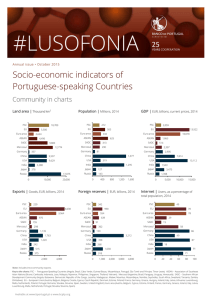

Socio-economic indicators of Portuguese-speaking Countries Community in charts Land area |

advertisement

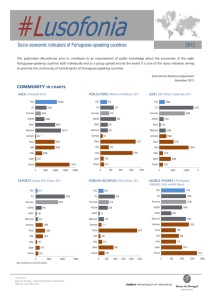

Annual issue • October 2014 Socio-economic indicators of Portuguese-speaking Countries Community in charts Land area | Thousand km2 PSC Population | Millions, 2013 PSC 10709 EU Euro area 9883 Mercosul 12774 Germany 294 SADC Mercosul 283 Mercosul 357 China 9597 China USA 9629 USA India Japan 378 Russia 17075 0 10000 82 1385 Exports | Goods, EUR, billions, 2013 2738 6913 USA 317 1255 127 Japan 142 Russia 400 800 1200 1600 Foreign reserves | EUR, billions, 2013 12649 India Japan 0 2402 China Russia 20000 1812 488 Germany India 3288 9602 ASEAN 619 SADC Germany 13080 Euro area 333 ASEAN 4496 SADC 1965 EU 506 Euro area 2624 ASEAN PSC 262 EU 5500 GDP | EUR, billions, current prices, 2013 1409 3691 1595 0 5000 10000 15000 Internet | Users, as a percentage of total population, 2013 PSC PSC 238 EU 4575 Euro area 3498 ASEAN SADC China USA India Japan 2000 4000 46 84 India 216 1000 15 Japan 919 86 Russia 370 0 84 China USA 325 Russia 394 0 2814 Japan 538 Russia 53 Germany 144 India 236 15 Mercosul 313 USA 1189 26 SADC 81 China 1663 76 ASEAN 584 Germany 1094 75 Euro area 495 Mercosul 325 Germany Euro area 44 EU 902 SADC 163 Mercosul EU ASEAN 959 PSC 311 2000 3000 61 0 20 40 60 80 100 Note: Includes intra-community exports. Key to the charts: PSC – Portuguese-Speaking Countries (Angola, Brazil, Cabo Verde, Guinea-Bissau, Mozambique, Portugal, São Tomé and Príncipe, Timor-Leste); ASEAN – Association of Southeast Asian Nations (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam); Mercosul (Argentina, Brazil, Paraguay, Uruguay, Venezuela); SADC – Southern African Development Community (Angola, Botswana, Democratic Republic of the Congo, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Swaziland, Tanzania, Zambia, Zimbabwe); EU – European Union (Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom); Euro area (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain). Avaliable at www.bportugal.pt e www.bcplp.org 2 #LUSOFONIA • October 2014 Portuguese-speaking Countries in charts Population | Thousands Land area | Thousand km2 Gross Domestic Product | EUR, millions, current prices 21559 13925 Angola Brazil 8512 200549 Brazil (3196) 174505 511 442 Cabo Verde 25900 18276 Mozambique 10537 10306 Portugal 2013 São Tomé and Príncipe 195 139 Timor-Leste 1185 854 2000 Angola 1247 (799) 1409 584 (107) Mozambique 802 TimorLeste 15 São Tomé and Príncipe 1 Portugal 92 (311) (40) 6770 2190 2013 6220 2910 2000 1240 560 Guinea-Bissau Mozambique 1040 410 Mozambique 25350 17340 2950 1700 (2001) São Tomé and Príncipe Timor-Leste 6410 1640 Timor-Leste 20000 5.9 6.0 Timor-Leste 3720 423 30000 Note: PPP – Purchasing power parity. A form of currency conversion alternative to market rates. It rests on the comparison of prices in local currency for the same representative basket of goods in different countries (to establish a parity between the purchasing power of the same amount of currency in each country). Frequently used in international comparisons. 