| Statistical Press Release Lisboa, 21

advertisement

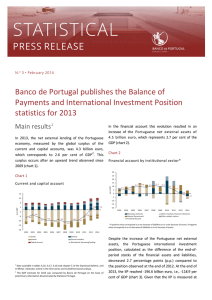

Statistical Press Release | Lisboa, 21st February 2013 | Banco de Portugal publishes the Balance of Payments and International Investment Position statistics for 2012 The Banco de Portugal publishes today in the statistical bulletin and on BPstat | Statistics online the statistics of the balance of payment and the international investment position related to 2012. A short synthesis of the main results is presented. Main results In 2012, the net external lending of the Portuguese economy, measured by the global surplus of the current and 1 capital accounts, was of 1.3 billion euro, which corresponds to 0.8 per cent of GDP . This surplus occurs after an upward trend observed since 2009 (chart 1), mainly influenced by the evolution of the international trade in goods. Chart 1. Current and capital account 10 2.3 8 6 4 2 1.2 1.7 2.3 4.5 5.2 0.8 in % GDP 0 -2 -5.2 -4 -6 -8 -8.3 -4.6 -5.8 -6.9 -6.8 -3.9 -8.9 -10 -9.2 -9.9 -12 -9.4 -10.1 -11.1 -4.9 -14 -16 -18 2002 Goods 2003 Services 2004 Income 2005 2006 Current transfers 2007 2008 Capital account 2009 2010 2011 2012 Net external borrowing requirements This evolution resulted in the financial account on an increase of the Portuguese net external assets of 1.8 billion euro, which represents 1.1 per cent of the GDP (chart 2), in contrast with the previous year’s reduction of 9.7 billion euro. 1 The GDP estimate for 2012 was computed by Banco de Portugal on the basis of information disseminated by Statistics Portugal, namely the volume change for the 4th quarter. 1 Statistical Press Release | Lisboa, 21st February 2013 | Chart 2. Financial account by institutional sector * 30.0 25.0 20.0 as % GDP 15.0 10.0 6.7 11.1 9.5 6.7 9.1 5.0 10.4 9.0 8.5 5.7 4.4 0.0 -1.1 -5.0 -10.0 -15.0 -20.0 2002 2003 2004 2005 2006 2007 2008 2009 Monetary Authorities Other Monetary Financial Institutions Other resident sectors Financial account 2010 2011 2012 General Government * A positive value corresponds to a net increase of liabilities or to a net decrease of assets. A negative value corresponds to a net decrease of liabilities or a net increase of assets. In 2012, the Portuguese international investment position, measured by the difference between the end-of-period stocks of the financial assets and liabilities, decreased 11.2 percentage points (p.p.) when compared to the position observed at the end of 2011, standing at -192.8 billion euro, which means, -116.1 per cent of GDP (chart 3). This evolution is justified, especially, by a negative price variation, brought about by the appreciation of the debt securities issued by the General Government and held by non residents, which was not offset by the increase of net assets observed in the financial account. At the end of 2012 the net external debt stood at 164.6 billion euro, equivalent to 99.1 per cent of GDP, that is, 12.8 p.p. higher than the one observed at the end of 2011. 2 Statistical Press Release | Lisboa, 21st February 2013 | Chart 3. International investment position 40% 20% 0% in %GDP -20% -40% -55.4% -60% -58.2% -63.1% -67.4% -78.8% -80% -88.9% -100% -96.1% -104.9% -110.6% -120% -107.2% -116.1% -140% 2002 2003 2004 2005 2006 2007 2008 Monetary Authorities Other monetary financial institutions Other resident sectors International investment position 2009 2010 2011 2012 General Government Current and capital account In 2012, the evolution of the current and capital accounts presents in 2012 was significantly different from the one observed in the previous years. Chart 4. Current and capital account: 2010-2012 4.0 2.0 1.3 0.0 -2.0 Billion euro -4.0 -6.0 -8.0 -10.0 -9.9 -12.0 -14.0 -16.0 -16.3 -18.0 Jan Feb Mar 2010 Apr May Jun 2011 Jul Aug Sep Oct Nov Dec 2012 3 Statistical Press Release | Lisboa, 21st February 2013 | The surplus of the current and capital accounts increased of 6.6 p.p. of GDP compared with the value observed in 2011. This increase is brought about by the reduction of the deficits of the goods account, by 3.1 p.p., and of the income account, by 1.1 p.p., and also of the increase of the surpluses of the services account, the current transfers account and of the capital account by 0.7 p.p., 0.5 p.p. and 1.1 p.p., respectively (chart 5). Chart 5. Current and capital account – decomposition of the annual variation of the total surplus 7 6.6 6 5 3.7 in % GDP 4 3 3.1 2 0.6 1 0 0.7 1.1 1.1 0.5 1.0 -1 -2 -3 2009 2010 Goods Income Capital account 2011 2012 Services Current transfers Year-on-year rate of change The deficit of the goods account decreased almost 40 per cent: from -14.2 billion euro in 2011 to -8.6 billion euro in 2012. This behavior resulted from the growth of exports, by 5.7 per cent, as from the decrease of imports, by 5.5 per cent. The services account surplus increased nearly one billion euro (from 7.7 billion euro in 2011 to 8.7 billion euro in 2012), mainly due to the contribution of travel. The expenditures of foreign tourists in Portugal increased 5.6 per cent in 2012. The account of goods and services presented a surplus of 111 million euro in 2012, which compares to a deficit of -6.5 billion euro in 2011. Regarding current transfers, in 2012 it was observed an increase of the emigrant remittances of 13.1 per cent, along with a decrease in remittances from migrants of 10.3 per cent. Financial account In 2012, the net external lending of the Portuguese economy translated, at the financial account level, into an increase of the net external assets. Within this context, it is worth mentioning the increase of the liabilities of the General Government, mainly associated to the loans obtained by Portugal in the scope of the Financial and Economic Assistance Program, which was partly counterbalanced by the amortization of public debt securities held by non residents. The other financial monetary institutions recorded redemption of liabilities, both in the form of securities and in the form of loans and deposits, which was partially offset by a decrease in assets of foreign securities. The non monetary financial institutions presented an amortization of liabilities associated to securities held by non residents. 4