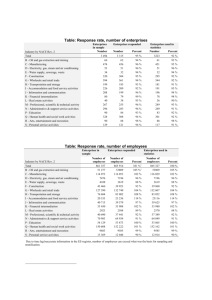

8 SECTORAL ANALYSIS OF NON-FINANCIAL CORPORATIONS IN PORTUGAL 2011/2012

advertisement