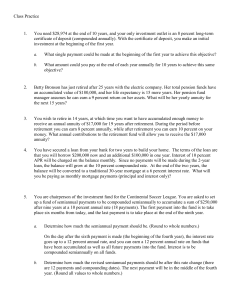

Honors Finance Chapter 5 Time Value Lump Sums Name: 1. Larry Doby invests $50,000 in a mint condition 1952 Mickey Mantle Topps baseball card. He expects the card to increase in value 8% per year for the next five years. How much will his card be worth after five years? 2. At a growth rate of 9 percent annually, how long will it take for a sum to double? To triple? Round the answer to the nearest whole number of years. Bonus: How does the Rule of 72 apply to this question? 3. You owe a creditor $40,000 in seven years. If you decide to payoff the loan today, what is the most you should pay the creditor to payoff the loan in full if the prevailing interest rate is 9%? 4. Juan Garza invested $20,000 ten years ago at 12% interest compounded quarterly. How much has he accumulated in the investment? 5. You need $28,974 at the end of 10 years, and your only investment option is an 8% long-term CD compounded annually. What single payment could be made at the beginning of the first year to achieve this objective? Honors Finance Chapter 5 Time Value Annuities Name: 1. You have decided to heed the sage advice of your finance teacher and put aside $2,000 a year beginning with your 25th birthday and continuing for 10 years. Your best friend, on the other hand, decides to wait until s/he is 35 before making the $2,000 annual payments. Provide the information requested about the investments assuming a 10% compounding rate. a. How much money will you deposit over the 10-year period? b. How much money will your best friend deposit over the 30-year period? c. How much money will you have at your age 65? d. How much money will your best friend have at age 65? 2. You have won the lottery and are trying to decide whether to take the lump sum payment or the annuity. The annuity has a value of $9 million dollars to be paid in annual payments over the next 20 years. If the annuity earns 5% interest, what will be the amount of the lump sum payment? What factors should you consider when deciding between the annuity and lump sum payment? 3. Your favorite aunt has left you some money in her will. The will specifies that you will receive: $1,000 one year from her death; $2,000 two years from her death; and $3,000 three years from her death. How much is your aunt’s gift worth today? Use 8% interest. 4. You would like to give back to the Council Rock community by funding an endowment for the Parks & Recreation Department. You would like the department to have $15,000 available every year for community programs. How much money would you need to invest today to fund this endowment at 7% interest? Honors Finance Chapter 5 Yields, Taxes, and Amortization Name: 1. The First City Bank pays 7% interest compounded annually on deposits. The Second City Bank pays 6.5% interest compounded quarterly. Based on their effective interest rates, in which bank would you prefer to deposit your money? 2. Sue wants to buy a car that costs $12,000. She has arranged to borrow the total purchase price of the car from her credit union at a simple interest rate equal to 12 percent. The loan requires quarterly payments for a period of three years. If the first payment is due in three months (one quarter) after purchasing the car, what will be the amount of Sue’s quarterly payments on the loan? 3. You want to start investing for your retirement and can afford to put aside $500 a month for the next 25 years. You have a choice between investing in a taxable retirement annuity earning 9% interest and a taxdeferred annuity earning 6% interest. Assuming you are in a 30% tax bracket, which option should you choose? 4. Complete the following amortization table. Year Beginning Value 1 $7,500 Total Payments Interest Payment Ending Values $600 2 3 Principal Payment $2,694.68 $215.57 Honors Finance Chapter 5 Reinforcement Problems Name: 1. You are planning to retire in twenty years. You'll live ten years after retirement. You want to be able to draw out of your savings at the rate of $10,000 per year. How much would you have to pay in equal annual deposits until retirement to meet your objectives? Assume interest remains at 9%. 2. You can deposit $4000 per year into an account that pays 12% interest. If you deposit such amounts for 15 years and start drawing money out of the account in equal annual installments, how much could you draw out each year for 20 years? 3. What is the value of a $100 perpetuity if interest is 7%? 4. You deposit $13,000 at the beginning of every year for 10 years. If interest is being paid at 8%, how much will you have in 10 years? 5. You are getting payments of $8000 at the beginning of every year and they are to last another five years. At 6%, what is the value of this annuity? 6. How much would you have to deposit today to have $10,000 in five years at 6% interest compounded semiannually? 7. Construct an amortization schedule for a 3-year loan of $20,000 if interest is 9%. 8. If you get payments of $15,000 per year for the next ten years and interest is 4%, how much would that stream of income be worth in present value terms? 9. Your company must deposit equal annual beginning of year payments into a sinking fund for an obligation of $800,000 that matures in 15 years. Assuming you can earn 4% interest on the sinking fund, how much must the payments be? 10. If you deposit $45,000 into an account earning 4% interest compounded quarterly, how much would you have in 5 years? 11. How much would you pay for an investment that will be worth $16,000 in three years? Assume interest is 5%. 12. You have $100,000 to invest at 4% interest. If you wish to withdraw equal annual payments for 4 years, how much could you withdraw each year and leave $0 in the investment account? 13. You are considering the purchase of two different insurance annuities. Annuity A will pay you $16,000 at the beginning of each year for 8 years. Annuity B will pay you $12,000 at the end of each year for 12 years. Assuming your money is worth 7%, and each costs you $75,000 today, which would you prefer? 14. If your company borrows $300,000 at 8% interest and agrees to repay the loan in 10 equal semiannual payments to include principal plus interest, how much would those payments be? 15. You deposit $17,000 each year for 10 years at 7%. Then you earn 9% after that. If you leave the money invested for another 5 years how much will you have in the 15th year? Taken from http://www.studyfinance.com/lessons/timevalue/index.mv?problembank.