA ‘ncCc.e — ooo(I#)[1_(I+20fl - .IO 0 ( (I#rc7 —Ps 1-’ th Example 5: Suppose Brenda receives an inheritance of $20,000, on her 20 birthday. However, according to the will of the donor, she is not to receive the money until she is 30 years old. She plans to leave the money in the interest bearing account, earning 8% interest compounded quarterly, and only make quarterly withdrawals, starting at the end of the first quarter after her birthday, for 15 years total. How much will each withdrawal be? r 20— - 0 As o—’1S S 2C 000 (i + S o 4(i0) 0 rcrb z: QLtinp ì = oda s - - .o,n , 1 t’IS (j )°J/(*) ‘ —(j+ E 44i. (/[i 44io.-9 = Example 6: Upon graduation from college, Luce’s parents decide to give her a large cash gift, singe their business is doing well. They’re forward-thinking parents and want to invest in their daughters retirement. They give her exactly enough to create monthly retirement payments of $4,000, paid at the end of each month, starting in 40 years. The payments will last for 20 years total. After shopping around, they found an extremely safe investment that pays 5.4% interest, compounded monthly. How much will they put in this account for Luce upon graduation? P r £ín ‘ p in, w-ai •?j10OO) Ppooi_(i-i (°)(i -I- - m -iuI o tp=20 osi i--=i. )r= \_ZO.12. 53./9. 7 LL CV’::-t.fl fliLfYLflhi- rnJfl -. t,. ,—, * ,. U .— ‘ I. £ 0 .1 — : — - • : -