2013 2000 2013 2000 -0.1 16.7 3.0 10.5 0.4 7.1 9.6 (2001) 4.0 6.0 0 6 3 200000 Note: Figures for Timor-Leste include oil revenues. 42.6 Angola 14.4 47.7 29.6 93.7 Cabo Verde 63.9 2013 22.5 Guinea-Bissau 4.6 2004 45.3 Mozambique 22.5 98.0 Portugal 3.8 -3 100000 Brazil 0.1 -1.0 Portugal São Tomé and Príncipe 10000 234 83 Bank deposits | 268.4 Cabo Verde Guinea-Bissau Portugal São Tomé and Príncipe As a percentage of GDP 7.7 Brazil 8500 165666 127317 Portugal 0 Angola 14750 Brazil 11847 4529 (131) Inflation | Consumer Price Index, year-on-year percentage change current prices 732 393 Mozambique 40000 GDP per capita | USD, in PPP, 0 697578 (503) GuineaBissau 36 Note: Figures in brackets refer to the area of the respective Exclusive Economic Zone. Cabo Verde 1688769 Brazil Guinea-Bissau Cabo Verde 4 (574) 20000 0 Angola 9117 Cabo Verde 1716 1273 Guinea-Bissau 91619 Angola 9 12 15 18 74.9 São Tomé and Príncipe 43.6 22.5 39.2 Timor-Leste 15.1 0 50 100 150 3 #LUSOFONIA • October 2014 Portuguese-speaking Countries in charts Human development index | Business environment | Global competitiveness | Ranking position Ranking position Ranking position 149 161 Angola 2014 79 73 Brazil 2000 123 100 Cabo Verde 116 122 Brazil Cabo Verde 121 125 Cabo Verde 177 167 Guinea-Bissau Mozambique 178 170 Mozambique 41 28 128 50 100 150 2014 2006 169 167 172 174 Timor-Leste 158 (2002) 200 0 50 100 150 57 66 114 not assessed Guinea-Bissau not assessed 133 121 Mozambique 31 45 São Tomé and Príncipe 142 119 0 139 137 Portugal São Tomé and Príncipe Timor-Leste 180 173 140 125 Angola Brazil Guinea-Bissau Portugal 179 155 Angola 36 34 Portugal São Tomé and Príncipe 2014 2006 not assessed 136 122 Timor-Leste 200 0 50 100 150 Note: Human Development Index: composite indicator calculated by the United Nations Development Programme (UNDP), which takes into account life expectancy, educational attainment and income (1: maximum – 175: minimum in 2000; 1: maximum – 187: minimum in 2014). Note: Doing Business Indicators: range of indicators relevant to the business environment regulatory framework, compiled by the World Bank. A composite indicator is calculated to encapsulate the overall quality of the business environment in each country (1: maximum – 175: minimum in 2006; 1: maximum – 185: minimum in 2014). Note: Global Competitiveness Indicator: composite indicator calculated by the World Economic Forum, which encapsulates a wide set of macroeconomic and structural indicators seen as relevant for measuring competitiveness (1: maximum – 125: minimum in 2006; 1: maximum – 148: minimum in 2014). Life expectancy | At birth, years Literacy rate | Adult population (15+) able Internet | Users, as a percentage of to read and write, as a % of total population total population 51 45 Angola Brazil 74 70 Brazil Cabo