| Statistical Press Release Lisbon, 20

advertisement

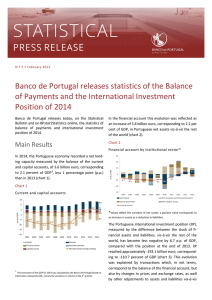

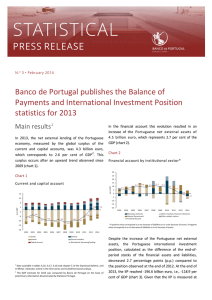

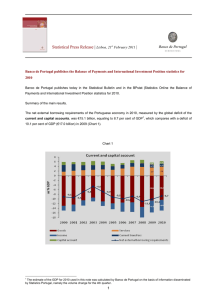

Statistical Press Release | Lisbon, 20th February 2012 | Banco de Portugal publishes the Balance of Payments and International Investment Position statistics for 2011 Summary of the main results In 2011 the net external borrowing of the Portuguese economy, measured by the global deficit of the external current 1 and capital accounts, was 8.9 billion euro (5.2 per cent of GDP ), remaining on a downward trend for the third consecutive year (chart 1), and largely reflecting the evolution of international trade in goods. Chart 1 - Current and capital account 8 1.2 6 4 2 1.1 1.3 1.8 3.9 4.5 0 as % GDP -2 -4 -7.7 -4.6 -6 -6.9 -6.8 -8 -9.2 -9.4 -10 -5.2 -10.5 -9.9 -8.9 -8.9 -10.1 -5.0 -11.1 -12 -4.6 -14 -16 -18 2001 2002 Goods 2003 2004 2005 2006 2007 2008 Services 2009 2010 Income Current transfers Capital account Net external borrowing requirements 2011 This evolution resulted in the financial account on a 9.4 billion euro increase of the net external liabilities of Portugal, which corresponds to 5.5 per cent of GDP (chart 2). This increase in liabilities is partly associated with the loans received by Portugal in the context of the Economic and Financial Assistance Programme. 1 The GDP estimate for 2011 used in this note was computed by Banco de Portugal on the basis of information disseminated by Statistics Portugal, namely the volume change for the 4th quarter. 1 Statistical Press Release | Lisbon, 20th February 2012 | Chart 2 - Financial account by institutional sector 30% 25% 20% 15% as % GDP 9.1 9.1 10% 4.4 6.7 5% 11.1 9.5 10.4 9.0 8.5 6.7 5.5 0% -5% -10% -15% -20% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Monetary Authorities Other Monetary Financial Institutions General Government Other resident sectors Financial account The increase in the Portuguese net external liabilities was more than offset by the devaluation of portfolio investment liabilities issued by the General Government and by the resident financial institutions, in line with the perception of a greater sovereign risk. As a result, the net international investment position of Portugal, measured by the difference between the end-of-period stocks of financial assets and liabilities, stood, by end 2011, at -177.2 billion euro (-103.6 per cent of GDP), which represents an improvement of 3.6 percentage points (p.p.) when compared with the position observed at end 2010 (chart 3). At the end of 2011 the net external debt stood at -142.3 billion euro, equivalent to 83.2 per cent of GDP, that is, 1.1p.p. lower than the one recorded at the end of 2010. Chart 3 - International investment position 40% 20% 0% as % GDP -20% -40% -46.3 -55.4 -58.2 -60% -63.1 -67.4 -78.8 -80% -88.9 -96.1 -100% -107.3 -110.6 -120% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -103.6 2011 Monetary Authorities Other monetary financial institutions General Government Ohter resident sectors International investment position 2 Statistical Press Release | Lisbon, 20th February 2012 | Current and capital account In 2011 the decrease by 3.6 p.p. of GDP in the global deficit of the current and capital accounts, was brought about by the reduction in the goods account deficit (2.8 p.p.), the increase in the surplus of the services account (0.6 p.p.) and the current transfers (0.5 p.p.), that largely offset the rise in the income account deficit (chart 4). Chart 4. Current and capital account – contribution to the year-on-year rate of change 4 3.6 2.8 3 2 1.0 1.2 as % GDP 1 0.6 0.5 0.1 0 -0.4 -1 -2 -3 -2.2 2008 2009 2010 2011 Goods Services Income Current transfers Capital account Year-on-year rate of change The decline in the goods account deficit stemmed from the growth of exports (15.4 per cent) that overcame by 1.2 per cent the growth of imports, similarly to what had been recorded in 2010. For the improvement in the services account surplus the main contribution came from travel, with an increase of 7.2 per cent in the expenditures made by foreign travelers in Portugal in 2011, while travel expenditures made by Portuguese abroad remained virtually unchanged from the previous year. Interest associated with the loans received by Portugal in the context of Economic and Financial Assistance Programme, which amount to 0.3 per cent of GDP in 2011, contributed to the accentuation of the income account deficit. Financial account In 2011 the net external requirements of the Portuguese economy translated, at the financial account level, into an increase of the net external liabilities. The increase in the general government liabilities was, to a large extent, related with the loans granted to Portugal in the context of the Economic and Financial Assistance Programme, partially offset by a redemption of securities held by non residents. The monetary financial institutions recorded redemption of liabilities, both in the form of securities and in the form of loans and deposits, which was partially offset by a decrease in assets in foreign securities. 3