UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL

advertisement

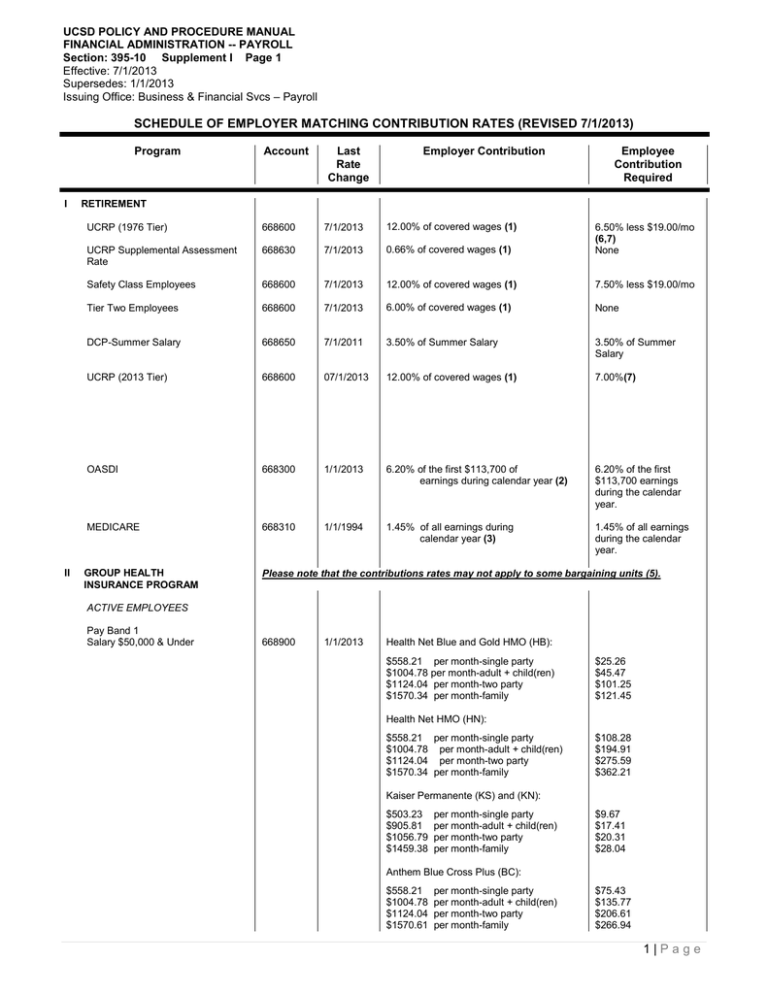

UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL Section: 395-10 Supplement I Page 1 Effective: 7/1/2013 Supersedes: 1/1/2013 Issuing Office: Business & Financial Svcs – Payroll SCHEDULE OF EMPLOYER MATCHING CONTRIBUTION RATES (REVISED 7/1/2013) Program I II Account Last Rate Change Employer Contribution Employee Contribution Required RETIREMENT UCRP (1976 Tier) 668600 7/1/2013 12.00% of covered wages (1) UCRP Supplemental Assessment Rate 668630 7/1/2013 0.66% of covered wages (1) 6.50% less $19.00/mo (6,7) None Safety Class Employees 668600 7/1/2013 12.00% of covered wages (1) 7.50% less $19.00/mo Tier Two Employees 668600 7/1/2013 6.00% of covered wages (1) None DCP-Summer Salary 668650 7/1/2011 3.50% of Summer Salary 3.50% of Summer Salary UCRP (2013 Tier) 668600 07/1/2013 12.00% of covered wages (1) 7.00%(7) OASDI 668300 1/1/2013 6.20% of the first $113,700 of earnings during calendar year (2) 6.20% of the first $113,700 earnings during the calendar year. MEDICARE 668310 1/1/1994 1.45% of all earnings during calendar year (3) 1.45% of all earnings during the calendar year. GROUP HEALTH INSURANCE PROGRAM Please note that the contributions rates may not apply to some bargaining units (5). ACTIVE EMPLOYEES Pay Band 1 Salary $50,000 & Under 668900 1/1/2013 Health Net Blue and Gold HMO (HB): $558.21 per month-single party $1004.78 per month-adult + child(ren) $1124.04 per month-two party $1570.34 per month-family $25.26 $45.47 $101.25 $121.45 Health Net HMO (HN): $558.21 per month-single party $1004.78 per month-adult + child(ren) $1124.04 per month-two party $1570.34 per month-family $108.28 $194.91 $275.59 $362.21 Kaiser Permanente (KS) and (KN): $503.23 $905.81 $1056.79 $1459.38 per month-single party per month-adult + child(ren) per month-two party per month-family $9.67 $17.41 $20.31 $28.04 Anthem Blue Cross Plus (BC): $558.21 $1004.78 $1124.04 $1570.61 per month-single party per month-adult + child(ren) per month-two party per month-family $75.43 $135.77 $206.61 $266.94 1|Page UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL Section: 395-10 Supplement I Page 2 Effective: 7/1/2013 Supersedes: 1/1/2013 Issuing Office: Business & Financial Svcs – Payroll SCHEDULE OF EMPLOYER MATCHING CONTRIBUTION RATES (REVISED 7/1/2013) Program Account Last Rate Change Employer Contribution Employee Contribution Required Anthem Blue Cross PPO (BP): $558.21 per month-single party $1004.78 per month-adult + child(ren) $1124.04 per month-two party $1570.61 per month-family Anthem BC Lumenos HRA (BL) $106.76 $192.17 $272.40 $357.80 $478.51 $861.31 $1004.87 $1387.68 $9.67 $17.41 $20.31 $28.04 per month-single party per month-adult + child(ren) per month-two party per month-family Kaiser Umbrella (KU): $558.21 $1004.78 $1124.04 $1570.61 668540 1/1/2013 Core Medical (CM): $112.21 $201.98 $235.64 $325.41 Pay Band 2 Salary $50,001 to &98,000 668900 1/1/2013 per month-single party per month-adult + child(ren) per month-two party per month-family $137.54 $247.57 $337.04 $447.07 None per month-single party per month-adult + child(ren) per month-two party per month-family Health Net Blue and Gold HMO (HB): $522.16 $939.89 $1041.74 $1459.47 per month-single party per month-adult + child(ren) per month-two party per month-family $61.31 $110.36 $183.55 $232.59 Health Net HMO (HN): $522.16 $939.89 $1041.74 $1459.47 per month-single party per month-adult + child(ren) per month-two party per month-family $144.33 $259.80 $357.89 $473.35 Kaiser Permanente (KS) and (KN): $467.18 $840.92 $974.49 $1348.24 per month-single party per month-adult + child(ren) per month-two party per month-family $45.72 $82.30 $102.61 $139.18 Anthem Blue Cross Plus (BC): $522.16 $939.89 $1041.74 $1459.47 per month-single party per month-adult + child(ren) per month-two party per month-family $111.48 $200.66 $288.91 $378.08 Anthem Blue Cross PPO (BP): $522.16 $939.89 $1041.74 $1459.47 per month-single party per month-adult + child(ren) per month-two party per month-family $142.81 $257.06 $354.70 $468.94 Anthem BC Lumenos HRA (BL) $442.46 per month-single party $45.72 2|Page UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL Section: 395-10 Supplement I Page 3 Effective: 7/1/2013 Supersedes: 1/1/2013 Issuing Office: Business & Financial Svcs – Payroll SCHEDULE OF EMPLOYER MATCHING CONTRIBUTION RATES (REVISED 7/1/2013) Program Account Last Rate Change Employer Contribution $796.42 per month-adult + child(ren) $922.57 per month-two party $1276.54 per month-family Employee Contribution Required $82.30 $102.61 $139.18 Kaiser Umbrella (KU): $522.16 $939.89 $1041.74 $1459.47 668540 1/1/2013 Core Medical (CM): $112.21 $201.98 $235.64 $325.41 Pay Band 3 Salary $98,001 to &147,000 668900 1/1/2013 per month-single party per month-adult + child(ren) per month-two party per month-family $173.59 $312.46 $419.34 $558.21 None per month-single party per month-adult + child(ren) per month-two party per month-family Health Net Blue and Gold HMO (HB): $485.16 $873.29 $967.98 $1356.11 per month-single party per month-adult + child(ren) per month-two party per month-family $98.31 $176.96 $257.31 $335.95 Health Net HMO (HN): $485.16 $873.29 $967.98 $1356.11 per month-single party per month-adult + child(ren) per month-two party per month-family $181.33 $326.40 $431.65 $576.71 Kaiser Permanente (KS) and (KN): $430.18 $774.32 $900.73 $1244.88 per month-single party per month-adult + child(ren) per month-two party per month-family $82.72 $148.90 $176.37 $242.54 Anthem Blue Cross Plus (BC): $485.16 $873.29 $967.98 $1356.11 per month-single party per month-adult + child(ren) per month-two party per month-family $148.48 $267.26 $362.67 $481.44 Anthem Blue Cross PPO (BP): $485.16 $873.29 $967.98 $1356.11 per month-single party per month-adult + child(ren) per month-two party per month-family $179.81 $323.66 $428.46 $572.30 Anthem BC Lumenos HRA (BL) $405.46 $729.82 $848.81 $1173.18 per month-single party per month-adult + child(ren) per month-two party per month-family $82.72 $148.90 $176.37 $242.54 Kaiser Umbrella (KU): $485.16 per month-single party $210.59 3|Page UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL Section: 395-10 Supplement I Page 4 Effective: 7/1/2013 Supersedes: 1/1/2013 Issuing Office: Business & Financial Svcs – Payroll SCHEDULE OF EMPLOYER MATCHING CONTRIBUTION RATES (REVISED 7/1/2013) Program Account 668540 Last Rate Change 1/1/2013 Employer Contribution $873.29 per month-adult + child(ren) $967.98 per month-two party $1356.11 per month-family $379.06 $493.10 $661.57 Core Medical (CM): None $112.21 $201.98 $235.64 $325.41 Pay Band 4 Salary $147,001 & Over 668900 1/1/2013 Employee Contribution Required per month-single party per month-adult + child(ren) per month-two party per month-family Health Net Blue and Gold HMO (HB): $446.85 $804.33 $891.56 $1249.04 per month-single party per month-adult + child(ren) per month-two party per month-family $136.62 $245.92 $333.73 $443.02 Health Net HMO (HN) $446.85 $804.33 $891.56 $1249.04 per month-single party per month-adult + child(ren) per month-two party per month-family $219.64 $395.36 $508.07 $683.78 Kaiser Permanente (KS) and (KN): $391.87 $705.36 $824.31 $1137.81 per month-single party per month-adult + child(ren) per month-two party per month-family $121.03 $217.86 $252.79 $349.61 Anthem Blue Cross Plus (BC): $446.85 $804.33 $891.56 $1249.04 per month-single party per month-adult + child(ren) per month-two party per month-family $186.79 $336.22 $439.09 $588.51 Anthem Blue Cross PPO (BP): $446.85 $804.33 $891.56 $1249.04 per month-single party per month-adult + child(ren) per month-two party per month-family $218.12 $392.62 $504.88 $679.37 Anthem BC Lumenos HRA (BL) $367.15 $660.86 $772.39 $1066.11 668540 1/1/2013 per month-single party per month-adult + child(ren) per month-two party per month-family $121.03 $217.86 $252.79 $349.61 Kaiser Umbrella (KU): $446.85 per month-single party $804.33 per month-adult + child(ren) $891.56 per month-two party $1249.04 per month-family $248.90 $448.02 $569.52 $768.64 Core Medical (CM): None $112.21 $201.98 per month-single party per month-adult + child(ren) 4|Page UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL Section: 395-10 Supplement I Page 5 Effective: 7/1/2013 Supersedes: 1/1/2013 Issuing Office: Business & Financial Svcs – Payroll SCHEDULE OF EMPLOYER MATCHING CONTRIBUTION RATES (REVISED 7/1/2013) Program Account Last Rate Change Employer Contribution $235.64 $325.41 III per month-two party per month-family GROUP DENTAL INSURANCE 668950 1/1/2013 Delta Dental PPO (D1) $43.66 $90.00 $82.00 $147.11 $22.16 $38.64 $38.03 $54.52 None per month-single party per month-adult + child(ren) per month-two party per month-family GROUP VISION INSURANCE 668830 1/1/2013 Vision Service Plan: $12.11 $12.11 $12.11 $12.11 V None per month-single party per month-adult + child(ren) per month-two party per month-family Delta Care USA / PMI (D3) IV Employee Contribution Required None per month-single party per month-adult + child(ren) per month-two party per month-family POST EMPLOYMENT BENEFITS OPEB (Replaces Retiree Annuitant) 668231 7/1/2013 3.24% of payroll subject to retirement None Benefit Administration 668995 7/1/2010 0.17% of payroll subject to retirement None VI WORKERS' COMPENSATION INSURANCE 668500 7/1/2013 $0.61 per $100 of covered wages19900 funded employees $1.70 per $100 of covered wageshospital employees $1.70 per $100 of covered wagesmedical group employees $0.61 per $100 of covered wagesany other employees $0.61 per $100 of covered wagesfederal funded employees None VII EMPLOYEE SUPPORT PROGRAMS 668530 11/1/1990 $ .23 per $100 of covered wages19900 funded employee $ .12 per $100 of covered wageshospital employee $ .23 per $100 of covered wagesany other employee None VIII UNEMPLOYMENT INSURANCE 668520 7/1/2013 Percentage of all salaries and wages paid to covered employee, including perquisites, overtime differentials, etc. based on fund source as follows: .03% - General Funds .03% - Federal Funds .00% - Hospital Funds None 5|Page UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL Section: 395-10 Supplement I Page 6 Effective: 7/1/2013 Supersedes: 1/1/2013 Issuing Office: Business & Financial Svcs – Payroll SCHEDULE OF EMPLOYER MATCHING CONTRIBUTION RATES (REVISED 7/1/2013) Program Account Last Rate Change Employer Contribution Employee Contribution Required .30% - All Other Funds IX X XI GROUP LIFE INSURANCE Career Coverage 668980 1/1/2007 $4.34 per eligible employee per mo None Core Coverage 668560 1/1/1996 $ .47 per eligible employee per mo None NON-INDUSTRIAL DISABILITY INSURANCE 668800 1/1/2009 $6.71 per eligible employee a mo(4) None POST DOC RATES Health Post Doc 668720 1/1/2013 HMO-Health Net $416.32 $728.62 $989.06 $1256.91 per month-single party per month-adult + child(ren) per month-two party per month-family $8.50 $14.87 $30.59 $38.87 PPO-Health $389.29 $676.27 $942.30 $1188.36 Dental Post Doc 668710 1/1/2013 per month-single party per month-adult + child(ren) per month-two party per month-family $20.00 $40.00 $40.00 $60.00 Dental HMO-Health Net $9.18 $17.45 $16.52 $25.71 per month-single party per month-adult + child(ren) per month-two party per month-family None Dental PPO - Principal $24.36 $56.70 $50.81 $91.24 Vision Post Doc 668730 1/1/2013 per month-single party