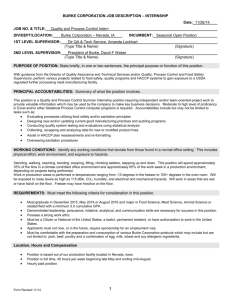

Jeremy M. Burke

advertisement

Jeremy M. Burke RAND Corporation 1200 South Hayes Street Arlington, VA 22202 703‐413‐1100 x5328 jeremyb@rand.org ________________________________________________________________ EDUCATION Duke University, Durham, NC Ph.D. in Economics May 2008 M.A. in Economics May 2005 University of Virginia, Charlottesville, VA B.A. in Mathematics and Economics May 2001 PROFESSIONAL EXPERIENCE RAND Corporation, Economist 2013 – Present Associate Economist 2010 – 2013 Director, 2012 – Present RAND Behavioral Finance Forum Associate Director, 2012 – Present RAND Center for Financial and Economic Decision Making Cornerstone Research, Associate 2008 – 2010 PUBLICATIONS AND WORKING PAPERS Burke, Jeremy, Curtis Taylor and Liad Wagman, “Information Acquisition in Competitive Markets: An Application to the US Mortgage Market,” American Economic Journal: Microeconomics , 2012, 4(4), 65‐106 Burke, Jeremy, “Primetime Spin: Media Bias and Belief Confirming Information”, Journal of Economics & Management Strategy, 2008, 17(3), 633‐ 665 Burke, Jeremy and Curtis Taylor, “What’s in a Poll? Incentives for Truthful Reporting in Pre‐Election Opinion Surveys,” Public Choice, 2008, 137(1), 221‐244 Burke, Jeremy, Jill Luoto, and Francisco Perez‐Arce, “Soft versus Hard Commitments: A Test on Savings Behavior,” working paper Burke, Jeremy and Angela Hung, “Trust and Financial Advice,” RAND working paper WR‐1075 Burke, Jeremy, Kata Mihaly, and Caroline Tassot, “A Literature Review of Interventions Designed to Build Savings and Credit in Economically Vulnerable Consumers,” working paper Mihaly, Kata, Noreen Clancy, Jeremy Burke, and Rebecca Rouse, “Building Financial Capability through Product Design and Program Delivery: Environmental Scan of Integrated Services and Bundled Products,” working paper Mihaly, Kata, Jeremy Burke, Noreen Clancy and Rebecca Rouse, “Building Financial Capability through Product Design and Program Delivery: A Review of Available Evidence,” working paper Burke, Jeremy, Katherine G. Carman, Rebecca Herman, Angela A. Hung, and Julia Kaufman, “K‐12 Financial Education Literature Review: Financial Education Curricula and Criteria for Rating Curricula,” working paper Burke, Jeremy, Rebecca Herman, Angela Hung, and Julia Kaufman, “K‐12 Financial Education Curriculum Assessment Rubric for Selecting Financial Education Curriculum,” working paper Burke, Jeremy and Kata Mihaly, “Financial Literacy, Social Perception and Strategic Default”, RAND Working Paper WR‐937 Burke, Jeremy, Angela Hung, Jack Clift, Steven Garber, and Joanne Yoong, “Impacts of Conflicts of Interest in the Financial Services Industry,” RAND working paper WR‐1076 Burke, Jeremy, “Unfairly Balanced: Unbiased News Coverage and Information Loss,” working paper NON ACADEMIC PUBLICATIONS AND WORKING PAPERS Garber, Steven, Jeremy Burke, Angela Hung and Eric Talley, “Potential Economic Effects on Individual Retirement Account Markets and Investors of DOL’s Proposed Rule Concerning the Definition of a ‘Fiduciary’,” working paper GRANTS AND OTHER RESEARCH SUPPORT PI – Burke, Karlan, Zinman J‐PAL North America 11/20/14 – 7/1/15 Nudges to Save, Nudges to Reduce Debt: A Randomized Trial of Tax‐Time Behavioral Interventions – Pilot Study This pilot project is investigating whether behaviorally informed nudges can help economically vulnerable consumers leverage tax refunds to improve financial stability Role: PI Total Funding: $49,678 PI‐ Hung Department of Labor 9/30/14 – 09/29/15 Automatic Enrollment and Other Behavioral Interventions in Retirement Savings Vehicles Project examining who opts out of auto‐enrollment in retirement savings plans and what influences the decision Role: co‐Investigator Total Funding: $305,563 PI‐ Hung Department of Labor 9/30/14 – 09/29/15 Literature Reviews Project to compare and contrast financial regulatory regimes around the world, review the literature on the efficacy of disclosure, and investigate other topics of interest Role: co‐Investigator Total Funding: $292,694 PI‐ Hung, Burke Consumer Financial Protection Bureau 9/30/14 – 1/31/15 Evaluation of Your Money, Your Goals Project to provide recommendations regarding how to conduct a reach assessment and evaluation of the Your Money, Your Goals program Role: co‐PI Total Funding: $138,289 PI – Herman, Hung Consumer Financial Protection Bureau 2/10/14 – 7/21/14 K‐12 Financial Education Curriculum Assessment This project is reviewing existing evidence on the efficacy of particular curricula in promoting financial capability among students and developing an assessment rubric for selecting financial education curriculum Role: co‐Investigator Total Funding: $419,291 PI‐ Burke Ford Foundation (via Innovations for Poverty Action) 12/1/13 – 3/1/15 Prize Linked Debt Reduction This pilot project is examining whether lottery linked rewards for on‐time debt repayments can improve consumer debt reduction and reduce defaults and delinquencies Role: PI Total