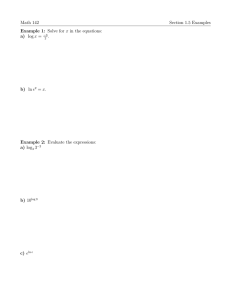

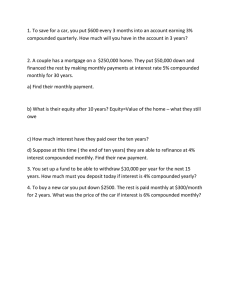

Algebra II More Story Problems: Solve the following equations:

advertisement

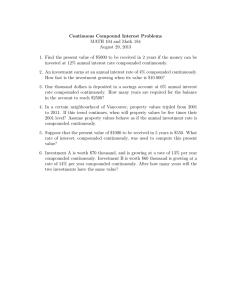

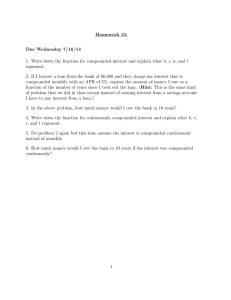

Algebra II More Story Problems: Solve the following equations: 1. 5 log (x + 1) = 25 2. 2 log x – log 4 = 2 You have $1500 to put towards your child’s future educational endeavors. With the soaring costs of college tuition, it is never too soon to start. Bank one says they will give you an interest rate of 5.5% compounded weekly. Bank two says they will give you an interest rate of 4.32% compounded continuously, but you must put in an initial deposit of $2500. 18 years from now when your little angel goes off to school, how much money will you have? 18 years from now, your kid has decided he wants to go to the University of Michigan. Out of state tuition is $30,000 for your first two years and $35,000 for your final two years. If you want to FULLY pay for your kids education, how much should you buy an investment bond for if you are getting an interest rate of 5.5% compounded continuously? What about if you get a 4.75% rate compounded semi annually? While looking around for financial planners, you come across someone who says every year they will double the amount of money in your 401k. You think “awesome, I am going to throw $3000 in there right now and I’ll have $48,000 in just 4 years!” He then says the maximum contribution you can put in is $0.01. Using y = abx write an expo function for this Make a table for the fist ten years of your retirement fund. X (years) Y (money) How much do you have after 15 years? How much you have after 20 years? The typical person works a full time job for 30 years before they can touch their retirement money. Is this a good retirement plan for you? Why or why not? How long would it take to triple an investment if given a rate of 6.7% compounded continuously?

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)