Document 12076486

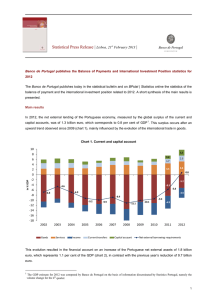

advertisement