PREPAID CARDS, MOBILE PAYMENTS AND INTERNET-BASED PAYMENT SERVICES

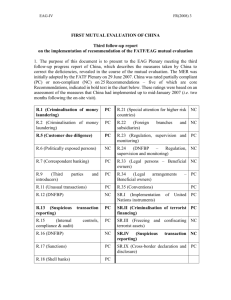

advertisement