per month-adult + child(ren) per month-two party per month-family None HMO-Health Net $4.29 $7.99 $7.16 $12.23 per month-single party per month-adult + child(ren) per month-two party per month-family None PSBP Sup Dis 668800 1/1/2013 None $7.95 PSBP Life Ins. and AD& D 668750 1/1/2011 $3.15 per month None PSBP Short-Term Disability 668740 1/1/2011 $8.82 per month None PSBP Broker Fee & Adm 668760 1/1/2012 $9.83 per month None PSBP Worker’s Compensation Employee TC-3252 668500 7/1/2012 Refer to - VI WORKERS' COMP None Fellows & Paid Directs 668500 1/1/2013 $32.65 per month None 6|Page UCSD POLICY AND PROCEDURE MANUAL FINANCIAL ADMINISTRATION -- PAYROLL Section: 395-10 Supplement I Page 7 Effective: 7/1/2013 Supersedes: 1/1/2013 Issuing Office: Business & Financial Svcs – Payroll SCHEDULE OF EMPLOYER MATCHING CONTRIBUTION RATES (REVISED 7/1/2013) Program Account Last Rate Change Employer Contribution Employee Contribution Required FOOTNOTES (1) Covered wages for UCRP members include all wages except overtime, additional compensation, awards, sea pay differential, additional negotiated salary ( Y Factor ), incentive ( Z Factor ) compensation. Applies to those in eligible titles and those that meet eligibility requirements. (2) The OASDI tax rate for 2013 is 6.20% of the first $113,700.00, a maximum contribution total of $7049.40. Certain deductions are taken before OASDI which include out of pocket expenses for Health Insurance, Dependent Care, Healthcare Reimbursement Account and Pretax transportation benefits. OASDI contributions are required from all career status employees (and matched by employers) hired after March 1976 with the exception of the following a) non-resident* aliens with F-1 or J-1 visas performing services to carry out the purposes for which they were admitted to the United States; b) non-resident aliens whose wages are subject to taxes or contributions under a social security system of a foreign country with which the United States has a tax treaty; and c) employees who were rehired and had elected not to contribute to the Social Security Program in the balloting of April 1976. (3) As of January 1, 1994 there will be no limit to wages against which the application of Medicare tax rate shall apply. Certain deductions are taken before Medicare which includes out of pocket expenses for Health Insurance, Dependent Care, Healthcare Reimbursement Accounts and Pre-tax transportation benefits. Medicare contributions are required from all employees ( and matched by employers ) hired or rehired after March 31, 1986 with the exception of the following: (a) non-resident* aliens with F-1 or J-1 visas performing services to carry out the purposes for which they were admitted to the United States; b) non-resident aliens whose wages are subject to taxes or contributions under a social security system of a foreign country with which the United States has a tax treaty; and c) registered students who are regularly attending classes at the University. *Non-resident for tax purposes as defined by the IRS Publication 519 (4) Employees may supplement this protection voluntarily by purchase of the University's Employee Paid Disability insurance. (5) Premium expense for specific Collective bargaining units’ may differ due to bargaining agreements and may vary based on Employee deduction, representation and salary band. Please contact the Payroll office for specific premium expense costs. See additional notes below: • • HX – Employee Contribution rates will continue at 2012 rates during bargaining SX, RX, TX – “TRIGGER” POINT RATES (6) Employee contributions rates may differ based on bargaining units representation. (7) Employees hired previous to July 1, 2013 are in 1976 Tier. Employees hired or become eligible July 1, 2013 and after are in 2013 Tier. 7|Page