Verde 75 70 Cabo Verde 54 51 Guinea-Bissau 2012 80 76 66 63 São Tomé and Príncipe Timor-Leste 67 59 Timor-Leste 20 40 60 80 100 41.4 (2000) 56.1 48.2 (2010) (2003) 2012 2001 94.5 91.0 (2011) Portugal São Tomé and Príncipe 0 56.7 Guinea-Bissau Mozambique Portugal 85.3 80.0 (2004) 89.2 84.9 (2010) 58.3 (2010) 20 40 60 80 0.1 51.6 Brazil 2.9 37.5 Cabo Verde 1.8 Guinea-Bissau 3.1 0.2 Mozambique 5.4 0.1 100 2013 2000 62.1 Portugal 16.4 São Tomé and Príncipe 23.0 4.6 1.1 0.0 Timor-Leste 37.6 0 19.1 Angola 91.3 86.4 (2000) 2000 50 47 Mozambique 70.6 67.4 Angola 0 20 40 60 80 4 #LUSOFONIA • October 2014 Banking systems of Portuguese-speaking Countries Financial soundness indicators Angola 2002 2007 2012 Capital adequacy 14.4 15.0 13.6 Return on equity 18.3 23.6 12.5 Non-performing loans (NPL) 10.4 2.9 6.8 Credit in foreign currency 74.8 69.9 42.7 Asset liquidity 72.0 34.2 26.3 2002 2007 2012 Capital adequacy 16.6 18.7 16.4 Return on equity 21.8 28.8 13.4 4.8 3.0 3.4 143.6 181.9 149.1 1.9 2.9 1.4 Capital adequacy Return on equity Asset liquidity Credit in foreign currency 2002 Non-performing loans (NPL) 2007 2012 Brazil Capital adequacy Return on assets Return on equity Non-performing loans (NPL) Provisions for NPL Non-performing loans (NPL) Provisions for NPL 2002 2007 Return on assets 2012 Key to the charts: Capital adequacy (as a percentage): - Angola, Mozambique and Portugal: [original own funds] / [risk-weighted assets]; - Brazil, Cabo Verde and Guinea-Bissau: [own funds] / [riskweighted assets]; - São Tomé and Príncipe and Timor-Leste: equity / assets. Return on equity (ROE) (as a percentage): return / equity. Return on assets (ROA) (as a percentage): return / assets. Non-performing loans (NPL) (as a percentage): [NPL] / [total credit]. Credit in foreign currency (as a percentage): [credit in foreign currency] / [total credit]. Provisions for NPL (as a percentage): [provisions] / [NPL] Asset liquidity (as a percentage): [liquid assets] / [total assets]. Liquidity ratio (as a percentage): [liquid assets] / [short-term liabilities] Credit / deposits ratio (as a percentage): [credit (net of impairments)] / [customer resources] #LUSOFONIA • October 2014 Banking systems of Portuguese-speaking Countries Financial soundness indicators Cabo Verde 2002 2007 2012 Capital adequacy 15.0 11.4 12.1 Return on equity 18.7 30.9 3.9 7.4 4.3 9.3 114.9 113.2 112.3 48.8 15.9 13.2 Non-performing loans (NPL) Provisions for NPL Asset liquidity Capital adequacy Return on equity Asset liquidity Provisions for NPL Non-performing loans (NPL) 2002 2007 2012 Asset liquidity: 2003, 2007, 2012 Guinea-Bissau 2007 2012 Capital adequacy 27.3 19.9 Return on equity -15.1 18.0 6.6 9.7 Liquidity ratio 81.4 84.1 Asset liquidity 23.3 44.6 Non-performing loans (NPL) Capital adequacy Return on equity Asset liquidity Non-performing loans (NPL) Liquidity ratio 2007 2012 5 6 #LUSOFONIA • October 2014 Banking systems of Portuguese-speaking Countries Financial soundness indicators Mozambique 