ATTACHMENT A

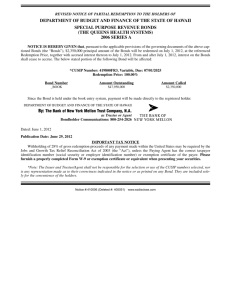

advertisement