University of Saskatchewan 1999 Academic Pension Plan November 1, 2012

advertisement

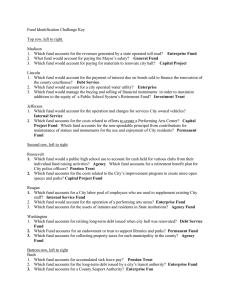

University of Saskatchewan 1999 Academic Pension Plan November 1, 2012 Agenda The 1999 Academic Plan Basics Valuation Basics Going-Concern Position Solvency Position Current Contribution Schedule Solvency “Extras” History of Plan Transfers Current Pension Landscape Plan Membership 1 The 1999 Academic Plan Basics What type of Plan do I have? – The Academic Pension Plan is a defined benefit pension plan – Provides a monthly pension at retirement – Based on service and best average earnings at retirement What benefit am I entitled to at retirement? – Monthly Pension; or – Lump sum transfer equal to greater of: 1. Commuted value of pension 2. Member and University contributions with interest 2 The 1999 Academic Plan Basics - continued How is my pension calculated at retirement? (2% x Service x BAE4) – (0.4% x Post-2005 Service x FAYMPE3) where: Service = pensionable service earned while a member of the Plan BAE4 = Best Average Earnings, based on average of highest 48 continuous months of earnings Post-2005 Service = pensionable service earned after 2005 FAYMPE3 = Average of the final 3 years of the Year’s Maximum Pensionable Earnings 3 The 1999 Academic Plan Basics - continued What do I contribute to the Plan? – Current member contribution rates are: • To August 31, 2010: 6.82% of earnings • After August 31, 2010: 8.50% of earnings What does the University contribute to the Plan? – The University matches your contributions plus pays for any additional amounts required to meet minimum funding standards (deficit funding) – Current University contribution rates are: • To August 31, 2010: 10.33% of earnings • After August 31, 2010: 8.65% of earnings 4 The 1999 Academic Plan Basics - continued When can I retire? Normal Retirement • June 30th immediately following age 67 Postponed Retirement • Last day of the month following a member’s normal retirement • No later than end of year member turns 71 Early Retirement • Last day of the month following the June 30th after age 55 (pension subject to early retirement reductions) 5 The 1999 Academic Plan Basics – continued Is my pension reduced at retirement? – Depending on when you retire, your pension might be reduced at retirement – Pre-92 service • not subject to early retirement reduction – Post-91 service • Amount of reduction for early retirement is equal to 0.25% for each month between your early retirement date (ERD) and the earlier of: Age 60; or Rule of 80 – Members with less than 10 years are subject to an actuarial equivalent reduction 6 The 1999 Academic Plan Basics – continued How will my pension be payable? – – – – Pension is payable at the end of each month for your lifetime Normal Form = Single Life, 10 year guarantee Pension on annual statement always calculated in normal form Optional forms available: • With Spouse: Joint & Survivor, reducing to 60%, 66 2/3%, 75% or paying full 100% A guarantee period of 5, 10 or 15 years can be attached Integrated options (i.e. level income option) • Without Spouse Single Life, guaranteed for 15 years Integrated options (i.e. level income option) – Normal form pension actuarially reduced based on which optional form chosen 7 The 1999 Academic Plan Basics – continued Is my pension limited? – The Plan limits the amount of pension you can earn in any given year – Limit is set by CRA and increases each year – Historical earnings limits Year Maximum Pensionable Earnings Limit 2012 $142,354 2011 $137,271 2010 $134,162 2009 $131,482 2008 $125,647 2007 $119,851 2006 $113,976 2005 $100,000 2004 $91,667 2003 $86,111 8 The 1999 Academic Plan Basics – Example #1 Member Information: – Member is age 60 – 21 years of total service (14 years of pre-2006 service and 7 years of post-2005 service) – Earnings and YMPE for the last 10 years are as follows: Year Actual Earnings Annual Pensionable Earnings After Appling Maximum Limit 2012 $100,000 $100,000 $50,100 2011 $95,000 $95,000 $48,300 2010 $92,000 $92,000 $47,200 2009 $90,000 $90,000 $46,300 2008 $85,000 $85,000 $44,900 2007 $84,000 $84,000 $43,700 2006 $82,000 $82,000 $42,100 2005 $80,000 $80,000 $41,100 2004 $76,000 $76,000 $40,500 2003 $75,000 $75,000 $39,900 9 Year’s Maximum Pensionable Earnings The 1999 Academic Plan Basics – Example #1 Calculation of BAE4 and FAYMPE3: – BAE4 is based on average of highest 48 continuous months of earnings – FAYMPE3 