2002 2007 2012 Capital adequacy 12.0 12.1 16.9 Return on equity 22.1 50.7 19.6 Non-performing loans (NPL) 22.0 2.6 3.2 Credit in foreign currency 69.9 28.5 28.1 Asset liquidity 53.9 36.0 33.4 2002 2007 2012 Capital adequacy 7.1 7.0 11.3 Return on equity 14.1 18.0 -5.5 2.3 1.5 9.7 62.8 74.1 54.3 130.7 161.4 127.9 Capital adequacy Return on equity Asset liquidity Credit in foreign currency 2002 Non-performing loans (NPL) 2007 2012 Portugal Capital adequacy Credit / deposits ratio Return on equity Non-performing loans (NPL) Provisions for NPL Non-performing loans (NPL) Provisions for NPL 2002 2007 Credit / deposits ratio 2012 Key to the charts: Capital adequacy (as a percentage): - Angola, Mozambique and Portugal: [original own funds] / [risk-weighted assets]; - Brazil, Cabo Verde and Guinea-Bissau: [own funds] / [riskweighted assets]; - São Tomé and Príncipe and Timor-Leste: equity / assets. Return on equity (ROE) (as a percentage): return / equity. Return on assets (ROA) (as a percentage): return / assets. Non-performing loans (NPL) (as a percentage): [NPL] / [total credit]. Credit in foreign currency (as a percentage): [credit in foreign currency] / [total credit]. Provisions for NPL (as a percentage): [provisions] / [NPL] Asset liquidity (as a percentage): [liquid assets] / [total assets]. Liquidity ratio (as a percentage): [liquid assets] / [short-term liabilities] Credit / deposits ratio (as a percentage): [credit (net of impairments)] / [customer resources] #LUSOFONIA • October 2014 Banking systems of Portuguese-speaking Countries Financial soundness indicators São Tomé and Príncipe 2003 2007 2012 Capital adequacy 21.2 16.7 24.4 Return on equity 19.2 -0.2 -0.2 26.6 18.9 Non-performing loans (NPL) Credit in foreign currency 67.4 77.9 57.9 Asset liquidity 69.0 44.0 36.3 Capital adequacy Return on equity Asset liquidity Credit in foreign currency 2003 Non-performing loans (NPL) 2007 2012 Timor-Leste Capital adequacy 2003 2007 2012 19.4 -9.8 1.9 29.5 51.7 Return on equity Non-performing loans (NPL) 6.3 30.2 30.8 Provisions for NPL 2.2 205.9 130.0 74.3 71.3 81.3 Asset liquidity Capital adequacy Return on equity Asset liquidity Provisions for NPL 2003 Non-performing loans (NPL) 2007 2012 7 8 #LUSOFONIA • October 2014 Portuguese-Speaking Countries in tables Gross domestic product | Annual percentage change, at constant prices Angola Brazil Cabo Verde Guinea-Bissau Mozambique Portugal São Tomé and Príncipe Timor-Leste 2001 a 2005 2006 2007 2008 2009 2010 Est. 2011 Est. 2012 Est. 2013 Est. 2014 Proj. 2015 Proj. 10.4 2.8 5.1 1.6 8.8 0.8 4.3 6.5 20.7 4.0 8.7 2.1 8.7 1.4 6.7 -3.2 22.6 6.1 10.5 3.2 7.3 2.4 6.0 11.7 13.8 5.2 6.7 3.2 6.8 0.0 9.1 14.6 2.4 -0.3 -1.3 3.4 6.5 -2.9 4.0 12.9 3.4 7.5 1.5 4.5 7.1 1.9 4.5 9.4 3.9 2.7 4.0 5.3 7.4 -1.3 4.9 14.7 5.2 1.0 1.2 -1.5 7.1 -3.2 4.0 7.8 6.8 2.3 0.5 0.3 7.4 -1.4 4.0 5.4 3.9 1.8 3.0 2.7 8.3 1.1 5.0 6.6 5.9 2.7 3.5 3.9 8.2 1.5 5.5 6.8 Inflation | Consumer price index, year-on-year percentage change Angola