Funding: $15,000 PI‐ Burke, Jamison, Karlan, Mihaly Consumer Financial Protection Bureau 8/10/13 – 12/15/15 Building Financial Capability through Product Design and Program Delivery (Task 2) This project is conducting a randomized control trial field test of a credit builder loan examining its impact on credit, savings, and financial stability amongst the economically vulnerable Role: co‐PI Total Funding: $849,536 PI‐ Burke, Luoto, Perez‐Arce Innovations for Poverty Action 3/25/13 – 11/30/13 A Randomized‐Control Trial of a Soft‐Commitment Product – Pilot Phase The goal of this pilot is to investigate take up and market viability of behaviorally informed soft‐commitment saving products developed to help individuals with self‐ control problems achieve their savings goals Role: co‐PI Total Funding: $10,000 PI‐ Dominitz, Hung Department of Labor 9/15/12 – On the Road to Retirement Project designing/implementing a long‐term research panel investigating IRA holders’ and DC plan participants’ retirement planning activities, financial advice interactions, and retirement savings, investment, and drawdown behavior. Role: co‐Investigator Total Funding: $625,000 PI‐ Burke, Karlan, Mihaly Consumer Financial Protection Bureau 9/1/12 – 7/1/13 Building Financial Capability through Product Design and Program Delivery (Task 1) Project examining the array of financial options available to economically disadvantaged consumers and identifying notable gaps. Role: co‐PI Total Funding: $523,268 PI‐ Burke, Luoto, Perez‐Arce National Institute on Aging (through RAND Roybal Center) 01/01/12 – 09/30/13 “Contract‐Free” Commitment The goal of this project is to examine the efficacy of soft‐commitment products in increasing American’s savings. Role: co‐PI Total Funding: $100,000 PI‐ Burke, Mihaly, Rohwedder National Institute on Aging (through RAND Roybal Center) 1/1/12 – Home Equity and Retirement Savings Behavior Project investigating how changes in home equity have impacted retirement savings behavior Role: PI Total Funding: $80,000 PI‐ Hung, Yoong Department of Labor 9/15/11 – Research Support for Regulatory Impact Analysis Project examining individuals’ savings behavior in defined contribution and individual retirement accounts, perception of and reliance upon professional financial advice, and knowledge of fiduciary duties and fee structures Role: co‐Investigator Total Funding: $750,000 PI‐ Hung, Yoong Department of Labor 9/15/11 – Designing More Effective and Understandable Pension Benefits Statements Project conducting a survey and an experiment to test for differences in understanding, retirement savings intentions and cognitive biases based on the provision of pension benefit information in different forms Role: co‐Investigator Total Funding: $300,000 PI‐ Burke, Mihaly National Institute on Aging (through RAND Roybal Center) 1/1/11 – 9/15/12 Financial Literacy, Social Perception and Strategic Default Project examining the influence of financial literacy, knowledge of default consequences, and perceptions of others’ behavior on mortgage default Role: PI Total Funding: $96,784 ACADEMIC EXPERIENCE Pardee RAND Graduate School Professor Spring 2011 – Duke University Instructor Department of Economics Undergraduate Game Theory Fall 2007 Qualifier Camp Summer 2005 (Preparatory class for 1st year Ph.D. students taking qualifying exams) Research Assistant Summer 2005 – Fall 2006 Department of Economics, Curtis Taylor Teaching Assistant Department of Economics Microeconomic Analysis I, II (Ph.D. level courses) Fall 2004 – Spring 2005 Mathematics Review Session for incoming Ph.D. students Summer 2004 AWARDS Graduate School Summer Fellowship, Duke University, Summer 2007 PARISS Fellowship, Social Science Research Institute, Duke University, Fall 2006‐Spring 2007 Conference Travel Fellowship, Spring 2007, Fall 2007 Full Scholarship, Department of Economics, Duke University, Fall 2003 – Spring 2008 PRESENTATIONS Boulder Summer Conference on Consumer Financial Decision Making (poster session), May 2015 CFPB Research Conference (poster session), May 2015 Yale/IPA Researcher Gathering on Advancing Financial Inclusion, May 2015 CFED Assets Learning Conference, September 2014 RAND Behavioral Finance Forum, May 2014 IFIE‐IOSCO Global Investor Education Conference, June 2013 RAND Behavioral Finance Forum, May 2013 Center for Economic Studies, U.S. Census Bureau, November 2012 American Real Estate and Urban Economics Association Mid‐Year Conference, May 2012 University of Southern California , Annenberg School, February 2010 Louisiana State University, November 2007 Annual Meeting of the American Political Science Association, August 2007 Econometric Society North American Summer Meeting, June 2007 Annual Meeting of the Midwest Political Science Association, April 2007 Social Sciences Research Institute, Duke University, March 2007 REFEREEING SERVICE Journal of Economics and Management Strategy, The RAND Journal of Economics, The B.E. Journal of Theoretical Economics, Public Choice