is based on average of final 3 years of YMPE Year Annual Pensionable Earnings After Appling Maximum Limit Year’s Maximum Pensionable Earnings 2012 $100,000 $50,100 = (100,000 + 95,000 + 92,000 + 90,000) / 4 2011 $95,000 $48,300 = $94,250 2010 $92,000 $47,200 2009 $90,000 $46,300 2008 $85,000 $44,900 2007 $84,000 $43,700 2006 $82,000 $42,100 2005 $80,000 $41,100 2004 $76,000 $40,500 2003 $75,000 $39,900 10 BAE4 FAYMPE3 = (50,100 + 48,300 + 47,200 ) / 3 = $48,533 The 1999 Academic Plan Basics – Example #1 Calculation of pension: (2% x Service x BAE4) – (0.4% x Post-2005 Service x FAYMPE3) Lifetime Pension = 2% x 21 x $94,250 – 0.4% x 7 x $48,533 = $38,226.07 per year payable in the normal form = $3,185.51 per month payable in the normal form 11 The 1999 Academic Plan Basics – Example #2 Member Information: Age : 65 Service: 31 years (24 years of pre-2006 service and 7 years of post-2005 service) Earnings and YMPE for the last 10 years are as follows: Year Actual Earnings Annual Pensionable Earnings After Appling Maximum Limit 2012 $175,000 $142,354 $50,100 2011 $170,000 $137,271 $48,300 2010 $165,000 $134,162 $47,200 2009 $160,000 $131,482 $46,300 2008 $155,000 $125,647 $44,900 2007 $150,000 $119,851 $43,700 2006 $145,000 $113,976 $42,100 2005 $135,000 $100,000 $41,100 2004 $120,000 $91,667 $40,500 2003 $100,000 $86,111 $39,900 12 Year’s Maximum Pensionable Earnings The 1999 Academic Plan Basics – Example #2 Calculation of BAE4 and FAYMPE3: – BAE4 is based on average of highest 48 continuous months of earnings – FAYMPE3 is based on average of final 3 years of YMPE Year Annual Pensionable Earnings After Appling Maximum Limit Year’s Maximum Pensionable Earnings 2012 $142,354 $50,100 2011 $137,271 $48,300 2010 $134,162 $47,200 2009 $131,482 $46,300 2008 $125,647 $44,900 2007 $119,851 $43,700 2006 $113,976 $42,100 2005 $100,000 $41,100 2004 $91,667 $40,500 2003 $86,111 $39,900 13 BAE4 = (142,354 + 137,271 + 134,162 + 131,482) / 4 = $136,317 FAYMPE3 = (50,100 + 48,300 + 47,200 ) / 3 = $48,533 The 1999 Academic Plan Basics – Example #2 Calculation of pension: (2% x Service x BAE4) – (0.4% x Post-2005 Service x FAYMPE3) Lifetime Pension = 2% x 31 x $136,317 – 0.4% x 7 x $48,533 = $83,157.62 per year payable in the normal form = $6,929.80 per month payable in the normal form 14 Valuation Basics Both employees and the University contribute to a separate trust to fund benefits Intent is that contributions relating to an employee together with investment returns on those contributions will fully fund the employees pension Question: how much needs to be contributed? – Assess through an Actuarial Valuation – Actuarial valuations must be prepared and filed with regulators at least once every three years – Last filed valuation prepared as at December 31, 2009 – Next required valuation is December 31, 2012 15 Valuation Basics - continued Purpose of the actuarial valuation is to assess – the plan’s financial health – future contribution requirements Two perspectives: – Going-concern • longer-term view • compares current assets plus future contributions to the value of benefits for past and future service – Solvency (required by regulators) • shorter-term view • compares current assets to the settlement value of benefits for past service (e.g. annuity purchase) 16 Going-Concern Position Total Assets Filed Dec 31, 2009 Interim Dec 31, 2010 Interim Dec 31, 2011 $ 142,413,000 $ 145,841,000 $ 143,560,000 142,181,000 142,056,000 154,373,000 3,785,000 $(10,813,000) 1.03 0.93 Total Actuarial Liabilities Surplus / (Unfunded Liability) $ 232,000 1.00 Funded ratio $ Current service cost at Dec 31, 2011: 20.51% of pensionable earnings 17 Current Contribution Schedule University is currently matching employee contributions per plan requirements and contributes an additional amount based on most recent valuation results and legislation: To August 31, 2010 After August 31, 2010 Member 6.82% 8.50% University – matching 6.82% 8.50% University – additional 3.51% 0.15% 18 Solvency Position Total Assets Total Actuarial Liabilities Surplus / (Solvency Deficiency) Filed Dec 31, 2009 Interim Dec 31, 2010 Interim Dec 31, 2011 $ 142,213,000 $ 145,641,000 $ 143,360,000 166,551,000 172,808,000 194,415,000 $ (24,338,000) $ (27,167,000) $ (51,055,000) Current solvency ratio that is applicable: 85% (December 31, 2009) 19 Solvency “Extras” Solvency relief – University elected 3 year temporary solvency relief for the December 31, 2009 valuation – Province currently reviewing minimum funding requirements for public pension plans in Saskatchewan, with changes to be released prior to December 31, 2012 – Transfer deficiencies still apply if members transfer out value of pension 20 Solvency “Extras” - continued Transfer Deficiency – Applies to individuals who terminate employment and elect to transfer the lump sum value of their entitlement out of the Plan – When a Plan has a solvency deficiency, legislation requires that a portion of every lump sum (LS) payment be held back – Transfer Deficiency = Portion of LS held back = (1- solvency ratio) x total lump sum entitlement – Transfer Deficiency paid out, with interest, at end of five year period following the date of payout – No impact on members retiring and commencing a pension from the Plan 21 Solvency “Extras” - continued Example – Transfer Deficiency – – – – – Date of termination = Jan 1, 2012 Total lump sum entitlement = $100,000 Solvency ratio = 0.85 LS payment on Jan 1, 2012 = 0.85 x $100,000 = $85,000 Transfer Deficiency payment on Jan. 1, 2017 = (1–0.85) x $100,000 = $15,000 (with interest) 22 Estimated Financial Position at Dec. 31, 2012 Dec 31, 2012 5% Margin 10% Margin 6.5% 6.5% Estimated Unfunded Liability $10.7M $18.2M Estimated Solvency Deficiency $56.8M $56.8M - With solvency 42.3% 43.4% - Without solvency 22.7% 26.6% Assumed ROR in 2012 Estimated Total Contribution Requirements starting Jan 1, 2013 (% of pensionable earnings) 23 Lump Sum Transfer Option Members retiring from the Plan have the option of either taking a pension or a lump sum transfer Reserves are included in going-concern balance sheet to account for this option History of lump sum transfers vs. pensions for the last 9 years is as follows: 24 Lump Sum Transfer Option Year # electing a pension from the Plan # electing a lump sum transfer from the Plan 2011 9 2010 7 Total lump sum payments out of the Plan during year $5,066,000 Average lump sum payment out of the Plan in year $724,000 9 4 $4,804,000 $1,201,000 2009 1 9 $5,685,000 $632,000 2008 2 6 $3,923,000 $654,000 2007 7 17 $11,007,000 $647,000 2006 12 6 $4,961,000 $827,000 2005 9 14 $8,604,000 $615,000 2004 6 11 $6,899,000 $627,000 2003 8 9 $6,405,000 $712,000 Total 63 (43%) 83 (57%) 25 Current Pension Landscape Challenges facing DB pension plans: – Sustainability and affordability – Pensions being paid for longer – Investment markets volatile and uncertain: • Approximately 75% of a pension plan's funding comes from investment returns • Threatens benefit security • Places additional funding strain on the current system – Pension plans have grown to a size that is often a multiple of the operating budget of the sponsoring organization • Hiccup with the pension plan means significant burden for the sponsor and its employees 26 Current Pension Landscape - continued Concerns: – The pension plan may result in serious funding challenges for sponsors – Safety margins in plans may not be adequate • requires increased funding relative to benefits provided General consensus in the industry is that the way in which benefits are funded and promised needs to be reviewed: – Want to avoid future generations paying for the promises made to past generations – Want to deliver on promises that have been made 27 Plan Membership Active Members Dec 31, 2010 Dec 31, 2011 196 181 Average age 57.5 years 58.1 years Average years of service 19.0 years 19.6 years Average annual salary $ 114,487 $ 119,583 Accumulated employee contributions with interest $ 36,087,654 $ 33,942,908 Accumulated University contributions with interest $ 38,510,057 $ 36,015,200 Expected average remaining service lifetime 6.6 years 6.3 years Number 28 Plan Membership - continued Pensioners and Survivors Dec 31, 2010 Dec 31, 2011 88 98 69.6 years 70.0 years Average annual pension $ 39,518 $ 39,280 Average period since retirement 6.7 years 7.0 years Number Average age Temporary Pensioners Number Average monthly pension Average period since retirement Average total number of payments remaining 29 Dec 31, 2010 Dec 31, 2011 20 19 $ 3,748 $ 4,202 2.3 years 2.5 years 33.6 months 30.9 months Plan Membership - continued Other Members Total Contributions with Interest Dec 31, 2010 Dec 31, 2011 51 48 $ 1,309,611 $ 1,207,962 $0 $0 $ 3,140,210 $ 3,426,199 $ 276,947 $ 282,348 Pending Retirements $ 3,274,008 $ 2,702,326 Total $ 8,000,776 $ 7,618,835 Number Deferred Inactive Pending Terminations Pending Deaths 30 Questions 31