Brazil Cabo Verde Guinea-Bissau Mozambique Portugal São Tomé and Príncipe Timor-Leste 2001 a 2005 2006 2007 2008 2009 2010 Est. 2011 Est. 2012 Est. 2013 Est. 2014 Proj. 2015 Proj. 64.9 8.5 1.3 0.6 12.9 3.1 12.1 4.4 12.2 3.1 5.8 3.2 9.4 2.5 24.6 7.2 11.7 4.5 4.0 9.3 10.3 2.7 27.6 8.6 13.2 5.9 6.7 8.7 11.8 0.8 24.8 7.5 14.0 4.3 -0.4 -4.5 3.0 -0.1 16.1 1.8 15.3 5.9 3.4 5.6 16.6 2.4 12.9 9.2 11.4 6.5 3.6 3.4 5.5 3.5 11.9 17.4 9.0 5.8 4.1 1.7 2.2 2.1 10.4 11.7 7.7 5.9 0.1 -0.1 3.0 0.4 7.1 4.0 8.0 5.8 2.2 2.8 6.0 0.2 6.0 1.0 7.2 5.4 2.5 2.0 5.6 1.0 4.0 3.8 Overall budget balance | As a percentage of GDP, commitment basis Angola Brazil Cabo Verde Guinea-Bissau Mozambique Portugal São Tomé and Príncipe (Domestic primary balance) Timor-Leste 2001 a 2005 2006 2007 2008 2009 2010 Est. 2011 Est. 2012 Est. 2013 Est. 2014 Proj. 2015 Proj. 1.1 -3.7 -5.8 -7.0 -4.4 -4.5 -3.8 11.8 -3.5 -3.2 -5.5 -4.1 -3.8 -12.7 -9.5 19.9 4.7 -2.7 1.2 -10.5 -2.9 -3.2 125.4 -8.2 37.5 -5.6 -1.6 -1.6 -2.4 -2.3 -3.7 14.7 -6.2 44.9 -9.6 -3.3 -5.8 3.7 -5.0 -10.2 -18.0 -8.1 31.3 5.3 -2.8 -10.6 -0.2 -3.8 -9.9 -10.5 -4.1 37.9 10.2 -2.6 -7.7 -0.6 -4.5 -4.3 -12.6 -3.0 42.7 6.7 -2.8 -10.5 -2.7 -4.6 -6.4 -10.8 -3.3 46.9 0.3 -3.3 -9.0 -3.4 -5.3 -4.9 -2.0 -2.7 36.1 -4.9 -3.3 -8.1 -3.7 -12.0 -4.0 -14.6 -3.0 36.9 -4.2 -2.5 -6.5 -1.8 -7.5 -2.5 -6.0 -2.6 33.1 1.7 External current account | As a percentage of GDP Angola Brazil Cabo Verde (Current and capital account) Guinea-Bissau Mozambique (Current and capital account) Portugal (Current and capital account) São Tomé and Príncipe (Current and capital account) Timor-Leste 2001 a 2005 2006 2007 2008 2009 2010 Est. 2011 Est. 2012 Est. 2013 Est. 2014 Proj. 2015 Proj. -0.5 -0.3 -10.2 -2.7 -0.4 -15.3 -7.4 -8.7 -7.4 -29.3 25.6 1.3 -6.6 -5.2 -5.6 -10.7 20.9 -10.7 -9.9 -42.6 -25.2 19.2 17.5 0.1 -12.9 -11.2 -3.5 -9.7 -3.0 -10.1 -8.9 -44.7 83.0 39.7 8.5 -1.7 -13.7 -12.2 -3.3 -11.9 -7.6 -12.6 -11.1 -50.9 -15.9 45.6 -10.1 -1.5 -14.6 -11.9 -5.7 -11.0 -7.2 -10.9 -10.1 -40.1 3.3 39.0 9.1 -2.2 -13.5 -11.1 -8.4 -10.6 -7.3 -10.6 -9.4 -43.7 -23.1 39.8 12.6 -2.1 -16.3 -15.6 -1.4 -23.1 -19.8 -7.0 -5.8 -42.9 -25.4 40.4 12.2 -2.4 -10.9 -10.2 -9.1 -42.4 -39.4 -2.2 0.8 -37.8 -23.0 43.4 4.9 -3.6 -2.8 -2.4 -4.9 -37.5 -34.4 0.1 2.6 -28.3 -19.0 34.2 2.2 -3.6 -9.2 -9.0 -4.9 -46.8 -43.4 0.1 2.8 -31.3 -18.9 31.9 2.0 -3.7 -10.8 -10.5 -4.4 -47.0 -43.8 0.1 4.0 -28.5 -17.2 26.7 -0.8 Main sources: Central banks, Ministries of Finance and national statistical institutes of Portuguese-speaking countries; Eurostat, European Central Bank (ECB), International Monetary Fund (IMF), Organisation for Economic Co-operation and Development (OECD), World Bank, United Nations (UN), World Trade Organisation (WTO), CIA Factbook, World Economic Forum. #LUSOFONIA | Annual issue • Banco de Portugal Av. Almirante Reis, 71 | 1150-012 Lisboa • www.bportugal.pt Edition International Relations Department • Design Administrative Services Department | Editing and Publishing Services ISSN (online) 2183-1014