AML-CFT basics - Alliance for Financial Inclusion

advertisement

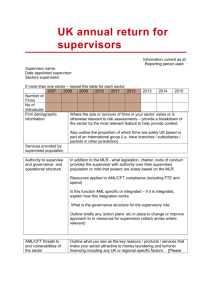

Bringing Smart Policies to Life The basics: AML/CFT for financial inclusion Last update: 2010 AML/CFT: Definition “International effort to bring integrity to financial systems, protecting them from criminal abuse.” • Anti-Money Laundering (AML) Combating the Financing of Terrorism (CFT) standards set by the Financial Access Task Force (FATF) • System integrity is a key ingredient to overall market stability and sustainability AML/CFT: A barrier? • Inappropriate implementation of AML/CFT regulations can play a role in excluding low income people from access to formal financial services • Main challenge is typically the Know Your Customer (KYC) requirements • But adherence to standards appropriately applied can help create confidence and sustainability in the system AML/CFT: Regulators role • Adopt laws that criminalize laundering the proceeds of crime and the provision of financial support to terrorists • Provide clear instructions to entities, including on KYC requirements • Ensure appropriate oversight of financial institutions – and other private sector actors – during implementation AML/CFT: Industry role • Identify customers, verify identities using reliable, independent source documents, data or other information about the person • Obtain information on the purpose and nature of the financial relationship or transactions • Maintain comprehensive records of customer information and transactions • Monitor customer transactions and alert authorities to suspicious transactions Policy Question: Appropriate response • How to tailor AML/CFT measures to the domestic environment? • Is it possible to take a service-based approach rather than an institution-based approach to regulate new offerings? • How to ensure AML/CFT controls are proportionate to the prevailing or likely risks of crime? Policy Question: Capacity • How to create AML/CFT obligations that match public and private institutional abilities to meet, implement and supervise? • How to phase in AML/CFT controls over time as capacity is built but in a way that does not hinder market development? Policy Question: Capacity • Can KYC function be outsourced by regulated institutions to other regulated institution or to authorized 3rd party agen, especially in areas with no bank office? KYC and mobile phone services FATF and WB advise: • International AML standards already address mobile financial services vulnerabilities • No need for new standards • Offer great flexibility for low-risk transactions They claim current regulations often do not: • Address full spectrum of entities (MNO’s) • Provide clarity on licensing process • Take advantage of the flexibility available Example: KYC in Philippines • Regulators recognize any of 18 different documents as acceptable forms of ID • Philippines customers using G-Cash must register via their mobile phone or internet. They cannot withdraw or deposit until they undergo face-to-face Customer Due Diligence (CDD) at an accredited shop, partner or bank. Example: Record Keeping in Malaysia • FATF recommends mobile operators and other payment system providers keep CDRs similar to banks • Maxis keeps records of transactions for active customers on an ongoing basis. If the account is terminated they archive the info for seven years. Example: Reporting obligations Hong Kong and Macao • MNO’s are considered reporting entities under the AML/CFT regime – same as financial institutions • MNO’s report suspicious transactions to authorities, including the channel used and whether it was mobile Thank you! © Alliance for Financial Inclusion 2010 info@afi-global.org www.afi-global.org